Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 Sep, 2020

By S&P Global

Throughout the coronavirus crisis, Australia has reported some of the lowest totals of confirmed cases and deaths compared to other developed economies. However, companies in the country have suffered under the strain of a downturn similarly to that of other advanced nations. The effects are likely to be long-lasting.

The country’s “companies will be hit on multiple fronts heading into 2021,” S&P Global Ratings said in a Sept. 1 report. “Many companies will continue to incur significant damage from COVID-containment measures, amid the weakest macroeconomic environment in decades.”

After slumping only 0.3% in the first quarter when massive wildfires raged across the country, Australia’s economy contracted 7% in April-June, according data released by Australian Bureau of Statistics on Sept. 2. The deep decline marks the worst economic conditions seen in nearly three decades for the only major economy to have avoided recession in 2008. Household spending, which accounts for roughly 56% of the country’s output, plunged 12.1% in the second quarter. Government spending ticked up 2.9%.

Melbourne, Australia’s second-largest city, is under lockdown orders that require its 5 million residents to largely stay home and keep non-essential activity at a standstill until Sept. 13. The Australian state of Victoria’s continued containment measures, implemented in July after infections spiked, has stalled an economic recovery. The state, Australia’s virus hotspot, reported 113 new coronavirus cases on Sept. 2 for the first time in four days, according to government figures, diminishing hopes that the contagion has been controlled after two months of below triple-digit daily totals of new infections.

Across Australia, which has a population of 25 million people, approximately 26,000 coronavirus cases have been identified, and roughly 660 people have died, according to Johns Hopkins University data.

“Measures such as the ‘JobKeeper’ program in Australia (which pays employers to keep workers on the payroll) are playing a pivotal role in maintaining employment and supporting economic activity. The recent extension of the JobKeeper program until the end of March 2021, albeit at a reduced rate, will continue to provide much-needed economic support in the coming months,” S&P Global Ratings said. “Nonetheless, we believe that worsening credit quality and defaults in the small and medium enterprise sector are likely to accelerate as these support mechanisms are removed.”

Roughly 25% of rated Australian companies are on negative outlook or CreditWatch with negative implications, according to S&P Global Ratings.

“Our record run of 28 consecutive years of economic growth has now officially come to an end,” Australian Treasurer Josh Frydenberg said during a Sept. 2 press conference. “COVID-19 has wreaked havoc on our economy and our lives like nothing we have ever experienced before. But there is hope and there is a road out.”

Today is Thursday, September 3, 2020, and here is today’s essential intelligence.

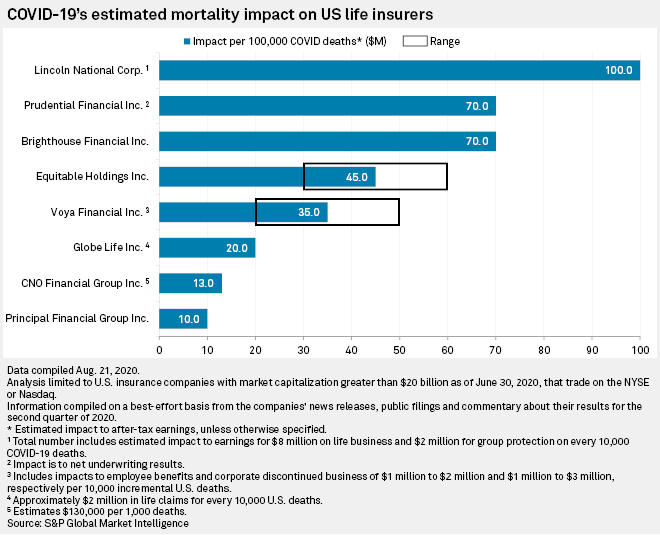

Life Insurers See Elevated Mortality; LTC Blocks May Benefit From COVID-19

The escalating U.S. death toll from the coronavirus pandemic is having an effect, albeit a limited one, on life insurers' finances, while their long-term care businesses are reporting lower claims levels given concerns surrounding assisted living facilities. Several public U.S. life insurers made passing comments about elevated mortality during their second-quarter earnings calls, which could leave them exposed to higher payouts on life policies. But analysts noted that, thus far, the financial impact of policyholder deaths is less than what had been previously guided by most companies.

—Read the full article from S&P Global Market Intelligence

Amazon Sellers Face New Warehouse, Delivery Rules Amid Early Holiday Season Prep

Amazon.com Inc. has placed new restrictions on its third-party sellers that will force the merchants to scramble for shipping alternatives and absorb higher costs, experts say, as the e-commerce retailer preps for the holiday season early and works to keep one-day Prime shipping on time. Historically, Amazon sets limits on inventory around the holidays to handle higher volumes during the busiest time of year for retailers. But experts say Amazon had little time to plan ahead for a coronavirus-induced spike in demand, which caused more supply chain challenges and difficulty getting products to customers on time.

—Read the full article from S&P Global Market Intelligence

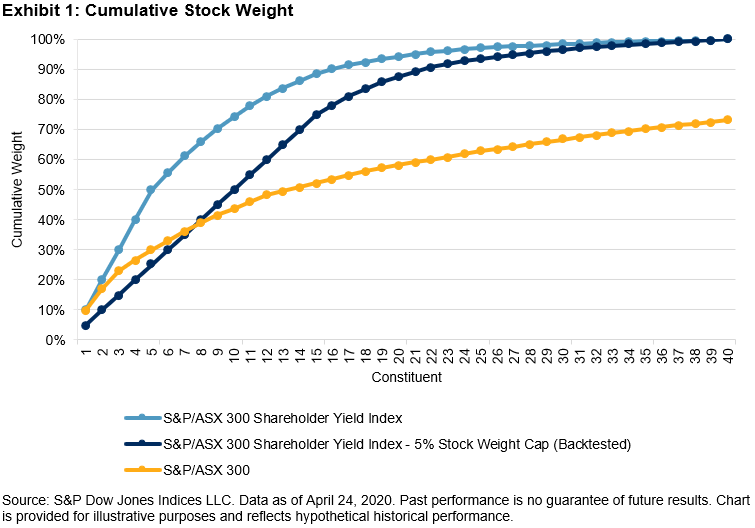

Changes to the S&P/ASX 300 Shareholder Yield Index Explained

The S&P/ASX 300 Shareholder Yield Index consists of the 40 stocks from the S&P/ASX 300 with the highest shareholder yield, which is a combination of dividend yield and buyback yield. In order to achieve sustainable performance, the eligible stocks are screened for liquidity, free cash flow, and dividend growth.

—Read the full article from S&P Dow Jones Indices

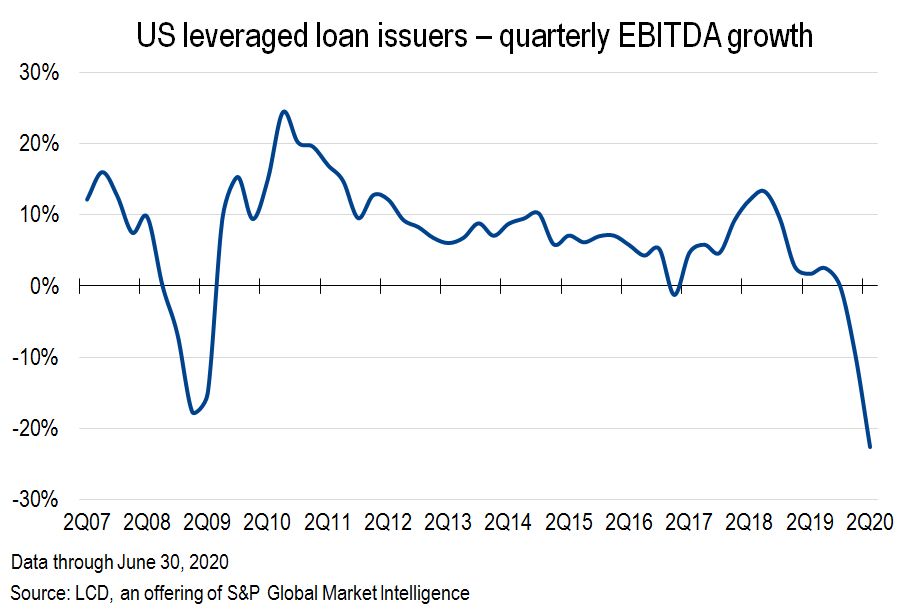

Earnings At Leveraged Loan Issuers Plunge 23%, Exceeding Great Recession Decline

Confirming grim fears about the $1.2 trillion U.S. leveraged loan asset class, the coronavirus pandemic cut a broad swath through corporate earnings in the second quarter, resulting in the deepest plunge in profits for public filers within the S&P/LSTA Loan Index since LCD started tracking the metric in 2002. At negative 23%, the year-over-year change in EBITDA followed on a 9% drop in the first quarter, and exceeded the prior peak decline of 18%, recorded in the first quarter of 2009, as the Great Recession descended.

—Read the full article from S&P Global Market Intelligence

CLO Portfolio Overlap: European Managers May Look Beyond Their First Choice Of Assets In The COVID-19 Era

This year, COVID-19 has notched up the difficulty level of managing European collateralized loan obligation (CLO) portfolios even further for CLO managers. As European economies move deeper into recession, S&P Global Ratings expects that the number of speculative-grade corporate borrowers to default will increase. European cash flow CLOs--which invest primarily in these loans made to speculative-grade companies--hence may face strong headwinds. These conditions, combined with other factors, could reduce the loan universe into an even smaller subset for managers to choose from to build their portfolios.

—Read the full report from S&P Global Ratings

How The European CLO Market Has Developed Over 180 Days Of COVID-19

In May, S&P Global Ratings’ published "How COVID-19 Changed The European CLO Market In 60 Days," which discussed how the first two months of COVID-19 had altered the market for European collateralized loan obligations (CLOs). Following six months of heightened rating actions on nonfinancial corporates spurred by the economic fallout from the pandemic, data for CLOs show how the market has continued to evolve.

—Read the full report from S&P Global Ratings

U.K. Mortgage Payment Holiday Risks Emerge As COVID-19 Requests Have Peaked

Based on a sample of U.K. residential mortgages, S&P Global Ratings estimates that between 55% and 90% of borrowers have resumed their mortgage payments depending on their credit profile. Loosely underwritten pre-crisis loans and those granted over the last few years with stretched affordability tend to show a higher level of payment holidays. S&P Global Ratings estimates that 10.7% of borrowers on a payment holiday have had previous arrears, although only 1.7% of all loans are both on payment holiday and in arrears. In certain transactions, we could witness a sharp rise in delinquencies by mid-single-digits, especially in nonconforming transactions.

—Read the full report from S&P Global Ratings

Is The Worst Still To Come For Australian And New Zealand Companies?

Australian and New Zealand companies will be hit on multiple fronts heading into 2021. S&P Global Ratings believes many companies will continue to incur significant damage from COVID containment measures, amid the weakest macroeconomic environment in decades. The June 2020 reporting season highlighted a significant drop in earnings across many Australian and New Zealand companies, albeit they remained largely within S&P Global Ratings’ expectations. What's more, COVID-19 has driven or accelerated structural trends in a number of sectors, such as discretionary retail, that will potentially wipe out chances of a full recovery for some companies.

—Read the full report from S&P Global Ratings

COVID-19- And Oil Price-Related Public Rating Actions On Corporations, Sovereigns, And Project Finance To Date

In response to investors' growing interest in the coronavirus pandemic and its credit effects on companies, S&P Global Ratings is publishing a regularly updated list of rating actions S&P Global Ratings’ have taken globally on corporations and sovereigns (see list of article titles below) as well as summary table and supporting charts. Also included is a summary of project finance rating actions. These are public ratings where S&P Global Ratings’ cite the coronavirus pandemic, oil prices, or both as a factor. This information is as of Aug. 31, 2020, unless stated otherwise.

—Read the full report from S&P Global Ratings

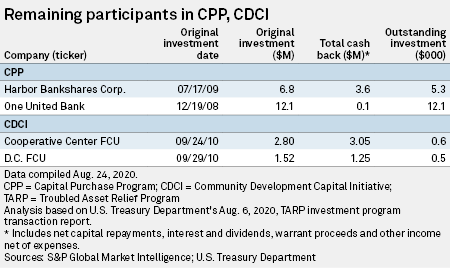

Only 4 Financial Institutions Still Left Under TARP After Carver Exit

With the recent exit of a New York-based depository, only two banks and two credit unions are still participating in TARP, which has included 763 institutions since it was launched in 2008 to recapitalize the industry in the wake of the credit crisis. Carver Bancorp Inc. became the latest to exit the Troubled Asset Relief Program after completing the repurchase of shares from the Treasury in August. The remaining banks are Boston-based OneUnited Bank and Baltimore-based Harbor Bank of Maryland, while the credit unions are Berkeley, Calif.-based Cooperative Center FCU and Washington, D.C.-based DC FCU.

—Read the full article from S&P Global Market Intelligence

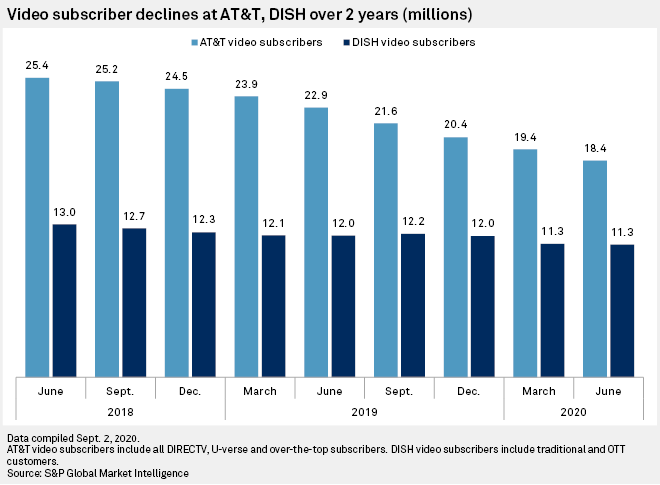

DISH/DIRECTV Merger Still Poses Significant Regulatory Risks – Experts

Eighteen years ago, Matthew Cantor was part of the legal armada that opposed the combination of the nation's two satellite video providers. Now, amid fresh M&A speculation, Cantor is still talking about the risks of such a deal. Recent published reports have indicated that AT&T Inc. is looking to sell all or part of its DIRECTV satellite video business. While potential interested buyers include private equity firms like Apollo Global Management and Platinum Equity, DISH Network Corp. Chairman Charlie Ergen said in August that he still sees a combination between DISH and DIRECTV as "inevitable."

—Read the full article from S&P Global Market Intelligence

Tesla's Surge Sparks IPO Rush Among Chinese EV Startups

Chinese startups XPeng Inc. and Li Auto Inc. are among several electric-vehicle makers that are looking to capitalize on investors' search for the next Tesla Inc. and to prepare war chests to survive the upcoming onslaught of electric vehicles by bigger, global brands on their home turf. Despite escalating geopolitical tension between the U.S. and China, Guangzhou-based XPeng on Aug. 27 became the second Chinese EV company after Li Auto to go public in the U.S. in under a month. XPeng's shares jumped 41.47% on its NYSE debut, while Li Auto's stock has jumped nearly 42% since its listing on the Nasdaq Stock Market on July 29.

—Read the full article from S&P Global Market Intelligence

Climate-Driven Water Issues May Increase Pressure On Miners With Tailings Dams

As climate change increases scrutiny on companies around the world, the mining sector is beginning to grapple with the substantial risk its operations present to global water supplies. Global stakeholder organizations released new standards for tailings dams, which are engineered, massive earthen structures containing mining waste, in early August. While the new standards are a step toward derisking tailings dam infrastructure, many still worry about the environmental and human risks the sector presents as climate change raises new threats to global water supplies.

—Read the full article from S&P Global Market Intelligence

UK Power Grid Balancing Costs Near GBP140 Million In July, Up 96% On Year

UK monthly power system balancing costs remained at unprecedented levels in July as constraint payments to gas, wind and interconnector assets boomed, National Grid data showed Sept. 2. UK electricity demand of 17.35 TWh in July was down 9% year-on-year as the economy emerged fitfully from lockdown, making for challenging balancing conditions at weekends in particular due to excess renewable energy supply.

—Read the full article from S&P Global Platts

This is How High-Yield Managers Are Addressing ESG

As part of S&P Global Market intelligence recent exploration of the impact of environmental, social, and governance (ESG) principles on the high-yield, S&P Global Market intelligence surveyed managers on their responses to clients’ expressed interest in ESG-minded investing. S&P Global Market intelligence did not attempt to query the entire universe of U.S. high-yield managers. Not every manager that S&P Global Market Intelligence queried replied, and some responses were not for attribution. Nevertheless, comments from the handful of firms mentioned herein should provide readers a feel for the current state of play.

—Read the full article from S&P Global Market Intelligence

Listen: ESG Insider: Overnight Change To Green Finance 'Just Not Reality'

Banks are coming under increasing investor pressure to act on climate change and transform their lending practices to the fossil fuel industry. Earlier this year, Barclays became the first European bank targeted by a climate-related shareholder resolution. The U.K.-headquartered lender recently announced plans to be a "net zero bank" by 2050, meaning its own carbon emissions and financing projects will be at zero by that time. Elsa Palanza, the bank’s global head of sustainability and citizenship, told ESG Insider that finding ways to help clients transition is key for a low-carbon future.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Market Intelligence

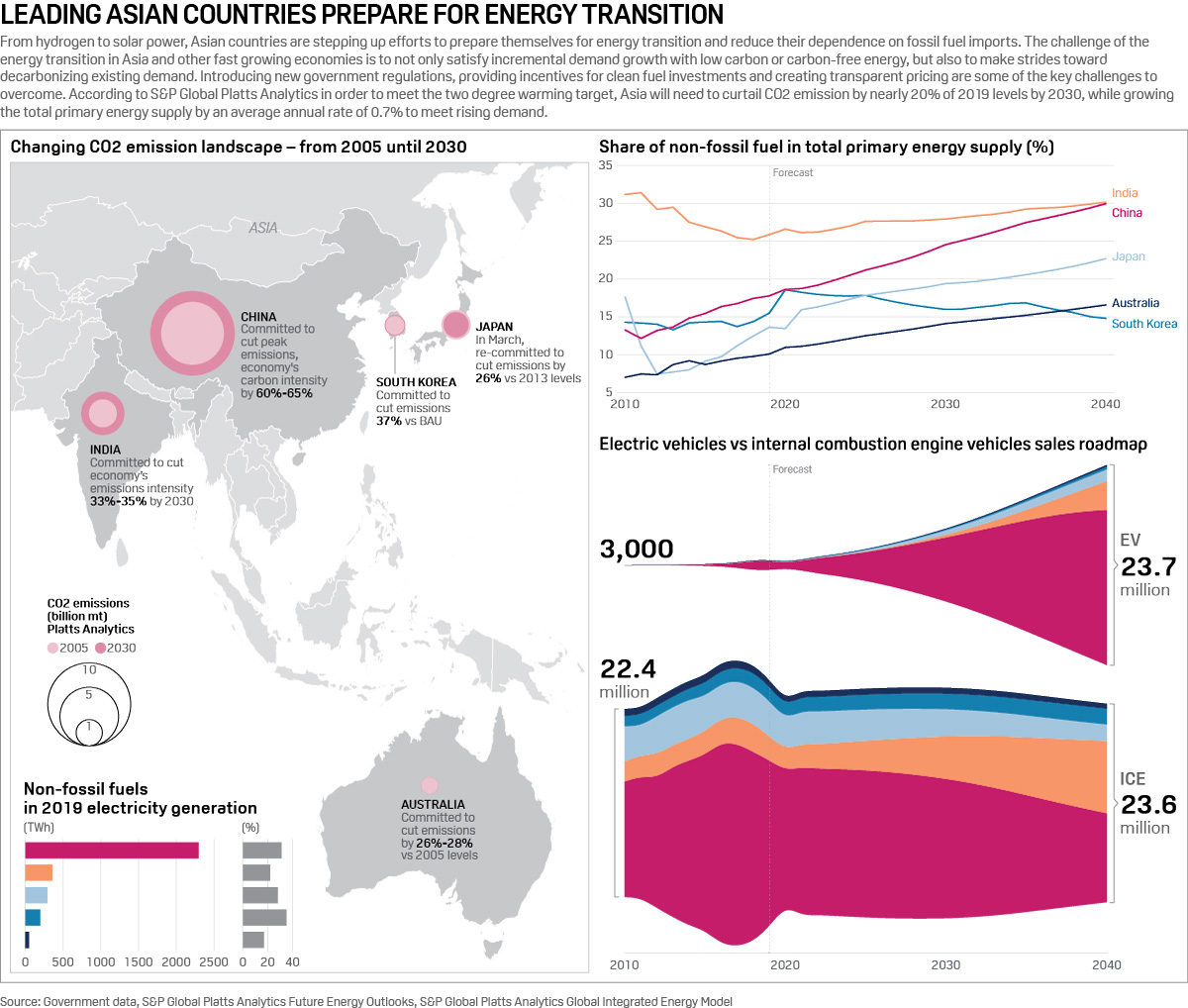

Infographic: Leading Asian countries prepare for energy transition

From hydrogen to solar power, Asian countries are stepping up efforts to prepare themselves for energy transition and reduce their dependence on fossil fuel imports. The challenge of the energy transition in Asia and other fast-growing economies is to not only satisfy incremental demand growth with low carbon or carbon-free energy, but also to make strides toward decarbonizing existing demand.

—Read the full article from S&P Global Platts

Oilfield Services Look To International Markets To Lure Investor Confidence

Investor confidence in oilfield services companies took a step back in August as the oversupplied oil market failed to inspire an expected rebound in international exploration and production, analysts said. Interest in the sector escalated after second-quarter earnings reports showed cost-cutting measures helped many companies beat earnings estimates and stay free cash flow positive. However, a little more than a month later, the share price gains have melted away.

—Read the full article from S&P Global Market Intelligence

Analysis: Sputtering Permian Basin Gas Production Lifts Waha Cash, Forward Prices

An early-summer rebound in Permian Basin gas production has definitively stalled out in recent weeks as drilling, well completions and rig counts across West Texas hit multiyear lows. In August, Permian production averaged 11.3 Bcf/d – down about 250 MMcf/d compared with levels in the month prior. In July, output hit summer highs at over 12.2 Bcf/d as an onslaught of previously curtailed wells were brought back online, data compiled by S&P Global Platts Analytics shows.

—Read the full article from S&P Global Platts

MISO Power Tracker: Hurricane's Gas Supply Impact Boosts Southern Prices

Hurricane-related natural gas price increases and transmission constraints boosted the Midcontinent Independent System Operator's Louisiana and Texas hubs' day-ahead on-peak prices substantially in August, compared with July, but month-to-month prices were down elsewhere in MISO, and year-to-year changes were mixed. MISO's October power forwards were up on the month but mixed on the year, despite natural gas forwards' strength in both comparisons.

—Read the full article from S&P Global Platts

Canadian Officials, Execs Tout Commitments To Keystone XL, Trans Mountain And More

Corporate executives and Canadian officials pledged their commitments to completing the long-delayed Keystone XL and Trans Mountain crude pipeline projects by 2023. A series of politicians and midstream energy CEOs said they're determined to capitalize on the need to transport more Canadian crude to the US Gulf Coast and other export markets, despite the increasing regulatory, legal, and environmental roadblocks that stand in their way, officials said Sept. 1 while speaking remotely for an RBC Capital Markets energy conference.

—Read the full article from S&P Global Platts

S&P Global Downgrades French Steel Tube Maker Vallourec

S&P Global Ratings downgraded French steel tube maker Vallourec on high debt levels and new refinancing plans. The tubemaker was downgraded to a 'CCC-' rating with negative outlook, from its previous 'CCC+" classification, the ratings agency said in a statement Sept. 2. S&P Global Ratings noted that weak market conditions hindered Vallourec from issuing EUR800 million ($947.4 million) of equity earlier this year, putting increasing pressure on the company's liquidity.

—Read the full article from S&P Global Platts

Listen: Changing Trade Flows: How China Is Helping CIS Steel Bounce Back

The CIS steel industry has emerged from pandemic demand slumps relatively quickly thanks to Chinese demand and government incentives in Russia. Although further challenges lie ahead, production cuts at steel mills appear to be less severe than at their European peers. Platts Managing Editor Laura Varriale is joined by Platts Metals Editors Katya Bouckley and Wojtek Laskowski to discuss the current shape of Russia and Ukraine's steel industry.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language