Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 30 Sep, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

With 35 days until the U.S. presidential election, septuagenarian rivals President Donald Trump and Democratic nominee Joe Biden spent the majority of yesterday’s debate—the first out of three that will take place between now and Nov. 3—speaking over and interrupting each other and the moderator, Fox News journalist Chris Wallace.

President Trump defended his administration’s handling of the coronavirus pandemic, stating that “we have done a great job” and that Mr. Biden “could never have done the job we’ve done” and “would’ve lost far more people.” The current leader said that his administration had created the “greatest economy in history.” Asked whether he believes human pollution and greenhouse gas emissions contribute to climate change, President Trump said he “want[s] crystal clean water” and “beautiful clean air,” is “all for electric cars,” that the U.S. is “doing phenomenal” in reducing carbon emissions, and that he believes “to an extent” in climate science.

Mr. Biden criticized the current leader’s handling of the coronavirus pandemic for “insisting that we go forward and open when you have almost half the states in America with a significant increase in COVID deaths and COVID cases” and described him as “a fool on this” for his laissez faire stance on mask wearing. He called on President Trump to “bring together the Democrats and Republicans and fund what needs to be done now to save lives” in an additional fiscal stimulus package. Mr. Biden said that rejoining the Paris Climate Accord will be “the first thing I will do” if elected president and that funding a climate plan will “create millions of good paying jobs.”

“In 47 months I’ve done more than you have in 47 years,” President Trump said, referencing the length his Democratic opponent’s political career.

“You’re the worst president America has ever had,” Mr. Biden said.

The first U.S. presidential debate of the 2020 election season came as the world’s biggest economy’s recovery from the pandemic-prompted downturn begins to take some baby steps.

“With consumer spending proving largely resilient through the summer (helped by federal fiscal stimulus) and unemployment—while still notably high—softening a bit more than we had forecast, third-quarter GDP is poised for a steeper rebound than many market participants expected,” S&P Global Ratings’ Chief U.S. Economist Beth Ann Bovino said in a recent report. “We expect a 29.5% bounce in third-quarter U.S. GDP, though that will only partly offset the massive losses in the first half of the year … For full-year 2020, real GDP is likely to contract by 4% (was a 5% drop in our June forecast) and then grow a modest 3.9% in 2021 (was 5.2% in June).”

The unemployment rate is unlikely to return to its pre-crisis level until mid-2024, according to Ms. Bovino, who sees “no coronavirus vaccine yet available as the country heads into flu season, a lack of new fiscal stimulus, and trade tensions with China on the rise” as the three greatest remaining risks to the “sluggish” recovery.

Whoever wins the presidency will inherit a federal deficit swollen by the government’s fiscal stimulus to combat the pandemic’s economic effects. The U.S. Congressional Budget Office expects the deficit to reach or exceed the country’s GDP next year.

"Regardless of which candidate wins, they will have to weigh another economic relief bill at the beginning part of next year," Michael Pugliese, vice president and economist for Wells Fargo Economics, told S&P Global Market Intelligence in an interview. "Whoever is president, it is definitely likely to be bigger in the next few years compared with 2019 as we recover from the pandemic and the economy has an output gap."

The Nov. 3 U.S. election is unlikely to affect consumer discretionary spending in the following three months, according to a new survey from 451 Research, part of S&P Global Market Intelligence. Of the 1,000 consumers surveyed from Aug. 31-Sept. 21, half of which had annual incomes greater than $125,000, 75% said the presidential election would have no impact on their spending for the next 90 days. More than 61% said that spending more time at home due to the pandemic was the main reason why they anticipate spending less in those next 90 days compared to the previous period.

"For a lot of people, [the election] is a very meaningful event every four years and consequential, but I think in the end, the majority of households don't really spend a lot of time thinking about it day to day between their jobs, their families," Joshua Levine, a senior research analyst for digital economics at 451 Research, said in a S&P Global Market Intelligence interview. "It's their personal finances that count, and the economy, and their job situation."

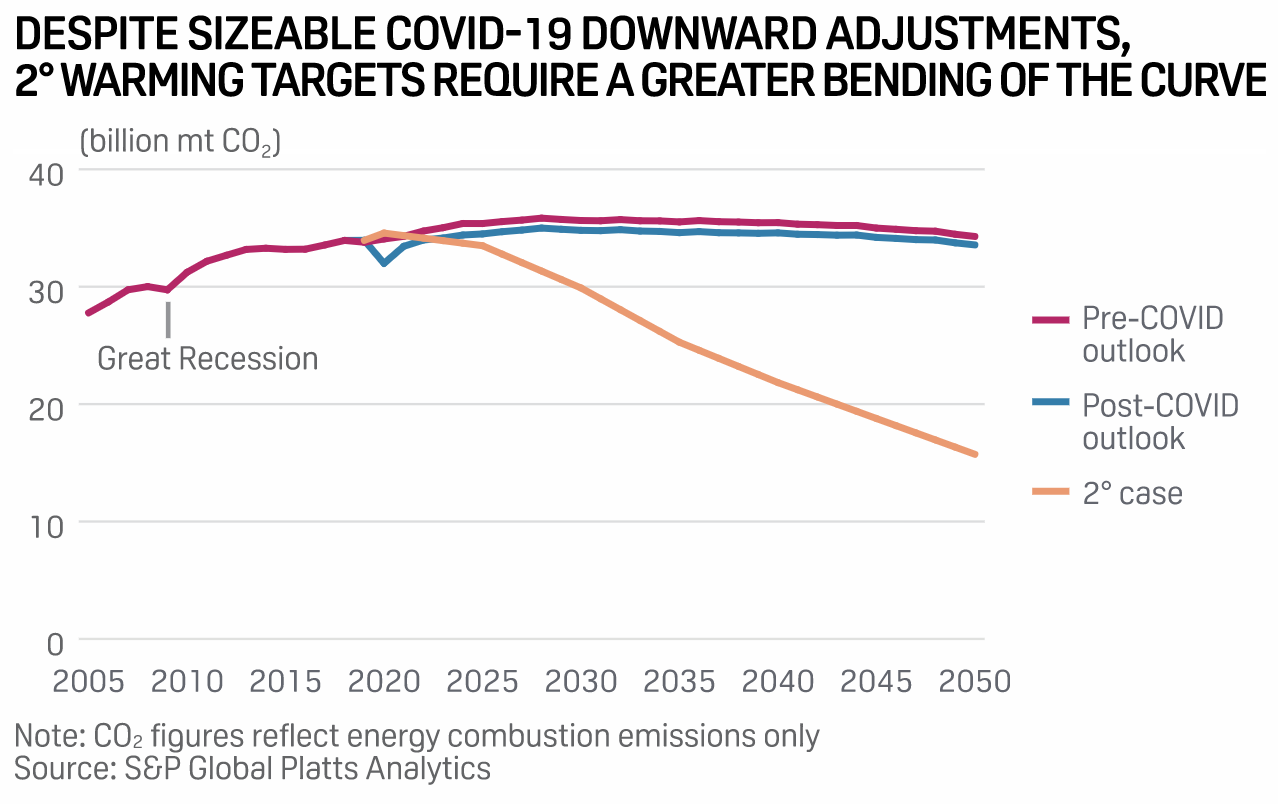

The outcome of the presidential election will drive the direction of the U.S.’s energy production and consumption at a critical moment in the fight against climate change. While the pandemic's effects will cumulatively lower global energy-sector carbon emissions by 27.5 gigatons from 2020-2050—equivalent to almost one full-year of emissions—more than 10 times the emission reductions resulting from the current crisis would be needed to meet the Paris Agreement’s 2-degree Celsius warming target, according to research from S&P Global Platts Analytics and S&P Global Ratings. Against this backdrop, President Trump has pledged to continue his present anti-regulation agenda, while Mr. Biden has proposed a $2 trillion climate plan to center on clean energy in the U.S. economy.

What’s likely to remain unchanged is the U.S.’s relationship with oil from Saudi Arabia.

"The Saudis are too important with regard to their spare capacity and leadership of OPEC," Jim Krane, an energy studies fellow at Rice University's Baker Institute, told S&P Global Platts in an interview, explaining that Mr. Biden and his running mate, Sen. Kamala Harris (D-CA), would likely need to continue the close relationship President Trump cultivated with the kingdom's Saud family rulers because oil remains central to the American economy. "It's too important for the U.S. economy to allow a major change in the relationship."

"I don't think we can fully get back to the old normal until 2022," Eric Handler, a senior media and entertainment research analyst at MKM Partners, told S&P Global Market Intelligence.

Today is Wednesday, September 30, 2020, and here is today’s essential intelligence.

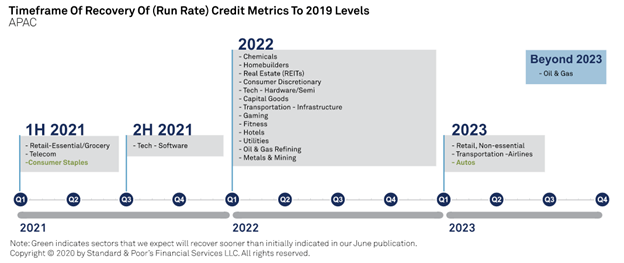

COVID-19 Heat Map: Updated Sector Views Show Diverging Recoveries

S&P Global Ratings is updating its COVID-19 sector recovery expectations. While there is a tremendous variance of recovery prospects across different corporate sectors, Ratings continues to believe it will take until well into 2022 or, in some cases, 2023 and beyond for many sectors to recover credit metrics. Low interest rates and the long road to recovery puts financial policy as a key factor and variable that could further shape and delay the recovery timeline.

—Read the full article from S&P Global Ratings

Credit Conditions Asia-Pacific: Recovery Roads Diverging

Deepening divergence in the COVID-19 recovery is weighing on credit conditions in Asia-Pacific. These differences cut across geographic, sector, and borrower profiles. Some "early exiters" such as China have already begun to tighten financial conditions, piling on stress for weaker borrowers. Other countries are still battling case resurgence yet have limited capacity to cushion the fallout with fiscal stimulus. While regional monetary settings remain accommodative, S&P Global Ratings sees limited space for lowering policy rates further.

—Read the full article from S&P Global Ratings

Credit Conditions North America: Potholes on the Road To Recovery

While credit conditions are largely favorable for many borrowers, pockets of risk are rising—particularly for U.S. state and local governments, whose tumbling revenues are adding to budget pressures. Risks around commercial real estate, too, are growing. The threat of financial-market volatility has heightened as the U.S. election draws near—especially if the presidency is in dispute, as in 2000.

—Read the full article from S&P Global Ratings

Economic Research: Despite a Bounce in the Summer, Canada's Economic Recovery is Far From Complete

Strict social distancing measures shaved off 18.2 percentage points from Canadian real GDP in March and April combined. Nearly five months into the recovery as lockdown restrictions eased in Canada, economic activity has surprised to the upside. However, the level of activity remains one-third below normal, and the recovery has been uneven. S&P Global Ratings does not foresee the Canadian economy getting back to its pre-pandemic level before the first quarter of 2022, with a 5.6% contraction in 2020.

—Read the full article from S&P Global Ratings

Credit Conditions Emerging Markets: Fragile And Uneven Recovery, Virus Resurgence Looms

Credit conditions in emerging markets continue showing a gradual improvement stemming from supportive financing conditions, the gradual economic recovery, and the likelihood that a COVID-19 vaccine will be available soon. A key developing risk is the phase out of credit forbearance and fiscal stimulus. As these measures are lifted, some of the pandemic's consequences will resurface, which could especially stress banks given a potentially rapid deterioration of asset quality, absent additional measures.

—Read the full article from S&P Global Ratings

Credit Conditions Europe: Ill-Prepared for Winter

Supported by wide-ranging policy measures, Europe has bounced back well from the COVID-19 lockdown coma in the spring. The question now is how stringent containment measures will need to be to suppress the second wave that is breaking across the Continent as winter approaches – and at what cost.

—Read the full article from S&P Global Ratings

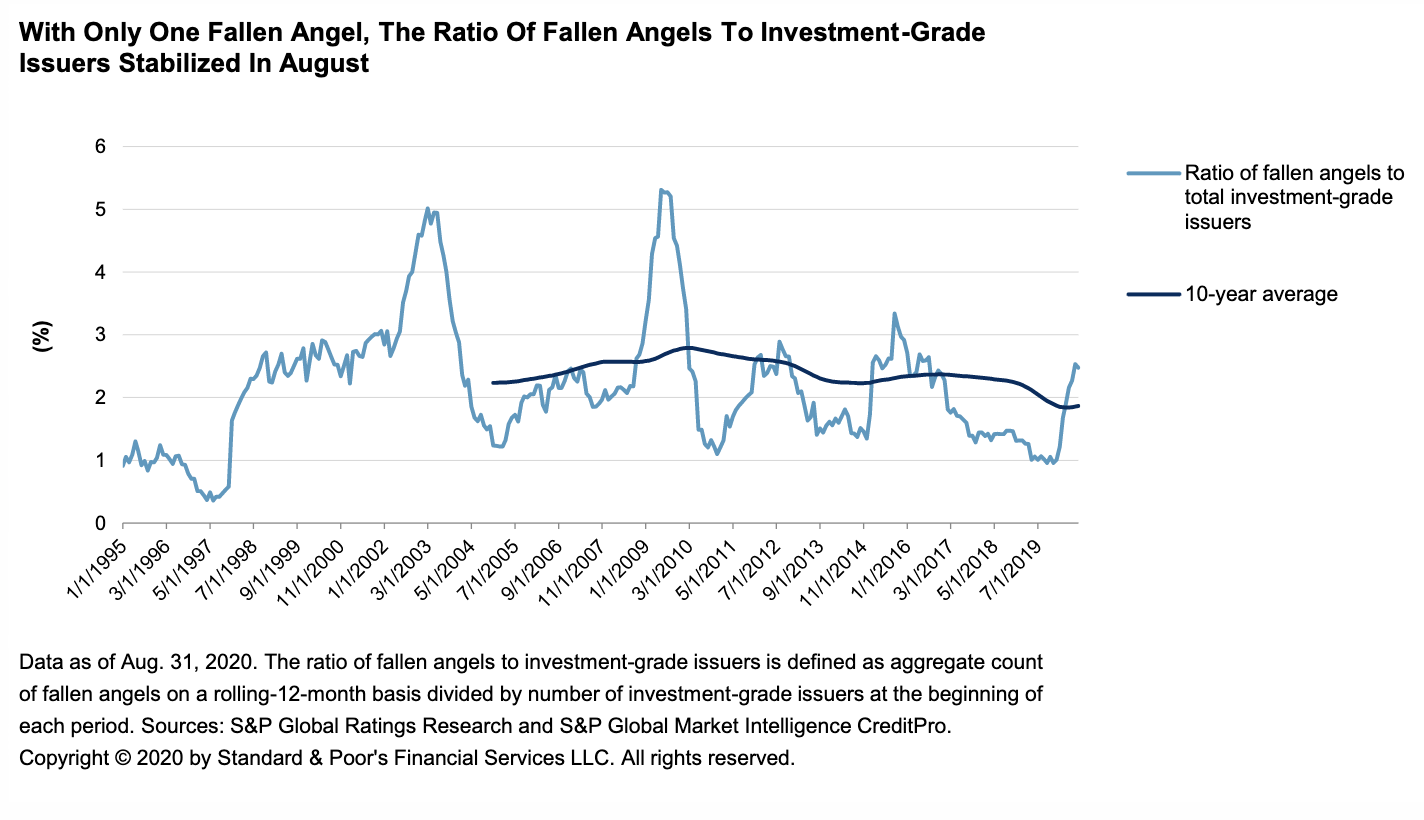

Credit Trends: 'BBB' Pulse: Potential Fallen Angels Remain Stable in August, with Five Outlook Revisions to Stable and Just One Downgrade

Credit trends in the 'BBB' rating category continue to stabilize as supportive capital market conditions provide some relief to the rapid rise in fallen angels in the spring. There was a single addition to fallen angels in August, the lowest since April. The share of potential fallen angels on CreditWatch negative also fell further to 11%, suggesting less immediate downgrade risk than a few months earlier.

—Read the full article from S&P Global Ratings

LossStats: After Epic Credit Cycle, Recoveries on Defaulted Debt Point Lower

U.S. corporate credit quality has soured noticeably over the past year or so, with leveraged loan defaults more than tripling over that period — to 4.16% from 1.29%, by amount, according to the S&P/LSTA Leveraged Loan Index — while downgrades have outnumbered upgrades nine to one, according to LCD. Indeed, as of Sept. 22, roughly a third of all currently outstanding loans belong to borrowers rated B- or lower (excluding those rated D), up from 23% a year earlier.

—Read the full article from S&P Global Market Intelligence

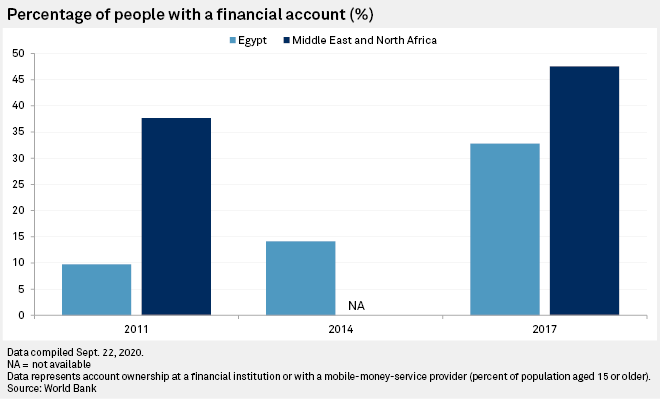

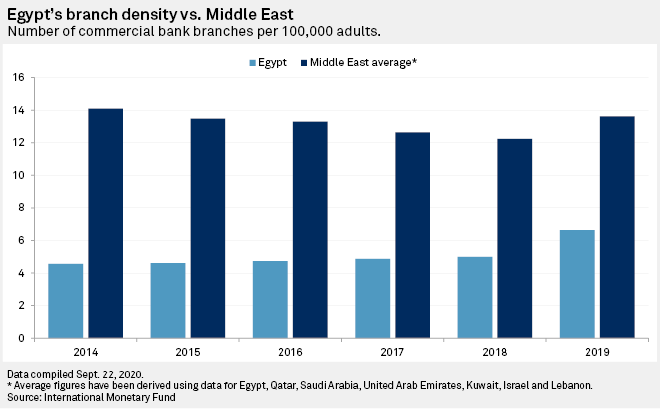

UAE Banks Target Lebanese Peers' Units in Growing Egyptian Market for M&A

Lebanon's ailing banks must sell their prized Egyptian subsidiaries, with Gulf lenders the most likely buyers as they seek to bolster their presence in the Arab world's most populous country. "There's growth opportunities in retail banking, plus SME lending, which banks haven't focused on," said Elena Sanchez-Cabezudo, head of MENA financials, equity research at EFG-Hermes in Dubai. "In corporate banking, there is pent-up demand for capex loans. … It's the usual emerging market dynamics of low credit penetration and a growing population."

—Read the full report from S&P Global Market Intelligence

Chinese Rural, City Banks' Asset Quality may Worsen Despite Economic Recovery

The asset quality of China's city and rural commercial banks is likely to worsen in the coming quarters due to the delayed recognition of bad loans and their exposure to commodity-related sectors, even as the country's economy recovers from the pandemic-driven crisis, analysts say. In the quarter ended June 30, rural and city commercial banks logged average nonperforming loan ratios of 4.22% and 2.30%, respectively, the highest among all bank types since the fourth quarter of 2018, according to data from the China Banking and Insurance Regulatory Commission.

—Read the full article from S&P Global Market Intelligence

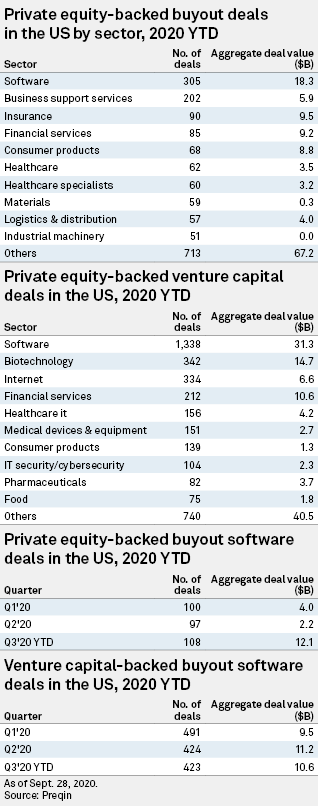

PE, VC Investors Get Software 'Sugar Rush' as Pace of Digitization Accelerates

Software activity has made up the bulk of U.S. private equity and venture capital dealflow in 2020, as coronavirus lockdowns left consumers and companies alike looking for digital solutions. Tailwinds in the technology sector have created a sea change in limited partner sentiment. In conversations at the beginning of the year with endowments, individuals were nervous about the heavy weighting of their technology investments, both public and private, a placement agent said in an interview.

—Read the full article from S&P Global Market Intelligence

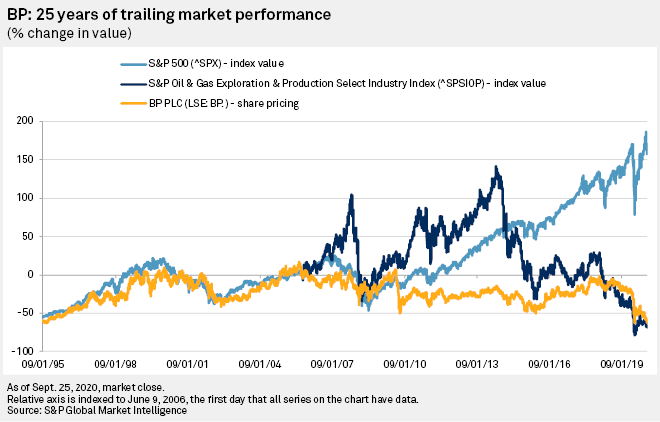

BP Stock Sinks to 25-Year Low as Market Eyes Green Energy Strategy with Caution

Long-awaited details on how BP PLC will pivot into the energy transition by hiking renewable energy spending while shrinking its legacy oil business were met by a less-than-warm reaction by investors as the company stock price has hit a fresh 25-year low. BP executives spent three days in mid-September explaining how the oil major will make itself over by expanding into renewable energy without sacrificing value on returns.

—Read the full article from S&P Global Market Intelligence

Duke Energy Considers Retiring 9,000 MW of Coal, Adding Vast Amounts of Storage

Duke Energy Corp. would retire all of its power plants in the Carolinas that "rely exclusively on coal" within the next 10 years and add between 1,050 MW and 7,400 MW of storage to its portfolio under the six scenarios outlined in its recently proposed 2020 integrated resource plans. The 15-year plans, or IRPs, filed with state regulators in North Carolina and South Carolina by Duke Energy Carolinas LLC and Duke Energy Progress LLC are designed to allow Duke Energy to achieve its goal of a 50% reduction of carbon emissions by 2030 from 2005 levels and net-zero emissions by 2050.

—Read the full article from S&P Global Market Intelligence

Vistra to Build More Renewables, Retire More Coal En Route to Net-Zero by 2050

To help achieve net zero carbon dioxide emissions by 2050, Vistra plans to spend $1.15 billion on solar and storage projects in California and Texas by 2022 and retire an additional 6.8 GW of coal assets by 2027, including all in Illinois and Ohio, the company said Sept. 29. Vistra President and CEO Curt Morgan in an investor call said his company is "well positioned to participate in the renewable and battery storage transformation."

—Read the full article from S&P Global Platts

Commodity Traders Look to Boost Renewables Exposure Ahead of Peak Oil

The world's biggest independent commodity traders are set to ramp up their investments in renewable energy as demand surges for clean fuels and investors increasingly look to back low-carbon projects. Trafigura believes renewables energy can be a "significant contributor" to its existing oil and metals-focused asset and trading business, providing a "third pillar" to its established operations, the trading house's CEO Jeremy Weir said Sept. 29.

—Read the full article from S&P Global Platts

Ford to Invest C$1.8 Billion to Become First Full Battery EV Maker in Canada

Ford Motor Company of Canada has announced an investment of C$1.8 billion ($1.35 billion) to become the first carmaker to manufacture full battery electric vehicles (BEVs) in Canada. It said Sept. 28 that it was committed to converting its Oakville Assembly Complex in Ontario from an internal combustion engine site to include a BEV manufacturing facility, starting in 2024, as well as introducing a new engine program at its Windsor engine plant.

—Read the full article from S&P Global Platts

COVID-19 to Have Little Impact on Peak Oil Demand Date: S&P Global

The COVID-19 pandemic is expected to hit long-term global oil demand by 2.5 million barrels per day but this would have little material impact on the timing of peak demand for the fuel, S&P Global Platts Analytics and S&P Global Ratings said in joint research published to coincide with Climate Week NYC. The impacts of the virus have been far-reaching in terms of drawing increased attention to climate policy and economic resilience, but huge efforts would be needed beyond renewable energy deployment and fossil fuel demand destruction in order to meet global climate protection goals, the multi-report research said Sept. 25.

—Read the full article from S&P Global Platts

Amid Dark Clouds, There are Silver Linings for Oil in Asia: Fuel for Thought

There were more questions than answers on oil’s roadmap at the S&P Global Platts virtual Asia Pacific Petroleum Conference, but delegates betting on Asia’s voracious appetite may have found solace in two key messages: China’s demand outlook looks promising and India’s refining expansion is far from over.

—Read the full article from S&P Global Platts

Upstream Consolidation in Near-Term Likely to Target Financial Metrics, Cash Flow Potential

As Wall Street lauded big upstream producer Devon Energy's proposed strategic acquisition of fellow "equal" WPX Energy Sept. 28, analysts said it is likely similar deals focusing on improving financial metrics will be seen in the near future, rather than mergers aimed at production growth. "It looks like E&P consolidation is in the air," investment bank Simmons Piper Sandler Research said in a Sept. 28 investor note.

—Read the full article from S&P Global Platts

ConocoPhillips says Eagle Ford, for Now, is Chief Focus in U.S. Unconventional Arena

ConocoPhillips sees the U.S.' Eagle Ford Shale as its current main domestic activity focus, at a time when most large U.S. upstream players are tapped out in the South Texas play, a top company executive said Sept. 29. ConocoPhillips has more rigs placed in the Eagle Ford than in the much busier Permian Basin in West Texas and New Mexico, where the bulk of industry activity is clustered, COO Matt Fox told the virtual Hart Energy DUG Permian/DUG Eagle Ford conference.

—Read the full article from S&P Global Platts

Listen: Flexibility, Adaptability and Efficiency are Keys in Surviving Fragile Oil Demand Environment

Fresh from the recent Asia Pacific Petroleum Conference or Platts APPEC, Gawoon Phil Vahn and Surabhi Sahu join Mriganka Jaipuriyar to share key themes and insights discussed at the event, which brought together - virtually - the who's who in the oil industry.

—Listen and subscribe to Global Oil Markets, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language