Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Research & Insights

Who We Serve

Research & Insights

Who We Serve

Blog — S&P Global Sustainable1 — 3 Apr, 2023

Sustainability criteria have become essential components of today’s business strategies as asset managers increasingly consider a company’s action plans with respect to environmental, social and governance (ESG) factors when making investment decisions. We saw evidence of the growing importance of sustainability in the 2022 S&P Global Corporate Sustainability Assessment (CSA). More than 3,000 firms participated in the annual assessment, representing half of global market capitalization relative to the S&P Global Broad Market Index.

The CSA compares companies across 61 industries via industry-specific questionnaires that assess on average 25 sustainability topics in 110 questions. Based on their performance, companies receive scores ranging from 0 to 100 and percentile rankings for financially relevant sustainability criteria. Over the past 24 years, the CSA has grown into a leading corporate sustainability database. Within just two years of becoming publicly available on the S&P Global Capital IQ Pro platform, ESG Scores calculated from the CSA have attracted the interest of capital markets stakeholders overseeing $30 trillion in assets under management.

More than one third of the 3,000 companies participating in the 2022 CSA responded to a Feedback Survey we offered to gather input on what motivates companies to participate. Respondents indicated that they see value in the process given the ability to use the results with important internal stakeholders and external capital markets participants. They gave the CSA a score of 7/10 for being a fair representation of the corporate sustainability performance in their respective industries. Below, we summarize some of the highlights from this feedback.

Increasing visibility with sustainability-focused investors

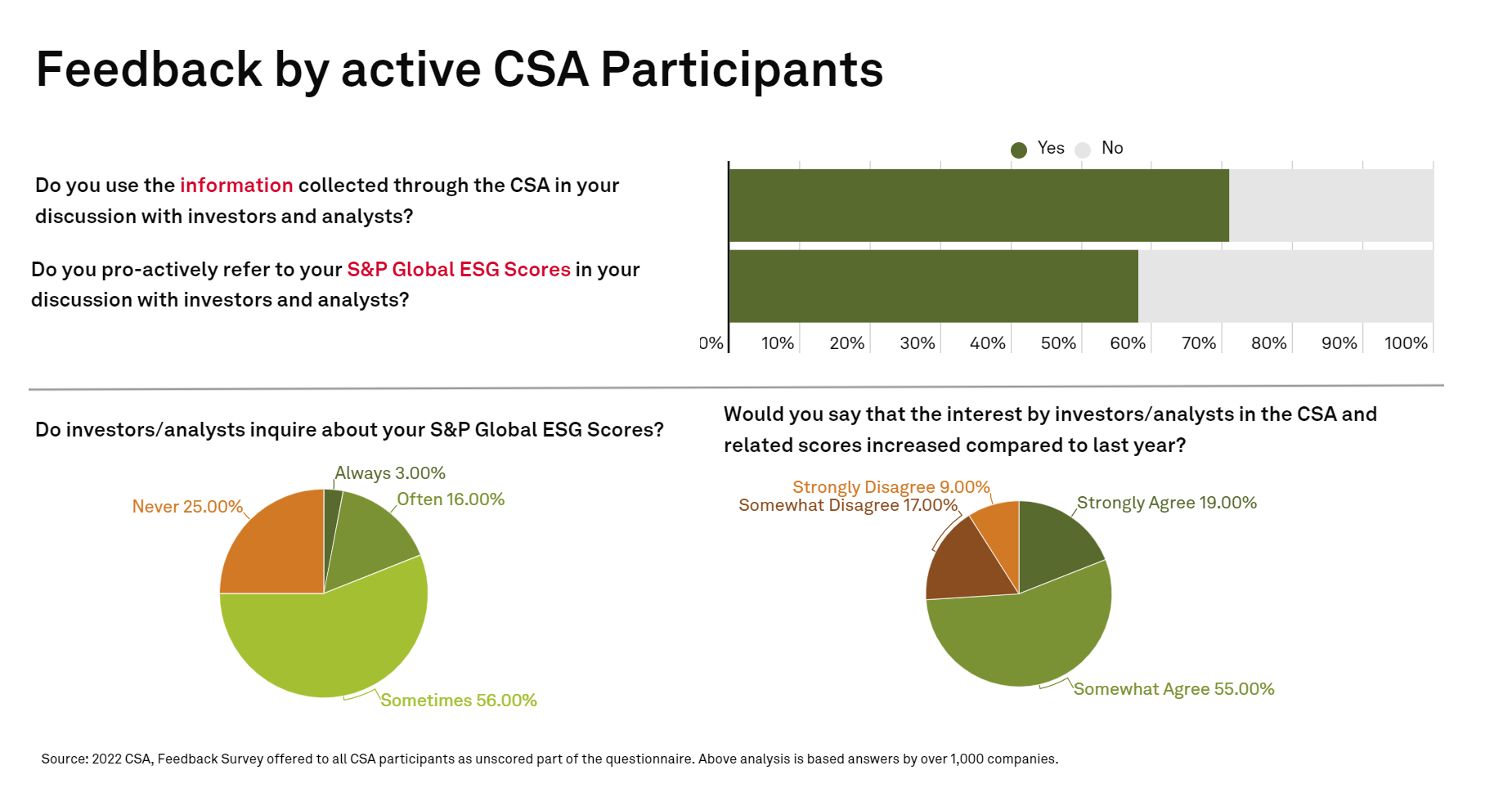

Asset managers globally are expected to increase their ESG-related AUM to $33.9 trillion by 2026, from $18.4 trillion in 2021, accounting for 21.5% of total global AUM. More than half of the 1,000+ companies that responded to our Feedback Survey said that gaining increased visibility with sustainability-focused investors was their number one reason for participating in the CSA. Three quarters of respondents also reported increased interest by investors and analysts in the CSA and related scores compared to the previous year, and over 70% are using their results in discussions with these groups. Many respondents also provided qualitative remarks about their reasons for participating, which included a desire to keep investors informed about the company’s progress towards attaining its sustainability goals.

Guiding companies' sustainability action plans

Pressure on corporate boards to shore up their sustainability credentials is set to grow as investors demand better accountability from the top and a heightened focus on these issues. Shareholder activism in this area increased 2021, including votes against directors for the lack of credible climate action plans. In addition, efforts to diversify boards and create policies that foster meaningful diversity, equity, and inclusion will continue to evolve from a box-ticking approach into a holistic appreciation of how differences in identities, expertise, and leadership styles can drive growth and innovation.

Against this backdrop, survey respondents ranked the following as their top perceived benefits of participating in the CSA:

Over one third of respondents also provided qualitative remarks about the internal benefits of participation. Almost half of these respondents (45%) stated that the CSA helps them better understand how to improve their sustainability reporting/ESG efforts and that it provides a framework to understand upcoming trends, standards, and more.

Continuing to iterate on the CSA process

Unlike ESG datasets that rely simply on publicly available information, S&P Global ESG Scores are uniquely informed by a combination of verified company disclosures, media and stakeholder analysis, and in-depth company engagement via the CSA. Companies contribute many hours in every assessment cycle, while S&P Global analysts validate disclosures for both accuracy and relevance, discuss methodologies and measurement best practices, and provide ongoing feedback. While this actively drives corporate disclosures and raises the bar on sustainability standards over time, the CSA team is cognizant of the time it takes companies to complete the assessment and every year takes steps to reduce the resources required. As of the 2023 CSA:

In addition, every year the methodology team eliminates questions that are no longer differentiating companies (because too many companies have high scores or there is a low response rate) or that are no longer deemed material from an investor perspective. Recently, 38 questions were deleted across all industries.

Going forward

As investors, regulators and the broader public continue to exercise greater scrutiny of corporate sustainability efforts, companies face rising pressure to demonstrate that they are adequately equipped to understand and manage related issues. Having detailed information to assess a company’s sustainability action plans and performance relative to peers will become even more important as investors and companies seek evidence-based insights, high quality data and advanced analytics to support their investment strategies when linking sustainability and business performance.

Explore our interactive presentation

We asked companies why they participate in the CSA; here’s what they said

We're at a pivotal moment for the corporate world’s understanding of biodiversity’s connection to climate change and the financial implications of nature loss.

Check if your company is invited for the 2023 Corporate Sustainability Assessment.