Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Dow Jones Indices — 8 Jun, 2020

Highlights

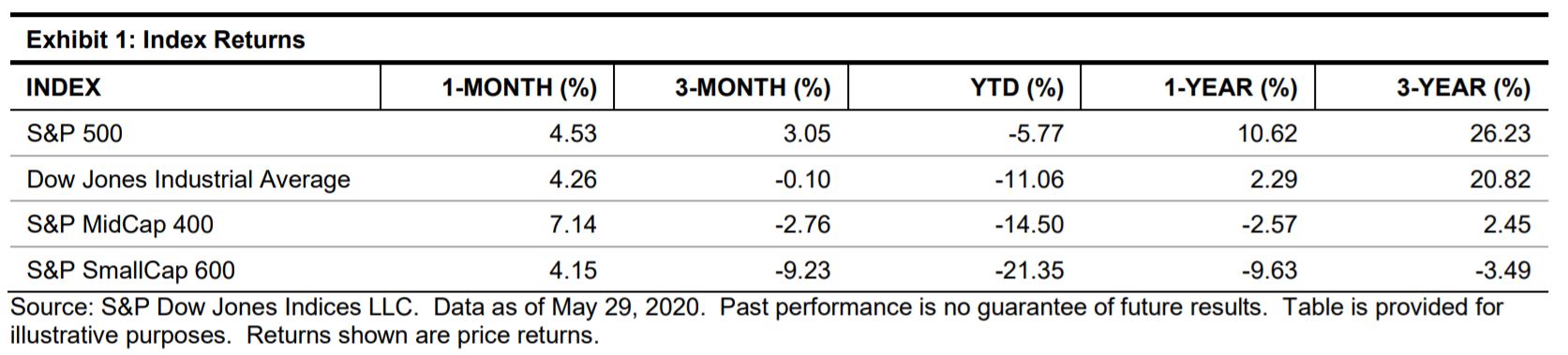

The S&P 500® was up 4.53% in May, bringing its YTD return to -5.77%.

The Dow Jones Industrial Average® gained 4.26% for the month and was down 11.06% YTD.

The S&P MidCap 400® increased 7.14% for the month and was down 14.50% YTD.

The S&P SmallCap 600® returned 4.15% in May and -21.35% YTD.

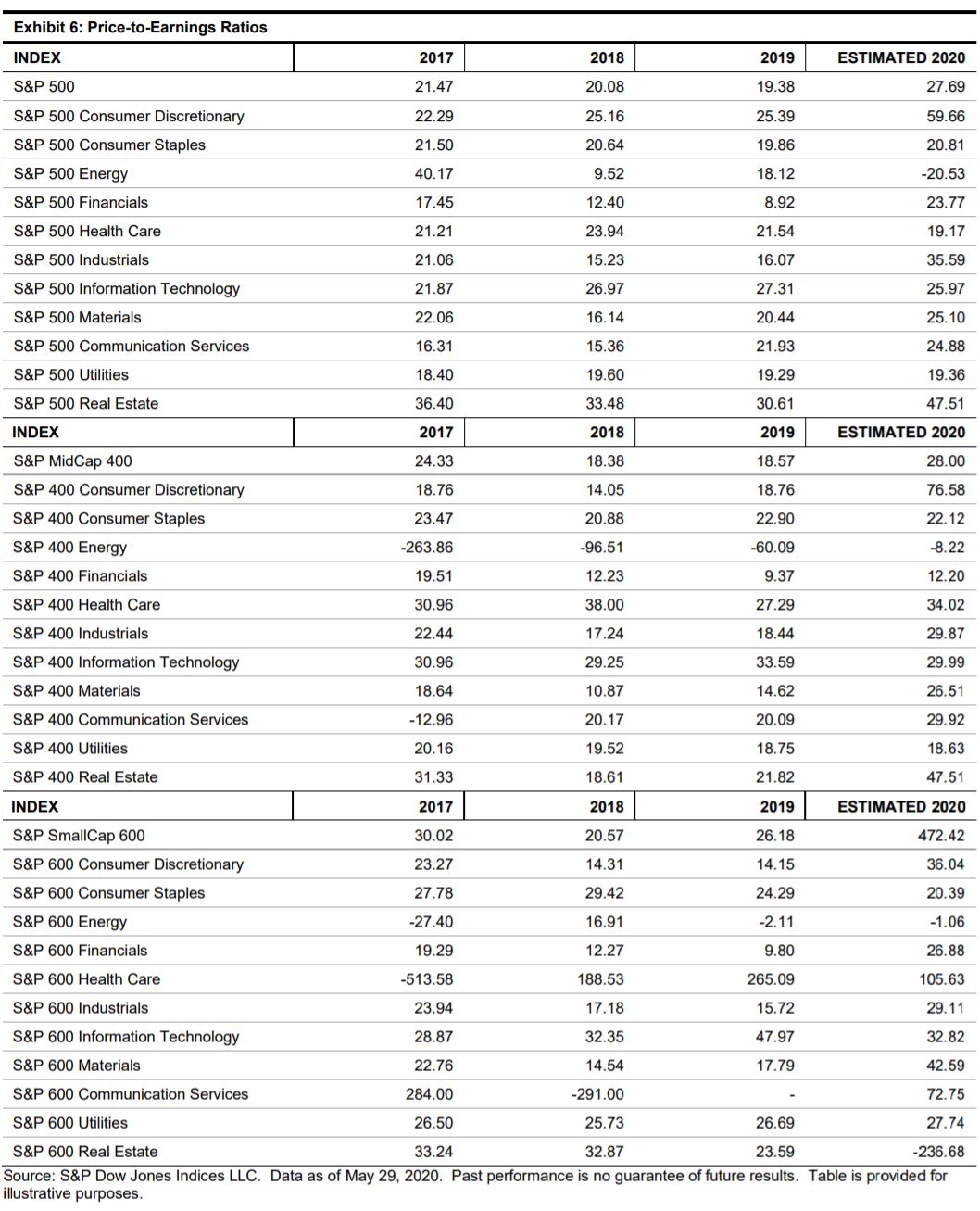

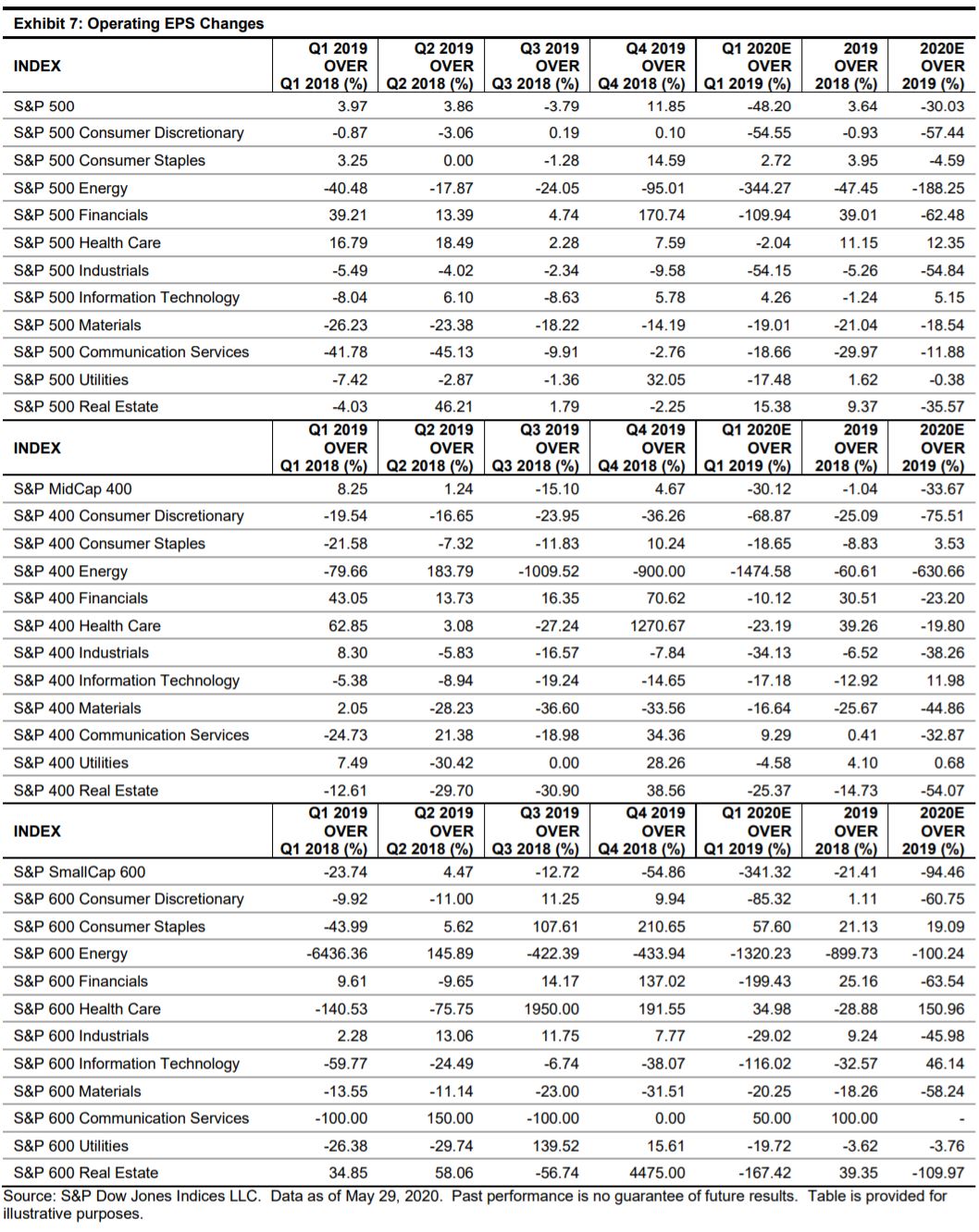

The grand Reopening of the U.S. began in May—come, buy, spend (if you have it; otherwise use your stimulus money), and enjoy the solitude of six feet as you scan your iPhone to pay (or for you oldies, use that archaic piece of plastic that you have not been using lately). If by some chance you need to cough (as they told Arlo Guthrie), “turn your head.” The U.S. started to reopen as the Memorial Day holiday kicked off not just the start of summer, but a return to what will be the new normal, with no one knowing what that will be, but most wanting to at least try. The anticipated opening has been what has kept the S&P 500 up—36.06% from its recent March 23, 2020, low (down 10.10% from its Feb. 19, 2020, closing high). Anticipation has been nice (did someone say, “Buy on anticipation, sell on reality?”), but now reality will start, along with the learn-as-you-go process and slow (or fast—we don’t know) continuance of opening; the key questions are, “If you open, will they come and spend?” and, “If they come, will they get sick?” At this point, an opening, any opening, is welcome, as the Street has mostly dismissed 2020 earnings and is looking toward recovery signs, which are expected to be seen in a turn up in earnings in the second half of 2020—and that will be the true reality test for the Street. At 27.7 times the expected 2020 EPS, there is no question as to why everyone is wearing a mask, as the Street is priced for 2021 (and even then it is high). If we see the upward turn in the second half, then the current levels may be justified, but if not, the Street will need to reprice, and for those of you who quickly forget, the last repricing was from the Feb. 19, 2020, high to the March 23, 2020, low—a 33.9% fall. In the “putting your money where your mouth is” reopening, the first major IPO since the virus spread to the U.S. was done, as insurance broker SelectQuote (SLQT) IPOed at USD 20, closing the month at USD 27.52, up 37.6%—ah, the good old days.

The U.S. market went into May after its best month (12.68%) since January 1987 (13.19%), as the focus changed to the start of the Reopening of the U.S. (most started on May 18, 2020, ahead of the Memorial Day holiday), with regions varying their approach and depth. The initial key issue for the reopening in May was if consumers would come back, and June’s key issue will be if they would be safe to do so and spend.

The Weekly Unemployment Claims totaled 40.8 million at the end of May, and they are expected to continue increasing, albeit slower. For Q1 2020 earnings, 97.1% of S&P 500 issues have reported their Q1 2020 earnings, with 323 of the 489 issues beating the 51.2% lowered estimates (and you thought it was a two-for-one stock split), and 290 of the 484 beating on sales. The Q2 2020 estimates declined 46.6% from year-end 2019, as Q3 2020 declined 32.0%, Q4 2020 declined 22.0%, and full-year 2020 declined 37.4% (good thing we aren’t pricing on 2020); 2021 estimates have declined 11.6%. Personal Income for April increased 10.5% due to government transfer payments (stimulus, enhanced unemployment benefits). For Q1 2020, the surprise was in the buybacks. With over 95% of S&P 500 buybacks reported, they were much stronger than expected. Based on current reporting, Q1 2020 is expected to post the fourth-largest buyback quarter, near the USD 200 billion mark (plus or minus a few CEOs’ salaries). The takeaway was that companies were mostly in for the quarter, even as many banks suspended their Q2 buybacks in mid-March. As for Q2 2020, don’t expect much and you won’t be disappointed, as some Information Technology and positive cash-flow consumer issues may continue buybacks; also working against buybacks is the public (and political) view. For May 2020, 11 S&P 500 issues increased their dividends (155 YTD), 1 initiated (2), 5 decreased (19), and 18 suspended (40), for a net change of USD -10.4 billion (USD -27.8 billion YTD).

“It’s a real world after all,” was sung as Shanghai Disneyland reopened (May 11, 2020), and admission was limited to 30% capacity (24,000), with temperature checks, social distancing, and masks part of the reopening. Next month in the U.S., Disney planned to open Florida’s Magic Kingdom Park on July 11, 2020, and Epcot center on July 15, 2020 (also with limitations and tests).

Since consumers quarantined, retail sales have plummeted, with April Retail Sales down 16.4%, a 21.6% year-over-year decline (with things expected to get worse), as initial estimates calculated that credit card spending has decreased 40%. The impact can be seen in retail bankruptcy filings, as retailers J.C. Penney, J. Crew, and Neiman Marcus declared bankruptcy, and Lord & Taylor plans to liquidate. In a developing trend, companies and employees have questioned the need for many to return to the office, as telecommuting accommodations appear to have some efficiencies (and savings). In an opening to that trend, Twitter’s (TWTR) CEO Jack Dorsey emailed employees telling them that they could work from home permanently (even after the coronavirus situation passes). In closer-tohome (mine) news, the New York Stock Exchange reopened some of its floor trading operations, along with precautions (you couldn’t take the city subway to work), tests, and the signing of an agreement not to sue the exchange. The opening of New York City, one of the last bastions of closures in the U.S., is expected to start Phase One on June 8, 2020, as going back to the office may be on a slower, more cautious timeframe (as for the NYC subway—CitiBike is a block away, with my office 4.1 miles away).

Relations between the U.S. and China were strained, as the U.S. said it “holds China accountable” for the spread of the virus. Trump threatened the World Health Organization (WHO) with permanently cutting off U.S. funds, and later in the month terminated the U.S. support of the WHO, as he blamed them and China for not fully disclosing the events on the COVID-19 situation in a timely manner. Trump continued to comment that China was at fault and failed to properly respond to the COVID-19 situation, as the U.S. Senate passed a bill unanimously (the Holding Foreign Companies Accountable Act), requiring U.S.-traded issues to forfeit their U.S. exchange listings if they do not comply with U.S. accounting audits. The law appeared to focus on Chinese issues (such as Alibaba [BABA] and Baidu [BIDU]). The U.S. added restrictions and requirements for semiconductor sales to Huawei. Trump restricted entry to the U.S. from Brazil, as that country became a concern area for the virus. China put approximately 108 million people on lockdown in northeast China, as new clusters of COVID-19 were detected.

The House (controlled by Democrats) was set to vote (and pass) a USD 3 trillion aid package (its fourth after the initial bill), including funding for state and local governments (USD 1 trillion), another USD 1,200 check for those making under USD 75,000 annually, expanding it to children and anyone with social security numbers (USD 290 billion), and expanding the additional unemployment benefits of USD 600 until January 2021 (USD 260 billion). The bill would then go to the Senate (controlled by Republicans), which said it was too soon for another aid program (the prior three packages totaled USD 9 trillion). Absent an event, no bill is expected soon, as politics ruled. U.S. Fed Chair Jerome Powell warned on the economy, as he said the future was “highly uncertain and subject to significant downside risks,” and he told the U.S. Congress to continue fiscal support (the market closed down 1.75% on the speech for that day). The U.S. passed the 100,000 death level due to COVID-19 (102,798 at this point, and 364,849 globally).

In the U.S., all 50 states have taken some measures toward the Reopening of the U.S., with several states reopening specific retail stores, and everyone watching to see if consumers will come and if there will be an upturn in cases. Square (SQ) joined Twitter in telling its workers they can continue to work at home after the COVID-19 situation has passed. Ride-sharing issue Uber (UBER) said it would let 3,000 workers go (a quarter of its staff) and close offices due to the virus. Similarly, reports spoke of office-sharing issue WeWorks having difficulties with receiving rent from customers and paying rent to offices.

The European Commission said it expected the EU GDP to decline 7.5% in 2020, marking the worst period for the region since the 1930s. Norway's central bank (Norges Bank) made its third cut in two months, reducing the rate to 0% from the previous 0.25%, saying it expected the country’s economy to decline 5% in 2020. Germany's top court gave the ECB three months to fix its asset purchases program, as it was ruled unconstitutional (a 7-to-1 ruling). The Bank of England said it expects U.K. GDP to decline 14% in 2020 and rebound 15% in 2021 (wouldn't that be nice).

Fed Chair Powell said that "the Fed hasn't run out of ammunition by a long shot," reinforcing its intent to support the economy, as he followed up with Congressional testimony, saying the Fed would do what was needed. The FOMC minutes reinforced the Fed’s commitment to take whatever action was necessary to "to support the economy." The European Commission proposed to the EU a USD 824 billion COVID-19 recovery plan and a USD 1.2 trillion regional plan. The Fed’s Beige Book (for April 7- May 18, 2020) reported declines in all districts, with significant job loss, as it saw no evidence of a quick “V” recovery.

The single, almost uniform, takeaway from this quarter’s earnings season was that corporations are uncertain of their future, since they are uncertain of the length and impact of COVID-19. Hence, few are giving forward guidance. The full Q1 2020 estimates have declined 50.5%, and results have come in mixed, as measured by the estimates. For Q1 2020, 489 issues have reported, representing 97.1% of the market value, as 323 of the issues (66.1%; historically it is two-thirds) have beaten the lowered estimates. Q1 2019 is expected to post a 49.8% decline over Q4 2019 and a 48.2% decline over Q1 2019. On the sales front, 290 of 484 (60.0%) issues have beaten estimates, as sales are expected to decline 10.0% from the record Q4 2019 and be 1.9% lower year-over-year (Q1 2019). Of the 484 issues, 19.5% have decreased their year-over-year share count by at least 4%, meaning they have added at least 4% to their EPS. Going forward, the year-over-year impact is expected to decline, as companies reduce (and suspend) buybacks; the quicker statistic would be the number of issues reducing shares each quarter.

S&P Dow Jones Indices added health care equipment issue DexCom (DXCM) and S&P MidCap 400 issues Domino’s Pizza (DPZ) and West Pharmaceutical Services (WST) to the S&P 500, as it removed Allergen (AGN) (which was acquired by AbbVie [ABBV]), Capri Holdings (CPRI), and Helmerich & Payne (HP), with the latter two being added to the S&P SmallCap 600.

Outside of the retail bankruptcies, Wal-Mart (WMT) reported a 10% increase in U.S. sales for the quarter, as its e-commerce increased 74%, and it said it would close its Jet.com e-commerce unit, which it purchased for USD 3.3 billion in 2016. Home improvement stores Home Depot (DH) and Lowe’s (LOW) also reported higher sales (but higher expenses), as did other stores permitted to remain open (typically selling food or daily essential items). Department store Kohl’s (KSS) reported a 41% decline in sales in Q1 2020, as its stores were mostly closed. Car ride issue Uber cut 14% of its workforce, as competitor Lyft (LYFT) cut its workforce by 17%. On the other side, home workout equipment maker Peloton (PTON) reported a surge in orders, as Beyond Meat (BYND) benefited from increasing meat prices (due to plant closings). Social media issue Facebook (FB) will open its office on July 6, 2020, as it said a majority of workers were able to work remotely and permitted those who wished to continue to work remotely to do so through 2020. The expectations were that similar polices for other companies would follow.

The U.S. 10-year Treasury closed at 0.66%, up from last month's 0.62% (1.92% at year-end 2019, 2.69% at year-end 2018, and 2.41% at year-end 2017). The U.S. 30-year Treasury closed at 1.41%, up from last month's 1.27% (2.30%, 3.02%, 3.05%). The pound closed at 1.2347, down from 1.2555 last month (1.3253, 1.2754, 1.3498); the euro was up to 1.1104 from last month's 1.0940 (1.1172, 1.1461, 1.2000); the yen closed at 107.82 from last month's 107.16 (108.76, 109.58, 112.68); and the yuan closed at 7.1373 from last month's 7.0623 (6.9633, 6.8785, 6.5030). Oil rebounded (after April's negative price trades) to close at USD 35.32, up from last month's USD 19.83 close (USD 61.21, USD 45.81, and USD 60.09). U.S. gasoline pump prices (EIA, all grades) increased, closing the month at USD 2.049 from last month's USD 1.870 per gallon (USD 2.658, USD 2.358, USD 2.589). Gold was up, closing at USD 1,743.00, from last month's USD 1,692.80 (USD 1,520.00, USD 1,284.70, and USD 1,305.00). VIX closed at 27.31, trading as high as 40.32 and as low as 25.92, down from 34.15 last month (13.78, 16.12, 11.05).

S&P 500

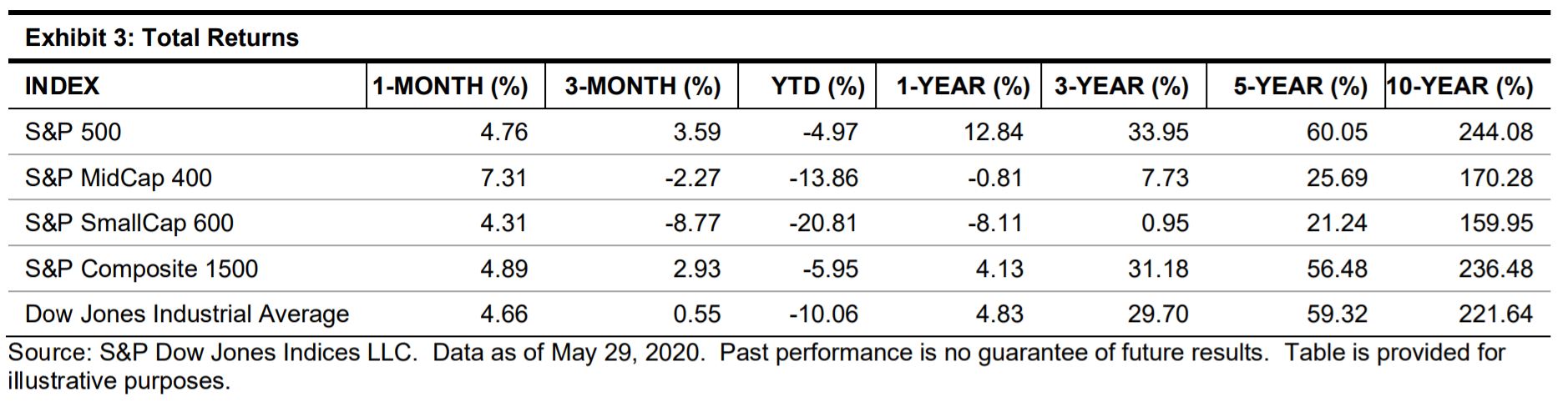

The S&P 500 closed at 3,044.31, up 4.53% (4.76% with dividends) for the month from last month’s 2,912.43 close, when it was up 12.68% (12.82% with dividends; its best month since January 1987), and the prior month’s 2,584.59 close, when it was down 12.51% (-12.35% with dividends; worst month since October 2008). Over the three-month period, the index was up 3.05% (3.59%); year-to-date, it was down 5.77% (-4.96%), and the one-year gain was 10.62% (12.94%). The Dow® closed at 25,383.11, up 4.26% (4.66% with dividends) from last month’s 24,345.72 close when it was up 11.08% (11.22%), and the prior month’s 21,917.16 close, when it was down 13.74% (-13.62%). Over the threemonth period, The Dow was down 0.10% (0.55%), and YTD it was down 11.06% (-10.06%), while the one-year return was 2.29% (up 4.83%).

Intraday volatility (daily high/low) decreased to 1.63% from last month’s 2.21% (5.34% the month before that); year-to-date, it was 2.32%, April was 2.48%, 2019 was 0.85%, 2018 was 1.21%, and 2017 was 0.51% (which was the low since 1962). S&P 500 trading decreased 11% (adjusted for trading days) over the past month, after the prior month’s 21% decrease, as the year-over-year month remained high, up 59% over May 2019; one-year trading volume was up 18% year-over-year.

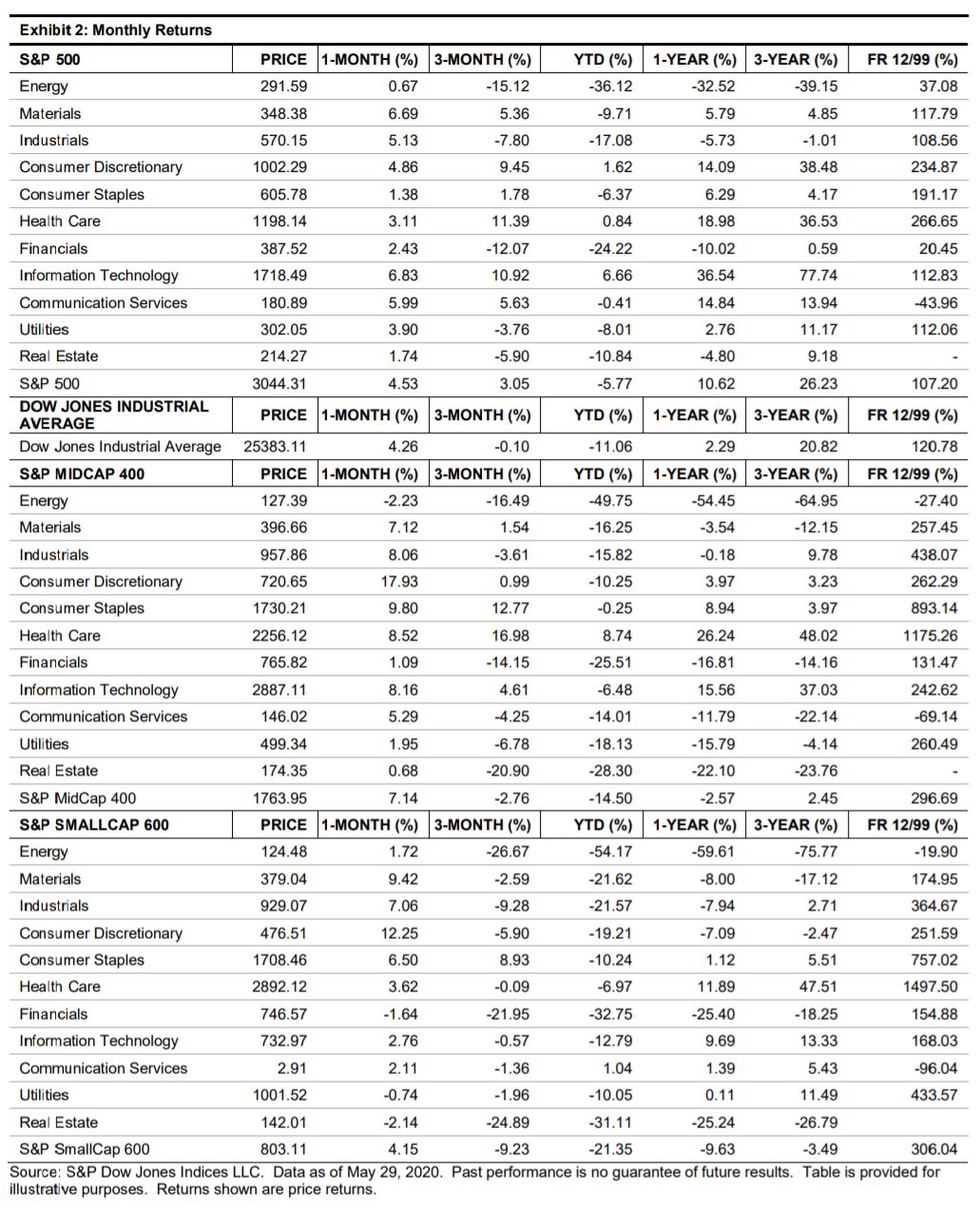

Sector variance decreased but remained high, as all 11 sectors gained for the second consecutive month, an exact opposite of the prior two months (March and February), when all declined. The spread for the month between the best (Information Technology, 6.83%) and worst (Energy, 0.67%) sectors declined to 6.83%, after last month’s 26.49% (the one-year average was 12.60%). Year-to-date, the spread was 42.78% (36.38% last month), and the 2019 spread was 40.41%.

For the month, Information Technology returned to the lead, as it gained 6.83% and was up 6.66% YTD (up 114.92% since the U.S. November 2016 election). Communication Services added 6.00% and was a tick in the red YTD, off 0.41%. Health Care added 3.11% for the month and was up 0.84% YTD. Consumer stocks continued to vary, as Consumer Discretionary gained 4.86% and was the third sector to be positive YTD, up 1.62%, as Consumer Staples added 1.38% for the month and was down 6.37% YTD. Financials posted a 2.43% gain, though it remained down 24.22% YTD. Energy was the worst sector in the index, as it added 0.67% for the month and was down 36.12% YTD.

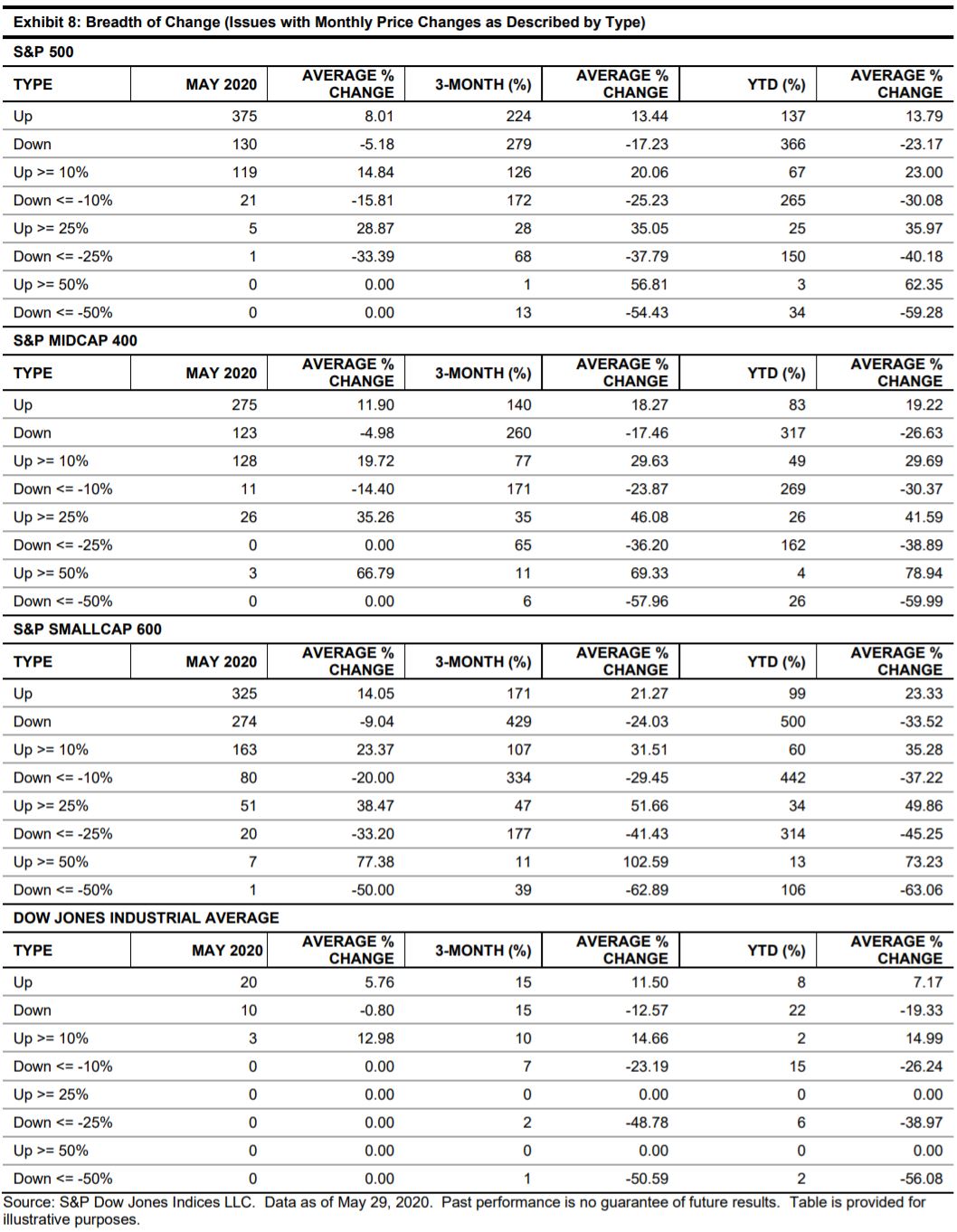

Breadth declined but remained strongly positive, as 375 issues gained (an average of 8.01% each), compared to last month’s 476 gainers (15.76%), and the prior month’s 41 (6.19%). Gains of 10% or more declined (but remained strong) to 119 (average gain was 14.84%), down from the prior month’s 305 (21.40%) and 6 (18.42%) the month before that; 5 issues gained at least 25%, compared with 81 last month and 1 the month before that. On the downside, 130 issues fell (an average loss of 5.18%), compared with 29 last month (average -6.55%), and the month before that’s 463 decliners (-21.36% each). Twenty-one issues declined at least 10% (average -15.81%), compared with 7 (-15.71%) last month and 356 the month before that (-26.22%). One issue fell at least 25%, the same as last month. Year-to-date, breadth improved but remained strongly negative, as 137 issues gained (average of 13.79%), up from last month’s 86 (average 9.71%), while 67 (23.00%) were up at least 10%, compared with 34 last month (19.41%), with 25 up at least 25% (7 last month). On the down side, 366 issues were in the red (-23.17%), down from 417 last month (-23.48%), with 265 down at least 10% (-30.08%), compared with 333 last month (-28.11%), and 150 were down at least 25% (-40.18%) compared with 175 last month (-28.62%).

The Dow

May continued the recovery that started in late March, as the index posted its second consecutive month of gains. The Dow posted a 4.26% gain for May, after April’s broad 11.05% gain, as it trailed the S&P 500 and S&P MidCap 400 (but was slightly better than the S&P SmallCap 600). Year-to-date, The Dow was down 11.06%, its one-year return was up 2.66%, and its five-year return was 40.93% (59.32% with dividends), which easily beat the mid- and small-cap indices, but slightly trailed the S&P 500.

For the month, The Dow closed at 25,383.11, up 4.26% (4.66% with dividends) from April’s 24,345.72 close, when it was up 11.08% (11.22% with dividends), and March’s 21,917.16 close, when it was down 13.74% (-13.62% with dividends). Year-to-date, the index was down 11.06% (-10.06%), and the one-year return was 2.29% (4.83%). The two-year return was 3.96%, the three-year period was up 20.82%, and the index increased 150.41% over the 10-year period.

For the month, breadth declined but remained strong, as 20 of the 30 issues gained (average gain of 5.76%), compared with 27 last month (average 11.76%), and 2 the month before that. Three of the issues gained at least 10% (average 12.98%), compared with 16 last month, as none were up at least 25% (2 last month). On the downside, 10 issues fell (a slight -0.80% each), compared with 3 last month (-14.04%) and 28 the month before that, as no issue fell at least 10%, down from 1 last month and 15 in each of the prior two months. Year-to-date, 8 issues were up (7.17%), compared to 6 last month, and 2 were up at least 10% (1 last month), with 22 down at least 10% YTD (-19.33%), down from 24 last month.

For the month, consumer stocks got all the action, and a significant part of the trades, as the U.S. started the process of reopening, with regions differing greatly. Footwear and apparel issue NIKE (NKE) did the best, as it rebounded 13.08% for May and reduced its YTD decline to 2.69% (it remained up 92.99% from the U.S. Nov. 2016 election). Home Depot was close behind, up 13.03%, as it has remained open throughout the COVID-19 situation; the issue was up 13.78% YTD. Being open, however, didn’t help drug store chain Walgreens Boots Alliance (WBA) as much, as it declined 0.81% for the month and was down 27.17% YTD. Fast food restaurant McDonald’s also posted a slight decline, down 0.65% for the month and down 5.71% YTD. Health care consumer product maker Proctor & Gamble (PG) also posted a decline, down 1.65%, and it was down 7.19% YTD.

Information Technology generally did better, as network issue Cisco Systems (CSCO) was up 12.84% and down a tick YTD, -0.29%, with Intel (INTC) up 4.92% for May and up 5.15% YTD. Apple (AAPL) added 8.22% and was up 8.27% YTD, as International Business Machines (IBM) fell 0.53% and was down 6.82% YTD. Financials issues improved but remained down YTD, as Goldman Sachs Group (GS) was up 8.46% and down 18.90% YTD, insurance issue Travelers (TRV) was up 5.70% (down 21.88% YTD), and JPMorgan Chase (JPM) added 1.62% (down 30.19% YTD). Energy issue Exxon Mobil (XOM) did the worst, as it declined 2.15% and was down 34.84% YTD, while Chevron (CVX) fell 0.33% and was down 23.91% YTD.

S&P MidCap 400

The S&P MidCap 400 continued its rebound from its deep decline in March (-20.43%), as it posted the best monthly return of the core indices, up 7.14% for May, after April’s broad 14.06% gain. The twomonth return almost overcame the March damage, with the three-month period down 2.76%. Year-to-date, the damage remained (although improved), as the index was down 14.50% (better than the smallcap index, but lagging the S&P 500); the 1-year return was -2.59% and the 2-year return was -9.38%, while the 3-, 5-, and 10-year periods were positive at 2.45%, 15.69%, and 131.26%, respectively.

May had 10 of the 11 sectors post gains, down from April’s sweep of all 11 being up, which was a reversal of the prior two months when all 11 were down. Sector spreads declined but stayed high, as the difference between the best (Consumer Discretionary, 17.93%) and worst (Energy, -2.23%) group declined to 20.16% after last month’s jump to 69.67% from the prior month’s 42.50%. Year-to-date, the spread increased to 58.49%, compared with last month’s 48.81%, and the one-year period spread remained significantly high, at 80.68%, up from the prior month’s 72.66%, as Health Care was up 26.24% for the one-year period and Energy was down 54.45%.

Consumer stocks led the way up for the month and in general did better than other sectors over the past two years. For May, Consumer Discretionary rebounded 17.93%, as it remained down 10.25% YTD but up 3.97% over the one-year period. Consumer Staples was up 9.80%, as it was down a tick YTD, -0.25%, and up 8.94% for the one-year period. Information Technology added 8.16%, as it remained in the red YTD, down 6.48%, while Health Care gained 8.52% and was up 8.74% YTD—the best sector in the index. Financials posted a modest (by comparison) 1.09% gain and was down 25.51% YTD. Energy did the worst, declining 2.23% for the month and down 49.75% YTD.

Breadth declined but remained strong as the recovery progressed, and 275 issues gained an average of 11.90% each, up from 346 issues last month, which averaged 20.90% each (37 the month before that, 6.61% each). There were 128 issues that gained at least 10% (average 19.72%), compared with 254 last month and 8 the month before that, while 26 issues gained at least 25%, compared with 91 last month and 1 the month before that. On the down side, 123 issues fell an average of 4.98% each, up from last month’s 43, which had an average -4.81% each and the prior month’s 363 decliners (-25.98%). Declines of at least 10% were posted by 11 issues (-14.40%), compared with 4 issues (-25.98%) last month and 306 in the month before that (-29.80%). There were no significant declines of at least 25% for the second consecutive month (169 the month before that). Year-to-date, breadth improved but continued to be strongly negative, as 83 issues were up (an average of 19.22% each), compared with April’s 50 issues (average 14.84%), and 49 (29.69%) were up at least 10% (6 last month), with 26 up at least 25% (2 last month). On the downside, 317 issues were down, an average of -26.63%, which was an improvement from the prior month’s 350, which averaged -27.94%, as 269 issues were down at least 10% (-30.37%), down from the prior month’s 307 (-31.09), with 162 down at least 25% (-38.89%), compared with the prior month’s 193 issues (-38.77%).

S&P SmallCap 600

The S&P SmallCap 600 continued its rebound, as declines and sector volatility remained. For the month, the index added 4.15%, the worst of any headline index, after last month’s broad 12.60% rebound, which was after March’s 22.60% decline; the three-month return remained down 9.23%. Year-to-date, the small-cap index was down 21.35%, significantly worse than the other core indices (the next worst was the mid-cap index, at -14.50%, with the large-cap down 5.77%). The one-year return was -9.63%, the three-year return was -3.49%, and the five-year period was positive at 12.66%. The small caps have been unable to recapture the headlines and performance from last month, when they dominated for several days, as buying has not been overpowering; but for the past two months, it has been stronger than the selling. As the country reopens, there should be an initial glance as to forward direct business, as well as orders from larger-cap issues, with higher volatility expected as groups react to the indications.

Sector variance declined significantly, as broader sector moves were lower, with the difference between the best and worst sector declining to 14.39% from last month’s 53.03%. Year-to-date, the spread remained high, increasing to 55.21% from last month’s 53.90%, as the one-year spread was 71.49% (70.41% last month), with Health Care up 11.89% for the one-year-period and Energy down 59.11% over the past year.

For May, 9 of the 11 sectors gained, down from all 11 last month, and only 1 gainer in the month before that. Consumer groups did the best, as Consumer Discretionary added 12.25% for the month but remained down 19.21% YTD (still better than the index), while Consumer Staples was up 6.50% and down 10.94% YTD. Materials issues were up 9.42%, as they remained down 21.62% YTD (close to the index return). Real Estate did the worst, off 2.14% for the month and down 31.11% YTD, as Utilities was the other decliner for the month, off 0.74% and down 10.05% YTD.

For the month, breadth declined but stayed positive, as 325 issues gained an average of 14.05% each, compared with 496 gainers last month (which averaged a 25.23% gain) and March’s 62 gainers (11.22%). On the downside, 274 issues fell, with an average loss of 9.04%, up from last month’s 101 decliners, which averaged an 8.72% decline each, and the prior month’s 538 decliners (-30.00%). There were 163 issues with at least a 10% gain (average 23.37%), up from last month’s 359 (average 32.89%) and the prior month’s 26 (average 21.00%). Declines of at least 10% were posted by 80 issues (-20.00%), up from last month’s 24 issues (-22.21%) and the prior month’s 458 (-34.26%). Significant gains of 25% were booked by 51 issues, compared with 167 last month, as 20 issues lost at least 25%, compared with last month’s 4. Year-to-date, 99 were positive (average 23.33%), up from last month’s 63 (20.61% each), and 60 (36 last month) were up at least 10% and 34 (21) were up at least 25%. On the downside, 500 issues were down (average -33.52%), down from 537 last month (- 32.59%), while 442 were down at least 10% (427 last month) and 314 were down at least 25% (324 last month).

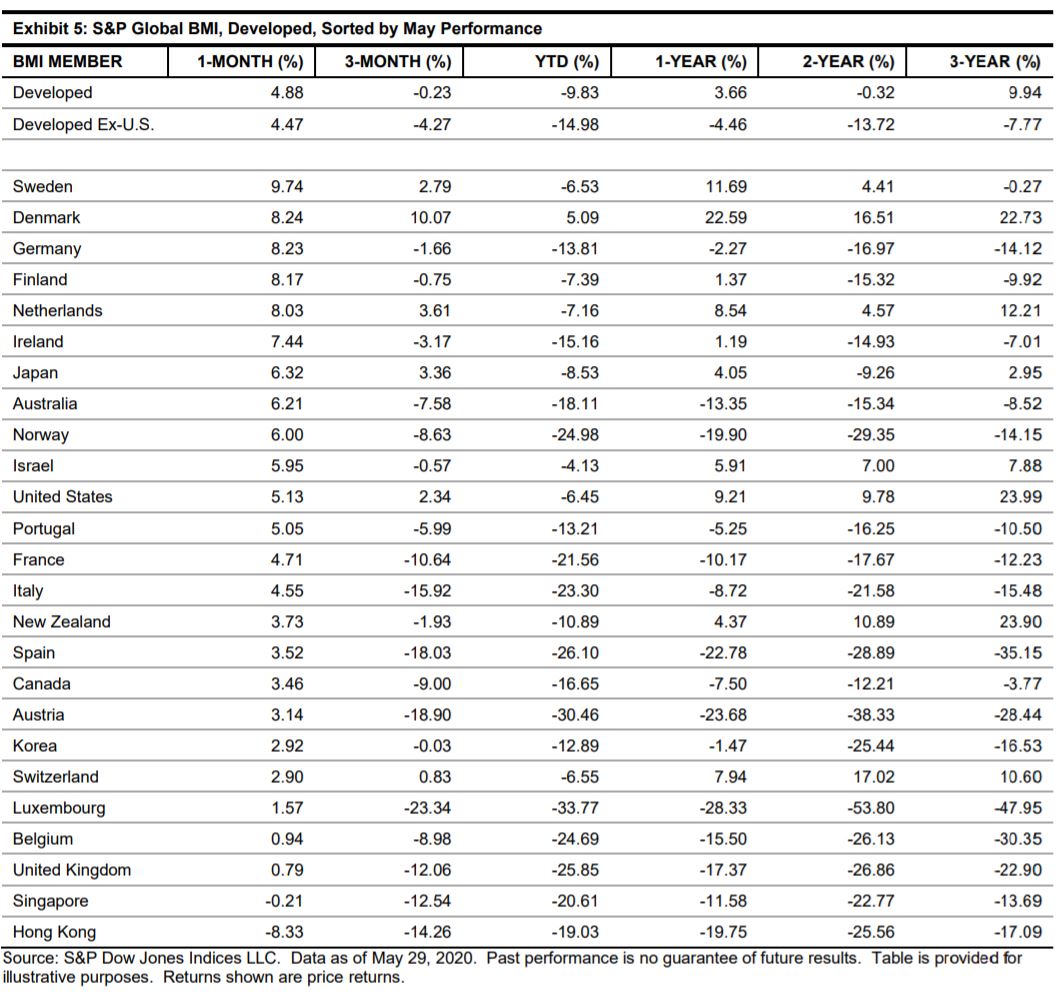

S&P Global BMI

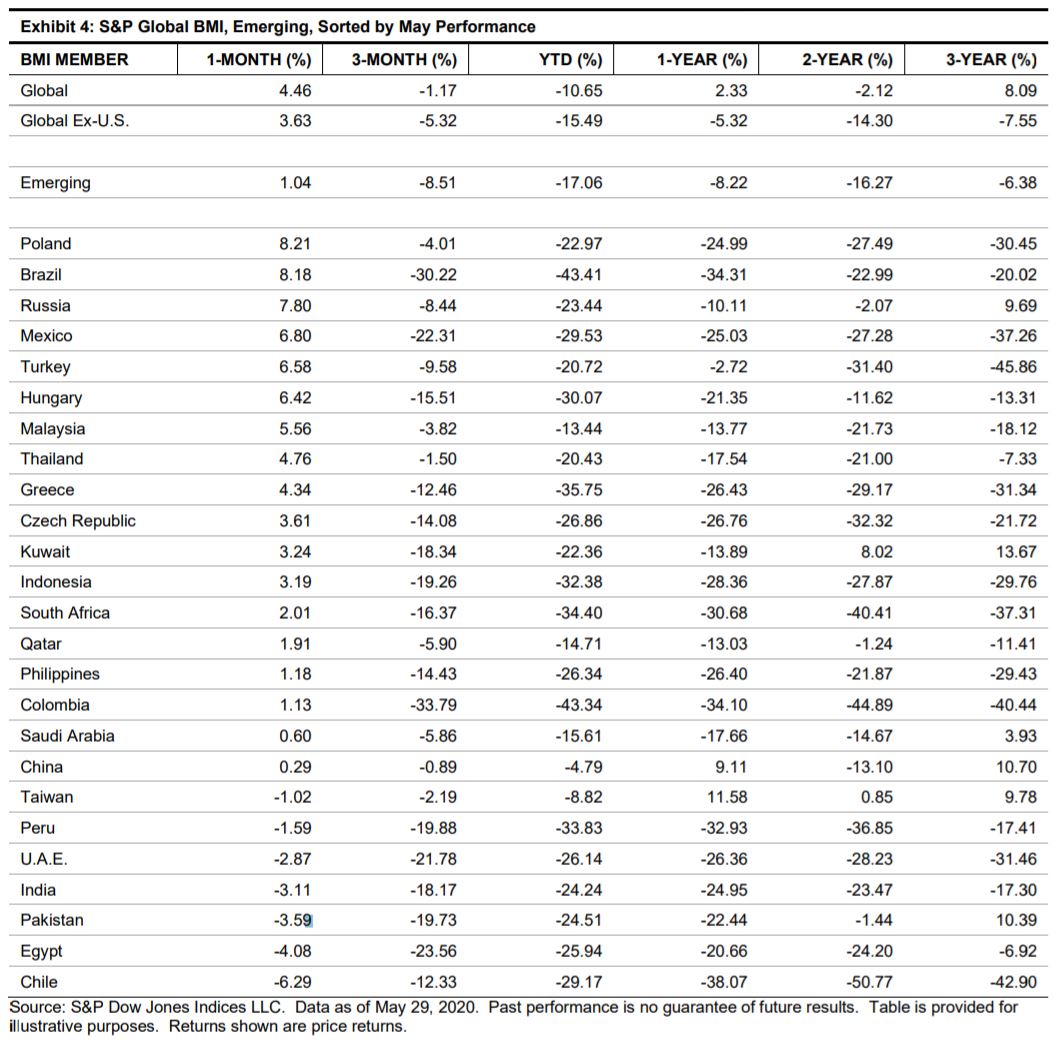

Global markets, in aggregate, held their rebounded gains from April (10.89%) after March’s decline (-14.61%); this month, they added to their gains, as the reopening of the world (in parts) started, while other areas (sometimes the same that were reopening) reported increased cases of COVID-19. For the month, 41 of the 50 markets gained, down from last month’s sweep, when all 50 markets gained (which was a complete reversal of March, when all 50 were down).

May posted a consolidated gain of 4.46% with the U.S. and was up 3.63% without it, after April’s broad 10.79% gain (8.00% without the U.S.’s 13.13% gain), which was a partial rebound from March’s massive 14.61% decline (-15.40% without the U.S.’s 17.95% decline). Year-to-date, global markets were down 10.65% (-15.49% without the U.S.’s 6.45% decline). Global markets were up 2.33% for the one-year period , and absent the U.S.'s 9.21% gain, they were down 5.32%. Longer term, the U.S. still dominated; the two-year global return was -2.12% with the U.S.’s gain of 9.78% and -4.30% without it, while the three-year return was up 8.09% with the U.S.’s gain of 23.99%, and absent the U.S., it was down 7.55%. From the Nov. 16, 2016, U.S. presidential election, global markets were up 22.15%, but absent the 40.08% U.S. gain, they were up 4.46%.

The S&P Global BMI increased USD 2.300 trillion (up USD 4.938 trillion last month and down USD 7.881 trillion in March). Non-U.S. markets increased USD 0.838 trillion (USD 1.659 trillion, USD -0.665 trillion), and U.S. markets increased USD 1.462 trillion (USD 3.279 trillion, USD -4.068 trillion). Emerging markets were up 1.04% for the month (up 9.34% last month), down 17.06% YTD, and down 8.22% for the one-year period. Developed markets were up 4.88% for the month (4.47% excluding the U.S), down 9.83% YTD (-14.98%), and up 3.66% for the one-year period (-4.46%).

Sector variance again decreased, as all 11 sectors gained, the same as last month and a complete reversal from March, when all 11 were down. The spread between the best (Information Technology, 6.96%) and worst (Real Estate, 0.86%) sectors for the month was 6.10% (the one-year average was 9.38%), down from last month’s 12.70% and the prior month’s 24.74%.

Emerging markets posted a 1.04% gain, after last month’s 9.34% gain and the prior month’s 17.18% decline, as the YTD return was -17.06%. The one-year return was down 8.22%, the two-year return was down 16.27%, and the three-year return was down 6.38%.

For May, 18 of the 24 markets gained, compared with last month when all 24 were up and March when all 24 were down. Poland did the best, adding 8.21% for the month, though it remained down 22.97% YTD and down 24.99% for the one-year period. Brazil was next, adding 8.12% but down 43.41% YTD and down 34.31% for the one-year period, and Russia was third, up 7.80%, down 23.44% YTD, and down 10.11% for the one-year period. Chile did the worst, as it declined 6.29%, bringing it down 29.17% YTD and down 38.07% for the one-year period. Egypt was next, posting a 4.08% monthly decline, and it was down 25.94% YTD and down 20.66% for the one-year period, then Pakistan, which was down 3.59% for the month, down 24.51% YTD, and down 22.44% for the one-year period.

Developed markets posted a consolidated 4.88% gain after last month’s 10.98% rebound (which was in response to March’s 14.28% decline), while the return excluding the U.S. was 4.47% (7.59%, -14.81% last month). The YTD return was -9.83% and -14.98% excluding the U.S. The one-year return was 3.66% and -4.46% excluding the U.S., the two-year return was -0.32% and -13.72% excluding the U.S., and the three-year return was 9.94% and -7.77% excluding the U.S.

For May, 23 of the 25 markets gained, compared to all 25 in April (and none in March). Sweden did the best for the month, as it added 9.74%, was down 6.53% YTD, and was up 11.69% for the one-year period. Denmark was next, adding 8.24%, up 5.09% YTD, and up 22.59% for the one-year period, as Germany added 8.23%, was down 11.78% YTD, and was down 2.27% for the one-year period. Hong Kong did the worst, declining 8.33%, down 19.03% YTD, and down 19.75% for the one-year period. Singapore was next, down 0.21%, down 20.61% YTD, and down 11.58% for the one-year period, and then the U.K., which was up 0.79%, down 25.85% YTD, and down 17.37% for the one-year period. Of note, Japan added 6.32%, was down 8.53% YTD, and was up 4.05% for the one-year period. Canada was up 3.46%, off 16.65% YTD, and down 7.50% for the one-year period.

Content Type

Theme

Location

Language