Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 7 Jul, 2021

Efficient ways to perform text analysis of S&P Global Ratings’ credit ratings research* using machine-readable technology.

This is the first blog in a three-part series.

Over the last few years, we have seen an increase in the examination of unstructured data, which is typically text-heavy, using such approaches as sentiment analysis (or opinion mining). This is a Natural Language Processing technique that is often used to determine whether data based on text from news articles and earnings transcripts is positive, negative, or neutral. Recently, our team has been exploring whether text analysis of credit ratings research can provide additional insights. For example, can text-based data in credit ratings research inform us of potential credit trends? In this blog, we explore the ability to spot trends in credit ratings research compared to earnings transcripts using this approach.

Earnings transcripts and credit ratings research contain a wealth of information. Of particular note, ratings research can offer a deeper look at credit risk and a longer-term perspective than earnings transcripts, which tell you how the company is doing currently and how the management expects performance to be in the future. Credit research typically focuses on long-term issuer credit ratings that consider an obligor's capacity and willingness to meet financial commitments, both long and short term, as they come due.[1] This includes a detailed review of the creditworthiness of guarantors, insurers, or other forms of credit enhancement on the obligation, as well as the currency in question.

References to COVID-19 in Earnings Transcripts and S&P Global Ratings Research

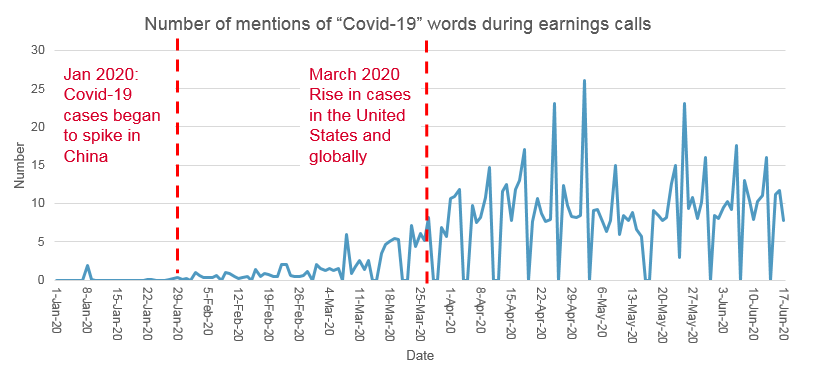

Chart 1 below indicates the number of times COVID-19, or similar references, were mentioned in earnings calls around the world between January 2020 and June 2020, based on Machine Readable Transcripts from S&P Global Market Intelligence.[2] The COVID-19 theme began to pick up in March 2020, indicating that this could have been an emerging source of systemic risk at that time. The number of mentions accelerated in subsequent earnings transcripts starting in May 2020, indicating that COVID-19 could have an impact on forward-looking earnings for some time to come.

Chart 1: Number of mentions of “COVID-19” words during earnings calls

Source: Machine Readable Transcripts by S&P Global Market Intelligence. Data as of June 2020. For illustrative purposes only.

There was a similar trend in the reporting of COVID-19 in S&P Global Ratings credit ratings research reports. In Chart 2 below, COVID-19 mentions started ramping up substantially in March 2020 (two months earlier than the peak we saw in the earnings transcripts above). Given the nature of credit ratings research, this example shows that machine-readable analysis of this research can potentially identify trends that could impact credit ratings earlier than when applied to earnings transcripts. The text content in credit ratings research also follows a structured format and is well organized and concise, which increases the information richness of its content by word count.

Chart 2: Number of articles that mention COVID-19 terms published by S&P Global Ratings

Source: RatingsXpress: Research, S&P Global Market Intelligence, as of June 2020. For illustrative purposes only.

Technological advances are providing new and efficient ways to evaluate extensive amounts of information, especially information that is unstructured. Given the purpose and structure of credit ratings research, important information can be gleaned by applying machine-readable approaches currently being widely used with earnings transcripts. S&P Global Market Intelligence’s RatingsXpress: Research provides bulk access to credit research from S&P Global Ratings in XML files with metadata. This enables users to develop text analysis algorithms to quickly summarize articles, filter relevant research, identify unique signals, monitor country and industry credit risk trends, and gain deeper insights from research reports in an automated fashion.

Click hereto request more information about how to gain useful insights from text analysis of credit ratings research.

*Credit ratings are prepared by S&P Global Ratings.

[1] “S&P Global Ratings Definitions”, S&P Global Ratings, 2020, www.standardandpoors.com/en_US/web/guest/article/-/view/sourceId/504352.

[2] Machine Readable Transcripts enable users to combine textual data from earnings, M&A, guidance, shareholder, and company conference presentations with traditional datasets to develop proprietary analytics. Coverage includes 10,600+ companies and growing, with 100% coverage of the S&P 500, Russell 1000, and FTSE 100, and 95% coverage of the S&P Euro 350.

Theme

Products & Offerings

Segment