Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Providing essential data requires that we go beyond the balance sheet. Our ESG solutions offer financially relevant analytics and timely data to assess risk, uncover opportunities and inform long term sustainable growth.

The COVID-19 pandemic is one of the most severe economic and energy shocks in modern history. On top of the massive disruptions to business, mobility, and everyday life, there clearly will be longer-lasting implications for the energy transition away from fossil fuels. While the shocks from the pandemic are leading to reductions in fossil fuel consumption and emissions, they will not be enough to put the world on a path to meet 2 degree global warming target, nor bring forward peak oil demand, nor drive coal consumption to near zero.

Key Takeaways

Roundtable Discussion Participants:

—Susan Gray, Global Head of Sustainable Finance, Business, and Innovation, S&P Global Ratings

—Manjit Jus, Managing Director, Global Head of ESG Research & Data, S&P Global

—Roman Kramarchuk, Head Energy Scenarios, Policy & Technology Analytics, S&P Global Platts

—Lauren Smart, Managing Director, Global Head of ESG Commercial at S&P Global Market Intelligence

—Reid Steadman, Managing Director and Global Head of ESG at S&P Dow Jones Indices

—Evan Greenfield, Senior Managing Director, Global Head of ESG at S&P Global (moderator)

S&P Global is proud to support Climate Week NYC 2020 to accelerate progress on climate risk, and provide the essential intelligence to achieve sustainability at scale.

Our vision of the coming climate disaster is limited by political, practical, and professional horizons—which limit foresight to, at best, a decade. The tragedy of this limited horizon is that our planning cycles are out of sync with the systemic risks of global climate change.

Investors focused on the carbon intensity of financial assets are necessarily aware of and preparing for transition risks, whereas investors focused on physical asset risk related to climate change are necessarily aware of and preparing for the possibility of inaction. To be clear, responsible investors must take both physical and transition risks into account, but the weighting of these two approaches will indicate the relative market force of optimism versus pessimism on climate.

Read the Full Featured Article

Key Takeaways

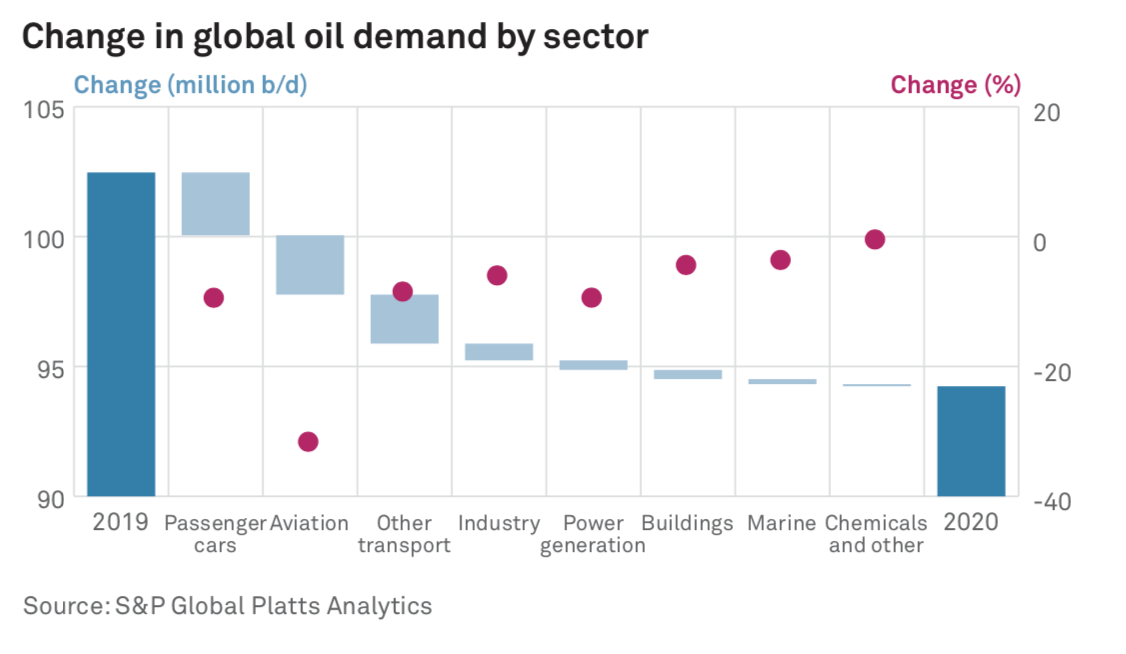

Crude and condensate output is forecast to fall 7% year on year, dipping below 80 million b/d, and oil prices in late August remained around $20/b below 2019 average levels.

In almost any other year, these cuts to capital spending and output could be attributed to supply-demand cycles and price responsiveness.

After 2022, growth in CO2 emissions essentially flattens to 0.2% a year before peaking in 2032. By 2040 emissions remain around 3 Gt above 2020 levels, as abatement efforts are offset by the continued use of coal for power generation in Asia's growth economies.

Fossil fuels would shrink to roughly half of total primary energy supply in 2050, from about 77% in 2020, if the world meets the minimum Paris Agreement target of 2C warming, according to the latest projections by S&P Global Platts Analytics.

The demand shock caused by the coronavirus pandemic has slashed 2020 emissions far more aggressively than the 2C pathway, but massive uncertainties loom regarding the demand recovery as well as the trajectories of both fossil fuels and renewables.

Achieving net-zero emissions can be a complicated feat and requires different strategies for different types of companies. "This isn't just a pie-in-the-sky commitment or announcement. This is something that we spent a lot of time researching and analyzing and studying," DTE Gas Co. President and COO Matt Paul said of the company's plan to achieve net-zero emissions by 2050 in an exclusive interview with ESG Insider, an S&P Global podcast about environmental, social, and governance issues.

Listen and subscribe on Apple Podcasts and Spotify.

Since the 2015 Paris Agreement, 180+ countries[2] have committed to accelerate the transition to a low-carbon economy by enacting a variety of policies. This includes the introduction or increase of a carbon tax. Major central banks and financial regulators across the world are planning to test the financial markets’ preparedness for associated physical and transition risks by introducing ad-hoc scenarios to financial institutions’ annual stress-testing exercises.

While scenario analysis is routinely performed by risk managers at financial institutions and non-financial corporations, energy transition risks pose new challenges. This includes the longer time horizons needed for the analysis, the scarcity of quality company emission data, and the lack of an established quantitative approach linking energy transition risks and opportunities to credit risk.

Climate change has created a need to evaluate the impact of different climate-related scenarios on counterparties, investments, and portfolios. To support these efforts, S&P Global Market Intelligence and Oliver Wyman present Climate Credit Analytics, a climate scenario analysis and credit analytics model suite. These tools combine S&P Global Market Intelligence’s data resources and credit analytics capabilities with Oliver Wyman’s climate scenario and stress-testing expertise.

Climate Credit Analytics translates climate scenarios into drivers of financial performance tailored to each industry, such as production volumes, fuel costs, and capex spending. These drivers are then used to forecast complete company financial statements under various climate scenarios, including those published by the Network for Greening the Financial System (NGFS), a group of over 60 central banks and supervisors.

This will enable users to have comprehensive and consistent sector-specific modelling, including key high carbon-emitting sectors. The tool leverages S&P Global Market Intelligence’s proprietary datasets and capabilities, including financial and industry-specific data, sophisticated quantitative credit scoring methodologies, and company-level data from Trucost and Panjiva.

Learn more about Climate Credit Analytics

The coronavirus pandemic may accelerate a shift from fossil fuel spending to investments in renewable energy, but the pace of that transition depends heavily on how governments direct economic recovery spending, and whether the consumer behavior changes induced by the outbreak become permanent.

Listen and subscribe on Apple Podcasts, Spotify, and other platforms.

To date, climate-conscious investors have largely focused on reducing relative portfolio carbon exposure, but divergent methodologies have made fertile ground for so-called “greenwashing.” While point-in-time analyses do not necessarily inform alignment with our needed transition to a low-carbon economy. However, a combination of groundbreaking new datasets and index innovation is emerging. Investors now have the choice to align with a scenario that may mitigate the most catastrophic impacts. The European Union (EU) is in the process of finalizing standards for defining a ClimateTransition Benchmark (CTB) and a Paris-aligned Benchmark (PAB), both of which use absolute measures to align with a 1.5°C trajectory rather than simply a relative carbon reduction.

How can indices provide greater insight into climate risk and help investors looking to go beyond traditional carbon reduction strategies?

Take a Closer LookThere is a pressing need for the world to reduce its greenhouse gas emissions to decrease the risks and impacts of climate change. Responsible action is required by all stakeholders, including investors.

Read the Full ArticleThe S&P 500 ESG Index aligns investment objectives with environmental, social, and governance values. It can serve as a benchmark as well as the basis for index-linked investment products.

Read the Full Article

ESG InFocus is a monthly newsletter from S&P Global Market Intelligence that captures news, insights, trends, and commentary into ESG developments driving change across business decisions. Stay informed on upcoming ESG related webinars, conferences, and networking events.

Subscribe to the Newsletter

That would be the largest drop since 1.4% in 2008 during the global financial crisis, according to the Global Carbon Project. That's significant but would still fall short of the 7.6% each year in reductions that the UN Environment Program says the planet needs to keep global warming below 1.5 degrees Celsius under the Paris Agreement.

Furthermore, climate watchers expect a rebound in emissions growth once economies restart and try to make up for lost time. This means companies and countries will still need to reduce their emissions further. To be sure, many are committing to becoming "net zero" by 2050, which is in line with the agreement, but is it achievable? Can they really reduce as many emissions as they produce? Here, in this article, we assess the ability of the world's forests and soils to capture carbon and offset emissions.

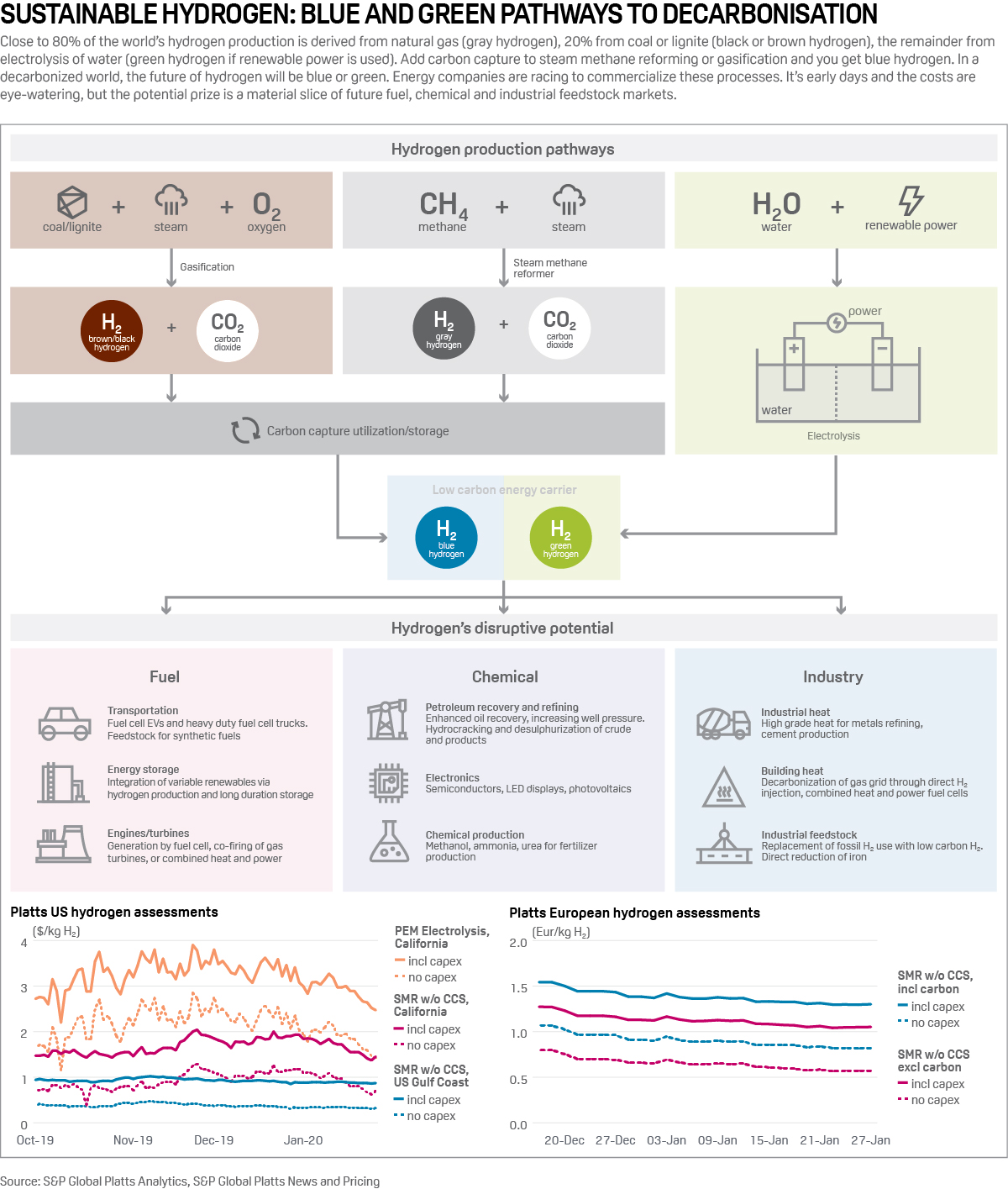

Close to 80% of the world's hydrogen production is derived from natural gas (gray hydrogen), 20% from coal or lignite (black or brown hydrogen), the remainder from electrolysis of water (green hydrogen if renewable power is used).

Derided, doubted, and now celebrated—an old solution to fossil fuels has become the fuel of tomorrow. Simon Thorne and Roman Kramarchuk of S&P Global Platts join the Essential Podcast with host Nathan Hunt to explain the practicalities and obstacles for hydrogen as an energy carrier.

Listen and subscribe on Apple Podcasts, Spotify, Google Podcasts, and our podcast page .

The commitments of governments, regions, and cities across the globe to reduce carbon emissions are creating transformative times for many industries. Few are facing more change than the global power sector, which is responsible for approximately one-quarter of global greenhouse gas (GHG) emissions. It is expected that renewable electricity will need to increase to 70-85% of supplies by 2050 in order to limit climate change to less than 1.5°C of warming to avoid its worst impacts, with coal-fired power being almost completely eliminated.

A Need for Leadership

Given its size and effect, it is important that the global power sector play a key role in the world’s decarbonization efforts. To recognize progress made on this front, Trucost developed a methodology to identify power companies at the forefront of the energy transition for the S&P Global Platts3 Global Energy Awards; The Energy Transition Award.

The short list of ten power companies included: Contact Energy, E.ON, EDP-Energias de Portugal, Enel, ENGIE, Iberdrola, Ørsted, Pinnacle West Capital Corporation, SSE, Sempra Energy, VERBUND, and Xcel Energy.

These companies shared the following traits:

–Demonstrate exemplary performance among peers in terms of current GHG impacts.

–Have been reducing their impact over time.

–Have published goals to meet the objects of the Paris Agreement to keep a global temperature rise well below 2°C from pre-industrial levels.

–Show a lower impact on potential earnings from a rising carbon price.