Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 7 Apr, 2021

By Fei Mei Chan

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

On April 4, 2011, S&P DJI launched two strategy indices, the S&P 500® Low Volatility Index and the S&P 500 High Beta Index. Ten years of live history let us compare how the two indices actually performed versus their pre-launch back-tests.

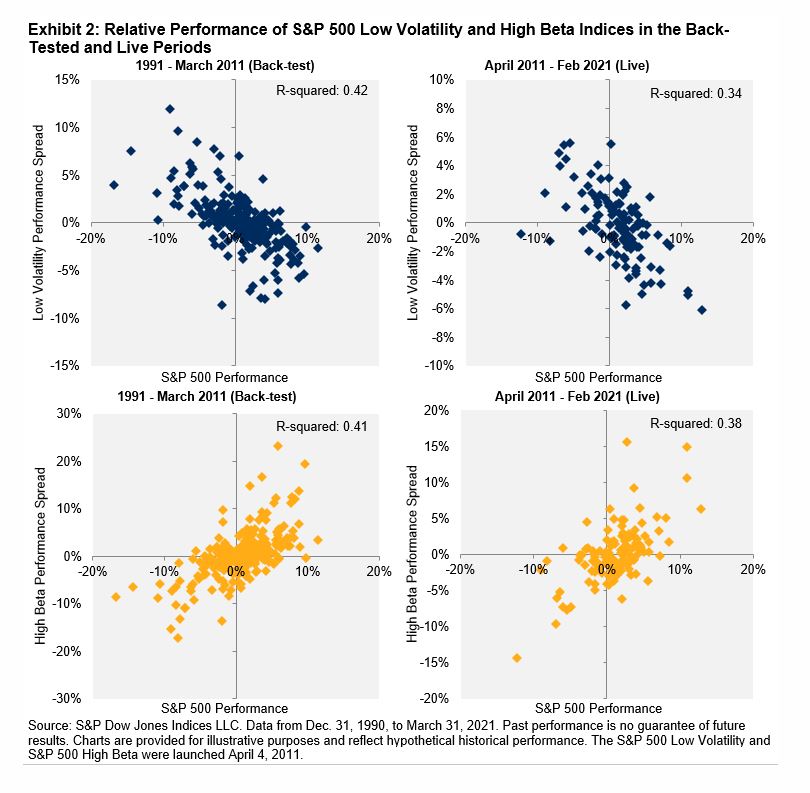

Many investors take back-tested history with an understandable grain of salt. But even live history can be deceptive if it doesn’t encompass market environments that reflect the full spectrum of reality. All strategies should be tested through different market environments, particularly strategies like low volatility and high beta that explicitly seek to provide a particular pattern of relative returns. Low volatility strategies seek to attenuate, and high beta strategies to amplify, the performance of the overall market. The behavior of both is therefore highly dependent on the market’s returns.

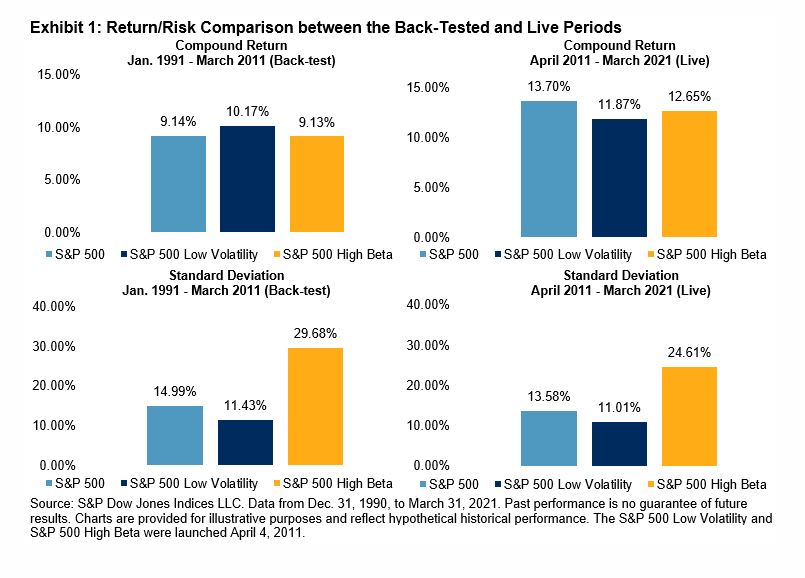

In the back-tested period from 1991 through March 2011, Low Volatility outperformed the benchmark S&P 500 with lower risk, while High Beta underperformed with higher risk. In the live period, Low Volatility underperformed while maintaining its goal of lowering volatility. High Beta’s live relative performance and risk were both comparable to those of the back-tested period.

Does Low Vol’s live underperformance mean that the index is somehow “broken” or that the back-test was not trustworthy? It’s important to remember that Low Vol’s out-or underperformance is highly dependent on the return of the benchmark S&P 500. The back-tested period included two bear markets: the bursting of the technology bubble and the financial crisis of 2008. With the exception of some small hiccups, the years in the live period, even including a pandemic, were mostly good (if not great) years.

In good markets, a low volatility strategy should not be expected to outperform. Low Vol’s major outperformance comes in years like 2000-2002 and 2008, which, thankfully for us, have not recurred since 2011.

So, did the two indices do what they were designed to do? For that, we look to their performance relative to the market. Exhibit 2 shows the monthly performance differentials of Low Vol and High Beta based on the performance of the S&P 500. Their behaviors have exhibited the same pattern both in the back-tested and the live period. We sometimes compare our indices to children; these two, at least, have been well behaved. Happy birthday.

The posts on this blog are opinions, not advice. Please read our Disclaimers.