Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Net zero goals imply huge shifts in strategy for global oil majors, but approaches vary. S&P Global Platts Analytics’ modelling lays out the potential displacement in both oil demand and capital expenditure up ahead, and highlights the inherent risks of each pathway for carbon reduction.

Published: August 1, 2020

By Mark Mozur

Highlights

A company that pursues a full-scale transformation of its business model as part of its energy transition strategy would either face intense competition from incumbents or could develop a path dependency.

Some oil producers and major lenders have announced that they will no longer seek to develop higher cost supplies such as Canadian oil sands or Russian Arctic offshore deposits.

Download the report here.

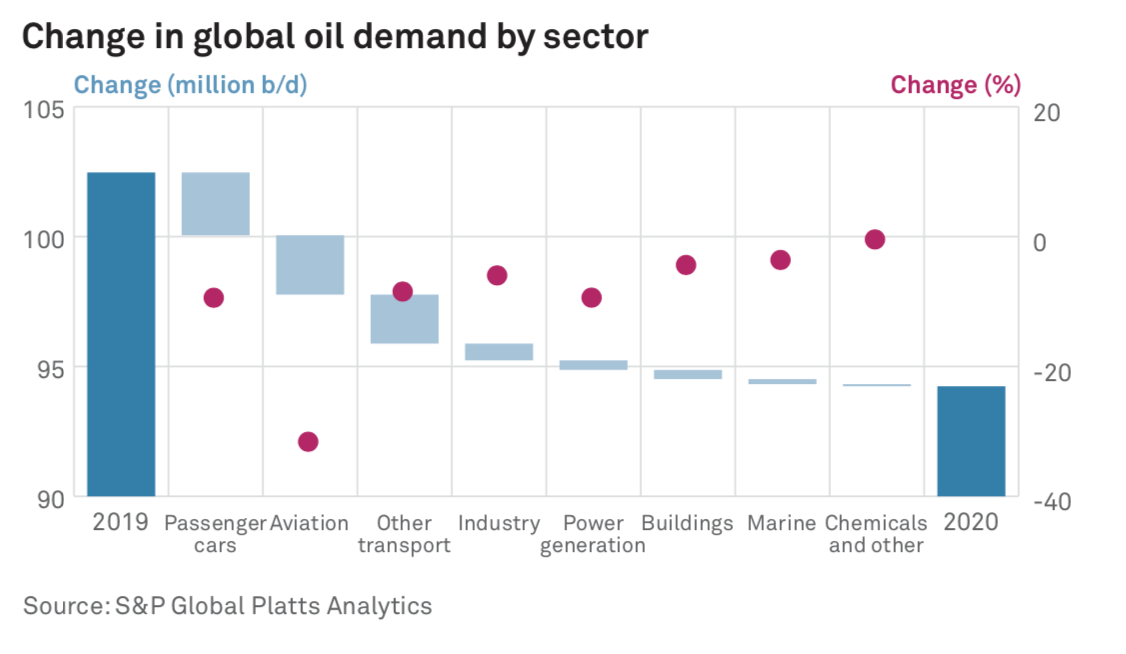

This year may be remembered as a tipping point for the oil and gas industry. In the midst of a global pandemic and economic lockdown that are expected to wipe out over 8 million b/d of oil demand, producers have slashed capital spending to the lowest in 15 years.

Crude and condensate output is forecast to fall 7% year on year, dipping below 80 million b/d, and oil prices in late August remained around $20/b below 2019 average levels.

In almost any other year, these cuts to capital spending and output could be attributed to supply-demand cycles and price responsiveness.

But in more ways to count, 2020 is not just any other year. Prompted by virus transmission fears and the new normal of working from home in many economic segments, the coronavirus pandemic has caused modellers to re-think how the legacy of the virus could change consumer – and business – behavior for years to come as no end-use sector has been immune to the impact of the global economic lockdown.

In the view of S&P Global Platts Analytics, the downside pressure to long-term oil demand in a post-pandemic world can be felt across the board, touching nearly every single end-use sector in our energy models. Examples include reduced vehicle miles travelled as consumers adapt to remote work and slower growth in international air travel as social- distancing norms become prohibitive for aviation and businesses choose to limit travel. There is also the dampening effect on international trade as businesses – and governments – accelerate efforts to “reshore” global supply chains.

In Platts Analytics’ long-term balances, the net impact has been to reduce projected 2050 oil demand growth considerably as these trends far outweigh upward pressure on demand from competing drivers such as the rise in e-commerce and home shopping, a continued preference for plastic packaging and – not to be forgotten – a substantially lower long-term oil price outlook.

In short, there is an emerging conversation aboutthe extent to which the coronavirus pandemic has shifted the world onto a low-demand and therefore a low-carbon trajectory. Whether in terms of the drop in fossil fuel consumption or in terms of the expected fall in CO2 emissions, Platts Analytics expects near-term decreases to exceed those required in a low-carbon world as defined by a modelled 2-degree-Celsius pathway. Platts Analytics forecasts a drop of 8% and 6%, respectively for the two indicators, versus 1.5% and 1.9% in a 2 C scenario.

The Paris Agreement, ratified by 189 parties to date, targets limiting the global rise in temperature this century to well below 2 C above pre-industrial levels, in order to avoid catastrophic impacts of climate change. From an energy end-use point of view, a 2 C pathway can be modelled by requiring that annual CO2 emissions decline to 10-15 Gt per year by 2050. This is based on the lowest Representative Concentration Pathway included in the most recent assessment report from the Intergovernmental Panel on Climate Change. S&P Global Platts Analytics has adapted this global greenhouse gas pathway to country-level emissions reductions requirements.

In the context of this ongoing conversation, it is all the more remarkable that even as some of the world’s most prominent oil producers have announced major cuts to capital spend, as well as asset write downs and dividend cuts, industry leaders such as BP, Total, Shell, and others have made headlines by effectively redoubling their commitment to long-term net zero targets. As of the third quarter, nearly every single international major has made some form of a low-carbon commitment.

The more ambitious of these aspire to be “net zero” by 2050, but all companies have some form of commitment to reduce the greenhouse-gas intensity of existing operations and some form of pledge to expand activity related to low-carbon energy carriers such as renewable power, biofuels, and even hydrogen. Concurrent with this, the reduced long-term oil demand outlook has caused many producers to adopt lower pricing guidance.

Platts Analytics has reviewed various corporate low- carbon commitments and while there is a diverse set of measures announced to date to achieve long-term targets, they do not all imply a full-scale business model transformation. The table to the right reflects an attempt to categorize low-carbon ambitions of upstream oil and gas producers.

In principle, all four pathways are viable options to reduce entity-level CO2 emissions. But at their hearts each of these transformations has a different set of implications for what a 2050, low-carbon world would look like.

Platts Analytics’ 2 C pathway has been modelled at the sectoral level and has been built by balancing long-term energy demand growth against structural constraints such as available non-fossil fuel supply, technology costs, and global emissions caps.

From an oil producer’s perspective, the end-user results of this modelling exercise are substantial. The collective share of fossil fuels in final energy consumption in 2050 is projected to decline from nearly 45% in current Platts Analytics’ long-term balances to under 30% in a 2 C sensitivity. The sensitivity analysis in terms of oil is even starker: 50 million b/d of demand destruction separates a reference-case outlook from a low-carbon sensitivity.

Most significantly, in a 2 C world refined petroleum products are almost entirely displaced from on-road transport (passenger cars and commercial road transport). Fossil fuel’s share of on-road transport demand is expected to fall from 91% now to 77% in 2050 in the Platts Analytics reference case compared with only 10% in a 2 C sensitivity. Though other transport sectors such as air and marine are slower to decarbonize, the volume growth is too small to replace the lost oil demand elsewhere.

Further, a 2 C sensitivity necessitates a massive buildout in the electric power grid. Strictly in terms of absolute demand levels, new low-carbon electricity demand is nearly equal to the reduction in fossil fuel supply for on-road use in 2050.

These modelling results would imply that oil and gas incumbents should seek to transform their business model fundamentally to the extent that they consider such a 2 C sensitivity viable. But perhaps it should come as no surprise that it is not that simple.

As mentioned above, the expected single-year drop in 2020 exceeds required reductions on a low-carbon pathway on the oil-demand side. Similar analysis can be applied to the supply side. To meet the reduced call on crude (and condensate) in a 2 C sensitivity, Platts Analytics assigned a basin-specific decline rate to currently producing assets and any assets expected to be brought online between now and the mid-2020s, when oil demand growth would be projected to peak. At a global aggregate level, this rolls up into an average annual base decline rate of 3.3%. Once again, this overall decline rate is more aggressive than the projected decline in oil demand, which would fall by 1.9% a year. Thus, in a 2 C sensitivity incremental investment in upstream oil production is still needed to meet demand.

The fact that new upstream oil investment is still needed to meet demand in such a sensitivity points to a key reason why many major producers have put forward hybrid strategies to achieve net-zero targets that blend across the four different categories described previously. As modellers, this fact also enables us to frame the energy transition in terms of capital allocation.

In Platts Analytics’ reference case long-term balances, the slashed upstream capital spending observed this year rebounds to average $380 billion a year in real 2018-equivalent dollars from 2025 through 2050. To calculate changes in capital allocation implied by a low-carbon pathway, Platts Analytics has mapped 2 C demand for refined products to current estimates of marginal supply costs.

In this analysis Platts Analytics has assumed that supply growth is optimized across cost, meaning that incremental oil production is almost exclusively restricted to core OPEC producers. Overall, from 2025 to 2050, this key assumption implies $3.4 trillion in total upstream capex, versus $9.5 trillion in the reference case, effectively leading to $6.1 trillion in potential long-term capital reallocation.

Moreover, policy uncertainties such as the potential application of some form of carbon pricing on oil output represent a potential upside to this estimate. The capital reallocation figure is contrasted against $14 trillion in needed spend on incremental power generation capacity in the same Platts Analytics 2 C pathway.

Recent events have borne out this analysis. Recognizing that a weaker demand outlook will not bolster long-term prices, some oil producers and major lenders have announced that they will no longer seek to develop higher cost supplies such as Canadian oil sands or Russian Arctic offshore deposits.

Any additional demand-side risk could cause other basins to fall out of the marginal supply stack as producers continue to adjust their long-term price view, and each such iteration could narrow the gap between the incremental capital spend in the Platts Analytics reference case ($9.5 trillion) and the Platts Analytics 2 C pathway ($3.4 trillion).

Should this happen, the post-coronavirus world would indeed be moving onto a lower-carbon trajectory. One key driver of this dynamic is that the customer base is essentially undergoing profound structural change that has weakened the demand outlook for nearly every major oil-product category, with the exception of plastics.

Returning to energy transition strategy frameworks, each strategy faces a unique set of risks related to the long-term demand outlook. At a general level, additional cost implications need to be applied in any strategy, affecting their commercial viability. But in terms of specifics, each strategy has a different key challenge.

Firstly, oil and gas producers that pursue carbon reductions strictly in terms of emissions offsets are exposed to the risk that long-term oil demand will continue to weaken, effectively leading to further reductions in asset value. Second, there are limits – both technological and natural – to efficiency gains faced by any company seeking to reduce emissions by transforming the environmental footprint of its upstream operations.

Third, while there are considerable benefits to oil and gas producers that transform their product offering to include low-carbon energy carriers, there is still a need to build out supply and distribution infrastructure at scale. That means an oil producer that transitions from the sale of jet kerosene to sustainable aviation fuel (biojet) would not need to develop a new customer base or even a new logistics network, but would need to develop new large-scale production infrastructure.

Finally, a company that pursues a full-scale transformation of its business model as part of its energy transition strategy would either face intense competition from incumbents or could develop a path dependency – investing in an energy transition solution that eventually falls out of long-term energy balances either due to regulatory constraints, commercial challenges or other reasons. The diversity of these challenges is reflected in the Platts 2 C pathway, which features a combination of all four in various degrees at the country level.

Each energy transition strategy also carries with it a different level of exposure to oil prices, related to the degree to which oil companies seek to preserve existing operations (and revenue streams). Paradoxically, the degree to which a successful energy transition strategy insulates producers from long-term exposure to oil prices is likely to have a direct impact on the return on capital employed, narrowing margins.

But this paradox is entirely consistent with one of the most important insights from modeling a low carbon sensitivity: in a 2 C pathway, long-term average oil prices are substantially lower than the Platts Analytics Reference Case and enter secular decline once peak oil demand is reached in the mid-2020s. Policy, including taxes, and technological change are modelled to accelerate the turnover of capital stock in a 2 C world, rendering demand inelastic to price in the long-term. That is, there is no demand rebound in response to low oil prices as consumer choice becomes constrained due to a ban on internal combustion engines.

Having already lowered the long-term average oil price outlook in the Platts reference case by around $10/b (constant 2018-equivalent dollars) due to the impact of the pandemic, a low-carbon pathway would require an additional $10/b reduction in average oil prices over 2020-50.

The energy transition ambition is staggering: the Platts Analytics 2 C sensitivity requires a 50% reduction in CO2 emissions by 2050 as well as a 50 million b/d reduction in oil demand. But at a time when the world has experienced an unprecedented – and unforeseen – drop in energy consumption, economic activity and emissions, some of the most prominent industry players have redoubled their commitments to achieving long-term net zero targets. And these long-term net zero targets come with a diverse set of energy transition strategies, ranging from procuring emissions offsets and improving operational efficiencies to pursuing a full-scale business model transformation.

The results of Platts Analytics’ low carbon modeling show that a combination of all strategies may be needed: the full displacement of oil as a transport fuel is offset by the growth in new end-user markets for carbon-free electricity. At the same time, even the most aggressive sensitivities still require new investment in upstream oil supply to meet demand.

Overall, the story might be told through capital re-allocation: energy transition would imply $14 trillion in new capital spend in low-carbon electricity against a $6 trillion reduction in upstream oil spending. That is a huge gap to fill, but if investments in low-carbon alternatives are profitable, the capital markets should be able to link a wide range of investors with these opportunities, given enough time and appropriate policy incentives.

Content Type

Location

Language