Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Sep, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Although Asia-Pacific economies were the first to rebound from the coronavirus crisis downturn, many are now experiencing curtailed growth due to the rise and geographic spread of the delta variant.

“Even as more economies consider living with COVID waves, pandemic response intensities have varied widely across Asia-Pacific over the recent months,” S&P Global Ratings said in its fourth-quarter economic outlook for the region. “The pace of activity is slowing as the delta variant of the coronavirus has imparted a negative impulse to growth; shutdowns are crimping mobility and spending, reducing production and confidence. That said, the tolerance for outbreaks is growing as vaccination rates rise.”

S&P Global Ratings has lowered its growth outlooks for many Asia-Pacific economies, particularly in Southeast Asia, due to the COVID-19 surges. S&P Global Ratings now expects full-year GDP growth for Asia-Pacific overall of 6.7%, down from the previous outlook of 7.1%. In the next few years, S&P Global Ratings sees expansion of 4.5%-5.2%. Only New Zealand and Singapore look set to have faster growth in 2021 than previously projected.

Uncertainty over the outcome of China’s recovery, recent regulatory actions taken by the government to control private enterprises, and the potential default of major property developer Evergrande have cast a shadow over the broader Asia-Pacific economic and credit outlooks.

The health of these economies hinges on their ability to gain control over COVID-19. Taiwan, Vietnam, and New Zealand feature a high response intensity to the contagion and, by imposing strict lockdowns in reaction to fresh outbreaks, may have a more gradual and choppier path toward normalization—while Korea, Japan, Indonesia, and Thailand have relatively lighter mobility restrictions in answer to outbreaks and are less willing to impose severe containment measures, according to S&P Global Ratings’ analysis.

“Varying government playbooks to contain COVID will create greater divergence in credit conditions among geographies and sectors,” S&P Global Ratings said in its regional credit outlook for the final quarter of this year. “Lockdowns continue to tangle supply chains. Coupled with mounting commodities prices, these factors could dent the earnings of industrial producers. Subdued sentiment will likely depress consumer spending, particularly for the discretionary sectors, and those that rely on a fully mobile population. Delays in the resumption of international travel would also hit the recovery of airlines and tourism-dependent countries. This collectively has the effect of diminishing the ability of issuers to unwind substantial debt accumulated during the pandemic.”

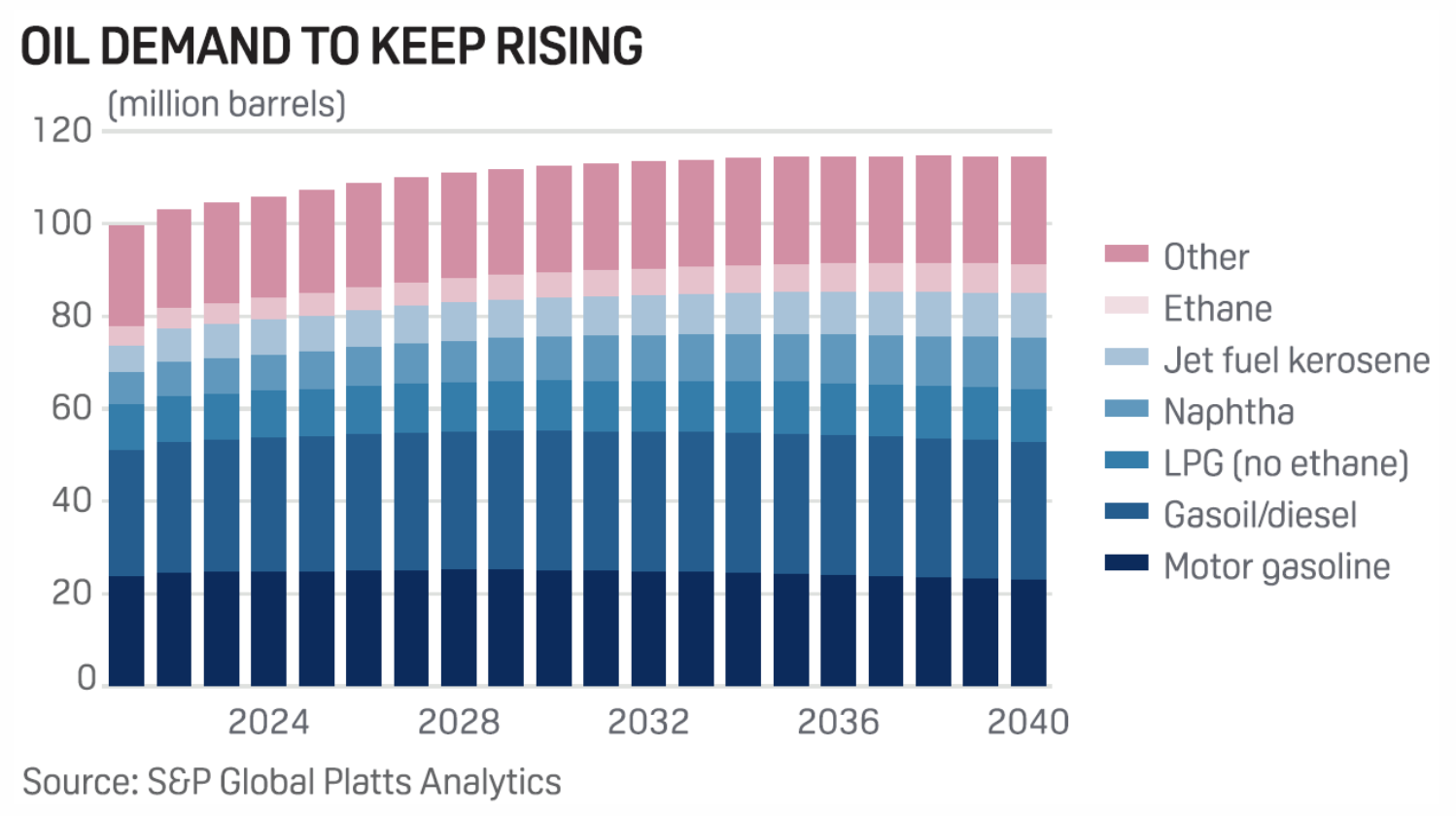

Regardless of the start-and-stop nature of many countries’ pandemic containment measures, oil demand—an indicator of activity—is nearing pre-pandemic levels across the region.

"Despite the resurgence of several COVID variants, petroleum demand in Asia and the world is still on the recovery trajectory," Mitsuyasu Kawaguchi, general manager of crude oil and tanker at Japanese refiner Cosmo Oil, said during a session at the S&P Global Platts Asia Pacific Petroleum Conference this week. "In lots of Asian countries, gasoline and diesel demand has already reached the pre-COVID level … Jet [fuel]/kerosene is now only the missing piece in the recovery."

Today is Wednesday, September 29, 2021, and here is today’s essential intelligence.

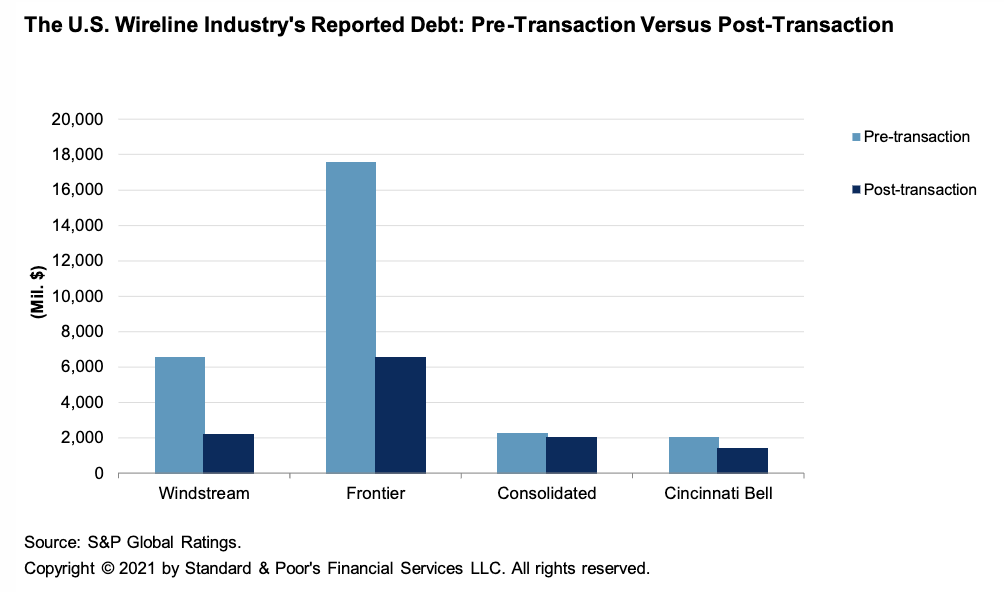

No Longer Constrained By Weak Balance Sheets, U.S. Wireline Telcos Are Repositioning Themselves With Fiber Upgrades

Exits from bankruptcies and recapitalizations have given U.S. wireline companies (telcos) a new lease on life. However, as they embark on aggressive fiber-to-the-home (FTTH) deployments, secular industry declines from legacy products—coupled with significant competition from cable broadband and lost subsidy revenue—could constrain top-line growth over the next several years. At the same time, high levels of capital expenditures and costs associated with FTTH builds will likely hurt telcos' credit quality in the near term, though S&P Global Ratings’ ratings already largely reflect this expectation for higher leverage and weaker free operating cash flow.

—Read the full report from S&P Global Ratings

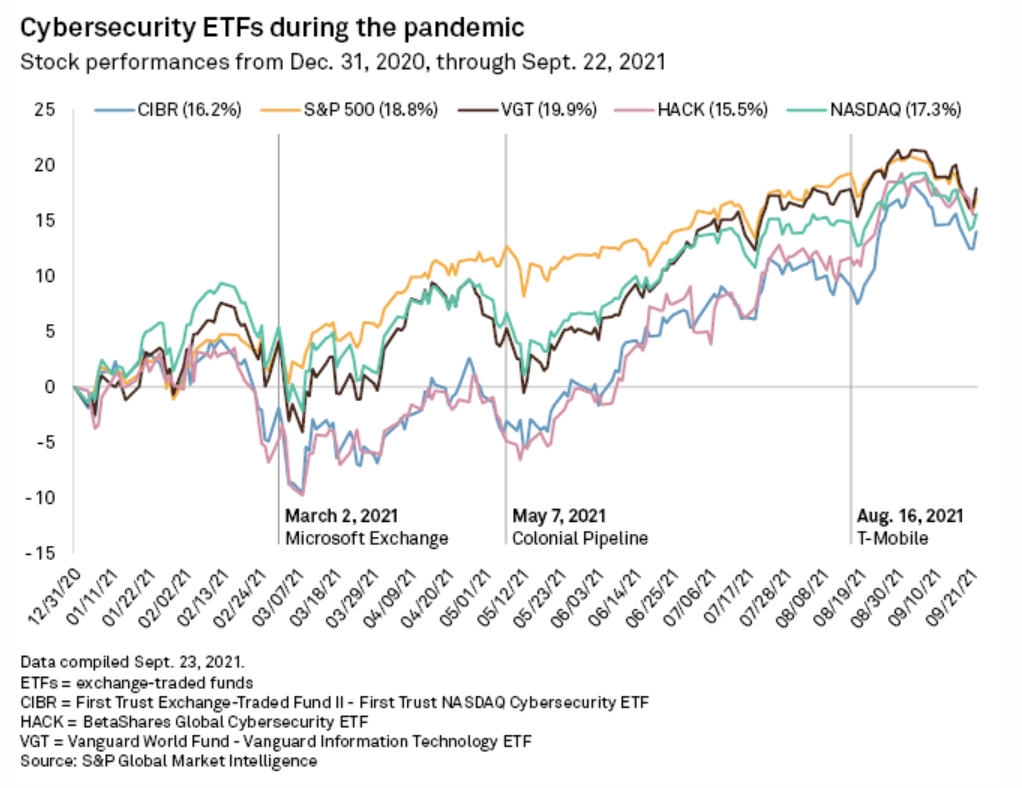

Cybersecurity Investments Set To Grow As Threat Landscape Heightens

While two of the most prominent cybersecurity-focused exchange-traded funds have underperformed the broader market so far this year, they enjoyed a couple bumps in the wake of major cyberattacks, like the Exchange Server hack at Microsoft Corp. in March. Other major attacks included the Colonial Pipeline Co. breach in May and the attack compromising a large swath of T-Mobile US Inc. customers in August.

—Read the full report from S&P Global Market Intelligence

U.K.’S Alternative Fiber Providers Set For Race Against BT, Virgin Media O2

CityFibre Infrastructure Holdings Ltd. raised £1.13 billion in mid-September, including from Abu Dhabi's Mubadala Investment Co. PJSC and infrastructure investor Interogo Holding AG, as it works to roll out fiber to a third of the U.K. by 2025. Smaller competitors including Grain Connect and Trooli Ltd. have also found new backers this year.

—Read the full report from S&P Global Market Intelligence

Kakaobank's Push Beyond Korea May Benefit From Messaging App Popularity

KakaoBank, the banking affiliate of the Korean internet giant, has plans to grow overseas after raising $2.2 billion in an IPO in August. Some sale proceeds will be used for international growth, along with the acquisition of financial technology companies, according to the prospectus.

—Read the full report from S&P Global Market Intelligence

Apple's New iPad Set To Capitalize On Demand For Devices Amid Pandemic

Apple Inc. is set to continue its domination of the tablet computer market with its newest iPads, which analysts think will appeal to consumers having to buy new devices as they work and learn from home. Analysts said the new models will help drive demand, especially among remote workers, but others note that tablets in general face hurdles in the marketplace as consumers continue to rely on other devices, such as laptops and phones.

—Read the full report from S&P Global Market Intelligence

Fuel For Thought: COP26 Climate Push Puts Middle East Oil And Gas Heavyweights On Edge

In the run-up to the UN's COP26 climate summit, Middle East oil and gas producers are going on the offensive. They have denounced keep-it-in-the-ground activists for pressuring investors to shun fossil fuel projects.

—Read the full report from S&P Global Platts

Global Leaders Must Weigh Energy Poverty While Setting Climate Policies: Barkindo

The UN climate talks in November must ensure developing countries' access to affordable, reliable energy when setting the pace of the energy transition to cleaner fuels, OPEC Secretary General Mohammed Barkindo said Sept. 27.

—Read the full report from S&P Global Platts

APPEC: Energy Transition Accelerates Amid Pandemic Related Hurdles - BP

The COVID-19 pandemic has had a dramatic impact on energy markets and while there have been many challenges, it has also meant that the momentum towards a net zero world has increased, Carole Howe, executive vice president of BP's trading and shipping arm, said.

—Read the full report from S&P Global Platts

Global Cobalt Supply Deficit 'Not As Dire,' Analysts Say

Amid the surge in EV sales this year, hunger for cobalt drove major producers to announce plans to increase output at multiple mine sites in the Democratic Republic of Congo and balance the market. Some battery- and EV-makers seek to find alternatives to cobalt, which can be costly or loaded with allegations of human rights abuses. But the metal will likely continue to play a key role in rechargeable batteries in cars and on the grid, at least in the short term.

—Read the full report from S&P Global Market Intelligence

Listen: Plastics Markets Braced For The Long Haul Amid Multiple Logistical Dilemmas

A lack of vessel space, high freight costs, port backlogs and a shortage of truck drivers, the logistical challenges facing the plastics industry have multiplied across 2021. Join Platts petrochemical editors Aziz Ehtaiba, Sarah Trinder and Callum Colford as they discuss what this has meant for polymers and ask Platts Analytics Yi-Jeng Huang what's next for the markets.

—Read the full report from S&P Global Platts

Global Gas Price Volatility 'Terribly Destabilizing' For Market, Tellurian's Souki Says

The "terribly destabilizing" rise in global gas prices should ease after the winter, restoring some balance to the market, the executive chairman of Driftwood LNG developer Tellurian, Charif Souki, said Sept. 28.

—Read the full report from S&P Global Platts

OPEC Sees Oil Plateauing In Demand In 15-25 Years But Retaining Energy Dominance

Accelerated momentum behind energy transition will take but a small bite out of oil, with liquid fuels remaining the largest source of energy over the coming decades, OPEC said Sept. 28, casting doubt on the ability of renewables to reach significant scale.

—Read the full report from S&P Global Platts

INTERVIEW: Just Resigned Libyan Deputy Oil Minister Says Foreign Support Critical To Reviving Output

Libya's energy industry has seen no end to political upheaval, with deputy oil minister Refaat al-Abbar's abrupt Sept. 28 resignation the latest turmoil.

—Read the full report from S&P Global Platts

China's Power Regulator Pushes Utilities To Stockpile Coal Through Oct For Winter

China's coal-fired power plants are facing challenges in coal procurement due to tight domestic supply, high prices in both the domestic and international coal markets, disruptions in shipping due to the recent typhoons and port closures, and strong electricity demand, the country's power regulator China Electricity Council, or CEC, said in a report dated Sept. 27.

—Read the full report from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Language