Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

14 Mar, 2020

Online apparel retailer Stitch-Fix reported fiscal Q2 revenues to Jan. 31 that were inline with expectations but provided guidance for the fiscal full year (though July 31) that was below expectations according to S&P Global Market Intelligence.

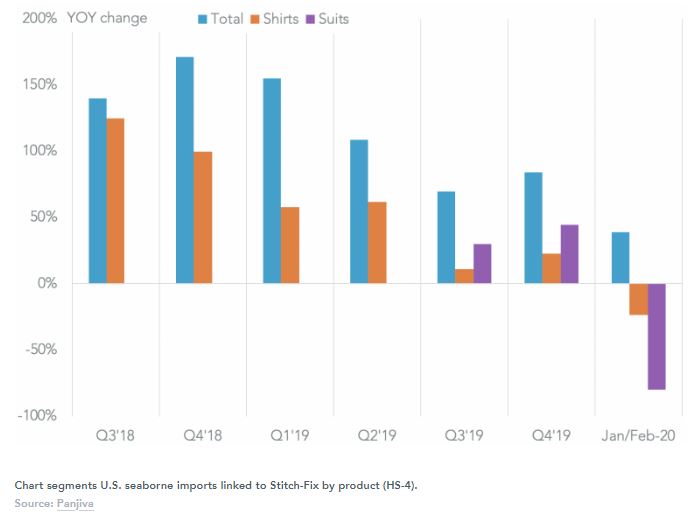

Panjiva data shows that U.S. seaborne imports for the new quarter are continuing to grow with a 38.9% year over year expansion in imports linked to the firm in January and February combined. Yet, that was markedly slower than the 84.2% rise seen in Q4.

At the product level (HS-4) there’s been a marked slowdown in shipments of shirts and suits, which may have fallen by 23.8% and 80.0% year over year in the past two months. Instead there’s been a surge in shipments of sweaters.

One element that hasn’t been blamed so far is the COVID-19 coronavirus outbreak – CEO CEO Katrina Lake stated that “to date, we haven’t yet seen a material impact on our business“.

Indeed, the firm may have a robust supply chain, with Lake noting “when we did a lot of the work around tariffs, we really got a handle around our kind of understanding of our dependence on China.“

Yet, there are second-tier effects to bear in mind – Lake stated that “there are fabrics, there are components, and so we’re really right now in the middle of working with our vendors. We really — we do anticipate it will have some impact on our business“.

There’s already widespread evidence of such issues, most recently with warnings from the government of Cambodia as outlined in Panjiva research of March 11, with interruptions in Vietnam also expected.

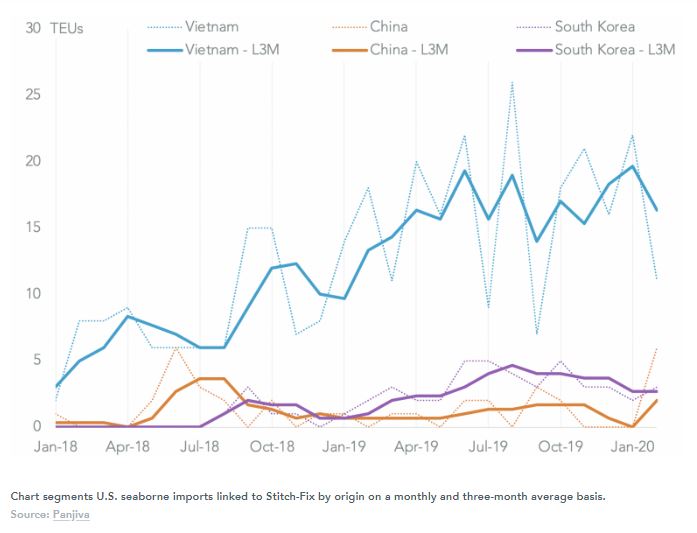

Panjiva’s seaborne data shows Stitch-Fix likely cut its imports from China to 4.7% in 2019 compared to 13.2% in 2018. Instead it has scaled up imports from Vietnam to 77.6% from 74.4% and those from South Korea to 14.9% from 4.7%. A renewal of shipments of China in February 2020 may reflect the reduction in section 301 duties to 7.5% from 15.0% from mid-month as part of the U.S.-China phase 1 trade deal.