Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 13 Mar, 2020

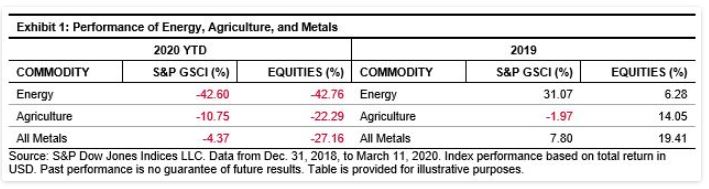

In our blog post from December 2019,[1] we highlighted the disparity seen last year between different sectors of the commodity futures and commodity equities markets. The second thing to watch highlighted the substantial 25% performance difference in 2019 between the S&P GSCI Energy and the S&P GSCI Equity Commodity Energy Index. However, so far in 2020, these different asset classes have moved in lockstep (see Exhibit 1). The other noticeable takeaway is the complete reversal of last year’s positive performance across the different commodity equities.

There were justified reasons for the disparity last year. In 2019, energy equities underperformed due to bearish market sentiment associated with high debt levels present across the sector. We highlighted how our colleagues at S&P Global Ratings expect the Energy sector to lead in terms of defaults over the next five years. This may prove to be correct much more quickly than expected, with crude oil prices plummeting below breakeven levels of production. Energy is so far the worst-performing sector in the S&P 500® this year, dropping initially due to the COVID-19 outbreak and then collapsing further by more than a six-sigma move after the end of the OPEC+ alliance. With Russia and Saudi Arabia engaging in a new market share battle, oil prices raced to decade lows. The highly levered U.S. energy names that comprise the S&P Equity Commodity Energy Index are now facing one of the toughest times in recent memory.

The S&P GSCI Energy was already the worst-performing commodity sector prior to the collapse in oil prices on March 9, 2020. Several negative catalysts that have been building over the past few years have arguably come to a head in the energy complex: the global push toward ESG-based investing is reducing investors’ appetites for companies with higher carbon emissions, U.S. shale oil production has expanded at breakneck speed, and the multi-year alliance of OPEC+ to prop up crude oil prices by production cuts has collapsed.

Unsurprisingly, the energy bond market has also taken a hit this week. In S&P Dow Jones Indices’ March 12th Daily Dashboard, Chris Bennet highlights the present concern in the energy credit markets, where the option-adjusted spreads for the S&P 500 Energy Corporate Bond Index are double the next-closest sector. For market participants looking for commodity exposure, it is important to consider the different instruments available to them, even in situations where the short-term performance impact of supply and demand shocks are similar.