Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 8 Jul, 2021

By Fiona Boal

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

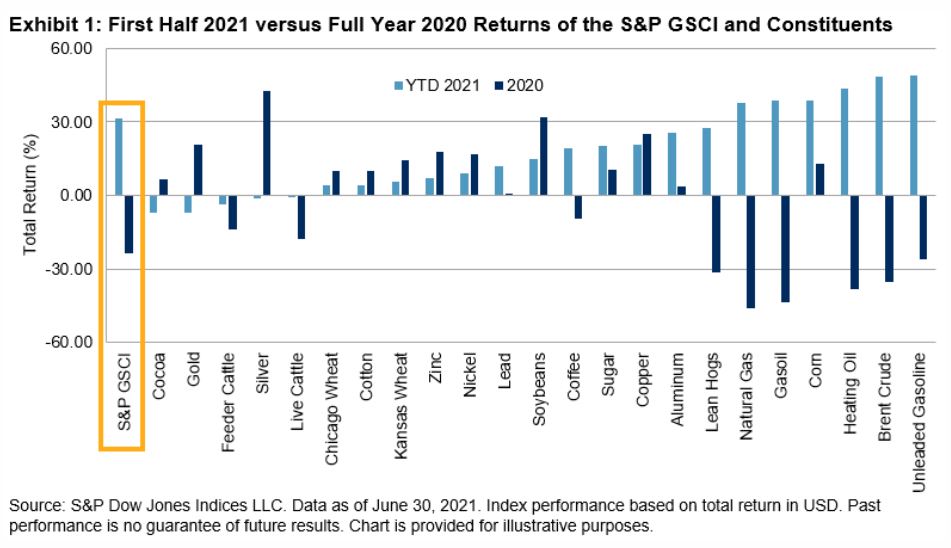

The S&P GSCI rose 31.4% in the first half of 2021, outperforming the S&P 500®, which rose 15.2%. The S&P GSCI has more than doubled since hitting an all-time low during the initial stages of the COVID-19 pandemic in April 2020. Several commodities have reached new all-time highs this year, as the global economy has reflated, consumer confidence hit pre-pandemic highs in many regions, and supply chains remained disrupted. Aggressive fiscal and monetary support has also buoyed the recovery in industrial commodities prices. But it may not be plain sailing for commodities over the following months; recent flattening of the yield curve in the U.S. and elsewhere would suggest that, at least for now, the inflation trade that has been supporting commodities has lost some of its appeal.

The S&P GSCI Petroleum rallied an impressive 49.0% over the first six months of 2021. While uncertainty over the course of the COVID-19 pandemic may temporarily limit the final push to normalize demand, there is no doubt that a robust recovery in many major markets combined with impressive supply discipline have justified the recovery in prices. Market participants will be watching the disagreements within the OPEC+ alliance closely, given that any longer-term deadlock could signal the beginning of the end for the broader supply agreement and increase the risk that members independently turn on the taps.

Following a sprint higher over the first few months of the year, prices for industrial metals have cooled marginally in the wake of attempts by Chinese regulators to dampen speculation in its domestic commodities markets and signs that the U.S. Federal Reserve is concerned about inflation. Following year-long rallies across the industrial commodities markets, the suggestion that U.S. interest rates may be hiked sooner than expected and Beijing’s plans to release strategic metal reserves were a double whammy to metal’s reflation story in June. Nevertheless, the S&P GSCI Industrial Metals ended June up 19.5% YTD.

Precious metals, particularly gold, was the clear loser in the commodities complex in the first half of the year. By the end of June, the S&P GSCI Gold had fallen 7.0% YTD, after the U.S. Federal Reserve sped up its expected pace of policy tightening, which led many market participants to reconsider the so-called inflation trade. The rise in U.S. stocks to a fresh record and a resurgent U.S. dollar also weighed on the yellow metal.

The S&P GSCI Agriculture finished the month flat but rallied 19.1% YTD. Apart from cocoa, all constituents of the S&P GSCI Agriculture subindex ended the first half in positive territory, but the clear winner was corn, with the S&P GSCI Corn up 38.9% YTD. The multi-month rally in corn prices followed an abrupt tightening of global corn supplies, including the announcement by the USDA on the last day of June that U.S. farmers had planted less acres of corn than expected.

The S&P GSCI Livestock rallied 7.5% over the first six months of the year. Some of the luster came off lean hogs in June, with the S&P GSCI Lean Hogs falling 11.3% in the wake of China’s announcement that the country’s hog herd was rebuilding faster than expected from African swine fever.

The posts on this blog are opinions, not advice. Please read our Disclaimers.