Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

COVID-19 is definitely still with us, but the economic impact is fading.

The pandemic continues to rage in some parts of the world, defying the comforts of high vaccination rates and confounding pronouncements that we may be nearing the exit. Europe is in the midst of its fourth COVID-19 wave, with the incidence skewed toward those countries and regions where effective vaccination is lightest; some lockdowns have been re-imposed.

The regional late summer surge in the U.S. has passed although the trough was higher than the previous wave and a new uptick has begun. Some countries in Asia-Pacific have begun to open up, although China retains a strict zero COVID policy. And a new omicron variant has been identified in South Africa, and it's spreading at a faster pace than delta.

While the spread of the virus has not been brought fully under control, its economic impact has clearly weakened. There are two elements to this story. First, for a given level of infections, measures restricting mobility have eased. This reflects governments having a higher degree of tolerance overall for COVID-19 infections, as well as being able to more precisely target and curtail certain types of activities.

As an example, skewing measures against unvaccinated parts of the population. Second, for a given level of mobility restrictions, the impact on consumption has declined (see chart 1). Households have redirected their spending power away from activities that are "locked down" (food and entertainment) and towards those where spending is still possible (durable goods). While the offset is not one-to-one, the reduction in consumption in mid-2021 was much lower and flatter than in 2020.

S&P Global Ratings believes the new omicron variant is a stark reminder that the COVID-19 pandemic is far from over. Although already declared a variant of concern by the World Health Organization, uncertainty still surrounds its transmissibility, severity, and the effectiveness of existing vaccines against it. Early evidence points toward faster transmissibility, which has led many countries to close their borders with Southern Africa or reimpose international travel restrictions.

Over coming weeks, S&P Global Ratings expects additional evidence and testing will show the extent of the danger it poses to enable us to make a more informed assessment of the risks to credit. Meanwhile, S&P Global Ratings expects the markets to take a precautionary stance in markets and governments to put into place short-term containment measures. Nevertheless, S&P Global Ratings believes this shows that, once again, more coordinated, and decisive efforts are needed to vaccinate the world's population to prevent the emergence of new, more dangerous variants.

2021 Legacy: Robust Rebound And Record Growth

Macro performance has generally exceeded expectations in 2021. The pattern has been driven by a combination of fiscal support, vaccinations and economic "gravity." These provide a useful lens through which to view the rebound. The first two of these factors tend to favor the advanced economies while the third has a larger influence on emerging markets. As we will argue below, the robust recovery has led to concerns about inflation.

Europe has been the latest strong performer, posting 9% annualized GDP growth in the third quarter (July to September). This reflected a Grand Re-Opening on the back of a strong vaccination push, fueled by the release of pent-up demand and rising confidence. This was not unlike the U.S. outturn in the second quarter of the year when vaccinations and confidence rose, although regional surges in COVID-19 and supply bottlenecks pulled down U.S. growth to just 2.1% in the third quarter.

Asia-Pacific: Ghosts Of COVID Past Hover Over 2022

Asia Pacific continues to underperform the U.S. and Europe as lockdowns crimp domestic demand and generate overreliance on exports for growth; our macro forecasts over 2021-24 remain broadly unchanged from the previous quarter.

Read the Full ReportRecovery Isn't Yet Complete While COVID-19 And Inflation Risks Remain Front And Center

Nearly two years into the pandemic, COVID-19 cases continue to ebb and flow, playing a central role in global economic activity. Nonsynchronous peaks and troughs of pandemic waves across core EMs have meant that the recovery is proceeding at varying and choppy speeds.

Read the Full ReportEurozone Economic Outlook 2022: A Look Inside The Recovery

S&P Global Ratings believes the recent rise in COVID-19 cases in some European countries will somewhat slow the recovery in consumption but still allow the eurozone economy to surpass pre-pandemic levels of activity in fourth-quarter 2021.

Read the Full ReportHigh Inflation And Labor Market Weakness Will Keep Risks Elevated In 2022

S&P Global Ratings lowered their 2022 GDP growth forecast for the six major Latin American economies by roughly half a percentage point--to 2% from 6.6% expected in 2021. This is mainly due to inflation being higher and less transitory than expected, which will translate into higher interest rates across the region.

Read the Full ReportEconomic Outlook U.K. Q1 2022: Onward And Upward

For now, the U.K. economy continues to recover at a rather fast pace. Driven mainly by household consumption, it is set to regain pre-pandemic levels sometime in the first quarter of next year.

Read the Full ReportEconomic Outlook U.S. Q1 2022: Cruising At A Lower Altitude

The U.S. economy picked up in the fourth quarter as COVID-19 infection rates subsided and vaccination rollouts progressed, allowing more people to get outside and spend. People have shown a willingness to forgive retailers for the higher prices as they prepare for long overdue visits with family this holiday season.

Read the Full ReportLocal And Regional Governments Outlook 2022: Long-Term Challenges Resurface As The Pandemic Eases

S&P Global Ratings expects the global economic recovery to continue next year, stabilizing credit quality of our rated non-U.S. local and regional governments (LRGs). This recovery, which started in first-half 2021, is reducing volatility and uncertainty caused by the pandemic.

Read the Full Report

The Big Picture summarizes the key themes impacting companies and industries, around the world, in 2022. Dive deeper into M&A trends, shifts in capital requirements, the ever-evolving growth of ESG and the “new normal” of life in pandemic times.

The pandemic and its aftershocks will remain pivotal to credit prospects in 2022. Surging global demand, extraordinarily benign financing conditions, supply chain strains, and soaring energy prices are just some examples of the powerful forces triggered by the shock of COVID-19 and the emergency policy response it required. In S&P Global Ratings’ view, credit momentum will remain positive, with financing conditions still heavily underwritten by supportive fiscal and monetary policy, and economic growth easing back to a more sustainable pace. Nevertheless, the recovery’s foundations are relatively fragile and vulnerable to setbacks. The pandemic itself remains very much active, with the omicron variant posing a new threat and vaccination rates worryingly low in many parts of the world. S&P Global Ratings’ base case is that default rates will remain low and credit prospects continue to show improvement, but uncertainties abound and risk premiums are uncomfortably low.

S&P Global Ratings considers three sets of challenges and opportunities likely to shape the year ahead: Aftershocks assesses the immediate pressures largely brought about by the pandemic; Future Shocks focuses on more structural factors and emerging technologies shaping the future of finance; and Climate And Energy Transition discusses the credit implications of the behavioral and technical shifts stemming from efforts to avert the most severe consequences of climate change.

COVID-19’s economic impact has waned but variants are a concern. As we enter the third year of the pandemic, it is difficult to say with certainty that this will be its last. Successful vaccination programs and the ramping up of their global vaccine supply offer the clearest route out and the transition from a pandemic to an endemic but manageable disease. Yet ,sharply escalating case counts in heavily vaccinated European nations and the threat that omicron or other variants might overcome existing vaccines are reminders of how far we remain from a post COVID-19 world.

Asia-Pacific: China Slows, A Chill Wind Blows

COVID-19 trends and policy responses, contagion risk from Chinese property woes, and rising inflation expectations have introduced regional uncertainty.

Read the Full Article

Emerging Markets: Inflation, The Unwelcome Guest

Risks are increasing for emerging markets (EMs) as inflation keeps accelerating in many key countries, adding to existing challenges.

Read the Full Report

Europe: Reining In As Full Recovery Nears

Strong demand and falling unemployment create a fundamentally positive outlook for credit in 2022, although cost pressures, monetary policy tightening, and Europe’s fourth COVID-19 wave, now compounded by omicron, are headwinds to monitor.

Read the Full Report

North America: As Recovery Rolls On, Inflation Risks Remain

Credit conditions remain largely favorable, although risks are looming—primarily those around inflation pressures and supply disruptions (including labor shortages) that many borrowers face.

Read the Full Report

Covered Bonds Outlook 2022: Performance Stable As Support Schemes Wind Down

Healthy job market recovery supports cover pool assets performance despite support schemes wind down. The wind-down of borrower support schemes appears well-synchronized with counteracting improvements in labor markets.

Read the Full Report

Amazon.com Inc., Walmart Inc. and other e-commerce companies are readying an arsenal of cost-saving measures as they prepare to battle inflation well into 2022.

While the largest retailers were able to provide a hedge against higher prices in the fourth quarter in part by stockpiling high-demand items ahead of holiday sales, market economists say labor and supply-chain constraints are unlikely to abate soon, indicating rising costs will continue into next year. Facing margin pressure, retailers are expected to navigate a challenging environment by reducing supply-chain inefficiencies, selling higher-margin goods, and passing some costs on to consumers.

Inflation: Is It Really Transitory?

Inflation has remained stronger for longer and the question is now whether major central banks can let price pressures pass through the economy without aggressive monetary-policy tightening.

Read the Full ReportEmerging Markets: Will Inflation Be The Next Pandemic?

S&P Global Ratings sees risks of an extended period of higher inflation in some EMs, as higher energy prices and prolonged supply-chain problems may spill over to core prices in countries with weakly anchored inflation expectations.

Read the Full ReportREITs Poised for Growth in 2022 Despite Inflation and Interest Rate Uncertainty

The U.S. REIT sector will continue to benefit from improving economic conditions in 2022, building on the recovery and growth of the past 12 months, industry experts say.

Read the Full Article

With more than 30 GW of offshore wind power capacity under development along the US East Coast, power market participants are paying close attention to when these projects will begin delivering power into the regional markets, with several milestones expected in 2022.

Some large state-level offshore wind solicitation winners were announced in December, and those projects will be watched in 2022.

Massachusetts on Dec. 17 awarded the Mayflower Wind offshore project 400 MW of capacity. In 2019, the state awarded 804 MW of capacity for the project, a joint venture between Royal Dutch Shell subsidiary Shell New Energies US and Ocean Winds of Spain.

The state also awarded 1,232 MW of capacity to the proposed Commonwealth Wind offshore project Dec. 17. That is a joint venture between Avangrid subsidiary Avangrid Renewables and Copenhagen Infrastructure Partners. Avangrid, a subsidiary of Iberdrola, is also working on the nation's first federally approved offshore wind project, the 800-MW Vineyard Wind Project.

Also, on Dec. 17, the Maryland Public Service Commission awarded offshore wind renewable energy credits, or ORECs, to two developers that have proposed more than 1,600 MW of electricity to be built off Maryland.

The decision in the states' second round of offshore wind solicitations supports US Wind and Skipjack Offshore Energy in building separate projects, the Public Service Commission said. Denmark's Ørsted is developing Skipjack, which was awarded 846 MW, and the US Wind project was awarded 808.5 MW.

Additional project milestones

Federal permitting reviews will be important in the coming years as the Biden administration has set a goal of installing 30 GW of offshore wind power capacity by 2030.

The Bureau of Ocean Energy Management, which handles federal offshore wind leasing and permitting, currently has nine construction and operations plans under review.

BOEM has targeted Aug. 1, 2022, to publish a draft environmental impact statement for Dominion Energy Virginia's Coastal Virginia Offshore Wind Commercial Project in the Federal Register.

Nuclear Energy Advocates See New Climate Focus Buoying Industry

The current focus on climate change has changed the conversation on nuclear energy, creating momentum for public and private sector action in 2022 to help push advanced nuclear technologies from concept to reality, nuclear advocates have said.

Read the Full ArticleYear Set to Be a 'Critical Investment Point' for European Hydrogen

The European hydrogen industry faces a "critical investment threshold" in 2022 with financers queuing up to channel money into the sector, and a wealth of capacity targets from governments, but many projects are yet to take final investment decisions, industry leaders said.

Read the Full ArticleIndia Sets Sights on Record Green Bond Issuance Entering 2022

Corporate and bank issuers in India are likely to tap the climate-related debt market more actively as the world's third-largest emitter of carbon dioxide will need as much as $10 trillion to be carbon-neutral by 2070, experts said.

Read the Full ArticleUtilities, Power Providers Poised to Tap Sustainable Financing Market in 2022

As North American utilities and power providers race to meet their net-zero carbon emissions targets, sustainable debt financing experts anticipate environmental, social and governance-linked issuances for the sector will continue to soar in 2022, particularly given the flexibility built in to certain structures and rising demand for private placements.

Read the Full ArticleMiddle East in Uphill Battle to Meet Net-Zero as Emissions Set to Rise

The Middle East faces an uphill battle to meet net-zero targets as a dependence on natural gas and crude oil in industry will lead to increased emissions over the coming years, according to S&P Global Platts Analytics.

Read the Full ArticleCOP26 Pledges to Drive Continued Focus on Methane Emissions for Gas Sector

Following heightened focus on methane emissions at the UN Climate Change Conference in Glasgow, the challenge will turn to implementation efforts by countries and companies, with implications for the U.S. natural gas sector.

Read the Full Article

Watch this space for market insights covering trends in oil, natural gas, petrochemicals and other commodities over the coming year.

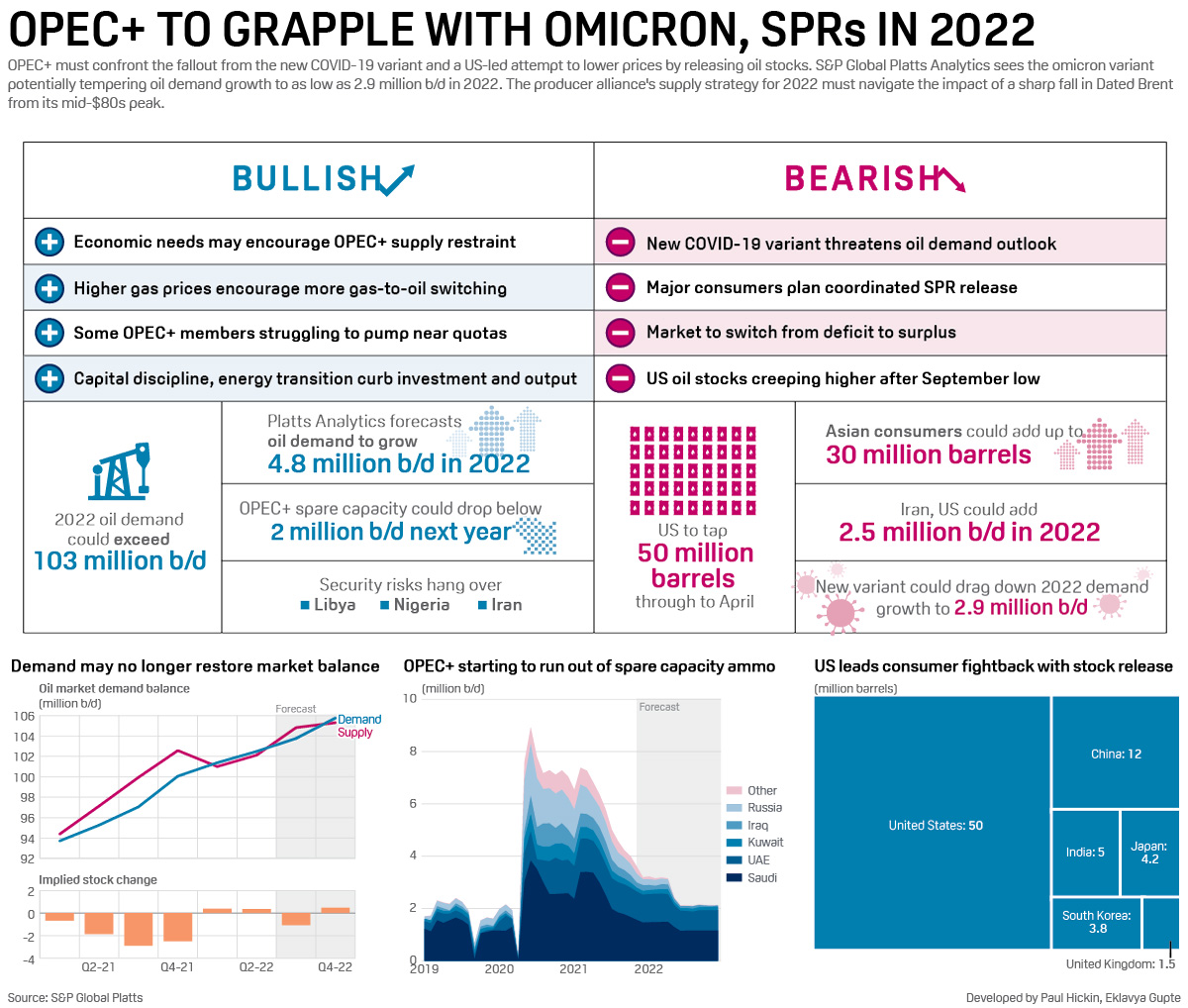

OPEC+ must confront the fallout from the new COVID-19 variant and a US-led attempt to lower prices by releasing oil stocks. S&P Global Platts Analytics sees the omicron variant potentially tempering oil demand growth to as low as 2.9 million b/d in 2022. The producer alliance's supply strategy for 2022 must navigate the impact of a sharp fall in Dated Brent from its mid-$80s peak.

Oil Market Tightness Could Resurrect Crude Investment in Coming Years

Renewed market tightness in the latter half of 2022, rather than repeated warnings over a looming oil investment shortfall, could give fresh support to oil prices and add impetus to an eerily cautious investment climate.

Read the Full ArticleDivestment, Not Reform, to Dominate Nigeria's Oil Sector

2022 poses to be a very challenging year for Nigeria. Africa's largest oil producer faces a race against time to implement reforms needed to bolster exploration and check declining oil production as it fights a wave of divestments from international oil companies.

Read the Full ArticleU.S. Gulf of Mexico Deepwater Oil, Gas Activity May Increase

More deepwater exploration and project sanctions in the US Gulf of Mexico could be in store for the E&P sector during 2022 assuming robust oil prices hold up, according to analysts.

Read the Full Article

European power markets enter 2022 in crisis.

There is no near-term path out of the current gas-driven super-inflation of prices, while another slew of coal and nuclear closures is poised to intensify Europe's reliance on price-setting gas-fired generation.

The interconnected nature of European power systems makes this the case even for national markets with little gas-firing.

Gas-Fired Generation Sees Momentum as U.S. Coal Supply Falters

U.S. gas-fired power burn demand is poised to continue outperforming well into 2022 as low coal production and stockpile levels likely persist, limiting price-induced fuel switching by power generators.

Read the Full ArticlePermian Gas Production Gains, Weaker Basis to Persist

As Permian Basin producers dial up drilling activity in response to stronger commodity prices, the outlook for gas production from West Texas has strengthened recently.

Read the Full Article

Third-party gas certification that took off in 2021, particularly in the Haynesville Shale in Louisiana and East Texas, could lead to the first certified gas US LNG export cargo in 2022, market watchers say.

The first US LNG cargo sourced entirely from certified gas could set sail as early as the second quarter of 2022, according to Project Canary CEO Chris Romer.

U.S. LNG Exports Look to Test South Central's Natural Gas Inventory

Although US South Central gas storage inventories have returned to near the five-year average, a colder-than-normal winter could lead to record-low stocks by the end of the season as demand from LNG and exports to Mexico could reach all-time highs in the months and years ahead.

Total inventories in the South Central region climbed from a massive deficit during the summer to a 3% surplus to the five-year average by late-December, according to data from the US Energy Information Administration, alleviating inventory concerns noted during the summer's injection season. However, elevated export demand may result in strong withdrawals from storage if late winter proves to be cold.

LNG export demand has averaged 11.4 Bcf/d since the start of the winter heating season in early-November, up 1 Bcf/d from levels observed during the same time last year amid increased global competition for the commodity, according to S&P Global Platts Analytics

While the roller coaster ride that US power markets have endured since the novel coronavirus pandemic took hold in March 2020 is not over, power forward traders may foresee a shortening of the hills and valleys by late 2022.

However, supply chain issues for materials such as steel and coal may tighten power markets more than forward traders realize.

The 2022 on-peak forward curves for four US hubs as of Dec. 22 show price rangers substantially smaller compared to year-to-date monthly average day-ahead on-peak locational marginal prices in 2021. The exception is California where drought, wildfires, extreme weather and high renewable penetration present higher risk.

Gas-Fired Generation Sees Momentum as U.S. Coal Supply Falters

U.S. gas-fired power burn demand is poised to continue outperforming well into 2022 as low coal production and stockpile levels likely persist, limiting price-induced fuel switching by power generators.

Fourth quarter to date, US gas-fired power burn has trended at close to 30 Bcf/d, outpacing the prior three-year average by 1.8 Bcf/d, or about 6%, S&P Global Platts Analytics data shows.

Gas demand from power generators has been surprisingly strong recently considering this year's historically elevated gas prices. At the US benchmark Henry Hub, the NYMEX prompt-month futures contract has averaged just under $5/MMBtu in the fourth quarter, up more than 75%, or about $2.10, from its year-ago level, S&P Global Platts data shows

High gas prices have historically put a damper on generator gas demand. Recently, though, tightening coal supply and rising prices for the fuel have limited generators' ability to simply switch away from gas – a trend that has clearly emerged in late 2021 and appears likely to continue into the New Year.

The emerging pressure on coal-fired generation has become most clearly evident in the Midcontinent Independent System Operator's territory.

Since late summer, power generation share for coal in MISO has slumped, giving way to both wind and natural gas. In December, coal has accounted for just 30% of total power generation in the MISO – down from a nearly 45% share in August, data from the ISO shows.

The year 2021 was spectacular for US corn, with prices up nearly 45% year on year, and fundamentals suggest that US corn values are likely to be supported in 2022.

Tightening supplies, growing ethanol demand, and strong exports have provided support to prices which looks set to extend into the new year.

US corn prices touched multi-year highs during April-May. The March 2022 corn futures contract on the Chicago Board of Trade reached as high as $6.405/bushel and was back over $6/bu coming into the end of the year.

Even as the corn harvest in the world's largest grower concludes, prices managed to stay firm on continued demand from the ethanol industry and extended support from soaring fertilizer prices. Corn is the primary feedstock for ethanol in the US and nearly 40% of the country's corn output is consumed by the ethanol industry.

Fertilizer prices saw an unprecedented rally in the past few months following a surge in prices of key feedstocks and certain export restrictions put in place by supplying countries. Prices of all major fertilizers have shot up over the last year -- some have more than doubled. Since corn is a fertilizer-intensive crop, a rise in fertilizer prices leads directly to higher input costs for US farmers and complicates their planting decisions.

Fertilizer prices impact supply

According to S&P Global Platts Analytics, a 3 million acre shift from corn to soybeans is possible in the US, with both corn and soybean acreage at around 90 million acres in the marketing year 2022-23 (September-August), due to fertilizer price and supply constraints. Soybean is likely to become attractive as it has lower fertilizer requirement.

EU Sugar Production Set to Rebound

EU sugar production is set to rebound in the marketing year 2021-22 (October-September), as cooler weather resulted in a lower incidence of virus yellows.

Read the Full ArticleLatin America Soybean Crush Set to Rise Despite Headwinds

The Argentinian and Brazilian soybean crush volumes look set to rise in 2022 despite several domestic challenges, according to analysts.

Read the Full ArticleBrazilian Sugar Production Supported by Strong Market Fundamentals

Brazilian sugarcane producers are expected to keep favoring sugar production over ethanol in the Center-South crop that starts on April 2022, taking advantage of the positive premium paid in the sugar export market over hydrous ethanol in the domestic market.

Read the Full ArticleRocky Road for Corn Exports in H1 Amid Weather Disruptions

Corn production in the two South American agricultural powerhouses Brazil and Argentina are projected to hit record highs in 2022, but this is unlikely to provide any comfort to buyers looking for a smooth supply environment, especially in the first half of 2022.

Read the Full ArticleEuropean Vegetable Oil Markets Expecting Production Rebound in the Year

The Black Sea sunflower oil market faces challenges in 2022 as farmers hold onto seed stocks in the first half of the year, but record sunflower oil production is still expected.

Read the Full ArticlePalm Oil Prices Could Retreat by H2 as Low Demand, Higher Production Play on Markets

High palm oil prices may spillover into 2022 on supply concerns but low demand from top buyers India and China combined with a narrowing price advantage over rival vegetable oils could cap its upside by the second half of the year.

Read the Full Report

As the COVID-19 pandemic drags on toward a third year, we consider: What will be the short- and long-term effects on the global economy and credit markets?

The global refined copper market is expected to be in a significant surplus in 2022, following a small supply deficit in 2021.

The refined copper market saw a deficit of 479,000 mt in 2020, according to the International Copper Study Group, or ICSG.

ICSG expects a small deficit of 42,000 mt in 2021, with 2022 supply forecast to exceed demand by a colossal 328,000 mt.

The 2022 surplus is based on the assumption of a 3.9% increase in refined output, the biggest increase in eight years, with copper demand expected to see a 2.4% increase, ED&F Man Capital Markets analyst Edward Meir said in a note Dec. 7.

Even though a rise in demand is anticipated, this will not be enough to absorb the increase in supply, Commerzbank's commodities analyst Daniel Briesemann said in a note.

Prices

With supply prospects looking optimistic, "many are calling for lower prices heading into 2022," Meir said, with ED&F's December copper price range between $9,315-$9,880/mt.

Reiterating the expectation of the global copper market being well supplied in 2022, "the market could therefore catch its breath before probably turning into a structural supply deficit later on," Briesemann said.

"In our view, the envisaged surplus should counteract strongly rising prices. We expect a (moderate) setback in prices in line with the improved supply situation. At the end of next year, the copper price should be trading at $9,500/mt," Commerzbank's analyst said.

Amazon.com Inc. and other U.S. e-commerce retailers are likely to pursue deals in 2022 that will further bolster their digital and technology capabilities, a move experts say will help them tighten their grasp on higher levels of online sales in the new year.

Amazon, Walmart Inc. and Target Corp. have emerged as beneficiaries of the pandemic, thanks largely to investments they have made in areas such as delivery, fulfillment and curbside pickup operations.

Insurtech CEO Says Data, Technology to Evolve Small Business Insurance in 2022

A few years before the COVID-19 pandemic started, CEO David McFarland co-founded Coterie, an insurtech that focuses on small business insurance. The company recently completed a $50 million series B financing round. S&P Global Market Intelligence spoke with McFarland to discuss how small business insurance might evolve in 2022, Coterie's future plans and the impact COVID-19 had on the company's products and operation.

Read the Full ArticleOil, Gas Sector Eyes Collaborative Security Posture to Ward Off Cyberthreats

With increased digitalization making oil and gas assets more susceptible to cyberattacks, the public and private sectors must work together in 2022 to build out more proactive security capabilities to mitigate the risk to critical energy assets, industry stakeholders and security experts said.

Read the Full ArticleAgencies Forecast Low to Mid-Single-Digit Gains in 2022 U.S. TV Ad Spending

Media buying agencies GroupM, Zenith Media Services Inc. and MAGNA forecast low to mid-single digit advances in U.S. TV ad spending during 2022.

Read the Full Report