Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 15 Jun, 2022

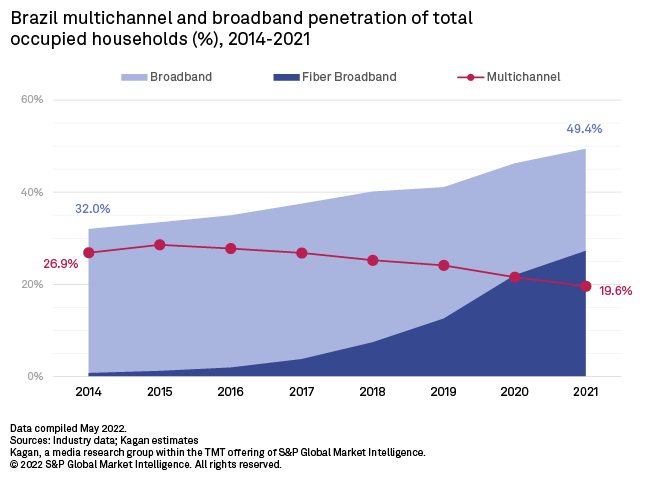

Seven years of cord cutting, in which Brazil's multichannel market shrank by over one-third and dropped from 19.5 million households in 2014 to an estimated 12.4 million in 2021, has led the few remaining major players in the market to refocus their strategies. The migration of pay TV services to streaming with virtual multichannel platforms and increasing interest in partnering with former rivals, both in video and broadband, as well as the public's continued appetite for linear content, were recurring themes in this year's Brasil Streaming conference, held May 23 virtually for the third year in a row.

* Brasil Streaming 2022 brought pay TV operators and streaming providers together to discuss the increasingly blurring line dividing the two markets, turning competitors into partners.

* The explosion in small internet service providers, which represent 45.1% of broadband households in Brazil as of 2021, most offering high-speed fiber services, provides an opportunity to serve a large, untapped market for video services with both VOD and linear streaming options through bundling partnerships.

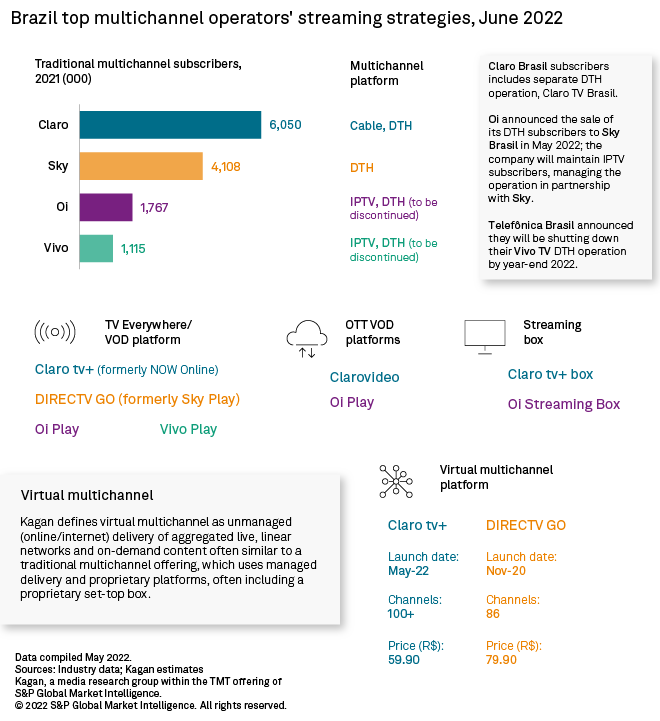

Brazil's two largest pay TV providers, América Móvil -owned cable operator Claro Brasil and direct-to-home group Vrio Corp.'s SKY Brasil, have both recently launched virtual multichannel services in the country to complement their traditional pay TV offers, leveraging the scale of their subscriber bases and existing relationships with programmers to provide full channel lineups to over-the-top customers. Migrating multichannel to streaming also allows the operators to reduce costs while expanding service reach beyond their physical network footprints.

Vrio's DIRECTV GO platform launched in Chile and Colombia in November 2018 and has since expanded across the company's Latin America and Caribbean markets, introduced in Brazil in November 2020. América Móvil, on the other hand, chose Brazil as the first market for its new streaming box product, Claro Box TV, and has since expanded to Colombia.

Following a successful soft launch in 2021, which saw the service add an over-the-top option, Claro Top Streaming, the company rebranded to integrate the streaming products, including TV Everywhere platform NOW Online, with its multichannel offer under the Claro tv+ moniker, according to a May 26 announcement. The new product line offers three plans, each over a different platform and serving a different price point: Claro tv+ app for OTT subscribers at 59.90 reais, Claro tv+ box for streaming box users at 89.90 reais, and Claro tv+ 4K for traditional multichannel at 129.90 reais.

Despite higher churn among streaming subscribers compared to traditional multichannel, as well as supply issues with the box hardware, Claro Brasil's TV director, Ricardo Falcão, sees an opportunity to reach new markets for video services. "With the rise of [small, regional] ISPs, the broadband market has grown exponentially … so there is a highly significant untapped market," he said during a panel. "In the last two, three months, we began expanding the Claro Box offer outside of our coverage area as an OTT. Obviously, the logistics are even more complex, as we don't have an existing distribution structure. … We will pursue partnerships with these broadband providers, as there are plenty of synergies in our businesses."

Indeed, between 2014 and 2021, small ISPs in Brazil are estimated to have grown by 1,183%, reaching 16.4 million. This accounts for 45.1% of total broadband households, and 87.6% of subscribers to small ISPs take fiber. This is almost twice the size of Claro's own cable broadband subscriber base, which, at 8.9 million, has been declining in the past two years with increasing competition from fiber providers.

Over the past year, Vrio too partnered with ISPs to bundle DIRECTV GO with its broadband services. According to Chief Marketing Officer Gustavo Fonseca, the company has already closed deals with 10 ISPs in Brazil, as well as others in Chile, Colombia and Peru. "TV needs scale," he said, referring to the 10 million DTH households served in Latin America by the former AT&T subsidiary, now owned by Argentina's Grupo Werthein. In comparison, most new ISPs in Brazil provide broadband only, while many triple-play operators are divesting pay TV to focus on connectivity. Among these are telcos ETB in Colombia, and Algar and Oi in Brazil, all of which shut down their pay TV operations, transferring existing subscribers to Vrio's DIRECTV Colombia and Sky Brasil, either on DTH or OTT/virtual multichannel.

For Roberto Guenzburger, Oi's consumer director, the regulatory burden of traditional pay TV services in Brazil makes it increasingly unprofitable compared to streaming, which also benefits from reduced costs in terms of hardware and infrastructure. "Consumers nowadays also prefer to use their own devices," he said. While the company does not plan to launch a virtual multichannel product, it will maintain its IPTV product as well as the Oi Play TVOD platform, which will be restructured, and partnerships with third-party streaming providers, transferring DTH and programming operations to Vrio.

Telefónica subsidiary Telefônica Brasil also announced it would be shutting down its Vivo TV DTH service at the end of the year, having frozen new sales in 2019, to focus solely on IPTV. The telco also recently launched a linear channel streaming service in Brazil, Vivo Play App, which has long been available in other Latin American markets as Movistar Play. In Brazil, it had been limited as a TV Everywhere service for pay TV subscribers. The platform is not considered virtual multichannel, however, since it is only available to subscribers of Telefônica Brasil's fixed or mobile services.

OTT services expand partnerships

This strategy of partnering with ISPs has long been used by streaming services in Latin America to help drive adoption. "Many streaming platforms have low usage," said Vrio's Fonseca. "Aggregation is important, it helps drive usage." As well as traditional multichannel operators, new players entering the aggregation game include streaming device provider Roku Inc. Since launching in the Brazilian market in 2020, the company has already closed distribution partnerships with 40 ISPs, according to Director of Marketing Luis Bianchi. On the content side, the channel lineup includes both on-demand and linear video, with DIRECTV GO recently added.

Brazilian broadcaster Globo has also invested in aggregation, partnering with multiple OTT competitors, such as Disney's Disney+ and Warner Bros. Discovery's Discovery+, to bundle subscriptions with its own streaming service Globoplay, which also includes the company's own basic and premium multichannel content as add-ons. For Globoplay Director of Sales Solutions Teresa Penna, the company's deep knowledge of the Brazilian consumer is valuable to its partners, helping to reduce churn and acquisition costs.

Already a client? Access our article here for more on OTT pricing and partnerships in Latin America.

The speakers highlighted the importance of linear programming, such as news, sports and reality television, which is still very popular in Latin America. Oi's Guenzburger cited a recent survey from Kantar IBOPE Media showing that linear television still represents 79% of video consumption hours in Brazil, while VOD represented only 21% of time spent.

Streaming players have reacted to this trend by adding live content such as sports to their catalogs, including Warner's HBO Max and Disney's Star+, which expanded their existing multichannel contracts for the TNT Sports and ESPN/Fox Sports brands to include streaming, as well as newcomers to sports broadcasting such as Amazon's Prime Video and Paramount Global's Paramount+. "Among users who subscribed [to HBO Max] to watch the Campeonato Paulista [state soccer championship], churn was lower than among the rest of the subscriber base," said Guilherme Lenz Cesar, sales director at LiveMode, which manages broadcasting rights for Federação Paulista de Futebol, the Paulista Football Federation.

Linear programming has also proved successful beyond sports for Fabrício Proti, vice president of ad sales and general manager of Paramount Brazil. According to him, in the 18 months since the company launched its Free Ad Supported TV, or FAST, service Pluto TV in Brazil, it has become the platform's fastest-growing market outside of the U.S., jumping from an initial 24 channels to 75 channels today.

Blog

Blog

Webinar