Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

10 Jun, 2021

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

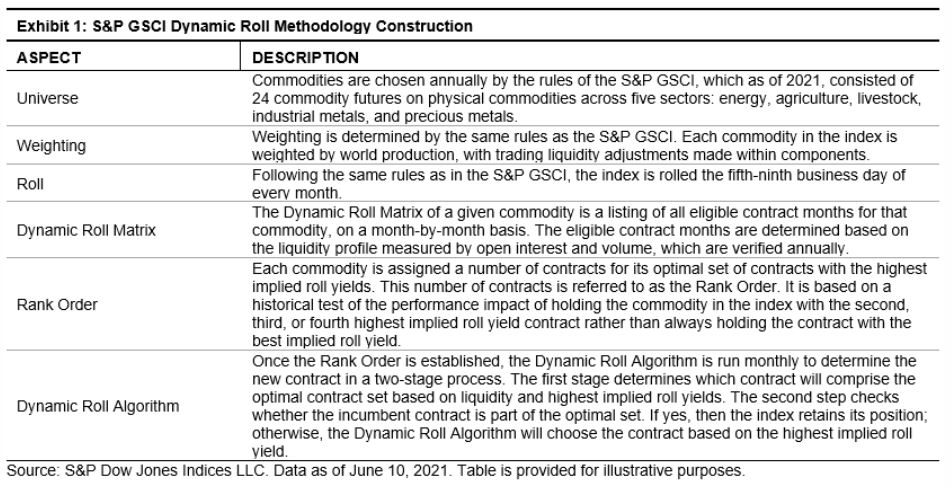

Launched just over 10 years ago, the S&P GSCI Dynamic Roll was the first dynamically rolling commodity futures index to be offered by a major index provider. What does it mean to dynamically roll? Exhibit 1 describes the process in detail. Employing a flexible monthly futures contract rolling strategy, the S&P GSCI Dynamic Roll is designed to alleviate the negative impact of rolling into contango, to benefit from backwardation, and potentially to lessen volatility while offering investors liquid, broad-based commodity exposure. Contango and volatility are the most cited reasons why market participants tend to steer away from commodities, despite the potential inflation protection and diversification benefits of including commodities in a diversified portfolio. The S&P GSCI Dynamic Roll may help to mitigate these concerns.

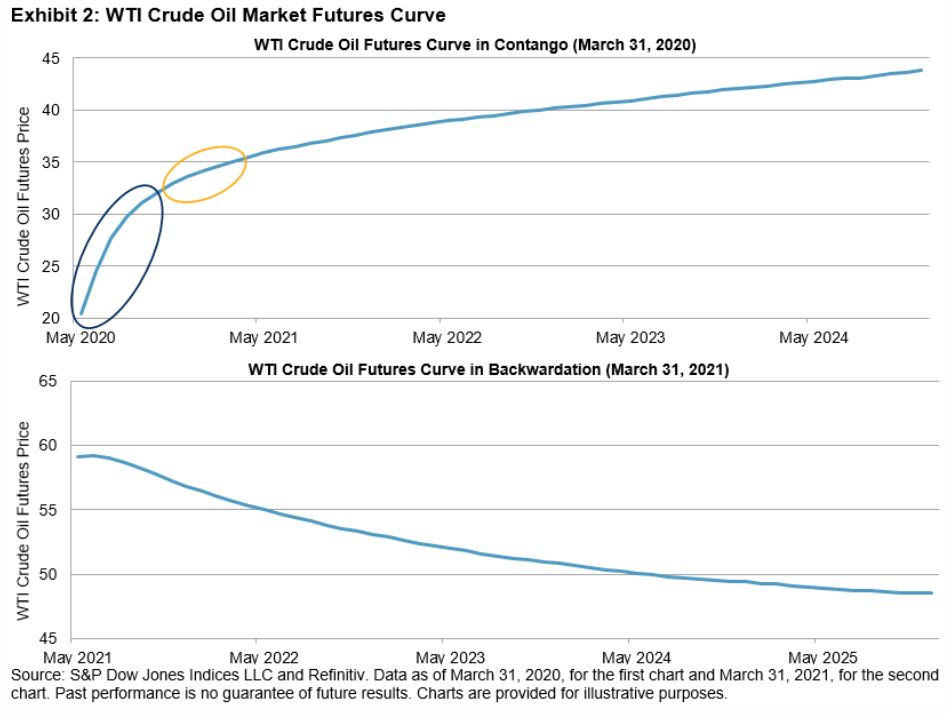

Roll yield or carry can add or detract from commodity returns. Any commodity investment product that uses commodity futures as the underlying instrument must continually reinvest, or roll, from expiring nearer-dated contracts into longer-dated contracts to maintain uninterrupted exposure to the respective commodity. If the futures curve is upward sloping (in contango), the roll yield will be negative. If the futures curve is downward sloping (in backwardation), the roll yield will be positive. When the futures curve is in contango holding a position further along the futures curve at a point where the curve is less steep, the negative carry is reduced each time the position is rolled, as opposed to staying in the most near-dated contracts with the steepest contango structure. Exhibit 2 illustrates the steep contango we witnessed in the crude oil market at the start of the pandemic lockdowns in 2020. The S&P GSCI Dynamic Roll was further out on the curve (yellow) than a typical near-dated exposure (navy), where the contango was steepest, thereby reducing the impact of the negative roll yield. In contrast, in March 2021, the crude oil market was in backwardation, and it was advantageous for investors to hold positions at the front of the futures curve.

With many of the 24 commodity constituents of the S&P GSCI in backwardation in 2021, a positive catalyst in the form of a positive roll yield is one of the current reasons to look at commodity exposure. After years of negative roll yields, investors are being rewarded for holding commodity exposure. The S&P GSCI Dynamic Roll is designed to benefit from backwardation by holding positions at the front of the futures curve.

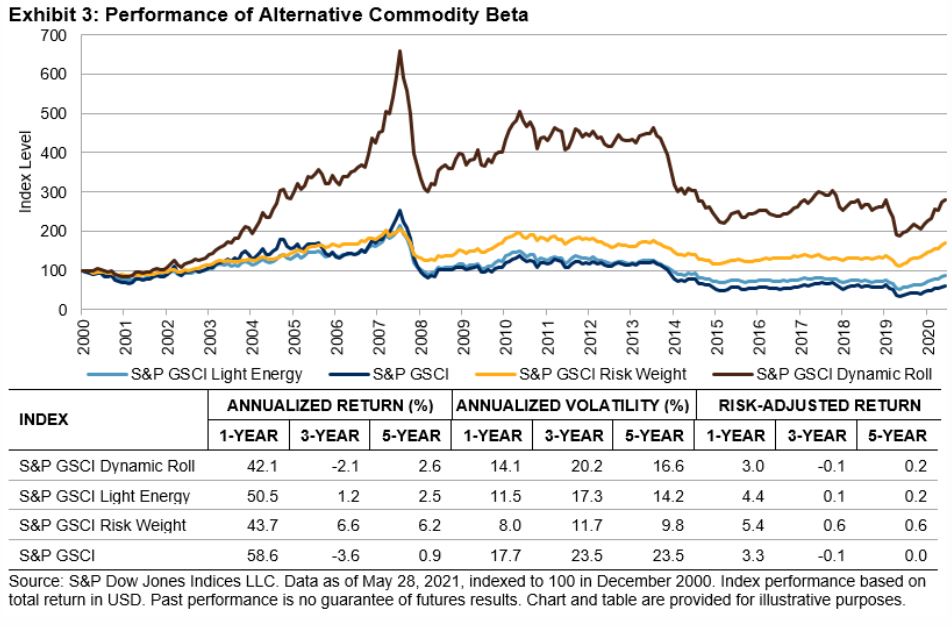

With the contango situation explained, we’ll move on to the volatility in commodities. As we’ve discussed in several prior blogs,1 commodities are typically the most volatile asset class, leading some risk-averse market participants to stay away. The S&P GSCI Dynamic Roll is designed to be able to hold positions further down the futures curve, limiting exposure to more volatile, near-dated or spot prices. Exhibit 3 illustrates the historical performance of the S&P GSCI Dynamic Roll versus the headline S&P GSCI and other popular alternative commodity beta indices.

Looking for a broad-based, long-only commodity benchmark this year? The S&P GSCI Dynamic Roll may be a better, less-volatile way to gain commodity exposure in 2021. Check out our new Commodities theme page for more information on our indices and timely research to deepen your knowledge of commodities.

1 https://www.indexologyblog.com/category/commodities/#categories

The posts on this blog are opinions, not advice. Please read our Disclaimers.