Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 23 Dec, 2020

By Nathan Hunt

This article was originally published as part of the 2020 Sustainability Accounting Standards Board Symposium.

Some critics of Environmental, Social, and Governance factors dismiss ESG as an exercise in competitive virtue-signaling in which shareholders, profitability, and returns are neglected in favor of social and environmental justice.

However, the profile of today’s ESG investors is not a good fit for the strident social and environmental activist that critics suggest. Blackrock, with assets under management of over $7.4 trillion, cannot be described as a niche investment management firm. Blackrock has become increasingly active in applying ESG criteria to their investment decisions and demanding accountability on climate change from the boards and the management of portfolio companies. Granted, Blackrock does not have sole discretion over the investment choices of all $7.4 trillion assets under management. On the high-growth passive investing side of their business, they can and do offer investment options in the form of ESG funds. But the investor makes the final decision on allocation.

Despite the option for passive investors to allocate their funds to non-ESG investments, Blackrock reports that their ESG investment options are generating more interest and growth than any other aspect of their business. If we accept the argument that ESG investments exist primarily as a virtue-signaling exercise, we must accept that Blackrock and its investors are willing to potentially misallocate trillions of dollars in funds in order to seem like nice people. This seems doubtful.

So why have Blackrock, State Street, and a variety of other asset management firms committed to making investment decisions using ESG factors? In short, what are we talking about when we talk about ESG?

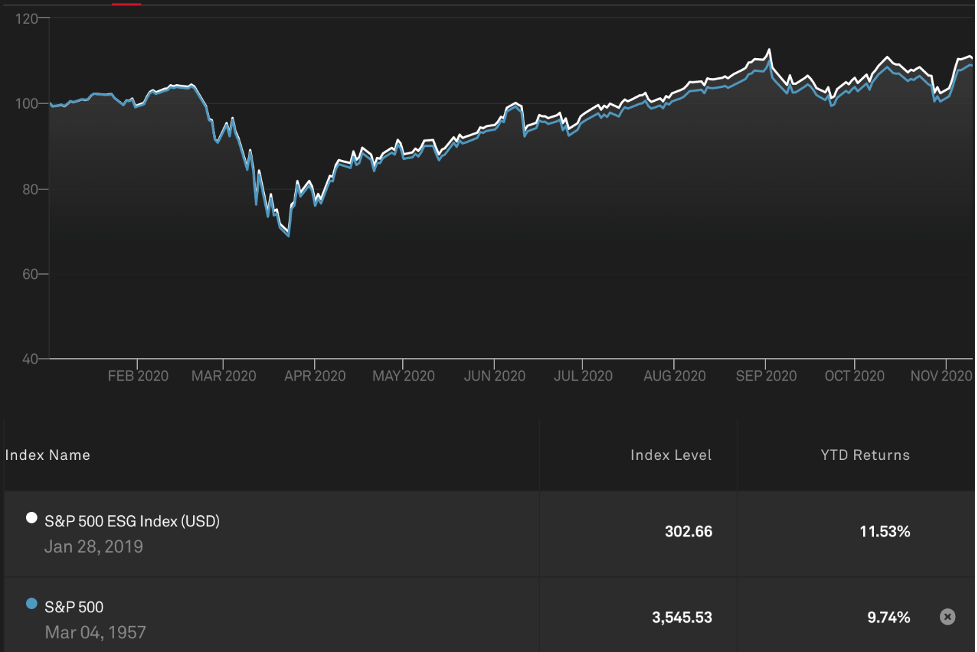

The performance of ESG indices over the course of 2020 may point to an answer. At the beginning of the year, before the novel coronavirus became widespread and restrictions on activity became commonplace, the performance of the S&P 500 ESG Index largely tracked that of the S&P 500 Index upon which it is based. However, as the year went on and the infection count increased, the S&P 500 ESG Index has provided a risk/return profile largely in line with the S&P 500, but has done incrementally better. Despite holding equities in many (but not all) of the same companies, the year to date performance for the S&P 500 ESG Index is 1.79% better than the S&P 500 Index.

ESG skeptics might suggest that this divergence could be due to the absence of oil stocks in the S&P 500 ESG index. Oil stocks have been particularly hard hit during the crisis for reasons unrelated to ESG factors. However, the S&P 500 ESG Index has been criticized precisely for including oil and energy stocks. The particular methodology of that index demands that it maintain exposure to those oil and energy companies that rate the best on ESG factors. Oil is baked into the outperformance.

The value of global assets invested according to environmental, social, and governance data has doubled over the past four years, reaching an estimated $40.5 trillion in 2020. As ESG has moved from the margins to the mainstream, asset managers and owners have come to rely on increasingly complex ESG metrics and measures, reflective of rigorous standards created by governing bodies like WBCSD, GRI, SASB, CDP and the CFA Institute. Despite real concerns over greenwashing in the market, today’s companies, investors, and regulators have access to a wealth of ESG data and benchmarks that allow them to set a high bar for sustainability.

ESG skeptics remain. In a recent opinion piece published by the Financial Times, economist Brad Cornell of UCLA suggests that the ESG concept has been overhyped and oversold. “It is impossible to have an honest discussion about ESG when its advocates believe that they occupy the moral high ground and view disagreement as immoral or unethical.”

There may be activists and investors who can be made to fit this description. There are values-based investors who reject certain “sin stocks” or entire sectors of the economy. There are also companies with a strong sense of mission, like Patagonia which Dr. Cornell mentions, that prioritize a range of social and environmental issues over near-term profitability.

However, the performance of the S&P 500 ESG Index during the crisis seems to indicate that ESG factors are capturing something that is financially material to a company’s performance particularly during periods of economic stress. Gillian Tett, also writing in the Financial Times, suggests a name for this thing – “resilience”.

In the academic literature, resilience has been defined as “an organization’s ability to face disruptions and unexpected events thanks to the strategic awareness and a linked operational management of internal and external shocks”. If ESG factors were primarily concerned with taking and holding the moral high ground, we would expect them to be anti-resilient. The moral high ground is built upon a preponderance of received opinion, often called “political correctness”. It is derided precisely because it is neither unexpected nor shocking.

To understand how ESG factors may be a measure of a company’s resilience, we need to dig beyond a superficial understanding of what informs an ESG score. There are over 100 questions companies must answer to complete the Corporate Sustainability Assessment which collectively cover over 1,000 data points. S&P Global uses the CSA to create our ESG scores which help to inform our Indices. Answers are weighted based on industry-specific criteria; criteria which includes everything from cybersecurity to supply chain management, from eco-efficiency to water-related risks, from labor practices to stakeholder engagement.

To provide just one example, here was a representative question from last year’s CSA: “Please indicate two important long-term (3-5 years+) emerging risks that your company identifies as having the most significant impact on the business in the future, and indicate any mitigating actions that your company has taken in light of these risks. For each risk, please provide supporting evidence from your public reporting or corporate website where the risk, the business impact and any mitigating actions are described.”

It seems logical to assume that a company willing to submit itself to such a rigorous self-examination is a company that is looking deeply at every aspect of its operations and organization. Investors are interested in this type of data because it may be material to a company’s future performance. By anticipating and preparing for climate change or a shift in the social structure or simply by following best corporate governance practices, a company prepares itself for other shocks and disruptions. It becomes resilient.

When we talk about ESG, we are not talking about ethics or morality. We are talking about resilience. Change is upon us – environmental change, social change, technological change, and geo-political change. ESG scores, benchmarks, and data are a way of measuring a company’s or a portfolio’s ability to weather that change effectively. ESG data for companies and investors is not, and was never intended to be, a badge of virtue.

Content Type

Theme

Location

Language