S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Diversity, Equity, & Inclusion

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Diversity, Equity, & Inclusion

S&P Dow Jones Indices — 22 Jan, 2021

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

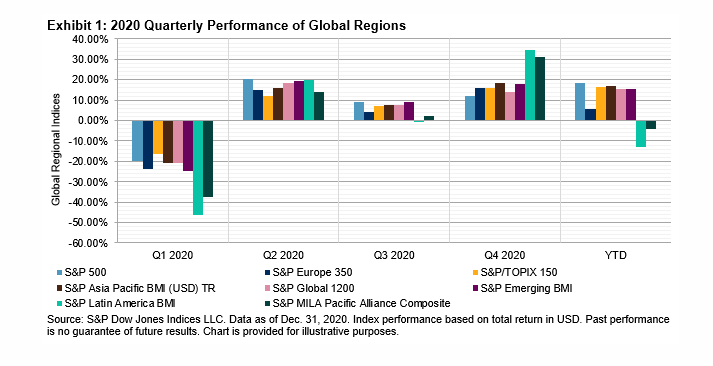

Volatility is often the name of the game in Latin America. While 2020 was no exception, global markets also rode the COVID-19 volatility wave (see Exhibit 1). The global pandemic exacerbated uncertainty around the world and all capital markets were affected, particularly during Q1 2020.

In Exhibit 1, we can see that the S&P Latin America BMI experienced the greatest loss (-46.0%) among our major regional indices in Q1, followed by the S&P MILA Pacific Alliance Composite (-37.5%), which represents Latin America excluding Brazil. Latin American equities rose in Q2, roughly in line with the global recovery, but then they lagged in Q3. Propelled by global economic optimism following the announcements of vaccine developments, the S&P Latin America BMI topped the leaderboard in Q4, gaining more than 30%, but it was not enough to recoup losses from earlier in the year, as the index finished the year down 12.9%.

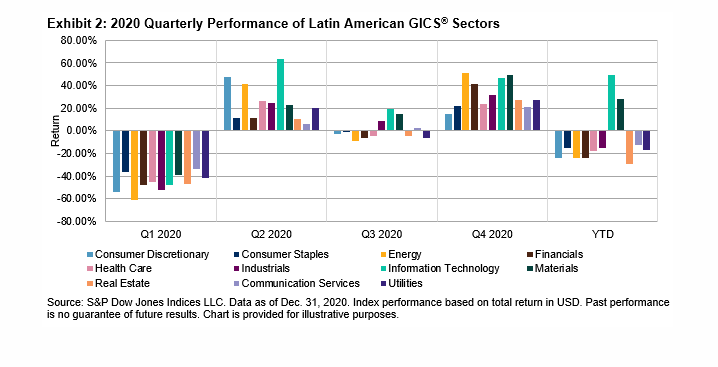

Similar trends were seen across sectors and countries throughout the year (see Exhibit 2). During the first quarter, all sectors and countries dropped, with Energy and Brazil performing worst. During the subsequent quarters, countries and sectors staged a strong recovery, though some fared better than others—a sign that the pandemic affected some countries and sectors more than others. While Q4 saw impressive returns, with Energy generating the best returns (51.2%), it was the Information Technology (49.2% YTD) and Materials (28.3% YTD) sectors that more consistently contributed to positive performance throughout the year. Materials companies, which include exporters of copper and iron, registered record prices for their exports, since January 2013 for copper and October 2011 for Iron.1

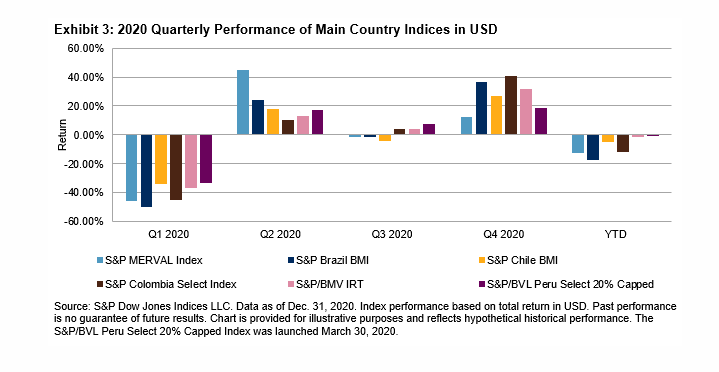

Among Latin American countries, all flagship indices ended the year under water when measured in USD (see Exhibit 3). The best performers were the S&P/BVL Peru Select 20% Capped Index, down 0.4%, and Mexico’s S&P/BMV IRT, down 1.8%.

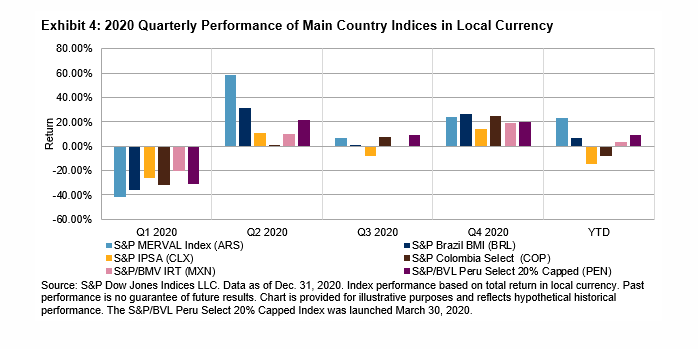

The story was different for returns in local currencies, given the significant depreciation of most currencies versus the U.S. dollar during the year (see Exhibit 4). The S&P Brazil BMI in BRL (6.43%), Argentina’s S&P MERVAL Index in ARS (22.9%), and the S&P/BVL Peru Select 20% Capped Index in PEN (8.8%) rounded up the leaders for YTD returns in local currency.

With the pandemic still raging in many parts of the world, what should we expect in 2021? The good news is that there are two vaccines with high efficacy being distributed in several countries. Currently, only citizens from Brazil, Chile, and Mexico have started to get vaccinated, while remaining Latin American countries are on a long waiting list. Economists in the region2 are watching the slow and fragile recovery. It is summer in the southern hemisphere, which has helped to curb the number of infections and hopefully by the fall and winter of 2021, the vaccine will have helped control the spread. The key now is how quick and effective the rollout of the vaccines will be in Latin America and the rest of the world before the global economy returns to a strong growth trend. It’s going to be an interesting year, yet again.

For more information on how Latin American benchmarks performed in Q4 2020, read our latest Latin America Scorecard.

1 Source: S&P Global Ratings and CapitalIQ. Copper (Comex HG), and NYMEX Iron Ore 62% Fe.

2 Diego Ocampo and Luis M. Martinez. Panorama del sector corporativo de América Latina para 2021: Un año de recuperación con altibajos. (Latin America Corporate Sector Overview for 2021: A Year of Recovery with Ups and Downs) Dec. 28, 2020. S&P Global Ratings.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Location

Segment

Language