Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 4 May, 2021

By Arpit Gupta

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

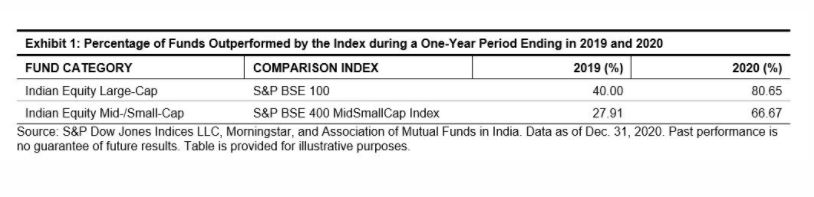

The percentage of active funds that underperformed their respective benchmarks in the Indian Equities Large-Cap and Mid-/Small-Cap fund categories over a one-year investment horizon doubled from 2019 to 2020, as seen in the SPIVA® India Year-End Scorecards for 2019 and 2020. The percentage of Large-Cap active funds that underperformed the S&P BSE 100 over a one-year investment horizon increased from 40% (in 2019) to 80.65% (in 2020). During the same period, the percentage of funds in the Mid-/Small-Cap category that underperformed the S&P BSE 400 MidSmallCap Index increased from 27.91% (in 2019) to 66.67% (in 2020).

A drag in active fund performance (relative to the benchmark) could result from multiple reasons, including adverse stock selection and sector allocation, unfavorable investment style, or failing to time market trends and turning points. In this blog, we evaluated the return betas of active funds to investigate as a potential reason that may have led the majority of Indian Equity Large-Cap funds and Indian Equity Mid-/Small-Cap funds to underperform in 2020.

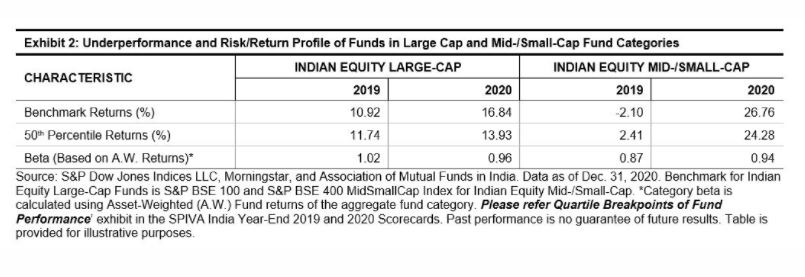

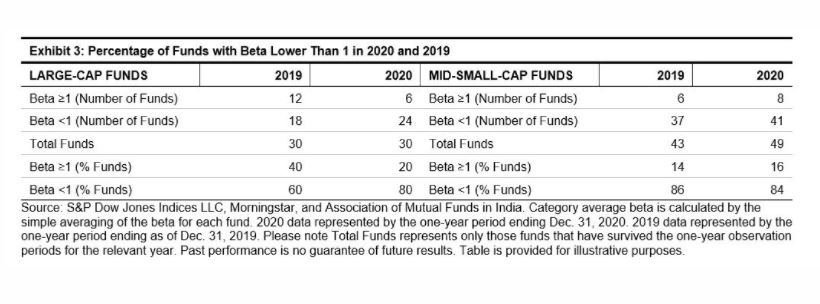

In 2019 and 2020, the benchmark for Indian Equity Large-Cap funds, the S&P BSE 100, returned 10.92% and 16.84%, respectively. Only 40% of active funds in this category underperformed the benchmark in 2019, but over 80% lagged in 2020 (see Exhibit 1). The large-cap active funds had an aggregate category beta of 1.02 in 2019, which was higher than the 0.96 recorded in 2020 (see Exhibit 2). We noticed a much higher number of Indian Equity Large-Cap fund managers with beta less than 1 in 2020 than in 2019 (see Exhibit 3). Due to the COVID-19 pandemic, many active large-cap fund managers might have positioned their portfolios with higher allocation to cash or low beta stocks to avoid market volatility or drawdown, which would have hurt their relative performance during market recovery in the latter part of 2020.

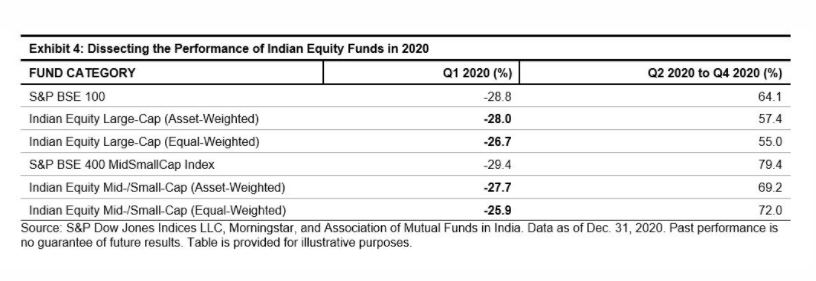

By dissecting the benchmark and fund returns during the market decline and recovery in 2020, it was obvious that the low beta allocation in large-cap funds affected their relative performance in opposite manners during the two periods. In Q1 2020, the S&P BSE 100 lost 28.8%, whereas Indian Equity Large-Cap active funds, with lower aggregate beta, suffered a slightly lower drawdown of -28.0% and -26.7% in their asset-weighted and equal-weighted average returns, respectively (see Exhibit 4). In contrast, when the market rallied during the latter nine months of 2020, active funds gained much less than the S&P BSE 100 (64.1%) across asset- and equal-weighted returns (57.4% and 55.0%, respectively).

For Indian Equity Mid-/Small-Cap funds, we noticed low aggregate category beta (<1) in both 2019 (0.87) and in 2020 (0.94). Over 86% and 83% of Indian Equity Mid/Small-Cap funds had beta less than 1 in 2019 and 2020, respectively. Low beta allocation in mid-/small-cap funds effectively avoided or reduced drawdown for many funds in 2019, with only 27.9% of Indian Equity Mid-/Small-Cap funds underperforming the S&P BSE 400 MidSmallCap Index (which was down by 2.1%). However, in 2020, the continuation of low beta allocation by active mid-/small-cap fund managers were penalized when the benchmark recorded a strong gain of 26.76%, resulting in over 66.67% of Indian Equity Mid-/Small-Cap funds lagging the benchmark in 2020.

As observed in the Indian Equity LargeCap fund category, low beta allocation affected the Indian Equity Mid-/Small-Cap funds’ performance differently during market sell-off and rally. In Q1 2020, the S&P BSE 400 MidSmallCap Index dropped 29.4%, while the Indian Equity Mid-/Small-Cap funds marked a smaller drawdown of 27.7% and 25.9% in asset- and equal-weighted returns, respectively. But for the rest of the nine-month period in 2020, the Indian Equity Mid-/Small-Cap funds lagged the benchmark index by 10.2% and 7.4% on an asset- and equal-weighted basis, respectively.

When active managers tailor the risk exposures of their portfolios, the success largely depends on their market-timing skills, which can be challenging, especially during volatile times. Low beta portfolio allocation for the Indian Equity Large-Cap and Mid-/Small-Cap stocks penalized more than helped their overall benchmark-relative performance in 2020, which reflected the difficulties in estimating the timing and size of market recovery from the pandemic crisis. This could explain why an increasing number of market participants shifted their preference toward passive investing, which provides plain vanilla market exposure at a competitive cost.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Location

Segment

Language