Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

The coronavirus pandemic hit the brakes on global economies, but as the pandemic becomes a constant and not a crisis, opportunity lies in recovery. If governments direct their nations’ recovery spending plans to align with green principles, plunging emissions could refocus growth in clean energy initiatives and companies can adopt ESG policies to help fight climate change.

Published: June 1, 2020

A post-pandemic economic recovery would see global CO2 emissions return to 2018 levels by 2022, according to Platts Analytics Scenario Planning Service, whose data and forecasts are visualized here.

After 2022, growth in CO2 emissions essentially flattens to 0.2% a year before peaking in 2032. By 2040 emissions remain around 3 Gt above 2020 levels, as abatement efforts are offset by the continued use of coal for power generation in Asia's growth economies.

Oil Demand Faces New Threat as 'Green Recovery' Hopes Take Root

As the world emerges from the economic wastelands of the coronavirus pandemic, hopes are growing that climate-friendly policies and behavior changes will speed the transition away from fossil fuels. But there may be speed bumps along the way.

Political parties, business leaders and environmental groups are calling for a 'green recovery' to transform the global economy in the wake of the pandemic. Many believe the push will accelerate the demise of the era of oil.

As governments around the world continue to tackle the coronavirus pandemic, many of us are adjusting to a new normal characterised by social distancing and other measures to slow the rate of contagion.

With Earth Day upon us, we take a moment to consider how the unfolding pandemic could affect the way we tackle other global systemic risks, such as climate change. Particularly as the healthcare industry zeroes in on precision medicine, therapies tailored to patients' genetic makeup, a better understanding of different populations' biological differences is vital in drug testing.

Financial Focus: Wind, Solar Capex, Led by Nextera, Remains Major Component of Utility Growth

Despite uncertainties tied to the COVID-19 pandemic and the ensuing economic downturn that could impact the scope and scale of wind and solar installations nationwide, renewable energy spending remains a significant part of many utility capital expenditure programs as environmental and sustainability considerations continue to influence utility sector investment plans and operational outlooks.

Read the Full Article

The coronavirus pandemic may accelerate a shift from fossil fuel spending to investments in renewable energy, but the pace of that transition depends heavily on how governments direct economic recovery spending, and whether the consumer behavior changes induced by the outbreak become permanent.

Listen to the Podcast

COVID-19 Highlights Scale of Action Needed to Tackle Climate Change

The global reaction to the coronavirus pandemic sheds light on how far the world still must go to slow the pace of global warming, climate scientists have suggested.

Energy transition refers to the global energy sector’s shift from fossil-based systems of energy production and consumption — including oil, natural gas and coal — to renewable energy sources like wind and solar, as well as lithium-ion batteries.

Access the Topic PageThe future financial and social consequences of climate change are becoming increasingly apparent to companies, investors and policy makers. Strong action to reduce emissions and limit climate change may avoid the worst physical impacts of climate change but presents significant market, technology and regulatory transition risks for market participants. Conversely, failure to adequately reduce greenhouse gas emissions may limit transition risks but will result in increasing climate change and associated physical risks.

Key Takeaways

As the Covid-19 pandemic continues its spread through countries and affects their economies, the private sector is discovering positive ways to support overwhelmed health and social care systems.

Fashion houses are replenishing hospital clothing supplies; cosmetic companies are contributing disinfectants; aerospace, sporting and academic institutions are manufacturing medical equipment; staffing agencies are adapting their benefits policies; and several corporations are pledging financial donations to support the response.

Evidence is also emerging that investors are signaling a preference for products that favor companies with a positive societal impact. ESG funds are continuing to gain assets, even during one of the most significant disruption to markets, and as of April 6, the S&P 500 ESG Index was outperforming the S&P 500 by 2.47%.

Webinar: Accelerating Progress on Climate Risk

Join S&P Global specialists and industry practitioners to explore the implications for company operations and investor portfolios through live data visualisations – and discover practical insights to accelerate your progress on climate risk.

US Renewable Generation Overtakes Coal in Q1'20

The share of natural gas and renewable sources in U.S. electricity generation widened in the first quarter compared to the prior year, primarily at the expense of coal generation.

Greenhouse gas emissions are expected to dip this year due to fallout from the pandemic that has plunged economies the world over into recession. S&P Global Platts Analytics estimates global GHG emissions will drop 5.5% this year.

That would be the largest drop since 1.4% in 2008 during the global financial crisis, according to the Global Carbon Project.

That's significant but would still fall short of the 7.6% each year in reductions that the UN Environment Program says the planet needs to keep global warming below 1.5 degrees Celsius under the Paris Agreement.

Transition to a 1.5°C World with the S&P Paris-Aligned & Climate Transition Indices

The landmark Paris Agreement marked a sea change in the global fight against climate change. Backed by empirical evidence from the UN Intergovernmental Panel on Climate Change (IPCC), ambition has since grown to limit global temperature rise to 1.5°C since pre-industrial levels.

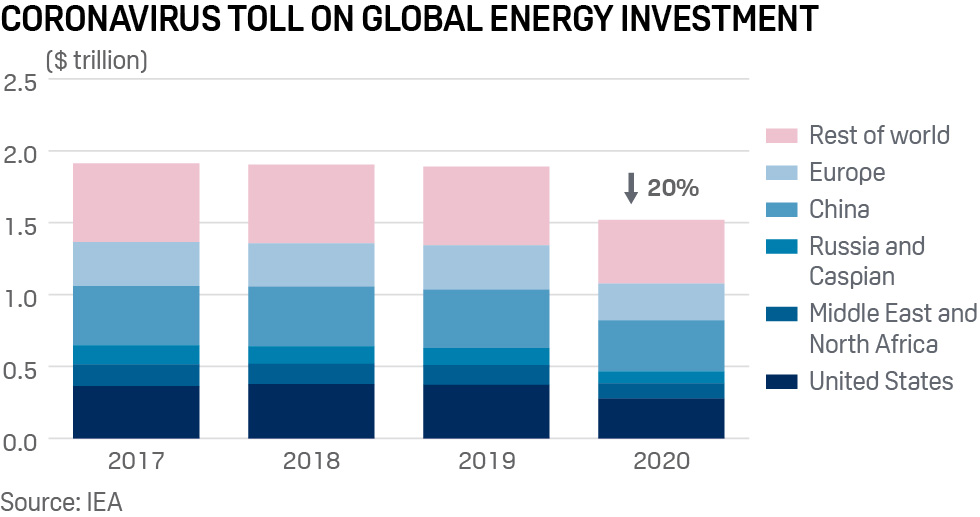

Global energy investment is expected to plunge by 20%, or almost $400 billion, in 2020 as the COVID-19 crisis risks slowing the world's transition to cleaner and sustainable energy systems, said the International Energy Agency on May 27.

Listen: US Power Sector Known for Reliability, Contingency Planning Faces Challenges from Coronavirus

The US power sector is known for its high level of reliability and focus on contingency planning and redundancies, but what happens when working next to your colleague suddenly becomes a health hazard?

Scott Aaronson, vice president of security and preparedness for the Edison Electric Institute, talks with Jasmin Melvin of S&P Global Platts about emergency preparedness for utilities and the challenges ahead for the industry.

Continuous methane emission sensors could help the oil and gas industry more effectively limit unintended leaks, and the University of Texas at Austin is spearheading a project to evaluate the technology's viability and durability.

Pandemic Impact Justifies New Focus on Low-Carbon Targets: BP CEO

Rising levels uncertainty over the future demand for oil, oil price volatility, a growing attractiveness of stable returns from some renewables, and an increased awareness of "the fragility of the world we live in" mean BP is taking the right path to pursue lower-carbon fuels, Looney said.

ESG InFocus is a monthly newsletter from S&P Global Market Intelligence that captures news, insights, trends, commentary into ESG developments driving change across business decisions. Additionally, stay informed on upcoming ESG related webinars, conferences and networking events.

Subscribe to ESG InFocus