Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERSBig Tech companies rallied in support of Ukraine following Russia's invasion of the country, resulting in disruptions to some popular services in the region.

House Lawmakers Home in on Russia-Ukraine Conflict in Big Tech Bills Hearing

A monthslong bipartisan effort to crack down on Big Tech pivoted much of its focus towards the ongoing Russia-Ukraine conflict during a House subcommittee hearing.

Read the Full ArticleCyber Threat Brief: How Worried Should We Be About Cyber Attacks On Ukraine?

S&P Global Ratings sees a heightened risk of cyber attacks on Ukraine amid escalating tensions with Russia, which could create knock-on effects for corporations, governments, and other parties in the region and beyond.

Read the Full ReportThe steep correction that technology valuations saw in the first weeks of 2022 may ultimately prove to be more boon than gloom for the long-term health of the market.

Following a boom in tech values during the pandemic, the new year brought a period of review. As individual and corporate wealth accumulated and supply chains tightened, inflation began soaring at historic rates. The U.S. Federal Reserve has signaled it will raise its benchmark interest rates in an attempt to realign markets. Investors are now rethinking the massive valuations they have put on growth companies, technology tickers in particular, as they assess the potential risks of an economy in flux.

The Nasdaq dropped almost 15% from Jan. 1 to Jan. 27. While it has since recovered some of that lost ground, the tech-heavy index is still off by 7.4% as of market close Feb. 9.

Market observers see several factors driving the realignment, including inflation, interest rates and a re-focus on fundamental financial metrics. However, analysts argue that this shift in investor sentiment and strategy is a natural thing, and it could represent a healthy, long-term cycle.

Media Sector's Capital Markets Activity Slows Down in December

Capital market activity in publicly traded media companies in the U.S., Canada, and Bermuda simmered down in December 2021, as the sector raised a total of about $1.78 billion, compared to $5.82 billion in November.

Read the Full ArticleEconomic Research: U.S. Real-Time Data: High Prices Dampen Economic Activity and Moods

The U.S. economy continues to decelerate in January as omicron slows economic activity and inflation takes a bite out of purchasing power.

Read the Full Re[prtAMC Shares Fall from Grace as Company Looks to Refinance High-Rate Debt

AMC Entertainment Holdings Inc. took extraordinary measures to survive a pandemic, and while it avoided bankruptcy, it seems the company will be paying interest on its COVID-19-era strategy for years to come.

READ THE FULL ARTICLEIndustry Top Trends 2022: Technology

S&P Global Ratings’ Industry Top Trends series sets out its industry experts’ assumptions for 24 global industries in 2022.

READ THE FULL REPORT

Technological disruption is the driving change agent for businesses, their competitive and industrial dynamics, and capital markets that fund growth. Media—including broadcast, cable, cinema, OTT, and telecom—is creating the culture of the future.

ACCESS THE TOPIC PAGEThe 2021 box office year started out slow as the U.S. remained in the grip of the COVID-19 pandemic and a winter surge in cases was underway. Then the vaccine rollout began, and studios committed to theatrical release dates for films that had been delayed in 2020.

Insurtech Fundraising May be More Challenging in 2022 After Record-Setting 2021

Insurtech companies set records in both fundraising and valuations in 2021. That may prove difficult to replicate, given the specter of rising interest rates and the struggles of publicly traded insurtechs.

READ THE FULL ARTICLEBillion-Dollar Movies Return, Signaling Shift in Studios' Streaming Strategy

The winter's return of a $1 billion-plus title to theaters proved that the box office is still as relevant as ever for big-budget franchises, even as distribution strategies for smaller films remain in flux.

READ THE FULL ARTICLEA frenzy of mergers and acquisitions, alongside accelerated technological disruption, have been transforming the power dynamics of the media and entertainment industry.

READ AND SUBSCRIBETechnology deal volumes and values hit astronomical records in 2021, and the break-neck activity is only set to continue in 2022.

The first three weeks of January saw nearly $100 billion in deals, maintaining the unprecedented pace that drove 2021 above $1 trillion in sector M&A. The month also saw Microsoft Corp. agree to pay more than any buyer in 2021 with its $77.96 billion acquisition of Activision Blizzard Inc.

Corporate development executives and investment banking advisers forecast the coming year to be equal to or even bigger than the 2021 market.

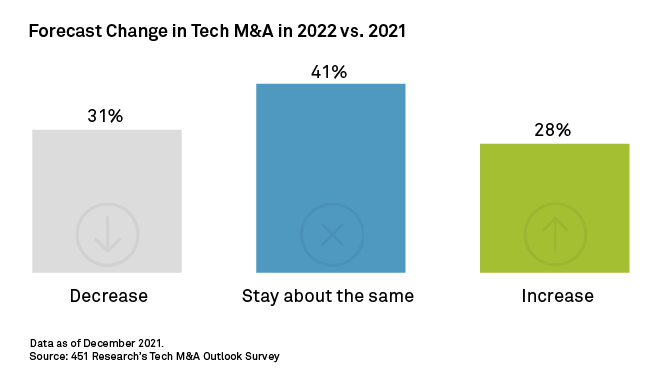

A full 69% of acquirers and advisers expect 2022 to sustain or add to 2021's feverish pace, according to recent 451 Research survey data. The market exited 2021 with $1.24 trillion in announced tech deals.

The survey found that 41% of respondents believe deal volumes will remain flat year over year and 28% believe activity will accelerate. A minority, 31%, said they believe activity will decelerate. The pessimism is atypical for deal-makers, who in past surveys have weighed more heavily toward M&A growth forecasts, 451 noted in a report on the survey, but it is also atypical for those deal-makers to be reflecting on a 13-figure run.

For targets, 451 survey respondents were confident in M&A valuations for the coming year involving private companies looking for a liquidity event. Only 35% of respondents said they believe private-company valuations will decrease in 2022 from historic highs, with the remainder saying they believe those valuations will hold or increase.

Cash-Rich Buyers, IPO Hesitancy to Drive Next Phase of Israel's Tech M&A Boom

Israel's technology M&A boom may weather potential interest rate rises due to cash-rich buyers taking advantage of lower valuations and startups shunning IPOs amid market volatility.

Read the Full ArticleThe Highs and Lows of AT&T's Dividend Cut

As part of its plan to spin off its interest in WarnerMedia, AT&T's board approved a post-close annual dividend of $1.11 per share, down 46% from $2.08 per share prior to the split.

READ THE FULL ARTICLEA DISH/DIRECTV Merger: To Be, or Not To Be

After years of speculation, recent moves by DISH Network Corp. have some analysts believing that a merger with DIRECTV may be on the horizon, though regulatory concerns could complicate any deal.

READ THE FULL ARTICLEMicrosoft Not Playing Around with $68.7B Buy of Activision

With Xbox consoles seeing strong demand and the subscriber base for the Game Pass subscription service hitting a new high, Microsoft Corp. is ready to grow its gaming business in a monumental way.

READ THE FULL ARTICLE

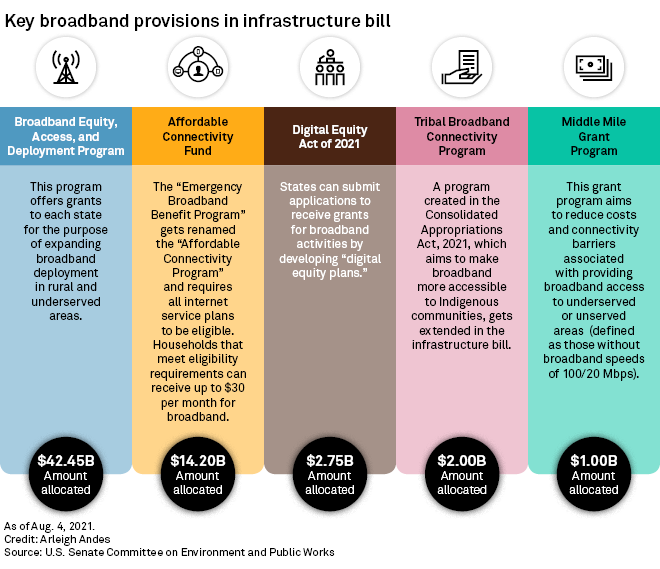

Republicans and Democrats agreed last year to spend tens of billions of dollars on building out internet service, but how and where to spend that money remains hotly debated.

At the Feb. 8 INCOMPAS 2022 policy conference, experts from Capitol Hill and independent U.S. agencies congregated to discuss how to best use the $65 billion allocated to broadband deployment in the bipartisan infrastructure act.

Congress to Ask NTIA Chief About Broadband Deployment Dollars

The National Telecommunications and Information Administration is tasked with doling out tens of billions of dollars to states to further broadband deployment efforts, and lawmakers are looking to better understand the agency's plans.

Read the Full ArticleRepublicans Go on Offense Against FCC Nominee in 2nd Hearing

Lawmakers welcomed the Federal Communications Commission nominee Gigi Sohn back for a second hearing, but Republican senators used the opportunity to express strong opposition to the pick.

Read the Full ArticleAviation, Wireless Industries Tussle Before Congress Over 5G Spectrum Delays

As the aviation and wireless industries continue to battle over the deployment of 5G spectrum, one thing is clear: Everybody blames somebody else.

READ THE FULL ARTICLEPrice Wars in India: Disney+ Hotstar vs. Amazon Prime Video vs. Netflix

Streaming competitions in India intensified as Netflix Inc. reduced its subscription fees in the market for the first time on Dec. 14, 2021, the same day that Amazon.com Inc. raised its Prime membership rates by about 40% to 50%.

READ THE FULL ARTICLEAnnual tech acquisition spending in 2021 soared above $1 trillion for the first year in history, as all major buying groups posted record deals. Valuation, too, hit unprecedented levels. But where does the priced-for-perfection tech M&A market go from here?

VIEW THE WEBINARBowing to ongoing industry trends, some U.S. cable news networks are launching new online subscription video services to offset declining traditional multichannel TV audiences. Fox Corp.'s Fox Nation and the forthcoming CNN+ from Warner Media LLC — to be launched in early 2022 — are examples. However, survey data of current Fox Nation viewers suggests the audiences for online cable news subscription video-on-demand services, at least initially, bear little resemblance to traditional cable news audiences.

Over the past five years, Kagan Consumer Insights survey results have documented the drop of traditional multichannel TV households — from 79% in 2017 to 65% in 2021 — while the percentage of internet households subscribing to an online video service has grown from 65% to 83% over the same period. As a result, online versions of many cable TV networks have been launched in recent years, including such familiar brands as Discovery+, AMC+, Disney+ and ESPN+.

Fox Nation, the online subscription video service operated by Fox News, was launched in late 2018. Results from the Kagan third-quarter 2021 U.S. Consumer Insights survey show that approximately 5% of internet households are currently using Fox Nation. In addition to news, Fox Nation offers a wide variety of daily TV programming, documentaries and movies. While many details of the CNN+ service have yet to be announced, numerous high-profile names from the news industry and Hollywood have already signed on to host shows.

NBCU Retracts Estimate for In-Market Regional Sports Streaming Launch

NBCUniversal Media LLC may be eyeing entry into the streaming arena for in-market regional sports coverage, but the timing of such a gambit remains unclear.

READ THE FULL ARTICLESubscribing for Originals Grows for Disney+, Declines for Other Top U.S. SVODs

Among top U.S. SVOD services, only Walt Disney Co.'s Disney+ saw an increase from 2020 to 2021 in the share of users who indicated they would be willing to subscribe if only originals were offered.

READ THE FULL ARTICLEWall Street Decides to Netflix and Sell

After several quarters of ambivalence on the part of investors, Netflix Inc. stock cratered following the company's fourth-quarter 2021 earnings release.

READ THE FULL ARTICLEPrice Wars in India: Disney+ Hotstar vs. Amazon Prime Video vs. Netflix

Streaming competitions in India intensified as Netflix Inc. reduced its subscription fees in the market for the first time on Dec. 14, 2021, the same day that Amazon.com Inc. raised its Prime membership rates by about 40% to 50%.

READ THE FULL ARTICLE

From cable to broadcast, OTT to telecom, and the technology behind it, S&P Global Market Intelligence’s TMT coverage provides the critical insights you need to stay ahead of your competition.

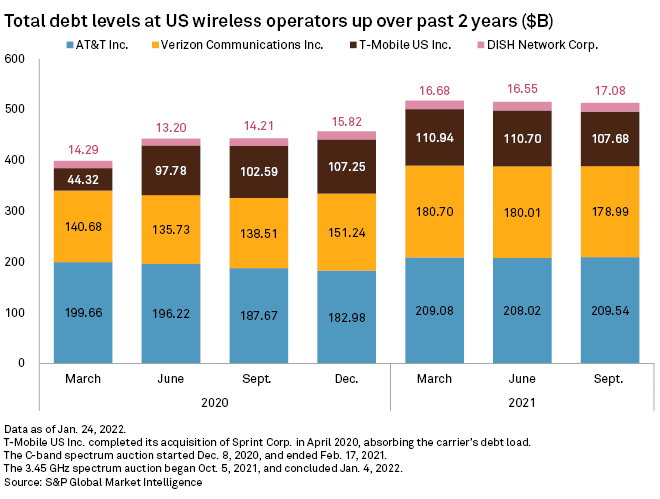

ACCESS THE TOPIC PAGEMobile carriers spent tens of billions of dollars on 5G spectrum over the past two years, but those investments may take a while to pay off, analysts say.

Looking at four of the biggest U.S. wireless companies — AT&T Inc., Verizon Communications Inc., T-Mobile US Inc. and DISH Network Corp. — the companies collectively spent nearly $100 billion in two near back-to-back mid-band spectrum auctions. Mid-band spectrum is considered essential for 5G delivery, balancing speed and range. It provides broader coverage than high-band spectrum and faster speeds than low-band spectrum.

While some analysts note the spending was important for the companies' plans to provide high-speed mobile and home 5G internet offers, others believe the financial outlays will handicap the heaviest spenders long-term, especially as they wrangle with both expected and unexpected delays in access to the spectrum.

Verizon and AT&T, in particular, spent too much in an attempt to keep up with T-Mobile's strong 5G footprint, according to Jeff Moore, principal of Wave7 Research, a wireless research company that covers U.S. postpaid, prepaid, smartphone and fixed wireless competition.

Altcoins and Indices — Announcing Two Equal-Weight Indices Covering Largest Coins

In the rapidly evolving world of cryptocurrencies, one area that is getting a lot of attention is altcoins (or alternative coins).

READ THE FULL ARTICLEFiber and 5G Rollouts a Baseline View of Operators Environmental Potential

As sustainable and green technologies go, many operators consider fiber rollouts to be key to achieving environmental goals.

READ THE FULL ARTICLEWireless Moves from 'Hobby' to Growth Engine for Cable Operators

With broadband growth slowing, wireless has ascended to become the long-term growth driver for Charter Communications Inc. and Comcast Corp., analysts say.

READ THE FULL ARTICLEJulia Haart on the Future of Tech, Talent, and Social Media

Utilizing emerging technologies in fashion has allowed talent to make a lasting impact on their brands and followers, says Elite World Group CEO Julia Haart.

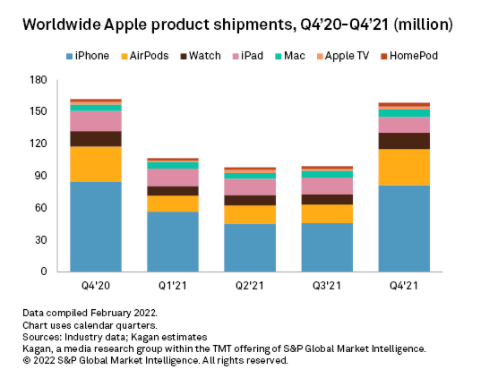

READ THE FULL ARTICLEApple's total product revenue climbed 9% year over year in the fourth calendar quarter of 2021, but Kagan estimates that unit shipments for the Apple devices we track fell 2% to 158.5 million as an increase in average selling prices offset ongoing supply constraints.

Sector rating actions will be more balanced following a significant positive bias over the last six quarters, reflecting good trends.

U.S. Tech Sector Outlook Strong Despite Equity Volatility And Slowly Improving Supply Constraints

Demand for U.S. technology companies is strong and broad, and outlooks for 2022 are strong due to trends in cloud, 5G, enterprise, automotive, and industrial end markets.

Although supply conditions will remain tight, they should ease throughout the year at different paces in different markets. Even so, S&P Global Ratings does not expect supply conditions to return to normal until 2023 at the earliest.

In terms of environmental, social, and governance (ESG) factors, governance risks are important for most tech issuers, and social risks are highest for a few key ones.

Sector rating actions will be more balanced following a significant positive bias over the last six quarters, reflecting good trends.