Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 28 May, 2020

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

What do presidential debates and an argument between passive and active investors have in common? They are both thrilling, demand the highest levels of rhetorical skills, don’t change audience opinions, and everyone goes home entertained. While presidential debates remain as exciting as ever, the shrillness of conversation between active and passive investors seems to have lessened. One could argue that this change is due to (1) a smaller degree of outperformance of star managers, (2) a convergence of fee differentials, and (3) the investment industry widening its focus to offer more solutions.

One of the drivers behind the shift in capital from active to passive is the question of active managers’ ability to outperform their benchmarks. Here, the burden of proof has fallen squarely on active managers. While there are, indeed, a few active managers who outperform, S&P DJI’s SPIVA® U.S. Scorecard[1] highlights that the last time the majority of all active U.S. managers outperformed was in 2013. In 2019, a full 70% of all active U.S. investors underperformed.

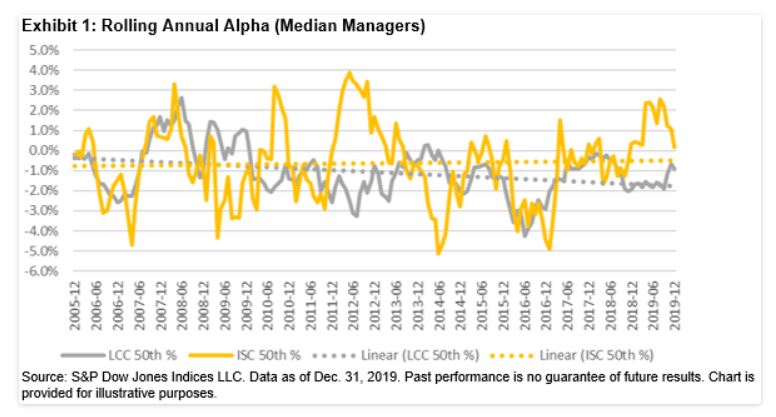

Based on the SPIVA Scorecard, some areas of the market are relatively easier for alpha generation than others. Over the past 10 years, on a net-of-fees basis, 63% of international small-cap (ISC) managers underperformed their benchmark, while the number for the U.S. large-cap core (LCC) was 97%. While there are periods of outperformance for a median manager, alpha is volatile and mostly negative (see Exhibit 1).

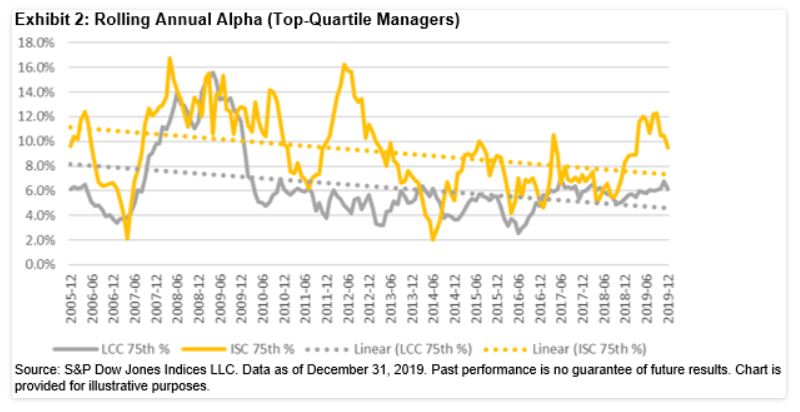

While the alpha generation of median managers is underwhelming, what about the best-performing investors? Let’s look at the top-quartile managers (see Exhibit 2). Identifying top managers a priori is, of course, unrealistic, and many strategies don’t survive—only 50% of LCC and 60% of ISC funds that existed 10 years ago are still live.[2] However, even with the benefit of perfect hindsight, what we want to analyze is whether we can discern any change in the magnitude of alpha for the best managers.

Top investors are still able to generate excess returns, although the downtrend is apparent, and persistence of this alpha is fleeting.[3]

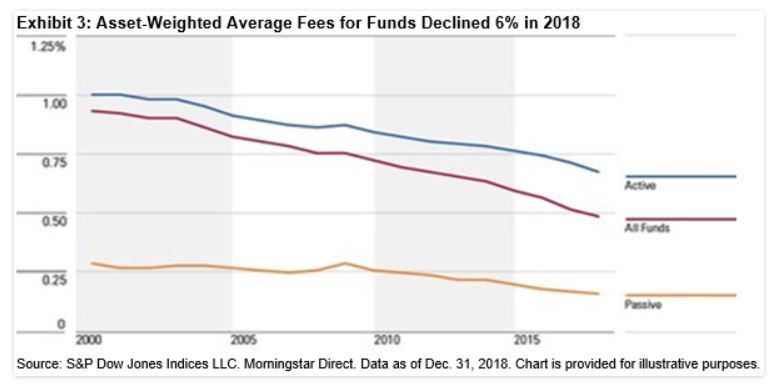

Many of us are aware of the pressure that active and, more recently, passive investors have been under with respect to the structural decline in fee levels. Technological and analytical advances contributed to increasing economies of scale and brought up a heightened investor focus on sources of performance. As fees continue to march lower (with the differential dropping by about one-third since 2000), the contrast between active and passive has become less pronounced (see Exhibit 3).SPIV

As healthcare and college costs continue to march higher, and as the burden of saving for retirement has shifted from employers to employees, the investment industry has repositioned itself. Managers are evolving beyond long-only, asset-class-specific strategies. Instead, outcome-based solutions such as target date funds, 529 plans, and income guarantee products have proliferated.

One can argue that the investment industry has morphed into a “manufacturing” industry: various solutions come to market that try to target a specific outcome. Contrast this with 10+ years ago, when many value propositions had to do with attempting to outperform a benchmark while maintaining a certain level of risk. Here at S&P DJI, we are actively engaging in providing index-based solutions such as our U.S. equity franchise, volatility indices, multi-factor and multi-asset approaches, thematic funds, ESG offerings, real assets, and custom indices.

Active and passive investors are opinionated groups. However, as the industry continues to shift and investment approaches evolve, we suspect that the two camps will continue to converge, heated discussions will become less so, and the focus will center more around providing appropriate solutions to investors regardless of the investment approaches.

[1] SPIVA U.S. Scorecard, Year-End 2019

[2] SPIVA Institutional Scorecard, Year-End 2018

[3] Soe, A., Can You Beat the Market Consistently?, 2019

Content Type

Theme

Location

Language