Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

SPECIAL REPORTS

May 11, 2021

The acceleration of ESG investing in private equity

The COVID-19 era accelerated many changes underway in private equity, with particularly striking impacts in the realm of ESG investing. Attitudes towards how and where money is invested are shifting, prompting both limited and general partners to re-evaluate their priorities.

Limited partners are increasingly turning their focus to ESG considerations, particularly where there is a need to align investments with the aims of their sponsor's corporate social responsibility strategies. Pension funds, for example, comprise the biggest group of PE investors and are rapidly embedding ESG concerns in their investment criteria.

An increasing number of PE firms are screening portfolio candidates against ESG yardsticks to identify potential issues. "Companies that consider active contributions to sustainable development will be preferred. Investment choices will be further filtered in cases where the ESG standards do not meet our expectations," says the CFO of a France-based PE firm.

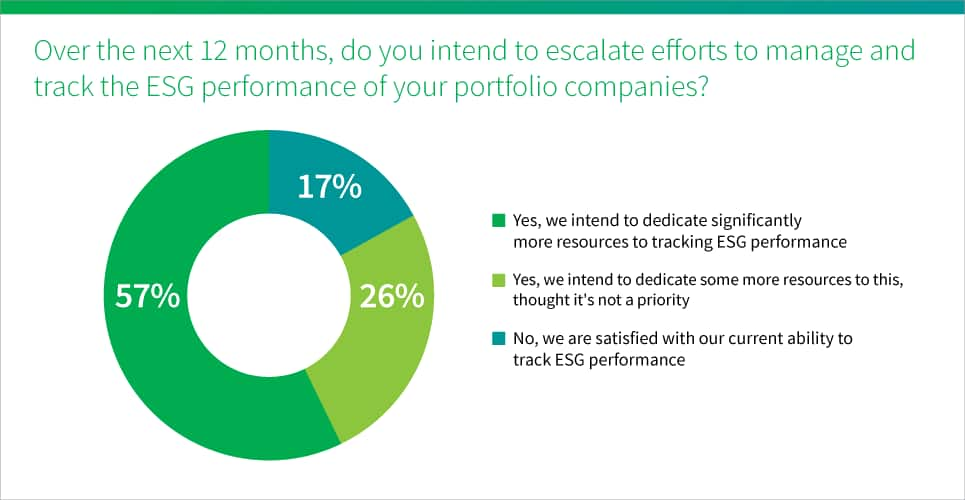

In a recent survey of senior private equity executives conducted by Mergermarket on behalf of IHS Markit, most respondents (83%) agree that the COVID-19 crisis will raise meaningfully the profile of ESG issues in the PE industry. The same proportion of respondents intends to escalate efforts to manage and track the ESG performance of their portfolio companies.

Although ESG is still perceived in some quarters as just another hurdle, several respondents point to business and reputational upsides. "We have understood the greater value ESG plays when associating with a target company," says the COO of a Swiss-based sponsor, while the CFO of a PE firm based in Germany says: "Environmental due diligence is being given more importance because this will define how the company is viewed in the market."

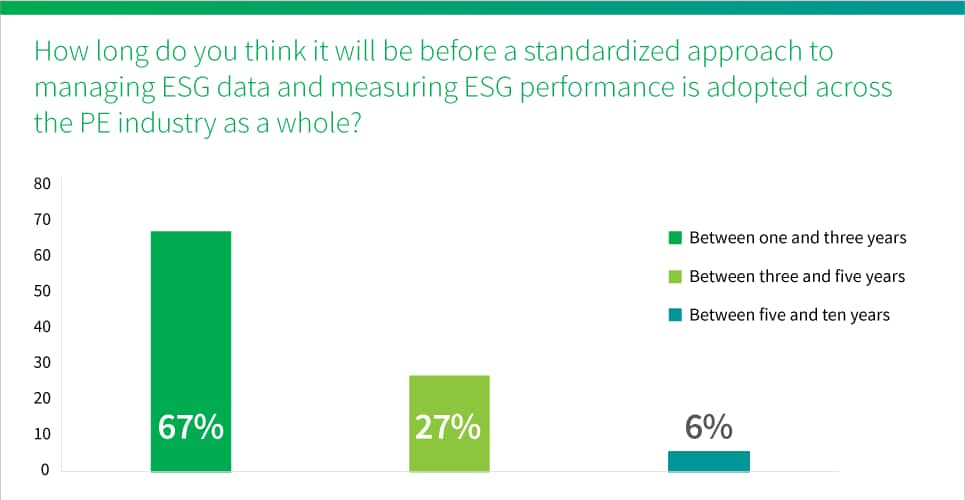

The lack of consistent ESG evaluation frameworks remains a stumbling block. But respondents expect this to change sooner rather than later: 67% think a standardized approach to managing ESG data and measuring ESG performance will be adopted across the PE industry in the next one to three years.

Read the full report: After the storm: Private equity after COVID-19.

IHS Markit provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fthe-acceleration-of-esg-investing-in-private-equity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fthe-acceleration-of-esg-investing-in-private-equity.html&text=The+acceleration+of+ESG+investing+in+private+equity+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fthe-acceleration-of-esg-investing-in-private-equity.html","enabled":true},{"name":"email","url":"?subject=The acceleration of ESG investing in private equity | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fthe-acceleration-of-esg-investing-in-private-equity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+acceleration+of+ESG+investing+in+private+equity+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fthe-acceleration-of-esg-investing-in-private-equity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}