Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Sep, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Green Hydrogen Starts Making Economic Sense

While most energy in our solar system is produced by the sun burning hydrogen, the use of hydrogen as an energy source by humans is relatively new. Hydrogen is the universe’s most common element, but it tends to bond tightly with other elements, making it difficult to find in a pure form. Separating hydrogen from its fuel stock — natural gas, ammonia or water — requires energy. Historically, this has limited the economic viability of hydrogen as a fuel. But new technologies and a new set of policies in the U.S. are leading to a reexamination of how profitable hydrogen can be.

When hydrogen is burned, it emits only oxygen and water, making it an attractive alternative to fossil fuel. But hydrogen is best thought of as a carrier, rather than a source, of energy. A carrier acts as a store of energy that can be consumed to generate electricity or provide heat. Because hydrogen requires energy to be rendered into a pure gas, it is best paired with energy sources that are intermittent, such as wind and solar. When the wind is blowing, wind energy can be used for electrolysis to separate water molecules into hydrogen and oxygen. When the wind stops blowing, hydrogen can be burned for energy.

"There could be a time where you have much more solar than your grid needs. And we have these situations in California, where we see curtailment of wind and solar," Roman Kramarchuk, head of energy scenarios, policy and technology analytics at S&P Global Commodity Insights, said during a recent interview. “This is where hydrogen can be created when you have that surplus solar that's being essentially thrown away.”

Before the Inflation Reduction Act, the process of producing green hydrogen, or hydrogen produced through electrolysis and renewable electricity, did not make economic sense for most regions in the U.S. However, the combination of hydrogen energy tax credits and renewable energy tax credits could reduce the levelized cost of energy by two-thirds, making green hydrogen economically viable for the first time. Other forms of hydrogen, such as blue hydrogen, which is produced from natural gas using carbon capture, do not qualify for both credits. Under the Inflation Reduction Act, the U.S. Energy Department has made $7 billion in federal funding available for hydrogen projects.

In the near term, demand for low-carbon hydrogen produced in the U.S. will likely come from Europe and Asia, where the high cost and limited availability of natural gas is leading many countries to reexamine their energy mix. The International Energy Agency predicted that global electrolyzer manufacturing capacity will grow sixfold by 2025 to 50 gigawatts per year. The agency further estimated that global hydrogen demand could reach between 115 million tonnes per year and 130 million tonnes per year by 2030, depending on how quickly governments fulfil current climate pledges.

Green hydrogen is tipping from the red into the black for U.S. energy producers. Beyond the current incentives and funding provided by the Inflation Reduction Act, the U.S. government could increase the profitability of hydrogen projects through demand creation, upgraded infrastructure, and common industry standards, regulations and certificates.

Today is Tuesday, September 27, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Economic Research: Economic Outlook Asia-Pacific Q4 2022: Dealing With Higher Rates

The external environment has soured for Asia-Pacific economies. China's outlook is subdued and growth prospects have worsened in the U.S. and Europe, pointing to weaker export demand. At the same time, global energy and commodity prices have eased. But with U.S. core inflation still high, the Federal Reserve is likely to keep raising its policy rate. S&P Global Ratings believes higher global interest rates and the associated capital flow strains, together with varying degrees of domestic inflation, will pressure Asia-Pacific central banks to lift rates, even as economies slow.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

The U.S. Dollar's Outperformance Makes Its Impact On Indices, Too

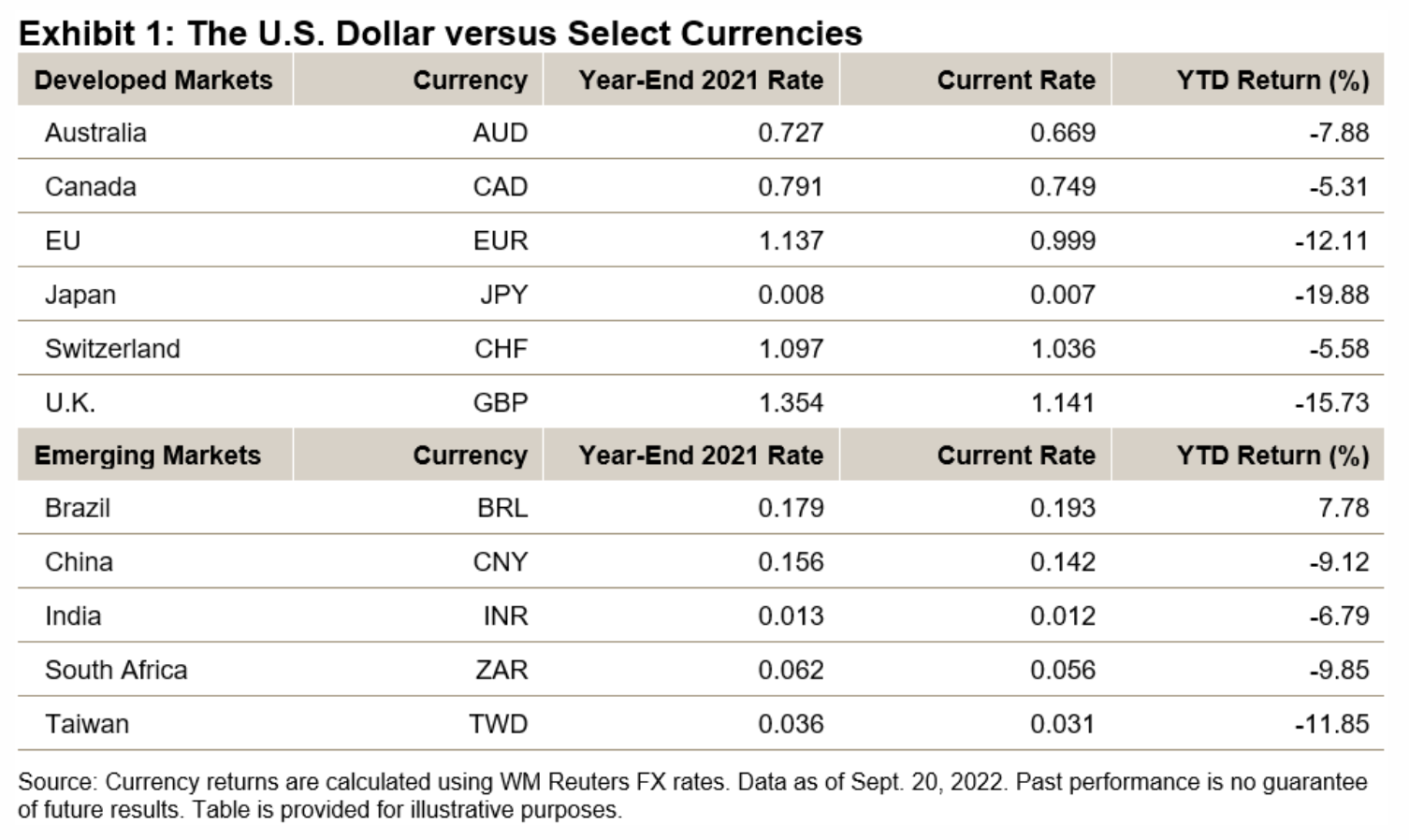

U.S. dollar strength has led to parity in EUR-USD exchange rates in recent days, with the value of the euro equaling 99 U.S. pennies at its low. While 114 U.S. pennies were still required to equal the British pound sterling, “cable”—the GBP-USD rate—has reached its lowest since 1985. In Asia, the Japanese yen has suffered the most YTD of any developed market currencies versus the U.S. dollar. Meanwhile, the Chinese yuan has surpassed 7 to the U.S. dollar, while the Brazilian real gained in contrast.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

U.S. Downturn Eases In September Amid Cooling Price Pressures And Fewer Supply Delays

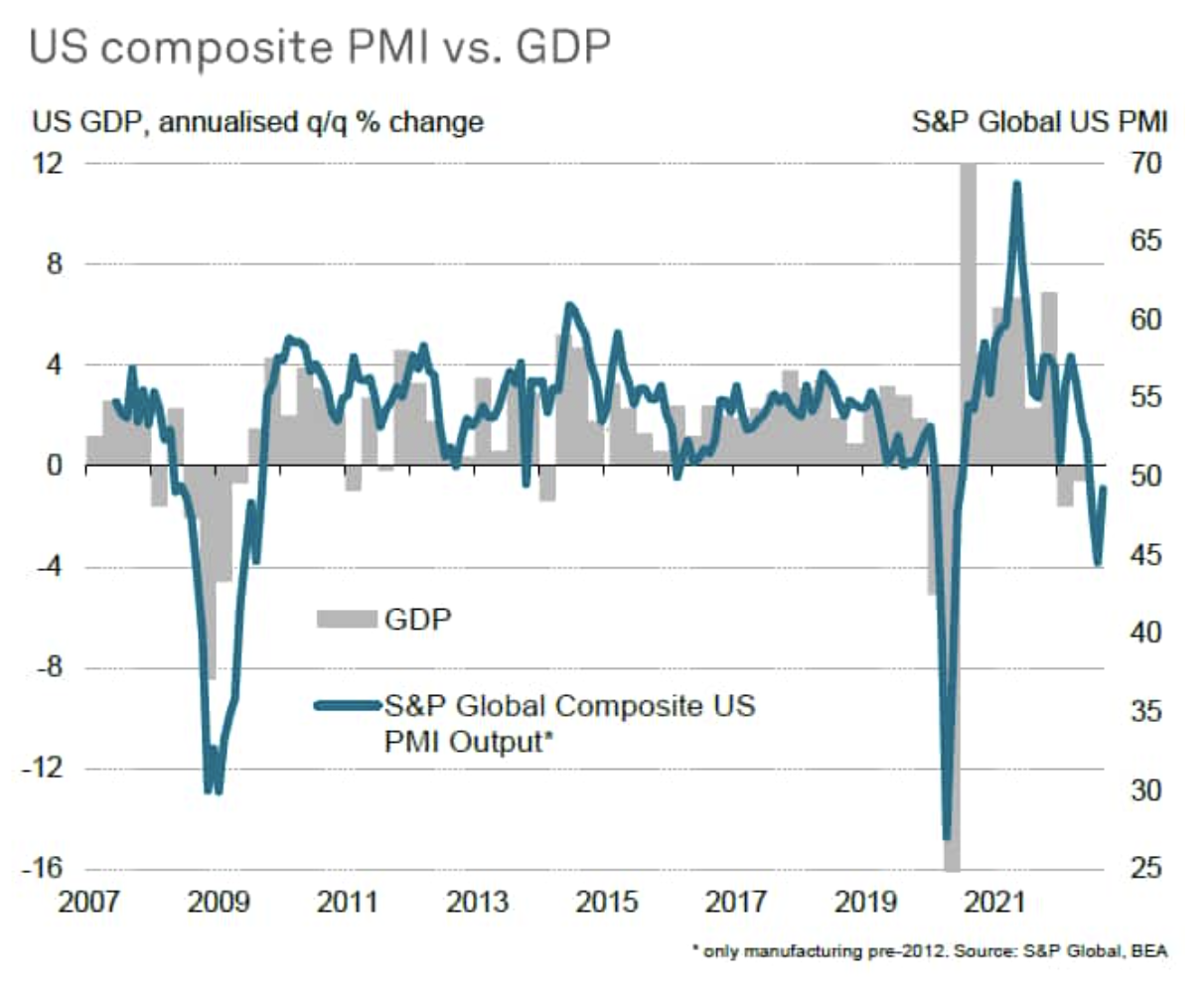

U.S. businesses reported a third consecutive monthly fall in output during September, rounding off the weakest quarter for the economy since the global financial crisis if the pandemic lockdowns of early-2020 are excluded. However, while output declined in both manufacturing and services during September, in both cases the rate of contraction moderated compared to August, notably in services, with orders books returning to modest growth, allaying some concerns about the depth of the current downturn.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Listen: As COP27 Approaches, Central Banks Signaling Need For Action On Climate

ESG Insider hosts Lindsey Hall and Esther Whieldon speak to Irene Monasterolo, professor of climate finance at French business school EDHEC, who tells them discussions at COP27 need to focus on adaptation both for developing and developed nations. They also hear from Stanislas Jourdan, executive director of Brussels-based NGO Positive Money Europe, where he leads advocacy campaigns and research on the European Central Bank and monetary policy. And they speak to Danae Kyriakopoulou, senior policy fellow at the London School of Economics’ Grantham Research Institute on Climate Change and the Environment.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

Russia Triggers European Energy Crisis But Middle East Supply Risks Drop

Energy security and supply concerns in Europe took a front seat in the third quarter of 2022 after Russia restricted supplies in response to sanctions but these heightened tensions have been offset by a drop in recorded attacks on oil facilities, pipelines and tankers in the Middle East, the latest update of S&P Global Energy Security Sentinel research project showed.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: U.S. TV Stations Set For Record Midterm Political Ad Spending

U.S. media companies are set to see record midterm political ad spending, with some TV station groups set to register all-time highs in the category. In the newest episode of MediaTalk, a podcast from S&P Global Market Intelligence, TV advertising experts and analysts said this election cycle has generated strong political fundraising on both sides of the aisle. A number of competitive congressional and gubernatorial races are developing into heated contests. The addition of hot-button topics such as rising food costs, sports betting and reproductive rights is spurring a surplus of ads as Election Day nears.

—Listen and subscribe to MediaTalk, a podcast from S&P Global Market Intelligence