The world is changing rapidly, and much of that change is linked to topics that fall under the broad sustainability umbrella — issues like climate change, net-zero, the just transition and biodiversity.

There are many different ways to define sustainability.For example, the International Sustainability Standards Board (ISSB) in December 2022 defined it as

The global standard-setting body called sustainability “a condition for a company to access over time the resources and relationships needed (such as financial, human, and natural), ensuring their proper preservation, development and regeneration, to achieve its goals.”

Sustainability is a growing area of focus for a wide range of stakeholders from both the public and private sector. At COP27 in November 2022, there was continued engagement and participation from the private sector on topics ranging from decarbonizing supply chains to nature and biodiversity.

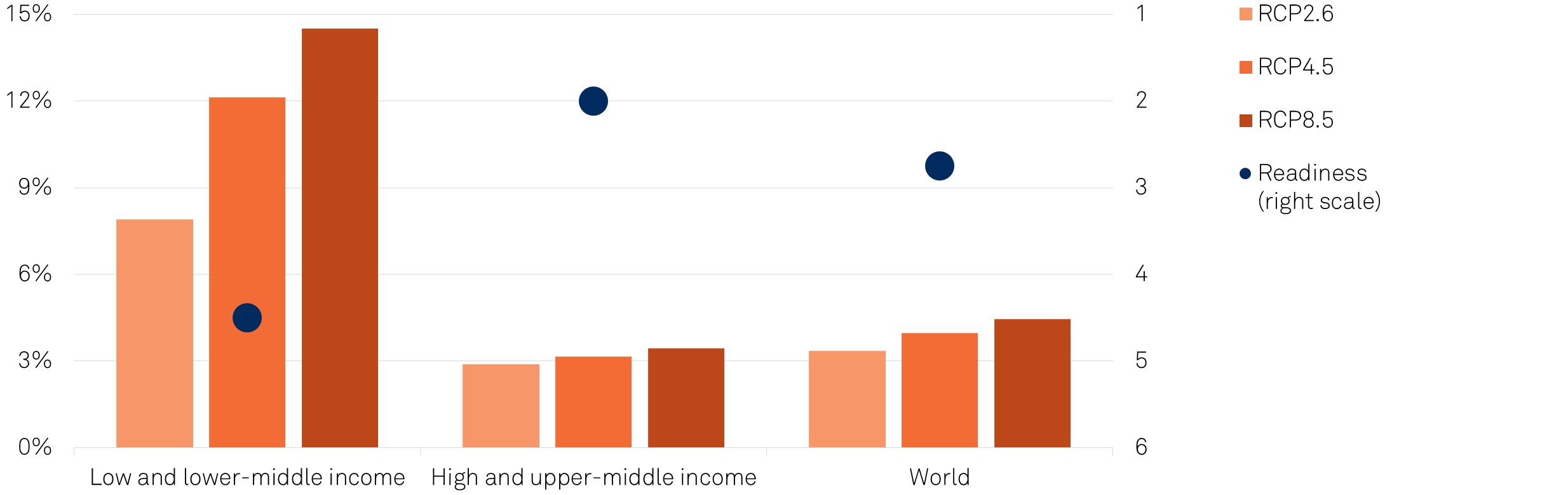

Climate change is already having stark financial and human impacts around the globe. Research from S&P Global Ratings explored more than 130 countries’ vulnerability and readiness for climate change over the next 30 years. An estimated 4% of global GDP could be exposed to losses under the current trajectory on commitments to address climate change, ranging up to an estimated 18% of GDP at risk for certain countries.

Lower-Income Countries Are More At Risk Of Physical Climate Hazards In 2050

Note: Countries’ income classification is based on World Bank data. Sources: S&P Global Ratings, S&P Global Sustainable1 (2022).

Scientists are increasingly making the connection between extreme weather events and climate change. Looking forward, climate studies — including the sixth assessment report (AR6) from the Intergovernmental Panel on Climate Change (IPCC) — point to a worsening picture of increasing economic losses even under low-emission scenarios in the absence of a significant uptick in investments to adapt to a changing climate.

There has been unprecedented market and policy momentum behind environmental, social and governance (ESG) in recent years. ESG factors are just one of many different lenses that can be applied to understand broader sustainability topics.

After multiple years of rapid market and policy momentum, sustainability is at an inflection point

Sustainability reporting standards and regulations have evolved rapidly. Since 2021 alone, there have been major developments such as the creation of the ISSB and the launch of the Taskforce on Nature-related Financial Disclosures (TNFD), which is drafting a framework for companies and other organizations to report and act on evolving nature-related risks. The TNFD approach is modeled on the Task Force on Climate-related Financial Disclosures (TCFD), which focuses on climate-related risk and continues to gain global momentum.

At S&P Global, we are empowering clients to navigate this evolving landscape with a broad suite of sustainability solutions

S&P Global’s data, analytics, work-flow tools and opinions can aid customers who are seeking to understand sustainability topics. Our research and insights build on public and proprietary data to advance understanding of topics like climate change, biodiversity, the energy transition, and human capital management.

Sustainability is ultimately a complex topic. Every company is different, and what matters varies from sector to sector. S&P Global offers transparent data and analytics on many individual pieces of the sustainability puzzle.

Our goal is to offer the most in-depth and expansive set of data, analytics and transparent methodologies to help our customers navigate the multiple ways to understand sustainability, and ESG, in this evolving landscape.

How S&P Global’s business divisions are engaging in the sustainability space

S&P Global plays an important role by providing clients with a broad suite of sustainability products and services. Our clients cover a wide range of disciplines, from corporations to academia to financial institutions. We recognize that there are many use cases for sustainability data and analytics, and stakeholders may approach sustainability from different angles. We provide data, analytics and tools to support different client workflow needs across many different use cases through our diverse portfolio of businesses.

Examples of how we contribute to better understanding in the sustainability space include:

Examples of how we contribute to better understanding in the sustainability space include:

- S&P Global Commodity Insights: Policymakers, decision-makers and traders can use our commodity insights to track and benchmark emerging technologies and new commodities; the value of decarbonization through the carbon markets; and scenarios that use macroeconomic trends and polices to forecast potential outcomes for the real economy.

- S&P Global Dow Jones Indices: Portfolio managers use our indices to measure and represent impacts, risks, returns and opportunities for markets and market segments.

- S&P Global Market Intelligence: The Market Intelligence division offers actionable data, research, analytics and workflow solutions supporting a broad suite of sustainability themes and drivers that are shaping today’s modern enterprise. Our solutions help our customers assess environmental and physical risks, track and benchmark their sustainability efforts against existing frameworks, manage financial risk inherent to sustainability factors, and prepare for regulatory reporting requirements around the world.

- S&P Global Mobility: Customers ranging from suppliers to manufacturers to governments to the finance industry use our with products and solutions to navigate risks, identify opportunities and evaluate impacts during the transition to an electrified, de-carbonized future.

- S&P Global Ratings: Our credit ratings continue to focus on assessing the creditworthiness of issuers. We consider ESG credit factors in our analyses when we believe they are material and relevant to our credit ratings. Separately, our Sustainable Financing Opinions provide additional insights into the alignment with third-party sustainable finance principles.

- S&P Global Sustainable1: S&P Global’s divisions are supported by S&P Global Sustainable1, a centralized group with a core focus on cross-company sustainability offerings. Sustainable1 helps to address customers’ unique sustainability needs by matching them with the products, data, research, insights and solutions from across S&P Global’s divisions.

We also believe it is important for our sustainability-related products and services to meet the high standards expected by clients, policy makers, and regulators. As sustainability becomes an increasingly important component of financial markets and the economy, we believe it is important to communicate with the policy and regulatory community. We therefore engage with policy initiatives designed to support the production of high-quality sustainability data and rating products around the world.

Conclusion

The world is changing, and so are the needs of our clients. S&P Global is one of the world’s foremost providers of sustainability intelligence. Our data, benchmarks, research and insights help provide capital market participants and others the resources needed to understand risk, opportunity and impact in order to achieve their sustainability objectives over the short, medium and long term.

S&P Global is committed to the independence and objectivity of its products and services, and has policies in place to help maintain an appropriate separation between the different business units, including S&P Global Sustainable1 which develops S&P Global ESG Scores.

Sustainability can have many different questions.