Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 3 Jun, 2020

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

On May 20, 2020, my colleagues and I sought to address some questions about dividends and the viability of tried and true approaches to dividend income.

During that session, Craig Lazzara, Ari Rajendra, and Howard Silverblatt of S&P Dow Jones Indices (S&P DJI) joined me to address:

A replay of that information session, which incorporated questions submitted during registration, is available at https://on.spdji.com/webinars. We received more questions during our session, and I thought it would be useful to publish the additional questions and provide answers as a follow-up to the session.

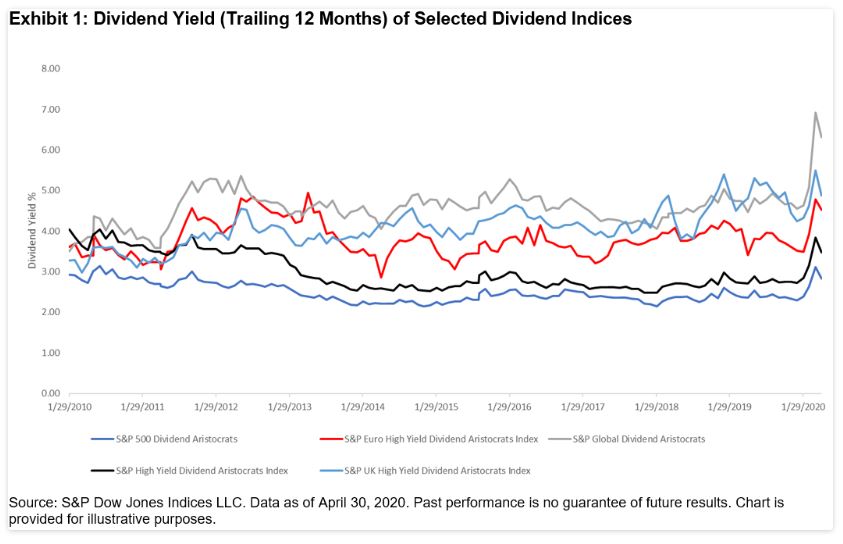

Q: What is the current yield of the different S&P DJI dividend strategies discussed in the presentation? How do you see its range going forward?

A (Ari Rajendra): While we can’t speculate on the range going forward, the data in Exhibit 1 provides a relevant perspective on the range of dividend yields for different S&P Dividend Aristocrats® Indices.

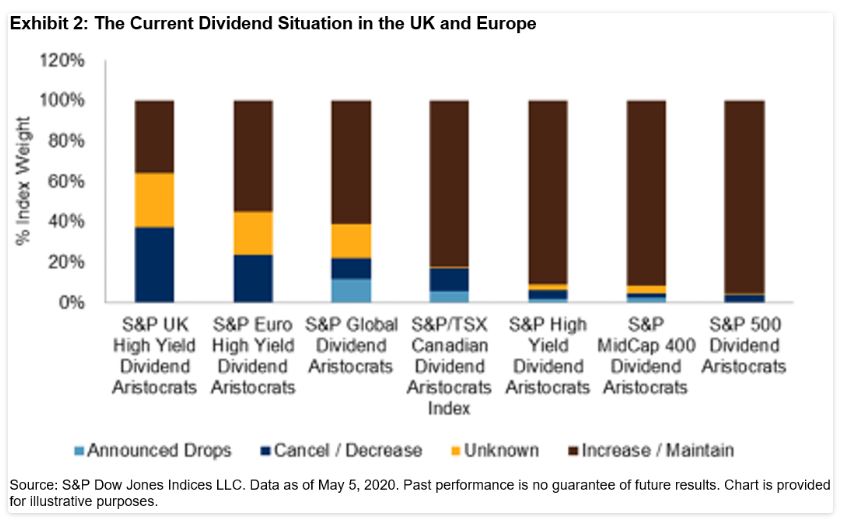

Q: Ari, can you go into a bit more detail on the dividend chart you showed (see Exhibit 2)? Are you assuming companies that took government money will cut or suspend dividends?

A (Ari Rajendra): No assumptions were made in the analysis; it was based on public announcements at the time of writing. If a company announced a cancellation or suspension as a result of taking government money, then it would be accounted for with no forecast made.

With respect to Exhibit 2, we grouped index constituents into four categories—announced drops, cancel/decrease, increase/maintain, and unknown. When a company postponed or not announced its dividends, we grouped them under the unknown category with no speculation on likely action.

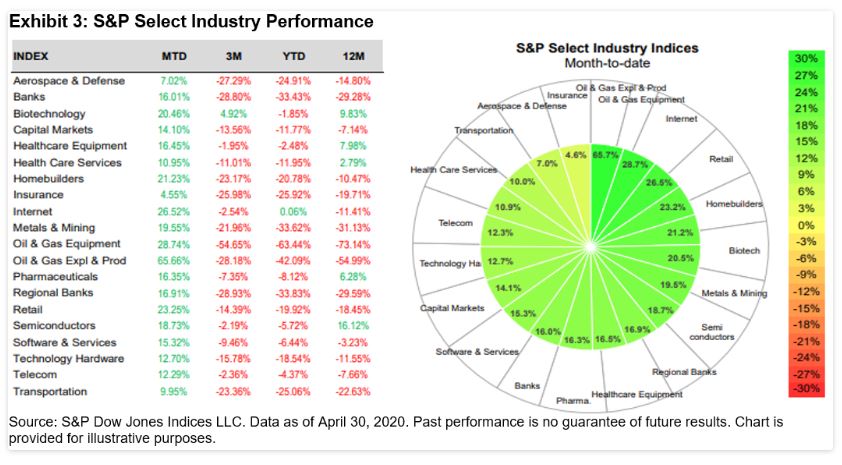

Q: Do we need a COVID-19 index that would cater to companies adversely affected by COVID-19?

A (Craig Lazzara): The Index Investment Strategy team at S&P DJI produces monthly index dashboards. The S&P Select Industry Dashboard shows the industries that were most adversely affected by COVID-19 across the three-month and YTD return categories displayed in Exhibit 3. Many of these industry-specific indices are tracked by an ETF.

A (Peter Roffman): We’re also examining the concept of COVID-19-based investing, and we’ve noted that COVID-19 has inspired new index concepts across a variety of areas, including COVID-19 coping and recovery industries, as well as ESG indices.

Q: As I am listening to this session, I am seeing that the S&P 500® Dividend Aristocrats was down about 16% versus the S&P 500, which was down 8%. Any comments on why the defensive characteristics discussed in the informational session aren’t showing?

A: Our colleague, Tianyin Cheng posted a recent and detailed analysis on why dividend indices underperformed during the coronavirus sell-off, available on the Indexology® Blog at https://www.indexologyblog.com/2020/05/15/why-did-dividend-indices-underperform-during-the-coronavirus-sell-off/.

Q: Do you believe COVID-19 first hitting Europe and China had any impact on the timing of suspensions (higher globally) versus the U.S.?

A (Ari Rajendra): I’m not sure we can conclusively say whether timing has been the driver of the regional differences. Between the UK and U.S., for example, the peak of the pandemic was almost concurrent. Broadly, we could say that the U.S. equity market had been much stronger than its global peers coming into this crisis. That said, the complexity of global supply chains and simultaneous fall in consumer demand may eventually result in this being a global issue rather than a regional one.

We greatly appreciate the engagement of the more than 600 people that registered for our dividend information session, as we seek to meet your needs for information and education. I recommend that North American-based advisors bookmark https://spdji.com/topic/financial-advisors-us, where we curate the latest content for your interests.

Content Type

Theme

Location

Language