S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Diversity, Equity, & Inclusion

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Diversity, Equity, & Inclusion

S&P Dow Jones Indices — 14 Jul, 2020

By Ved Malla

2020 has been overshadowed by the COVID-19 outbreak and the subsequent lockdown across the world. Capital markets have been negatively affected globally as well as locally in India. The lockdown in India began during the third week of March 2020 and has only recently been slightly relaxed. The first half of 2020 was volatile for the capital markets in India. All size indices and most sector indices posted negative returns for the six-month period ending June 2020.

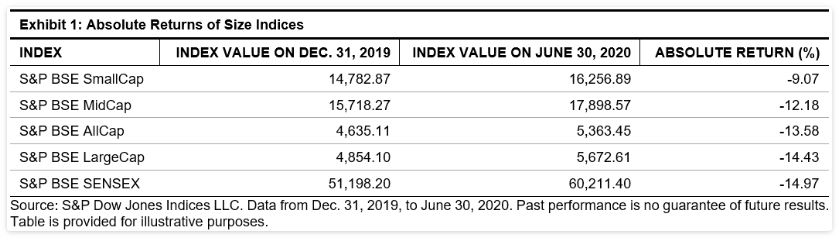

Exhibits 1 and 2 showcase the six-month returns for India’s leading size indices for calendar year 2020.

From Exhibits 1 and 2, we can see that the returns for large-, mid-, and small-cap segments for the first six months of 2020 were negative. The large-cap indices posted the lowest returns among the size indices. The S&P BSE SENSEX, which comprises the 30 largest and most-liquid listed companies in India, provided a negative return of nearly -15% over the first half of 2020. However, after a free fall that lasted until the end of March 2020, we have seen a good recovery in all the size indices. The S&P BSE SmallCap has had a better recovery than the large- and mid-cap indices.

Exhibits 3 and 4 showcase returns for the 11 leading sector indices in India over the past six months.

From Exhibits 3 and 4, we can see that the S&P BSE Healthcare and S&P BSE Telecom posted strong six-month absolute returns of 21.61% and 17.33%, respectively. The S&P BSE Realty, S&P BSE Finance, and S&P BSE Industrials posted the lowest absolute returns of -30.50%, -29.38%, and -19.85, respectively, for the first half of 2020.

To summarize, we can say that the Indian capital markets fell sharply in the first quarter of 2020, especially in the month of March. However, there has been a recovery in the second quarter, although the six-month returns were still negative.

Content Type

Language