Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 2 Feb, 2022

Highlights

Kagan projects streamers in Europe will see 12.3 million new OTT subscriptions and 8% year-over-year revenue growth in 2022.

As they expand in multiple territories, OTT video providers will likely look to partner with OTT aggregators and explore opportunities to create bundles.

The competition among streamers is causing the big players to look for synergies through M&A activity.

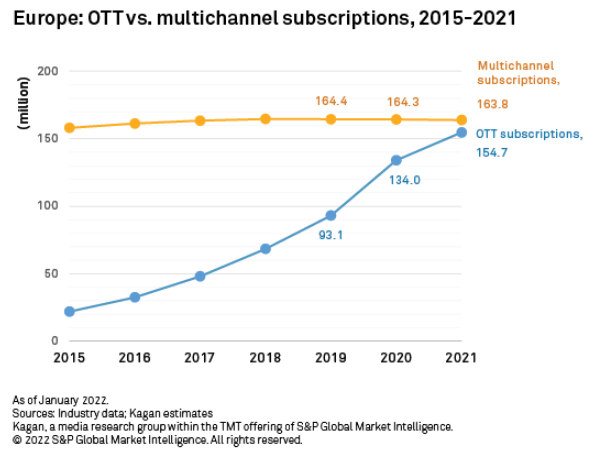

In another year of double-digit growth, subscription over-the-top video revenue in Europe reached $14.2 billion in 2021, up from $1.8 billion in 2015. Meanwhile, multichannel revenue has dropped by $3.9 billion since 2015 to $35.7 billion. For 2022, Kagan projects OTT will grow revenue by 8% and net 12.3 million additional subscribers. We expect the number of stand-alone streaming subscriptions to exceed that of multichannel for the first time by the end of 2022.

Key trends

Bundling, partnerships and further expansion

With media firms of various types going direct-to-consumer, content has become fragmented, forcing consumers to pay for multiple services to watch what they want. Kagan's consumer survey showed that the average number of SVOD subscriptions per household in the United Kingdom, Europe's largest OTT market by revenue, reached 2.2 in 2020 — double that of 2018. Hollywood studios, such as Walt Disney Co., Warner Media LLC (HBO), NBCUniversal LLC, ViacomCBS Inc. and Discovery Inc., are now running streaming services throughout Europe.

We expect more launches in 2022 as HBO Max debuts in Central and Eastern Europe as well as Portugal and Comcast Corp.'s SkyShowtime spreads across the wider region. These operators, along with smaller niche streamers, are partnering with OTT aggregator platforms to widen their household footprint and benefit from marketing and technology synergies. The aggregators include streaming device manufacturers such as Roku Inc.; pay TV operators such as Sky Ltd., Telefónica SA and Telecom Italia SpA; and online platforms such as Amazon.com Inc. Multichannel's model of packages with à la carte TV networks on the side was common in past decades and has been repurposed for the streaming era.

5G

Technological advancements in internet connectivity such as fiber and 5G paved the way for the emergence of streaming video services. European telcos are winding down their traditional TV services and focusing on third-party virtual multichannel or SVOD services to reduce costs while investing heavily in fiber, 5G and fixed-to-mobile convergence. 5G in particular could be a game changer by allowing for high-definition streaming on the go, further driving total viewing figures. In the latest Kagan Global 5G survey, 80% of mobile network operators in Europe listed 4K/8K simultaneous streams as one of the key drivers of 5G adoption.

M&A

After almost 10 years of minimal competition among streamers, with Netflix Inc. ahead of the pack and Amazon a distant second, the online video landscape now includes media and tech conglomerates such as Disney, AT&T's WarnerMedia and Comcast. While studios and broadcasters are looking to take out the middleman and sell their content directly to the end user, telcos that own the network infrastructure and have an established customer base are partnering with content owners to win the distribution battle. We expect this activity to continue through 2022 with the upcoming merger of WarnerMedia and Discovery, which will result in an offering that includes HBO, Discovery reality programs and Eurosport as well as the new CNN+ from Turner Broadcasting System Inc., which is slated to debut in 2022.

Content

In 2022, localization will remain key to global streamers' ability to compete with local players and minimize churn. Netflix and Amazon have made a clear shift from acquisitions to original productions. At the same time, past rights deals with other streamers and pay TV operators are slowing this transition. Netflix and Amazon's Prime Video have been employing localization strategies for years now and have managed to retain the top two spots in terms of household penetration in Europe. In response, Disney is targeting 60 European originals by 2024 in an effort to maintain their previous growth rate.

AVOD

Until recently, AVOD in Europe had been synonymous with broadcaster-operated streaming services, such as British Broadcasting Corp.'s BBC iPlayer or ITV PLC's ITV Hub. Lately, big media and tech firms, such as Comcast and ViacomCBS — some of which are already active in the SVOD space — have diversified their revenue sources in markets with high online video adoption by launching AVOD offerings. After building a loyal user base, the services look to convert users to paying subscribers in the medium to long term.

We see this trend continuing in 2022 with Fox Corp.'s Tubi possibly entering the region at some stage. Recent activity in the AVOD field includes Pluto TV launching in Italy and France during 2021, Amazon releasing IMDb TV in the U.K. and both ViacomCBS and Rakuten Group Inc. adding FAST channels to their platforms. Europe-based, non-broadcaster efforts include the expansion of Germany's rlaxx Tv GmbH into France, Spain and Portugal. The service is also available in the DACH region and the U.K.

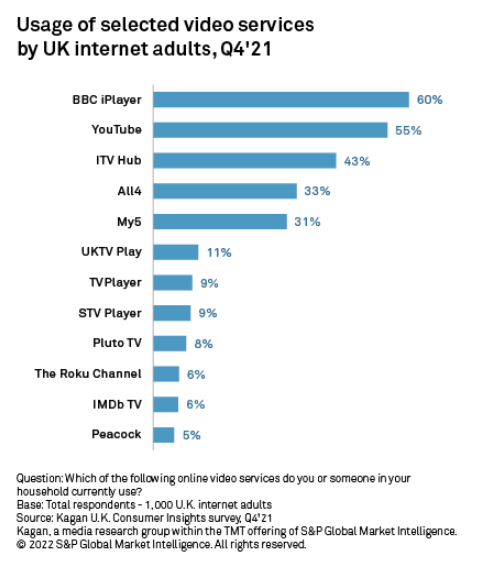

These new AVOD arrivals in Europe, such as Pluto TV, Peacock, The Roku Channel and IMDb TV, could face steep competition from popular incumbent services, such as YouTube, as well as free catch-up TV offerings from local broadcasters. Kagan's Consumer Insights U.K. survey conducted in December 2021 of 1,000 U.K. internet adults showed five services — BBC iPlayer, YouTube, ITV Hub, Channel Four Television Corp.'s All4 and Channel 5 Broadcasting Ltd My5 — used by 30% or more of respondents while newer launches from U.S.-based operators had yet to crack 10% share.

Blog

Blog