Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 23 Jul, 2020

By Brent Kopp

I had the privilege to sit down, albeit virtually, with Larry Swedroe, Chief Research Officer at Buckingham Wealth Partners, after he participated in our webinar for financial advisors, “How Has COVID-19 Affected Active vs. Passive Performance?” to dig deeper into his thoughts on SPIVA® results during the first four months of 2020.

Brent Kopp (BK) – What was your biggest takeaway from the SPIVA data during the pandemic that we examined during the webinar?

Larry Swedroe (LS) – One of the biggest myths that Wall Street needs investors to believe to keep playing the game of active management and paying higher fees is that active management maybe doesn’t win in bull markets due to a cash drag, but these managers will protect you in bear markets. We might be willing to accept a lower return in the long run, provided we get insurance in the really bad market environments, especially if I’m a retiree in the withdrawal phase. The truth is active managers tend to actually do a little bit worse in bear markets than bull markets. One study found that, at every turning point in the market, the average active manager got it wrong. For example, when the market was at a peak in March 2000, active managers had the least amount of cash, and at the bottom in August 2009, they had the most amount of cash.

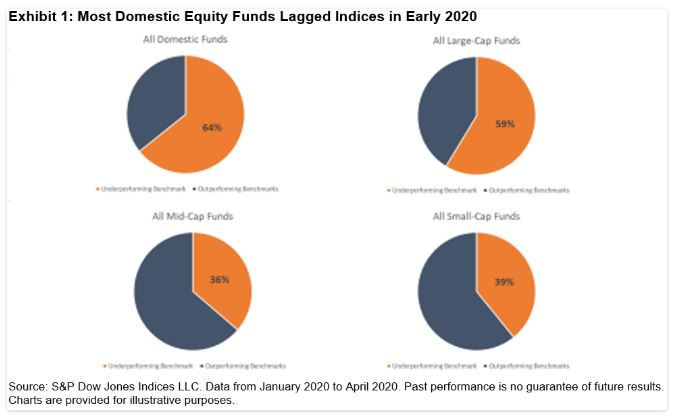

This data is in line with the period we examined in the webinar. During the initial stages of the COVID-19 crisis, we saw huge swings in the market. Even though active managers had the ability to go to cash, almost two-thirds still got it wrong and underperformed (see the top left pie chart of Exhibit 1).

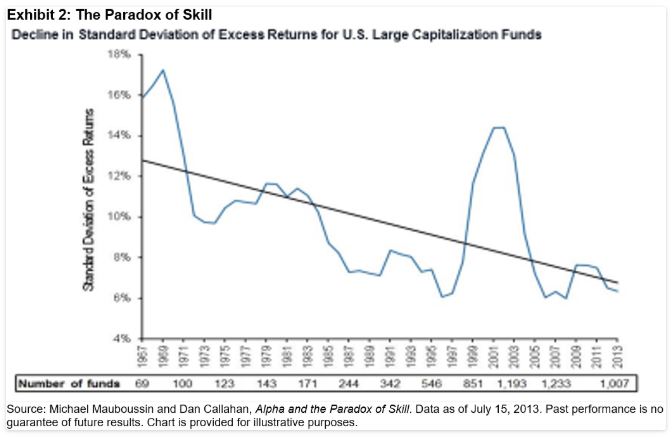

Every year, I hear on CNBC that this is a stock picker’s year, but it has never been a stock picker’s year when you adjust for risk appropriately over time. Exhibit 2 shows the rolling five-year standard deviation of excess returns of U.S. large-cap mutual funds over the past five decades. You should expect to see wide dispersions when there are large differences in levels of skill. The trend of declining dispersion in excess returns fits with our narrative that the competition is getting tougher for active managers.

BK – What do you find works best in client conversations to keep them committed to their investment and savings plan?

LS – Most important is education up front on investment history. We will show the quilt chart of returns that shows that there is no pattern to when an asset class will perform best. They simply rotate, and it’s quite random. We teach our clients that asset classes have similar risk-adjusted returns, just like most factors have similar risk-adjusted returns. We lead with the evidence. There will be long periods of outperformance and long periods of underperformance in different asset classes, and we don’t want to jump around to chase performance. We tell our clients that you are going to be challenged, and there will be times when you’ll question the strategy, but here are the underlying principles based in history. Staying disciplined is important. As Warren Buffett said, “temperament trumps intelligence.” In March 2020, we were buying stocks, and in June 2020, we were selling stocks, because it takes about a 20% market move to trigger our rebalance process, which happened in both directions in the first half of the year. We were buying low and selling high, which every investor dreams of doing. Unfortunately, they usually do the opposite.

BK – Do you have any parting bits of wisdom for us?

LS – Sure. Education is the armor that can protect you from your stomach, and I’ve yet to meet a stomach that makes good decisions. Heads make much better ones.

If you are interested in hearing more from Larry Swedroe, along with Craig Lazzara and Berlinda Liu from S&P Dow Jones Indices, on these SPIVA results, please find the following link to the webinar replay: “How Has COVID-19 Affected Active vs. Passive Performance?”

You can also click on this link to access the Engagement Hub, which offers CE credit for S&P DJI webinar replays covering market trends including risk management, ESG, SPIVA, and more.