Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 7 Sep, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Building a Bigger House of BRICS

Four of the five global leaders who collectively make up the BRICS group — comprising Brazil, Russia, India, China and South Africa — assembled Aug. 22–24 in Johannesburg. South African President Cyril Ramaphosa, Chinese President Xi Jinping, Brazilian President Luiz Inácio Lula da Silva and Indian Prime Minister Narendra Modi attended the summit in person, while Russian President Vladimir Putin called in remotely. Some observers attributed Putin’s absence to a war crimes indictment issued by the International Criminal Court in The Hague, the Netherlands, over Russia’s invasion of Ukraine. All participants voiced support for expanding the membership of the BRICS group, and invitations were issued to Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates. Formal membership for invitees to the group would take effect Jan. 1, 2024. Other discussions focused on the need to shift from the US dollar in international trade, partnerships on energy supplies and infrastructure, and the need for an international funding body independent of Western influence. Langelihle Malimela, senior analyst of country risk, Africa, at S&P Global Market Intelligence, joined the “Economics & Country Risk” podcast to share thoughts on “A bigger BRICS.”

At the BRICS summit, Putin reinforced the need for de-dollarization of international trade. While the topic came up repeatedly during the meetings, the adoption of alternative currencies to the US dollar in international trade remains difficult in a practical sense.

“Current members all have a shared objective, driven by various interests, of growing the group into a platform that can bring a more multilateral international system, which starts with diluting Western influence,” Malimela said.

S&P Global Commodity Insights noted that the invitations extended to OPEC heavyweights Saudi Arabia, the UAE and Iran — should those countries accept — would give the BRICS group unprecedented influence over global oil markets. Should all three countries join, the reconstituted BRICS group would control 41% of global oil production, according to International Energy Agency output estimates.

The BRICS group appears to be consciously presenting itself as an alternative to Western groups such as the G7. Many countries, particularly in the Global South, are chafing against restrictions on global trade that are perceived to favor the US and other traditional economic powers. An interest in international alternatives is especially popular in sanctioned countries such as Russia and Iran. The UAE and Iran have confirmed they intend to formally join BRICS on Jan. 1, 2024. Saudi Arabia, which is perceived to be in the midst of a diplomatic pivot away from the US toward Asia, has taken a more cautious response to the invitation.

Should Saudi Arabia and the UAE join the BRICS group, they would provide much-needed financial muscle to the New Development Bank, founded in 2015 as an alternative to organizations such as the World Bank and International Monetary Fund, and to fund infrastructure and sustainable development projects in emerging markets.

“Aside from the expansion that we saw at the recent summit, all indications are that more additions to the group will be considered next year,” said Malimela. “There are significant economic differences amongst those countries that have expressed an interest in joining and so the drivers diverge. But we believe more than 20 countries have expressed an interest in joining BRICS.”

Today is Thursday, September 7, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

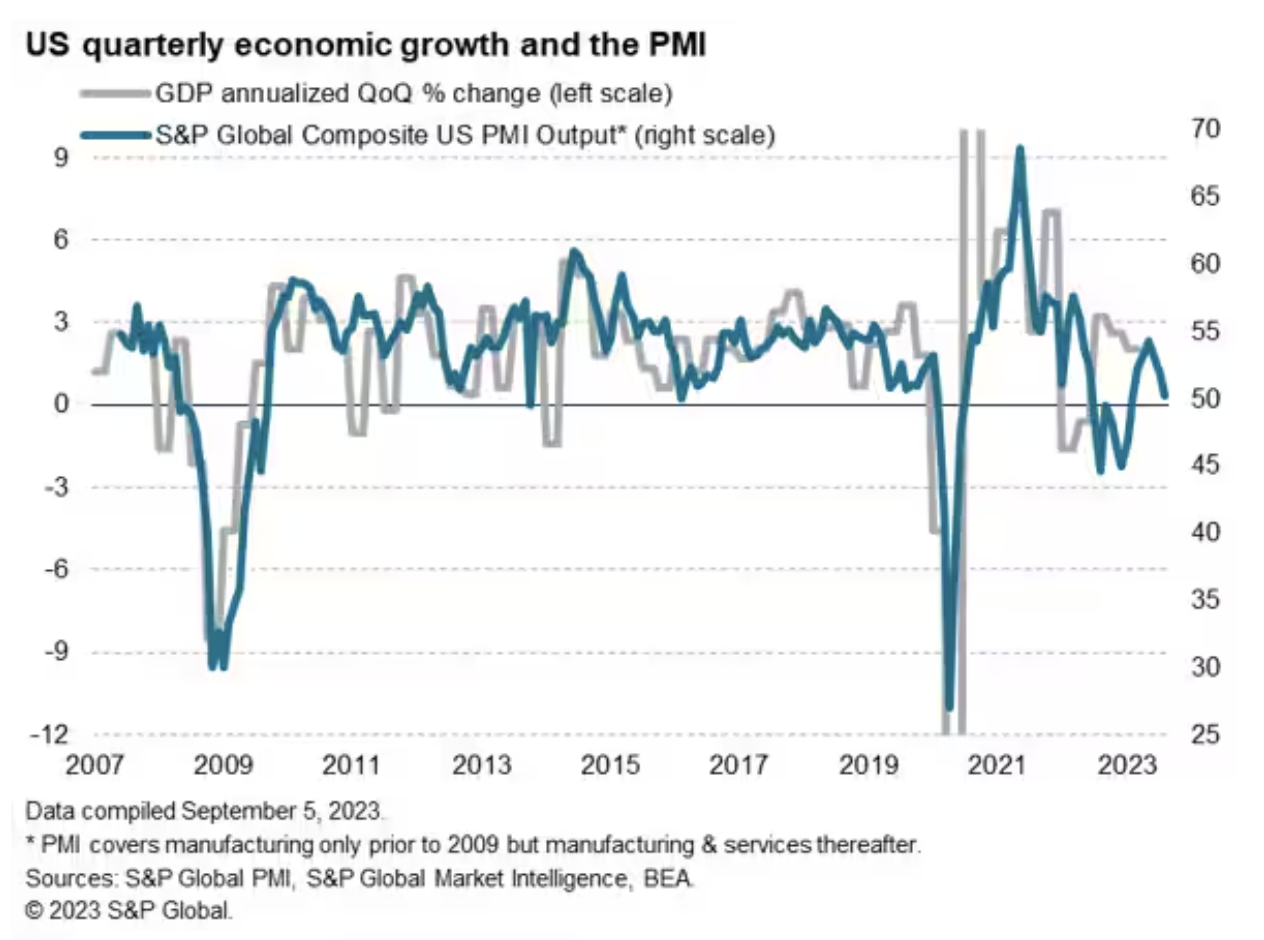

US Stagflation Risks Rise As Service Sector Falters Alongside Manufacturing Downturn

The latest PMI survey data from S&P Global send a signal of rising stagflation risks, as stubborn price pressures are accompanied by a near-stalling of business activity. The PMI numbers for the third quarter so far point to a faltering of economic growth after a robust second quarter, as a renewed manufacturing downturn is accompanied by a deteriorating picture in the service sector.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

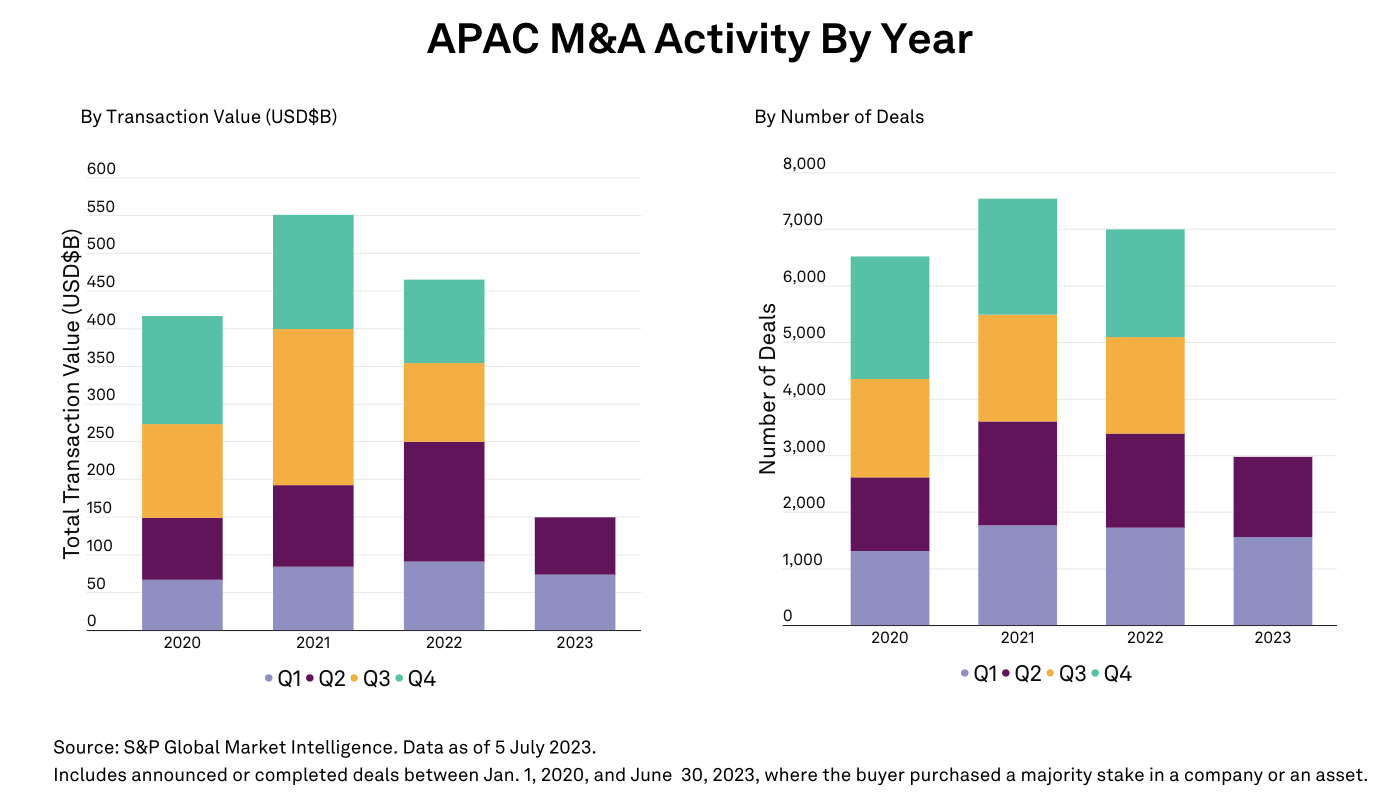

Asia-Pacific M&A By the Numbers: Q2 2023

The APAC M&A market was relatively muted in Q2. While total deal values increased slightly (4%) quarter-over-quarter to $76.3bn, the same deals value totals are down significantly (-52%) compared to Q2 2022. Volumes also declined -15% compared to the same period last year. However, one bright spot was the $23bn SPAC deal between Black Spade Acquisition Co and VinFast Auto Pte. Ltd, which marked the largest M&A transaction involved a special purpose acquisition company in almost two years. This deal also contributed to Hong Kong’s region M&A leadership for the quarter, with China coming in second at $17.2bn.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

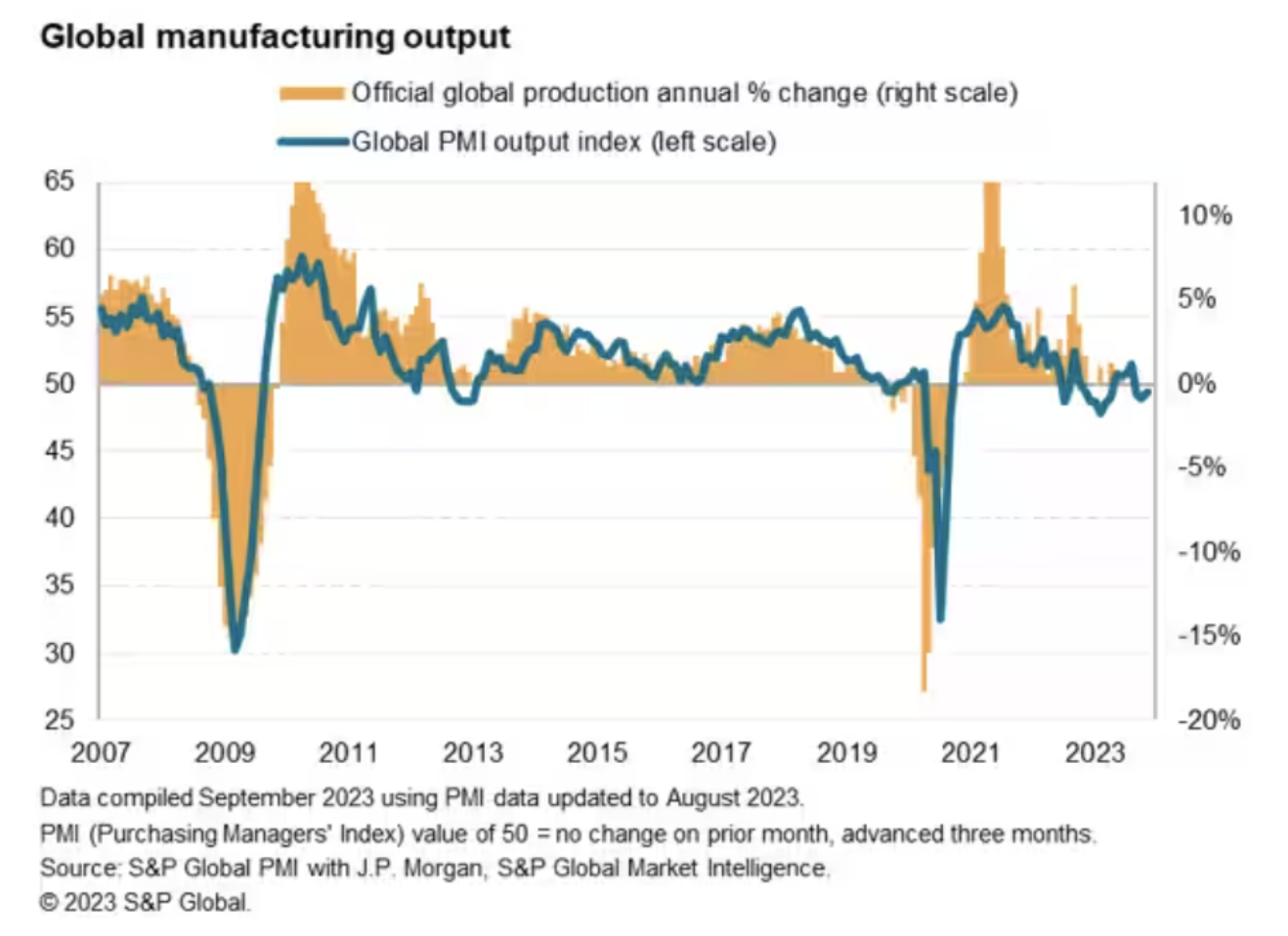

Factory Gloom Deepens As Downturn Persists Amid Falling World Trade

The JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™) compiled by S&P Global, remained below 50 in August to signal a continuing downturn of the goods-producing sector worldwide. Production losses remained modest, with output supported by companies enjoying smoother supply chains and eating into backlogs of work. But new orders continued to fall, led by an intensifying downturn in global trade flows, sending business expectations about the year ahead to their lowest since last November.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

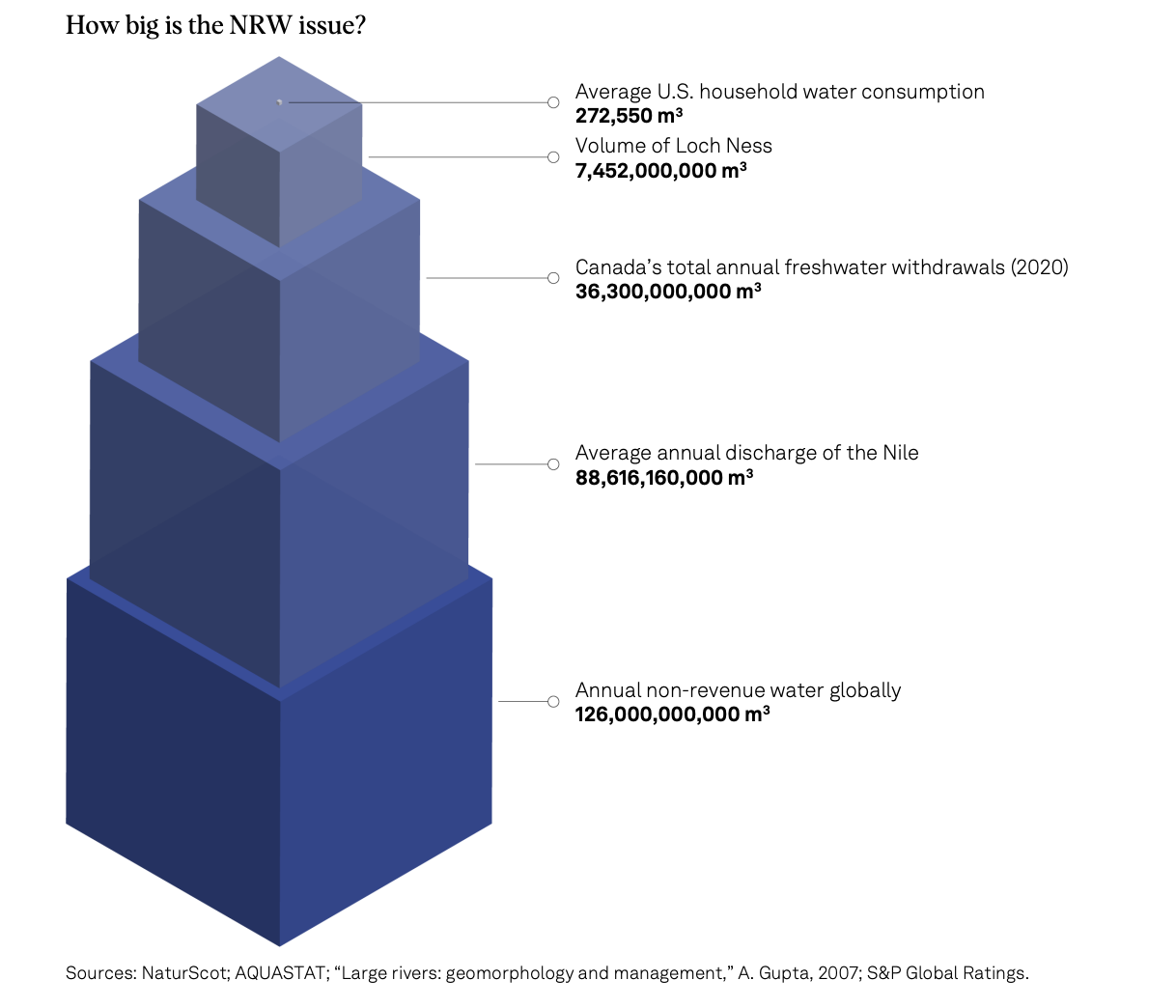

Sustainability Insights Research: Lost Water: Challenges And Opportunities

In this research, S&P Global Ratings looks at water infrastructure challenges through the lens of non-revenue water (NRW), meaning water that a utility sources and treats but for which it receives no financial compensation. NRW, or lost water, deters investment in water infrastructure assets. Reducing it can have many benefits, including increasing universal access to safe water, mitigating water stress, reducing the impacts of freshwater withdrawals on ecosystems and mitigating global greenhouse gas emissions. Investment decisions made today could significantly affect future NRW rates.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

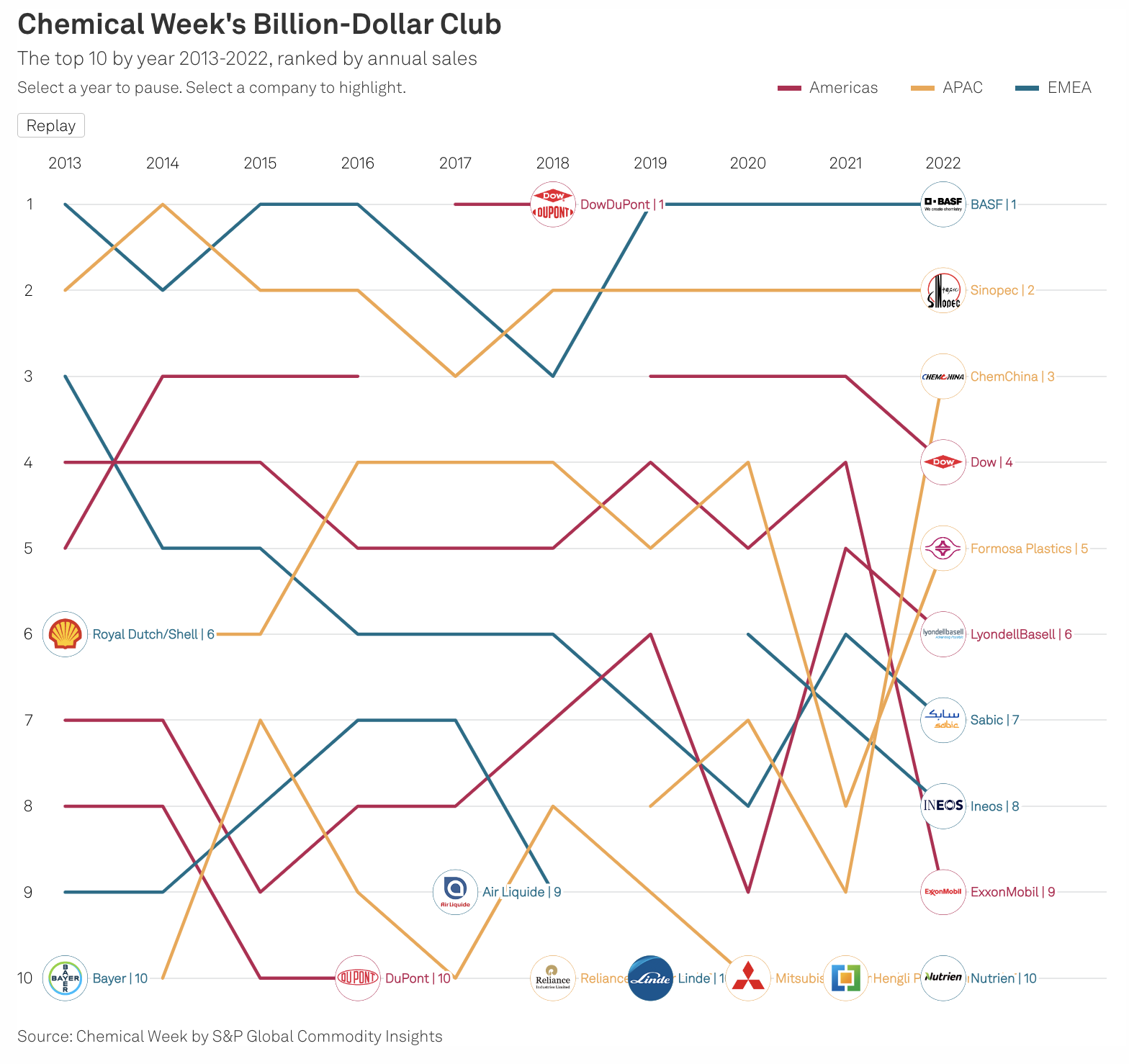

Chemical Week’s Billion-Dollar Club: Ranking The World's Top Chemical Producers

Sales for the chemical industry’s top companies grew strongly for the second straight year in 2022, but persistent inflation meant that results were more mixed than top-line figures suggest. The top of the industry’s leaderboard was relatively stable. BASF SE topped Chemical Week’s Billion-Dollar Club ranking of the chemical industry’s top companies by sales for the seventh time in the past 10 years in 2022. BASF has only been knocked off its perch by the short-lived combination of Dow Inc. and DuPont de Nemours, Inc. in 2017 and 2018 and by China Petrochemical Corp. (Sinopec) in 2014.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 131: Mixed Up M&A Markets

The last few quarters of the merger and acquisition markets have not been great, but the few green shoots of spring have turned into a blossom or two. The winds are blowing both hot and cold and analyst Melissa Incera returns to explore what these lumpy conditions are creating with host Eric Hanselman. Emerging markets, such as private 5G, are getting active and strategic acquirers are getting their pencils out, but private equity is still wrestling with the realities of higher interest rates.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Content Type

Location

Segment

Language