Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 8 Mar, 2022

As the effects of the COVID-19 pandemic continue to impact markets in Latin America and the Caribbean, 2022 will see the consolidation of broadband trends accelerated by the past two years. Broadband penetration is expected to reach over 50% of Latin American households by year-end 2022, with fiber driving growth. Fiber is forecast to become the region's largest fixed broadband platform, overtaking cable to reach 41.2% of total subscriptions.

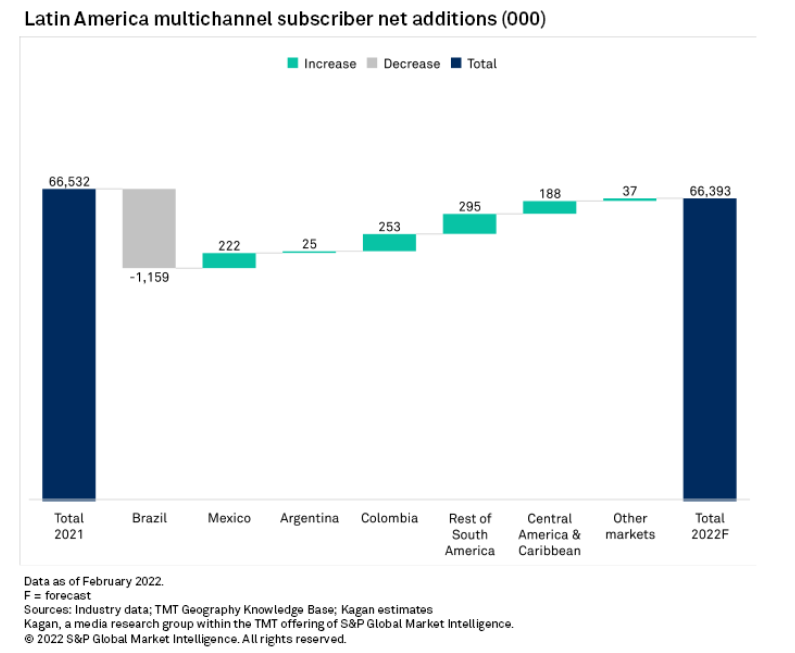

Meanwhile, multichannel performance is expected to slowly improve as economic recovery and rising family incomes allow households to return to old spending habits. After three years of decline, pay TV subscribers are expected to remain stable in 2022, as the rate of direct-to-home disconnections slows and cable returns to growth. Kagan forecasts the Latin American multichannel market to return to growth in the next 10 years, albeit at a slower rate than in the past two decades as increasing fiber adoption boosts streaming alternatives.

The Take

* Fixed broadband should reach over 50% of Latin American households by year-end 2022, with fiber overtaking cable to reach 41.2% of total subscriptions.

* After three years of decline, the multichannel market is expected to remain stable in 2022 as economic recovery slows the cord-cutting trend.

* Key trends for 2022 include growing virtual multichannel options from major pay TV players and continuing consolidation among small fiber ISPs in Brazil, with several planning IPOs.

* Postponed spectrum auctions are expected to delay 5G rollouts in some markets.

Economy: Outlook for 2022 and COVID-19 impact

Economic recovery following the downturn caused by the COVID-19 pandemic in 2020 is expected to continue in 2022, albeit at a slower rate. The Economic Commission for Latin America and the Caribbean, or ECLAC, forecasts the region's average economic growth this year at 2.1%, down from a preliminary estimate of 6.2% for 2021, with less than half of Latin American countries expected to recover to pre-pandemic GDP levels by year-end 2022.

High inflation is expected to be the main factor limiting growth in 2022, aggravated by currency depreciation, according to a report from S&P Global Ratings, a division of S&P Global, on the economic outlook for the region's six largest economies: Argentina, Brazil, Chile, Colombia, Mexico and Peru. The report also highlights uncertainty surrounding the results of elections in Colombia in March and May, and Brazil in October, as well as the implications of recent elections and a new constitution in Chile, which may delay investments and put additional strain on GDP growth.

Ratings sees less influence of pandemic-specific developments on GDP growth, although the uncertainty surrounding the omicron variant may be a cause for concern. As of Feb. 14, South America has the highest vaccination rate among global regions, with 69.2% of the population fully vaccinated according to Our World in Data, which may help limit the effects of the new variant in the region.

Fiber to reach one in five LatAm households

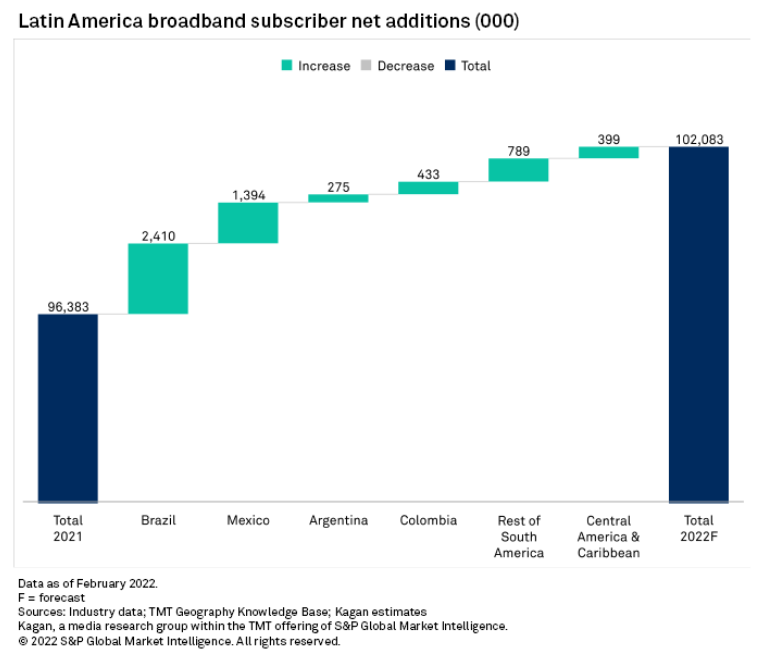

Kagan estimates the region's residential fixed broadband subscribers will expand by 5.9% in 2022 to 102.1 million, or 50.4% of occupied households, with fiber reaching one in five Latin American households by year-end. The platform is expected to continue driving broadband growth in the region, with subscribers increasing by 16.6% as telcos migrate customers from legacy DSL to fiber-to-the-premises networks and small ISPs expand coverage to previously unconnected markets. Cable is also forecast to lose market share to fiber, down 0.5 percentage points to 38.2%, although the platform should continue growing as cable multichannel subscriptions pick up in 2022.

While total multichannel households are forecast to reduce by 0.2% to 66.4 million during the year, cable TV subscriptions are expected to grow for the first time in four years, up 0.1% to 34.0 million households, as cord-cutting trends in the region slow with economic recovery post-pandemic. Multichannel penetration, however, is expected to continue dropping to 35.3% of total TV households in Latin America by year-end.

Already a client? Click here to read the full report, including detailed overviews of OTT and vitural multichannel trends, fiber M&As and IPOs in Brazil, and 5G developments in Latin America during 2022.

Blog

Blog