Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 24 Mar, 2020

By Hong Xie

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

Since mid-February, the market has turned sharply down in response to the coronavirus pandemic. The S&P 500® has fallen about 32% from its peak this year. Equity volatility shot up, as VIX® went from historical lows to the 70-80 range, which was last seen in November 2008. The 10-year U.S. Treasury Bond yield reached 0.32% intraday before it bounced back above 1%, as the market expected more debt issuance with drastic fiscal measures to combat the economic slowdown. How has U.S. corporate debt weathered this market storm so far?

Exhibit 1 shows the average credit spread of the U.S. corporate bond market in the context of post-2008 global financial crisis (GFC). The recent move has put spreads at the widest since the GFC, and still much tighter than the peak level during the 2008 GFC when the investment grade spread reached over 500 bps and high yield over 2000 bps.

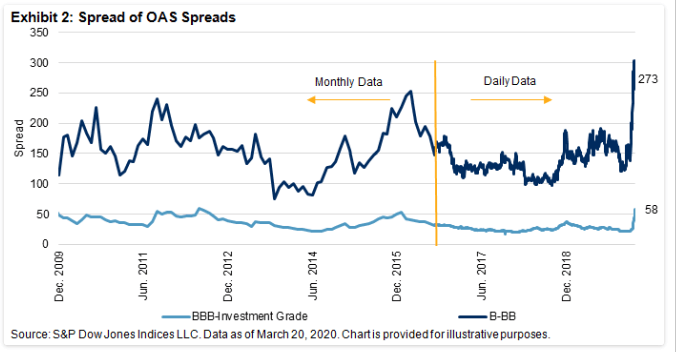

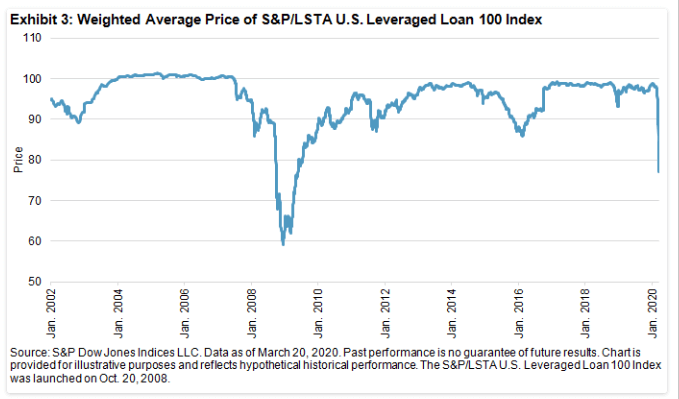

How did corporate bonds with different credit quality perform during this market stress? Exhibit 2 charts the spread difference between spreads of investment grade versus ‘BBB’ and ‘BB’ versus ‘B’. The widening of spreads between rating buckets has been consistent with the direction of spread widening, and the fact that the spread between ‘BB’ and ‘B’ has reached a new post-GFC high is very concerning. In fact, the weighted average price of leveraged loans dropped to 77.06 on March 19, 2020, a new low since the rally after 2009 (see Exhibit 3). Market participants may now wonder about the funding and default risk ahead.