Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 20 Mar, 2020

By Brian Luke

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

Equity markets have fared reasonably well aided by liquidity in ETFs, as my colleague Craig Lazzara highlights. Steep discounts to net asset values (NAVs) on popular fixed income ETFs are bringing an onslaught of doomsday projections. But while the signs of stress are evident, it’s important to decouple the dysfunction of the bond market from the investment product as well as the manager’s skill.

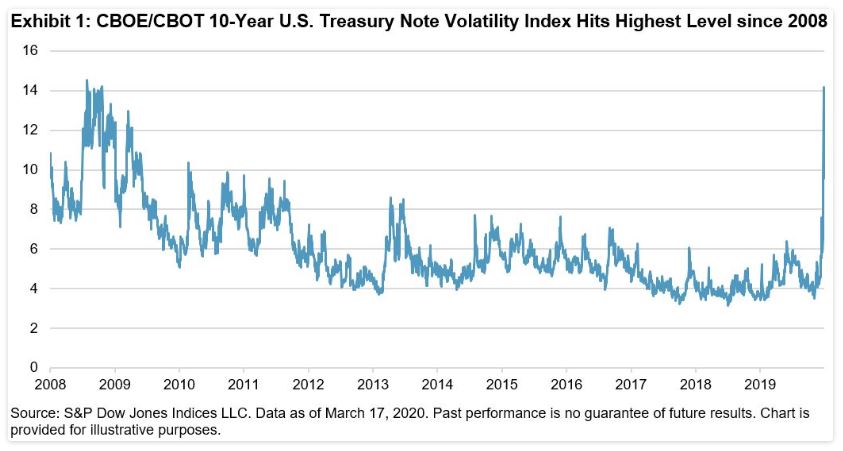

Let us first consider the market context. The rise of interest rate, credit, and volatility risk was previously discussed as the S&P U.S. Treasury Current 10-Year Index yield fell below 1%. Yields then halved and are now bouncing between 0.5% and 1%. Treasury bid-ask spreads were reported to widen to beyond 1 point and NAV discounts were seen in treasury and credit ETFs. Despite that illiquidity, fixed income ETFs experienced their largest daily volume in treasury and credit sectors. Liquidity is a premium. The Cboe/CBOT 10-year U.S. Treasury Note Volatility Index hit its highest point since the end of Lehman Brothers. This measure, along with its credit and swap variants, highlights the stress experienced across the fixed income markets.[1]

In terms of measuring the impact of these shocks on ETFs, Andrew Upward at Jane Street produced a great historical summary that was covered in a recent S&P Global webinar. In times of credit stress, the discount as a percentage of NAV reflects the price buyers are willing to pay. In recent days, the largest investment-grade and high-yield ETFs traded at over a 5% discount. This could be misinterpreted as a sign a credit ETF isn’t functioning well. There are a few critical points to counter that view. First, prices in the over-the-counter bond market are typically shown as “request for quote”—as soon as one wishes to sell at an advertised price, the trader showing the bid can remove it. The fact that an ETF has an executable price goes well beyond the unwilling participants in the OTC market. The second critical point is the latency in NAV calculation. As an index provider, we pride ourselves on using independent transparent pricing. These price providers play a heavy role in NAV calculation and are often referred to as price “evaluators,” since they are providing their evaluation on what the price of a bond should be on a given day. Having an independent resource is critical for the index and fund administration community. But they are not employing exacting measures to determine the price of a bond that may or may not have traded that day. The last point is a timing issue; the official index closes at 3PM, while the ETF and its NAV close at 4:00PM. This also causes a mismatch to NAV during times of volatility.

In the webinar, Bill Ahmuty, Head of SPDR Fixed Income Group at State Street Global Advisors, spoke about how fixed income volumes tend to grow during times of stress, while the underlying cash bond market volume tends to shrink. It appears that ETFs fulfill a critical need of liquidity when liquidity is needed most. ETF structure lends well to this, as investors can trade ETF shares without having to source the individual bonds. This only works to the extent that buyers and sellers can match their trades. Once they are matched, the liquidity must be met by the underlying bond market. As the fixed income ETF market grows, it has a better opportunity to meet or improve liquidity, similar to the equity market.

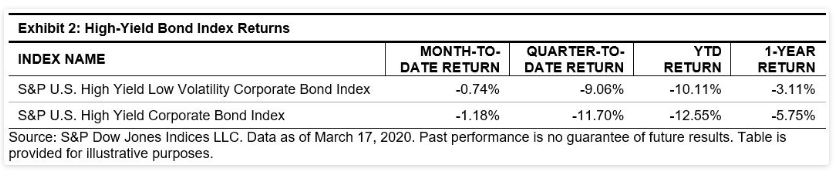

Finally, as investors look for those who successfully navigated these markets, the active versus passive debate will return. While that argument may be over for equity, new index-based strategies are proving their worth in fixed income. We will cover passive strategies and their performance in upcoming posts, but now, we want to highlight how the S&P U.S. High Yield Low Volatility Corporate Bond Index has outperformed its benchmark by 2.4% YTD.

While fixed income ETFs have largely performed in line with this market, the growth of secondary market trading will continue to help face future liquidity needs.

[1] For more information on this topic, please see the S&P Global webinar Measuring Fixed Income Volatility.