Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 25 Mar, 2020

By Berlinda Liu

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

Markets are down over 20%, COVID-19 is a global pandemic, negative global growth is looming—all of that just in the first 20 days of March! During same time period, VIX rose 65%, while the S&P 500 VIX Short-Term Futures Index jumped 175%. With a long-term beta of 0.7 to spot, a question might be—why did the S&P 500 VIX Short-Term Futures Index jump more than the spot?

The reason for this is that March was a time for catching up. In February, the spot jumped 113%, while the front two months’ futures lagged, rising 44% and 30%, respectively, thereby leading to a 134% and 146% respective catch-up in March.

Now, interestingly, the S&P 500 VIX Short-Term Futures Index, an unleveraged hypothetical basket of the first two VIX futures contracts, returned more than either of its constituents. This is because of “roll yield” due to the curve being in backwardation—where rolling an expensive first month to a cheaper second month adds to returns. VIX has been backwardated since Feb. 24, 2020, as shown in an earlier blog.

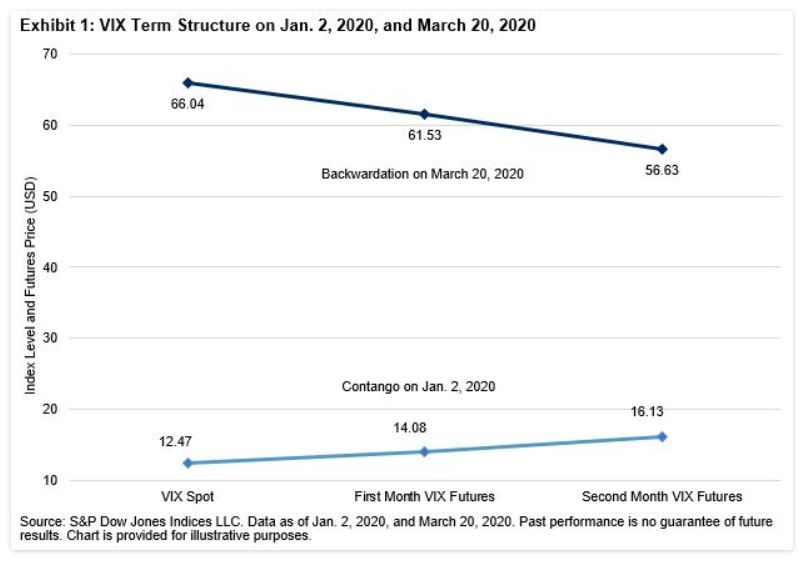

Exhibit 1 shows the VIX term structure on Jan. 2, 2020 (in contango) and on March 20, 2020 (in backwardation). In the first case, the S&P 500 VIX Short-Term Futures Index sold first-month futures at USD 14.08 and bought the same second month portion at USD 16.13, incurring a per-unit roll cost of USD 2.05. While on March 20, 2020, the daily roll of the index would sell higher at USD 61.53 and buy lower at USD 56.63, thus enjoying a per-unit profit of USD 4.90. Since VIX futures were backwardated for almost a month, this additional roll return was not negligible.

If a VIX futures gradient on a given day is quantified as its slope between the first- and second-month contracts, a positive slope (or a contango) amounts to a roll cost, while a negative slope (or backwardation) yields a roll carry.

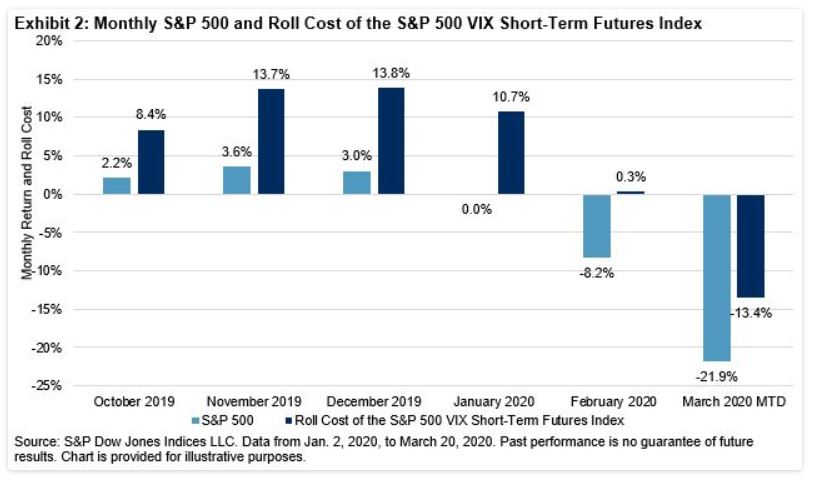

Further, we define monthly average VIX futures gradient as the average of daily slopes during that month. Since the S&P 500 VIX Short-Term Futures Index rolls continuously, this is essentially the actual monthly roll cost. A positive number indicates cost, while a negative number indicates roll yield. Exhibit 2 shows that the daily roll in the first 20 days of March contributed a positive return of 13% to the index return.

Exhibit 3 shows that the negative correlation between the S&P 500 VIX Short-Term Futures Index and the S&P 500 is stronger in a bear market than in a bull market. Interestingly, the correlation between its monthly roll cost and the equities market is also much stronger when the market goes down (see Exhibit 4). Thus, in a stressed market, it is more likely that the VIX futures term structure will be backwardated and investors will benefit from the daily roll of the index.

Vladimir Lenin said, “There are decades where nothing happens; and there are weeks where decades happen.” While the market has faced unprecedented pressure from a pandemic, the S&P 500 VIX Short-Term Futures Index has generated positive returns from the elevated VIX level and the roll yield from the VIX futures term structure. Backwardation is uncommon, but it has come to the rescue when it was needed most.