Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 25 Mar, 2020

By Rupert Watts

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

In January 2019, we highlighted several indices designed to reduce the impact of large equity market drawdowns. Here we analyze the same suite of indices divided across three broad categories: defensive equity, multi-asset, and volatility. This analysis simply reviews performance since the S&P 500®’s high on Feb. 19, 2020, through the close on Friday, March 20, 2020.[1]

The current bear market has progressed with extraordinary rapidity—there have been only 22 trading days since the S&P 500 reached its all-time high. As such, any conclusion we draw must be considered strictly preliminary. Moreover, it’s important to begin any evaluation with a reasonable set of expectations. Defensive equity indices are, after all, still equities; we hope that they will mitigate losses in the underlying benchmarks, but they’ll still go down, perhaps substantially. Loss mitigation should increase in multi-asset indices, which are able to shift capital away from a declining equity market. Finally, indices that can take a long position in volatility might, at least in the current circumstances, be the best risk mitigators of all.

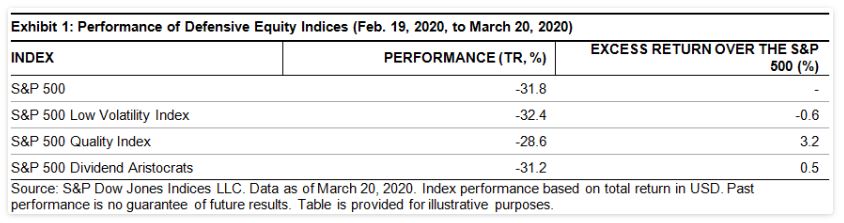

Defensive Equity

This category includes three well-known index series: the S&P Low Volatility Indices, S&P Quality Indices, and S&P Dividend Aristocrats® Indices. These indices have attracted significant inflows, particularly in recent years, as investors have balanced their need to maintain a position in equities with concerns about an aging bull market. As of the close on Friday, March 20, 2020, two of the three were beating their benchmark, the S&P 500, despite having just come through an extraordinarily difficult week. Coming into last week, the S&P 500 Low Volatility Index had recorded meaningful outperformance but then had a particularly tough week due to overweight positions in Real Estate and Utilities, two of the hardest hit sectors.

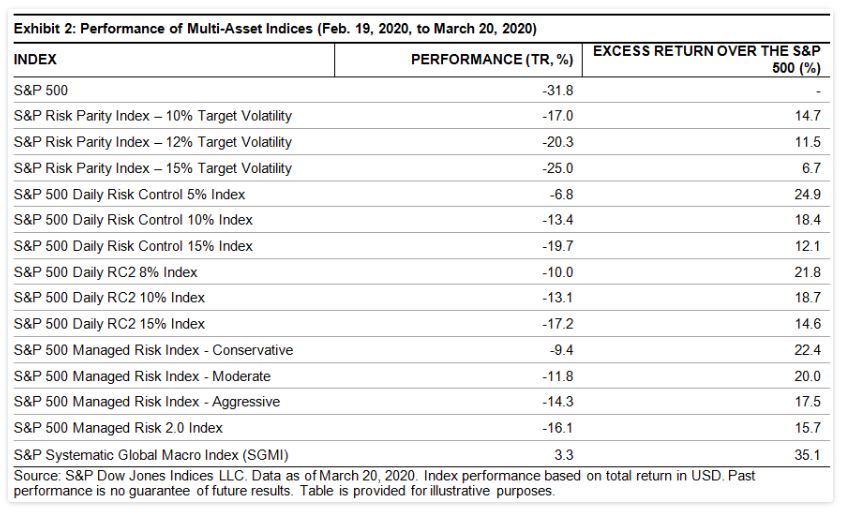

Multi-Asset

Multi-asset indices combine imperfectly-correlated asset classes (such as stocks and bonds) with the goal of creating broadly diversified portfolios. These indices employ disciplined asset allocation rules and dynamically adjust their leverage or allocation with the aim of achieving a more stable risk profile.

As expected, many of these indices have de-leveraged or increased allocations to safe-haven assets as volatility has increased in recent weeks. Thus far, several have posted double-digit drawdowns, which is not surprising when almost all asset classes are down. However, losses have been muted and many of our indices have posted meaningful outperformance compared to equities.

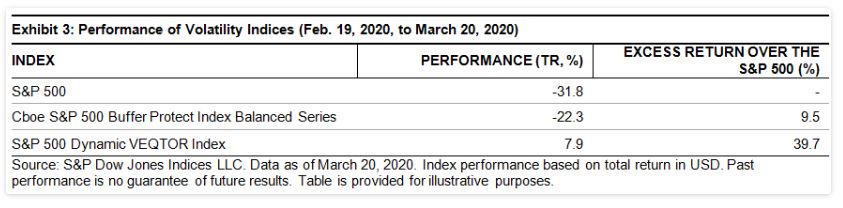

Volatility

Volatility can be thought of as an asset class in its own right, which market participants can use to access uncorrelated returns, provide downside protection, and improve risk-adjusted performance. Indices in this category either invest directly in volatility or use it as an allocation signal.

As you will see in Exhibit 3, the Cboe S&P 500 Buffer Protect Index Balanced Series posted meaningful outperformance. This is due to the fact that each monthly index within this series “buffer protects” against the first 10% of losses in the S&P 500 over a set period of time. The S&P 500 Dynamic VEQTOR Index, which rebalanced in and out of cash and increased its allocation to short-term VIX® futures as the VIX spiked, recorded positive returns, up 7.9%.

[1] For more details on these individual indices, please see: Seeking Volatility Protection Using Indices.