Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Digital startups in India are drawing investor interest, aided by a public “tech stack” and a positive macro story.

Published: August 3, 2023

By Shankar Krishnamurthy and Sampath Sharma Nariyanuri, CFA

Highlights

India’s public digital infrastructure and growing economy have helped to make the country a hotbed for startups. These tailwinds allowed the startup ecosystem to weather a global tech slowdown in 2022, turning India into the fourth-most popular destination for startups worldwide.

Startups in India have spawned a multitude of technology-first business models and permeated vast swathes of the economy. Although the global technology market decelerated recently, India’s startup ecosystem continues to enjoy tailwinds. As a result, the share of global venture capital flowing into Indian startups may roughly double by 2030.

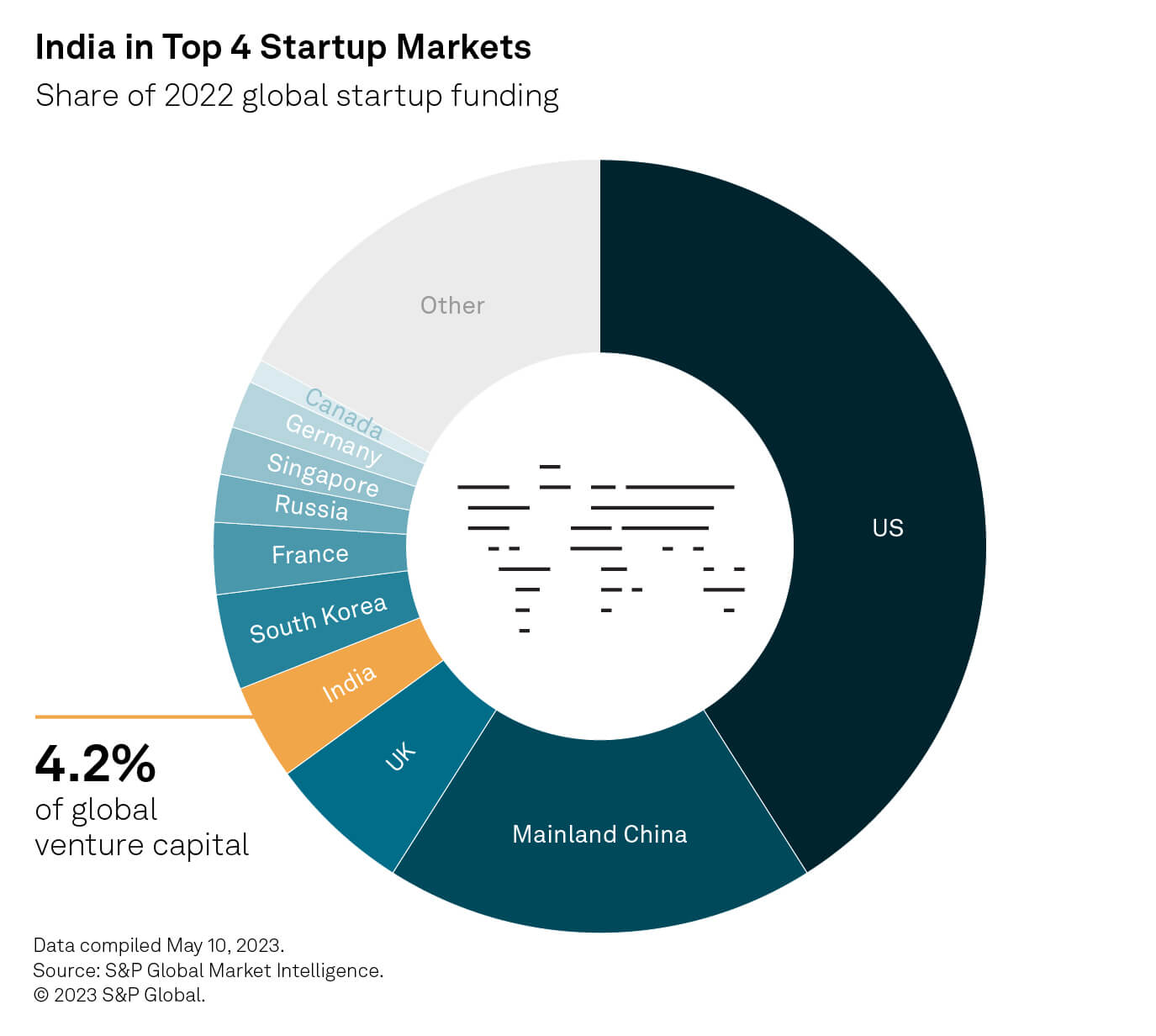

India emerged as the fourth-most popular destination for startups in the world in 2022, attracting 4.2% of global venture capital, behind the US (41%), mainland China (18%) and the UK (6%), according to S&P Global Market Intelligence. Moreover, Indian startups raised more capital than their listed counterparts did through public issues (IPOs and follow-on equity offerings). A consensual definition of startups is that they are primarily a creation of venture capital, which makes these measures a quantitative way to identify and track the growth of the startup ecosystem.

Doubts may arise about the sustainability of startups in India amid the wider global technology slump. As we look forward to 2030, three critical questions arise:

Despite the global slowdown in VC activity for startups, we expect India to be resilient for two reasons.

India’s huge economy means that it offers a significant runway for expansion, an essential filter for VCs scouting for high-growth startups. The country is home to some 1.4 billion people, and it is on course to become the world’s third-largest economy by 2030, according to S&P Global Market Intelligence.

Startups in India can also leverage the growing digital market, fueled by the expansion of mobile internet and the availability of the government-backed digital stack as a public utility.

Reliance Industries Ltd.’s rollout of Jio in late 2016 significantly expanded mobile internet services across the country. Consequently, 4G rose to 63.1% of total mobile subscriptions in 2021 from just 0.7% in 2015, according to 4G penetration rate estimates by Kagan, a part of S&P Global Market Intelligence.

The digital stack links Indians to digital identities, payments and bank accounts. Alongside widespread access to mobile internet services, it has enabled digital-native businesses to target millions of consumers. Government policies around funding, incubation and protection of intellectual rights have also helped to foster a startup community.

The country saw a record 26,542 startup registrations in 2022, even amid a global funding slowdown. India had more than 92,000 startups recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) as of Feb. 28, 2023. Young startups looking to get off the ground may face fewer challenges raising money amid the global VC slowdown, helped by low funding requirements and high potential. By contrast, VC investors may shy away from mature startups seeking much bigger amounts of cash.

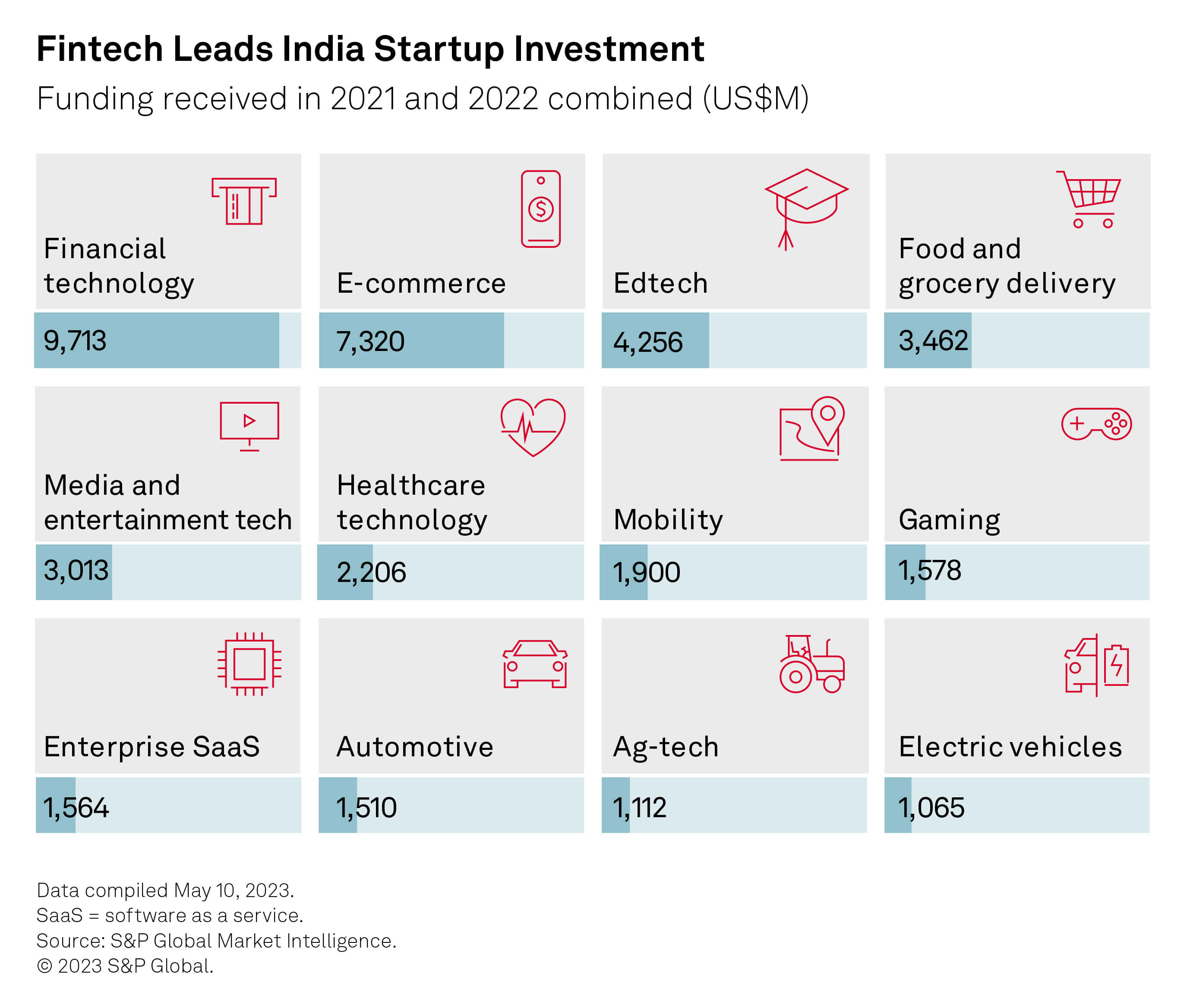

The financial technology sector has topped the funding charts in India in recent years, attracting a cumulative $9.7 billion in 2021 and 2022, according to S&P Global Market Intelligence data.

Venture capitalists initially focused on fintechs in the consumer-payment space. This sector is now mature, so attention has turned to other areas. For instance, fintechs are increasingly becoming the de facto distribution platform for banks to sell loans, wealth management products and credit cards to consumers.

The government is seeking to encourage the use of digital financial services by sponsoring API infrastructures that ease consent-based sharing of financial data and help underbanked individuals and small businesses access credit. The Account Aggregator (AA) network and the Open Credit Enablement Network (OCEN), which began operations in July 2020, execute lending workflows online and can be integrated with e-commerce, fintech and marketplace apps.

E-commerce and food-delivery services, the second- and fourth-largest startup segments in India, could benefit from another state-sponsored initiative called Open Network for Digital Commerce (ONDC). This system will bring interoperability across the widely fragmented digital commerce space. For instance, it will let customers of an e-commerce app participating in the network purchase goods from vendors listed on other participating apps. At present, apps are closed-loop networks, meaning that buyers and sellers on one app cannot transact with potential suppliers or customers elsewhere.

India’s digital commerce and on-demand services space won more than $10 billion of VC investments over the last two years, primarily driven by a cohort of startups attracting millions of middle-class Indians to their apps.

Other e-commerce formats could now gain greater investor attention. For example, online business-to- business marketplaces in manufacturing and retail raised $2.76 billion in aggregate in the last two years. These have the potential to proliferate further as tech-led, end-to-end integrated supply chain models offer a superior alternative to traditional systems.

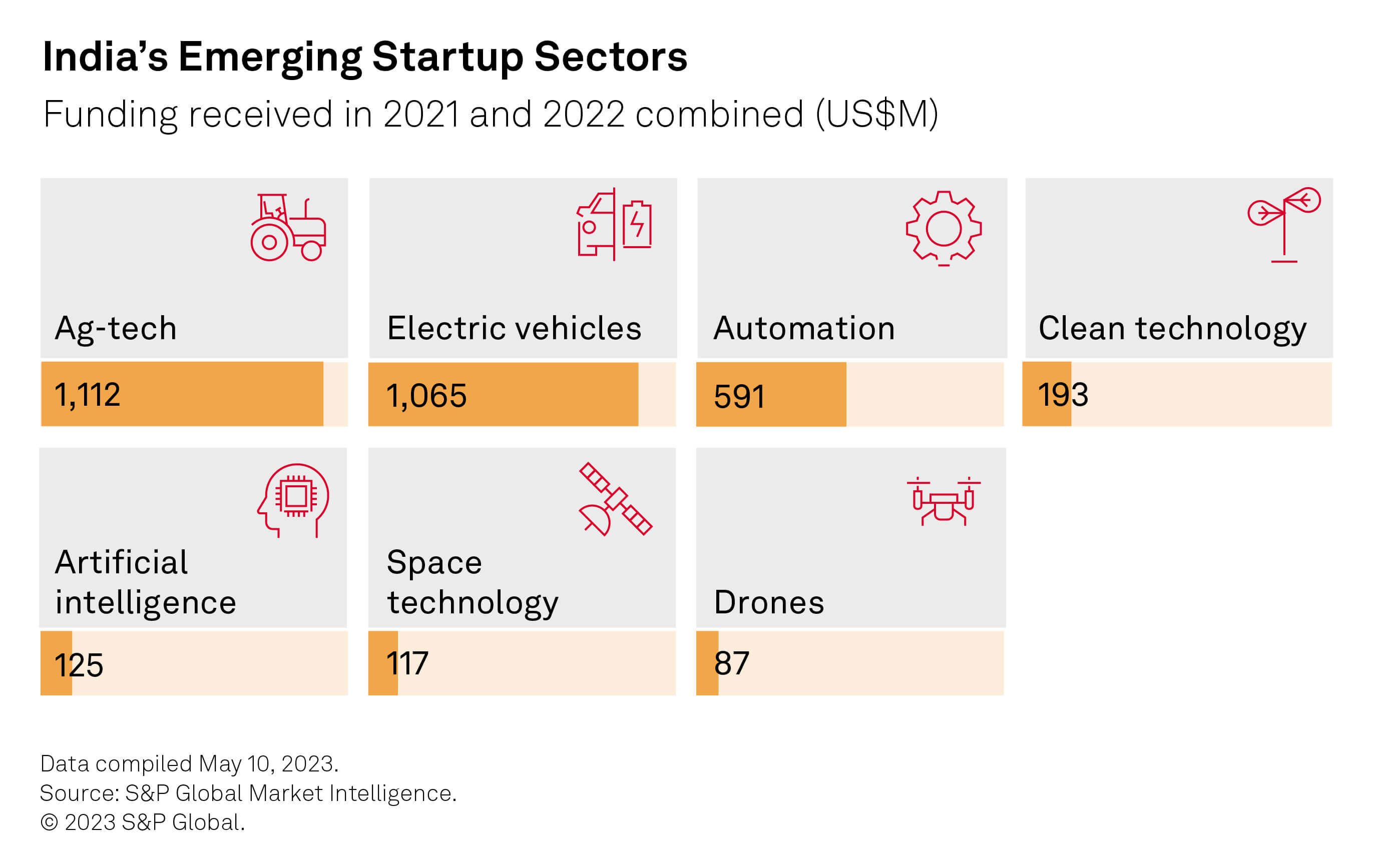

Several newer verticals for startups could see considerable momentum in the next few years.

Electric vehicles could benefit from the twin tailwinds of a concerted policy push and surging consumer demand. The sector will need about $266 billion of investment this decade to meet government targets, including having EVs account for 30% of private car sales and 70% of commercial vehicles sales by 2030, according to Government of India think tank NITI Aayog and the Rocky Mountain Institute. Venture capitalists will likely account for a significant share of these expected investments. The industry drew $1.5 billion of cumulative VC in India in 2021 and 2022.

Investors may also favor future-defining segments, including space technology, artificial intelligence, drones, robotics and clean technology. Companies in these sectors constitute a tiny share of India’s startup universe, and most are only seeking seed and early-stage investments. Among 91 firms that successfully undertook capital raising in the last two years, only four reached a mature stage, completing a series C or later round of financing.

In the near term, the global funding crunch could compress round sizes for Indian firms in the growth or mature stage. Late-stage businesses may similarly face lower valuation multiples and a greater focus on profitability. Younger firms experimenting with newer technologies and product innovation could defy the downturn.

In the longer run, India’s open APIs and public digital stack will likely act as enablers for new startups. The country’s positive macro story will also drive demand. The fintech and consumer tech segments will likely get bigger and more sophisticated, while startups in emerging technologies could gain greater traction and investor interest.

Global fintech funding primed for reset in 2023

Next Article:

With Physical Climate Risks Increasing in India, Adaptation Strategies Take Priority

This article was authored by a cross-section of representatives from S&P Global and in certain circumstances external guest authors. The views expressed are those of the authors and do not necessarily reflect the views or positions of any entities they represent and are not necessarily reflected in the products and services those entities offer. This research is a publication of S&P Global and does not comment on current or future credit ratings or credit rating methodologies.

Content Type

Language