Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Even as supply chains return to normal, the need for resilience is as important as ever. Firms will prefer strategies that lower costs and risk, such as technology investments and reshoring. They will likely cut back investments in purely risk-reducing projects, including just-in-case inventory strategies and supplier diversification.

Published: February 21, 2024

By Chris Rogers, David Tesher, Andrew Palmer, and Mark Fontecchio

Highlights

Corporations are emerging from a period of supply chain disruptions, with a tailwind from improvements helping their profitability. However, this does not eliminate the need for investing in future supply chain resilience strategies.

Firms must balance generating short-term cash flow with spending on long-term material resilience. Inventories are being cut back to pre-pandemic levels, which is unsurprising given higher interest rates and financing costs. This will, however, leave firms at risk of short-term inventory shocks.

Supplier diversification has reversed, reflecting a focus on cost-cutting and simplification. This could lead to more fragile supply chains, increasing geopolitical and logistics network risks.

Investments in technological improvements and reshoring can provide cost improvements and risk mitigation, but such strategies can be organizationally complex, expensive, take years to deliver and introduce new forms of risk.

Supply chain activity normalized in operational terms during 2023, but there are significant risks across the board heading into 2024. Supply chains need to be more resilient, but questions remain over whether corporations and their investors can make the necessary investments to fortify them.

The supply chain disruptions caused by the COVID-19 pandemic took a toll on firms' creditworthiness. According to "Supply-Chain Risks: A Credit Perspective," S&P Global Ratings took negative rating actions on over 200 corporate issuers due to supply chain events and bottlenecks in 2020–2022. These negative rating actions included downgrades, placements on CreditWatch with negative implications and outlook revisions to negative.

Consumer products was the industry that experienced the largest number of negative rating actions, accounting for 30% of the activity. (See chart, "Consumer products leads supply chain negative rating actions") A material disruption at any point across a supply chain can have consequences for a business' ability and willingness to meet its financial obligations, thereby affecting its creditworthiness.

High-profile examples of supply chain disruptions include restrictions on Russian gas and Ukrainian grain supplies due to conflict, container and shipping shortages in 2021 and 2022, and semiconductor shortages that began in 2020. These have elevated supply chain matters from procurement to the C-suite and the attention of investors.

Looking ahead, S&P Global Market Intelligence data shows that gross operating profit margins for manufacturing firms globally are expected to fall to 10.4% of sales in 2024 from 10.7% in 2022. We see the computing and electronics sector and domestic appliance manufacturing being particularly affected.

At the same time, capital expenditures are expected to exceed gross operating profits by 5% in 2024 after being equal to them in 2022. Investing in capital stock to maintain existing facilities and meet earnings growth objectives is another area that may take priority over spending on supply chain change.

S&P Global Ratings' credit condition outlooks also see risks from cost pressures, squeezing profits and eroding credit quality. Although risks remain high, the trend is toward improvement.

In North America, many corporate borrowers are finding it difficult to pass along high input prices such as wages and energy costs to end-consumers and end-customers. If profit erosion becomes more widespread and steeper than expected, credit quality could further suffer.

In Asia-Pacific, there are risks from global supply chain realignments. A further reduction in supply chain reliance on mainland China by Western and other importers could push up costs over the next few years, adding to inflation pressures. An escalation of international disputes over the seas and lands in south and southeast China would damage economic activity.

In Europe, the emphasis is on an extended period of favorable real interest rates that could expose financial vulnerabilities for issuers that find access to financing restricted and the cost of debt service prohibitive. That may squeeze issuers' surplus capital for investment in supply chain enhancements.

What companies are saying about supply chain stress

Quarterly earnings conference calls, analyzed using S&P Capital IQ machine-readable transcripts, show that mentions of "supply chain" as a topic (including semantically related keywords) soared during the pandemic, reaching a peak of 1.4x their 2021–2023 average for calls held during the second quarter of 2023. There has since been a decline in mentions of the topic, with calls held during the third quarter of 2023 mentioning supply chains just 76% of their average for the 2021–2023 period. Regardless, with 2,900 companies having mentioned the topic during the third quarter of 2023, there is still a wide-ranging focus on the state of supply chains.

As companies move beyond recent supply chain disruptions and implement longer-term strategic adaptations, one topic that has become more important is reshoring, which is associated more with longer-term inventory transitions than short-term turmoil.

Mentions of reshoring and related keywords have soared to 172% of their three-year average. This suggests an increased focus on a strategy that can take years to implement. The increased discussion about inventories comes partly at a time of slowing sales and may not necessarily reflect a decision to abandon just-in-case inventory strategies.

One of the most tangible signs of supply chain challenges during the pandemic was empty shelves. The shortage of inventories led many firms to over-order and cut stock levels in late 2022 and into 2023. While it is understandable to want to reduce inventories in a high-interest-rate environment, retaining a just-in-time approach can leave firms vulnerable to future shocks, whether political, operational or financial.

Data from the S&P Global Purchasing Managers' Index (PMI) indicates that most companies are returning to their pre-pandemic stocking strategies, with manufacturing stocks of finished goods in retreat for nine of the 10 months through September 2023. While the computing sector has experienced a particularly notable inventory decline, the downturn in consumer goods has been more sporadic.

Corporate financial data presents a mixed picture. As of Sept. 30, 2023, the inventory-to-sales ratio for the Russell 3000 group of manufacturers and retailers of goods was 54.1% on a trailing three-month basis compared with an average of 50.1% for the 2016–2019 period.

The elevated level is not necessarily indicative of a change in inventory patterns, as it is below the peak of 54.8% reached in March 2023.

The elevated level is caused by a handful of sectors. Apparel (including retailers and manufacturers) has an inventory-to-sales ratio of 74.7% versus 68.6% historically, while electronics (excluding semiconductors) stands at 39.1% versus 29.9% historically. Firms in both sectors are committed to reducing their inventories.

Sectors with longer sales cycles, such as household durable goods, are closer to balance. In September 2023, the inventory-to-sales ratio for that sector was 55.0%, well below the peak of 64.7% from a year earlier and in line with the historical average of 54.9%.

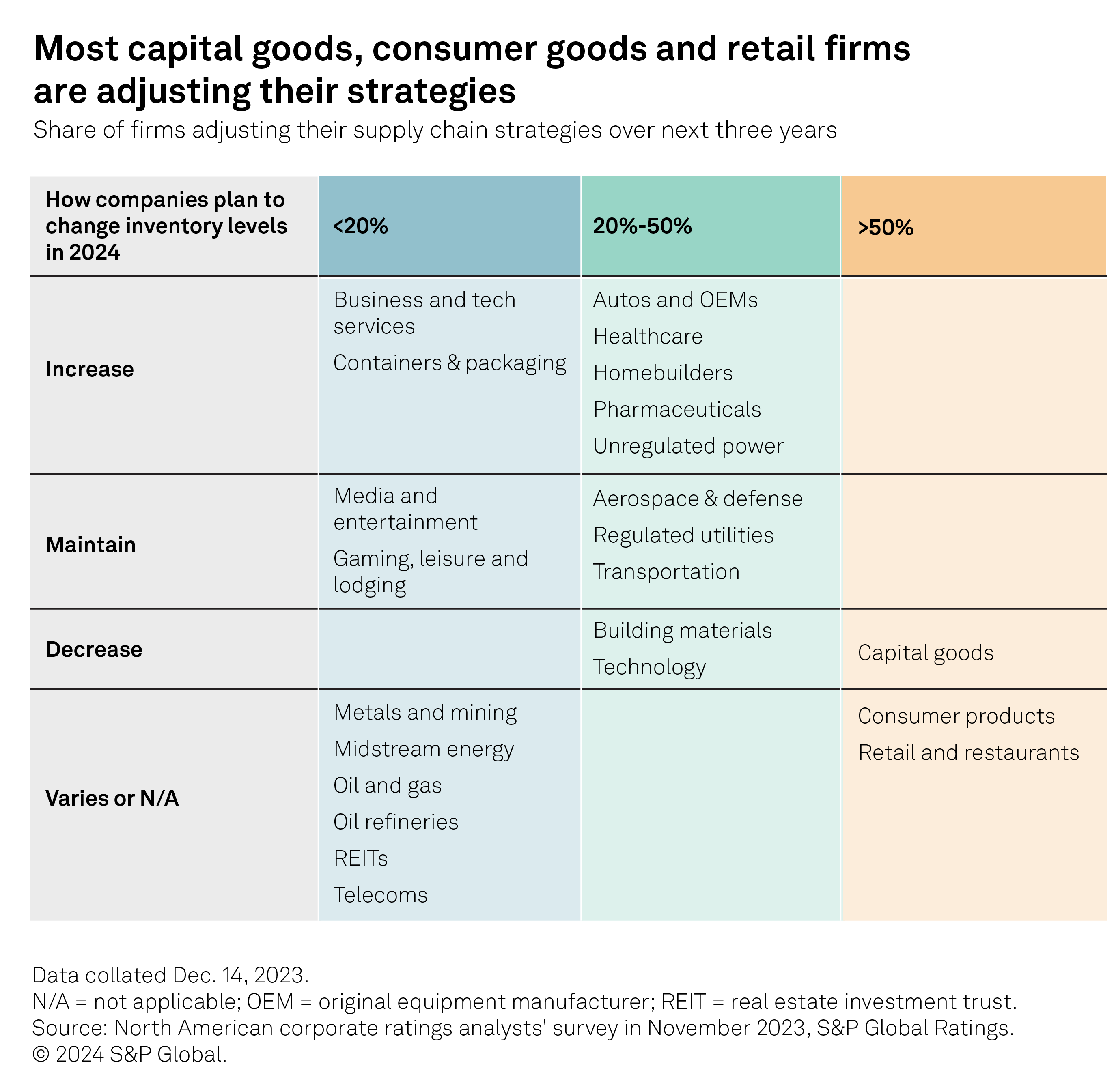

According to S&P Global Ratings credit conditions research, only a few sectors in North America plan to increase their inventories in 2024. These include containers and packaging, autos, healthcare and pharmaceuticals, and homebuilders. Others expect to maintain or cut their inventories.

Over the next three years, between 20% and 50% of companies across various sectors are anticipated to adjust their supply chains. We expect the ratio will likely be over 50% for capital goods and consumer products.

Companies can reduce supply chain risks by implementing supplier diversification and reshoring strategies. The two are often interrelated, but the diversification of suppliers can come in and out of fashion depending on the need for cost reductions. In the next three years, firms may focus on cost-cutting measures that could lead to shorter supplier lists and an increased concentration of orders among fewer suppliers to secure better prices.

Panjiva data shows that among the top 500 US importers from 2019 to 2023, the number of suppliers (shippers) per ultimate buyer (consignee) increased 13% in 2021 compared with 2019. This indicates the use of more suppliers to manage disruptions.

In 2022, there was a 2% decline, while data for the 12 months through Nov. 30, 2023, suggests a return to 3% below 2019 levels. At the sector level, there are signs of a more extreme run-up among consumer durables firms during the pandemic. At the same time, the reduction in diversification has also been faster, with the number of suppliers per buyer in 2023 down 8% versus 2019.

The auto industry has continued to expand the number of suppliers per buyer. This potentially reflects the sector's shift to EV production while maintaining its internal combustion engine production.

In the long term, abandoning diversification may lead to problems in the event of single-supplier risks or systemic issues, including geopolitical influence and large-scale logistics network interruptions.

Investments in supply chain technology can provide benefits including administrative cost reductions and improved planning accuracy through risk mitigation measures such as alternative route planning and supplier risk identification. The costs of implementing such data are much smaller than changes in inventory levels and supplier diversification.

Yet, the reputation of disruptive supply chain technologies — most notably in freight forwarding and trucking — has taken a hit due to business setbacks to high-profile startups in the sector. Digital paperwork, predictive analytics and AI tools can help enhance service-based, human-relationship-focused businesses but cannot completely replace them. S&P Global Market Intelligence has found examples of firms that have saved millions of dollars in logistics costs through systems consolidation, centralized planning and improved visibility.

A recent "Supply Chain Digital Transformation" survey by S&P Global Market Intelligence 451 Research found that six out of 10 supply chain organizations have a digital transformation strategy and are digitizing their business practices. The remaining companies have such plans in flight but have not yet launched them.

The level of development by sector varies markedly, with 75% of retail firms having a strategy underway while only 27% of the medical and pharmaceutical sectors are actively digitizing (though a further 55% are investigating a plan).

Electronic logging device rules show potential for organized technology investments

The electronic logging device mandate was implemented about five years ago to promote national road safety. It required commercial vehicles to have a telematics device to track how many hours drivers worked and operated their vehicles. The goal was to reduce the number of tired truck drivers on the road.

As a result of the mandate, there was a huge jump in the volume and types of data that fleet managers could start collecting from their vehicles, drivers and cargo assets. This led to a major disruption in over-the-road distribution in the US, with projects including route optimization, preventative maintenance and driver monitoring.

Digital bills of lading foundational to supply chain transformation

Digitizing logistics workflows is vital to broader supply chain technology investments. This is because bills of lading are crucial to the operational, compliance and finance functions of most manufacturing and retail firms. In early 2023, the Digital Container Shipping Association committed to achieving 100% digitization of bills of lading by 2030. The move could have cascading effects, including creating a new and comprehensive dataset that can be used for tracking, fraud prevention, contract enforcement and trade finance. A recent S&P Global survey showed that 80% of cargo owners and 70% of logistics service providers have implemented or are in the proof-of-concept stage for document digitization.

AI augments human judgment

S&P Global Market Intelligence analysis shows that AI technologies in supply chains cannot prevent disruptions on their own, but they can help predict probabilities of future ones if deployed in an organizationally integrated manner. AI-based tools may also shorten recovery times by indicating where there should be inventory redundancies. Additionally, these tools can be used for scenario planning, finding optimal distribution routes, and cost-cutting measures via document and customer service improvements.

Delivering successful technological improvements through the supply chain is highly complex, with long lead times and organizational changes required. Firms may therefore prefer less-speculative technologies while firmwide profitability remains depressed. The blockchain and autonomous vehicles are examples of technologies hailed as revolutionary that have yet to yield returns.

Additionally, technology investments cannot just be the purview of the IT department. After a period of experimentation, an honest assessment of returns versus investment based on realistic assumptions can prevent subsequent disappointments — vital for shareholder-owned firms.

At the implementation stage, buy-in from operational divisions and careful coordination with legal and compliance operations are required. The latter is particularly important where data must be shared with suppliers, customers or service firms such as logistics partners and newer IT partners in AI.

The decision to reshore supply chains is driven by cost minimization and risk mitigation, S&P Global Market Intelligence analysis shows. It is a well-established strategy and is set to continue for many years.

Geopolitically driven supply chain diversification strategies have been taking place across power tools, apparel, washing machines and computers. Geographic diversification will likely continue as the political backdrop for Asia-Europe and Asia-North America supply chains evolves. The rivalry between the EU and mainland China may increase, thanks to the former's review of the latter's EV industry. The outcome of the US elections in November 2024 could drive a rivalry with mainland China in 2025 and beyond.

Onshoring production to India is partly driven by the scale of the Indian market and the exigencies of the government's Production Linked Incentive program and tariffs, as discussed in "'Make In India' Manufacturing Push Hinges on Logistics Investments."

Nearshoring to Mexico for the North American market may enter a new phase in 2024, as flagged in "Mexico as a supply chain reshoring leader." However, the market has to compete with the US as a production center in several sectors, particularly in the electrification of transport.

Although reshoring has multiple benefits, it is costly and carries risks. Investment in new production facilities, qualification of new suppliers, establishment of quality control systems and meeting regulatory requirements can run into the tens of millions of dollars. Replicating integrated supply chains may require bringing several suppliers on board rather than a single investment decision, while geographically lengthy supply chains introduce operational risks. Moving manufacturing away from a country can lead to a loss of sales in that market, so firms often only use reshoring for incremental investments.

Additionally, the human factor should not be underestimated. Training skilled staff and instilling a culture of quality control requires time and effort. Moving to a different country also does not remove all risks. Managing such long-term decisions requires balancing operational risks raised by labor strikes and cargo disruptions with contract risks and policy uncertainty. S&P Global Market Intelligence country risk scores show that Vietnam generally offers lower risks than mainland China, except for infrastructure disruptions, while Malaysia is a lower-risk alternative to India.

Leveraging corporate commentary and earnings data for supply chain insights

Credit Conditions North America Q1 2024: A Cluster of Stresses

Credit Conditions Asia-Pacific Q1 2024: China Slows, India Grows

Next Article:

Decarbonization and development: Logistics network investments

This article was authored by a cross-section of representatives from S&P Global and in certain circumstances external guest authors. The views expressed are those of the authors and do not necessarily reflect the views or positions of any entities they represent and are not necessarily reflected in the products and services those entities offer. This research is a publication of S&P Global and does not comment on current or future credit ratings or credit rating methodologies.