Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 10 Jun, 2020

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

It’s time to look at dividend indices through the lens of these “unprecedented times.” Many market participants seek the comfort of dividend strategies, precisely for the yield they can generate. However, dividend investing is under siege, since many companies have announced reduced dividends or have suspended them altogether given the impact of the COVID-19 pandemic on the global economy. A crystal ball might come in handy to foretell the future. In the absence of that, we can look at historical periods of financial crisis to see how these strategies performed.

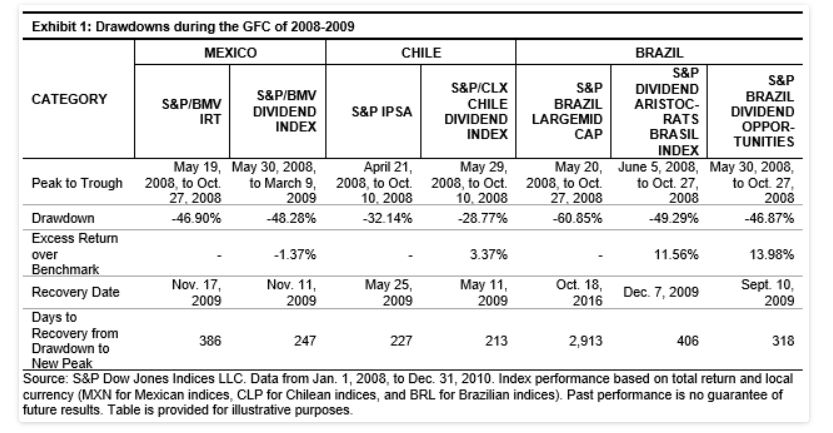

Exhibit 1 focuses on the Global Financial Crisis (GFC) of 2008, which shows that during mid to late October 2008, the main country benchmarks in Mexico, Chile, and Brazil declined substantially. However, with the exception of the S&P/BMV Dividend Index, the other local dividend indices outperformed their respective benchmarks. The S&P Dividend Aristocrats® Brasil and the S&P Brazil Dividend Opportunities outperformed the S&P Brazil LargeMidCap Index by 11.6% and 14.0%, respectively.

Not only did most dividend indices fare relatively well compared with their respective benchmarks during the GFC, but in all cases, the strategies recovered faster and, in some cases, much faster. In Mexico, the total return version of the S&P/BMV IPC took 139 days longer to recover than the S&P/BMV Dividend Index. The S&P Dividend Aristocrats Brasil Index and S&P Brazil Dividend Opportunities each took around a year to recover, while, shockingly, the benchmark took nearly eight years to achieve a new peak after the drawdown.

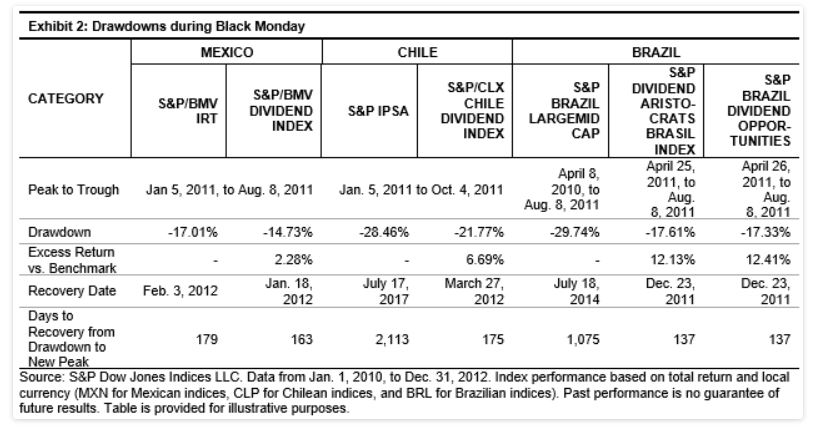

Was this a unique outcome tied to the GFC? Not necessarily. Exhibit 2 gauges the period between 2010 and 2012 to capture the period during Black Monday,[1] and it paints a similar picture as that of the GFC. However, in this case, all dividend indices outperformed their respective benchmarks and recovered much faster too.

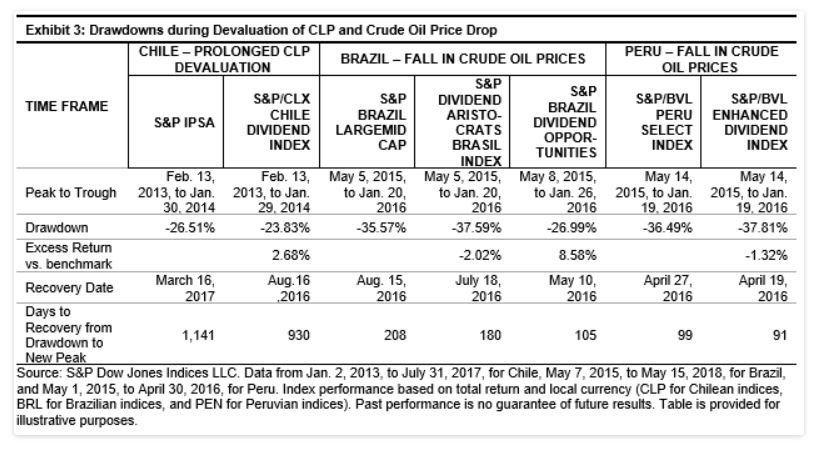

What happens when the events are more local? Exhibit 3 confirms similar results. In January 2014, a sharp devaluation of the Chilean peso against the U.S. dollar and the general loss of confidence in emerging markets caused a significant drawdown in Chilean equities. In January 2016, due to crude oil prices falling sharply, Peru and Brazil displayed major drawdowns.

In conclusion, history shows that dividend indices in Latin America were generally able to ride out unprecedented times better than their benchmarks. While past performance is certainly no crystal ball, it may provide useful context.

[1] The Black Monday crash of Aug. 8, 2011, refers to the time when the U.S. sovereign credit rating was downgraded by S&P Global Ratings for the first time in history.

Content Type

Theme

Location

Language