Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Sep, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

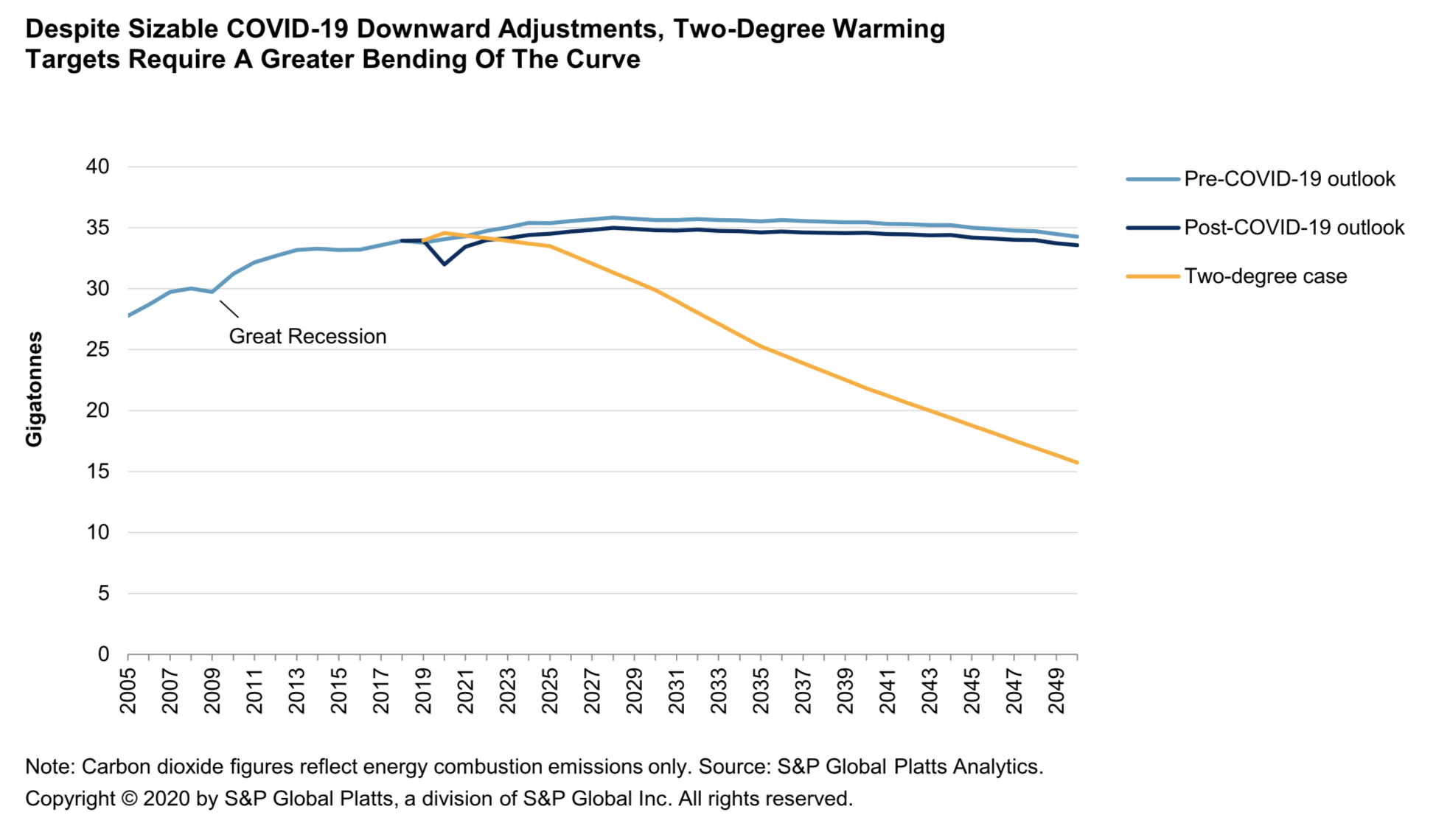

While the coronavirus pandemic’s disruptions have done more in nine months to reduce global emissions than any policy action in the five years since the Paris Agreement was signed, the long-term implications for the fight against climate change are yet to be seen. Will the decline in greenhouse-gas emissions during this crisis accelerate the global economy’s transition toward renewable energy sources enough to avert the worst scenarios experts have predicted?

In order to keep global warming at or below 2-degrees Celsius through 2050, the world will need to reduce emissions more than 10 times the pandemic-related decline, according to a new report from S&P Global’s Energy Transition Research Lab.

“COVID-19 has altered three fundamentals drivers of emissions: macroeconomics, behaviors, and policy, that combined will lower energy sector CO2 emissions by 27.5 gigatons over 2020-2050. However, this is only a minor step in the direction needed to meet the 2-degree target, which would require more than 10 times that reduction over the period,” Dan Klein, S&P Global Platts Analytics’ head of scenario planning, said in the report. “The emissions reduction achieved in 2020 nevertheless is equivalent to the decline required by 2027 in a 2-degree scenario, illustrating that sizable emissions reductions are possible.”

Next year, global oil demand will recover roughly 75% of this year’s decline, according to S&P Global Platts Analytics, which believes the pandemic has permanently altered long-term demand for oil. Overall oil consumption is unlikely return to pre-pandemic levels until late 2022.

S&P Global Platts Analytics forecasts demand for natural gas to suffer most through 2030 due to the pandemic exposing the long-standing structural weakness in gas demand.

“To put this another way, the proverbial bridge that natural gas has played in the energy transition has become shorter and narrower,” the S&P Global Energy Transition Research Lab said in the report.

Against the backdrop of S&P Global Ratings’ expectation that global GDP will contract 3.8% this year, the prospect of achieving such enormous emissions reductions largely depends on governments’ making good on their commitments to center sustainable policy in their recovery plans. The “greenness” of countries’ stimulus packages varies across regions.

U.S. Democratic presidential candidate Joe Biden has proposed a $2 trillion clean energy plan that includes supporting a carbon-free power sector by 2035. “A Biden win along with a democratic sweep in Congress (the House and Senate) could accelerate renewables policies and uptake demand in the U.S.,” S&P Global Ratings energy sector lead Aneesh Prabhu said in the report.

Combined with objectives for green hydrogen to accomplish within the next decade, one-third of Europe’s Recovery Fund is allocated to green investments. “Most governments have yet to disclose the details of their fiscal stimulus, but from what has been announced so far, it seems that national governments will go beyond what the EU is asking in terms of greening the economy,” S&P Global Ratings’ senior economist Marion Amiot said.

“The two economies that will shape the way that Asia-Pacific’s COVID-19 recovery affects the global energy transition are China and India. We expect China's transition to a low-energy-intensity economy, fueled increasingly by renewables, to stall in 2020 and 2021 as policy stimulus ripples through the economy,” Shaun Roache, S&P Global Ratings’ chief APAC economist, said in the report. “India’s economy has been hit by an enormous shock that will impose large, permanent damage. While the plunge in activity will reduce energy use, policymakers are unlikely to focus on energy transition until the economy regains its footing.”

Increased transparency and information will help markets work better—including commodities and energy markets—and this should naturally lead the transition, according to Roman Kramarchuk, S&P Global Platts’ head of energy scenarios, policy, and technology analytics, who is a co-author of the Energy Transition Research Lab report

“If markets are given the choice, then people can act on them,” Mr. Kramarchuk said during S&P Global’s Sept. 22 Climate Week webinar about the transition to a low-carbon economy.

Today is Friday, September 25, 2020, and here is today’s essential intelligence.

Economic Research: The U.S. Economy Reboots, With Obstacles Ahead

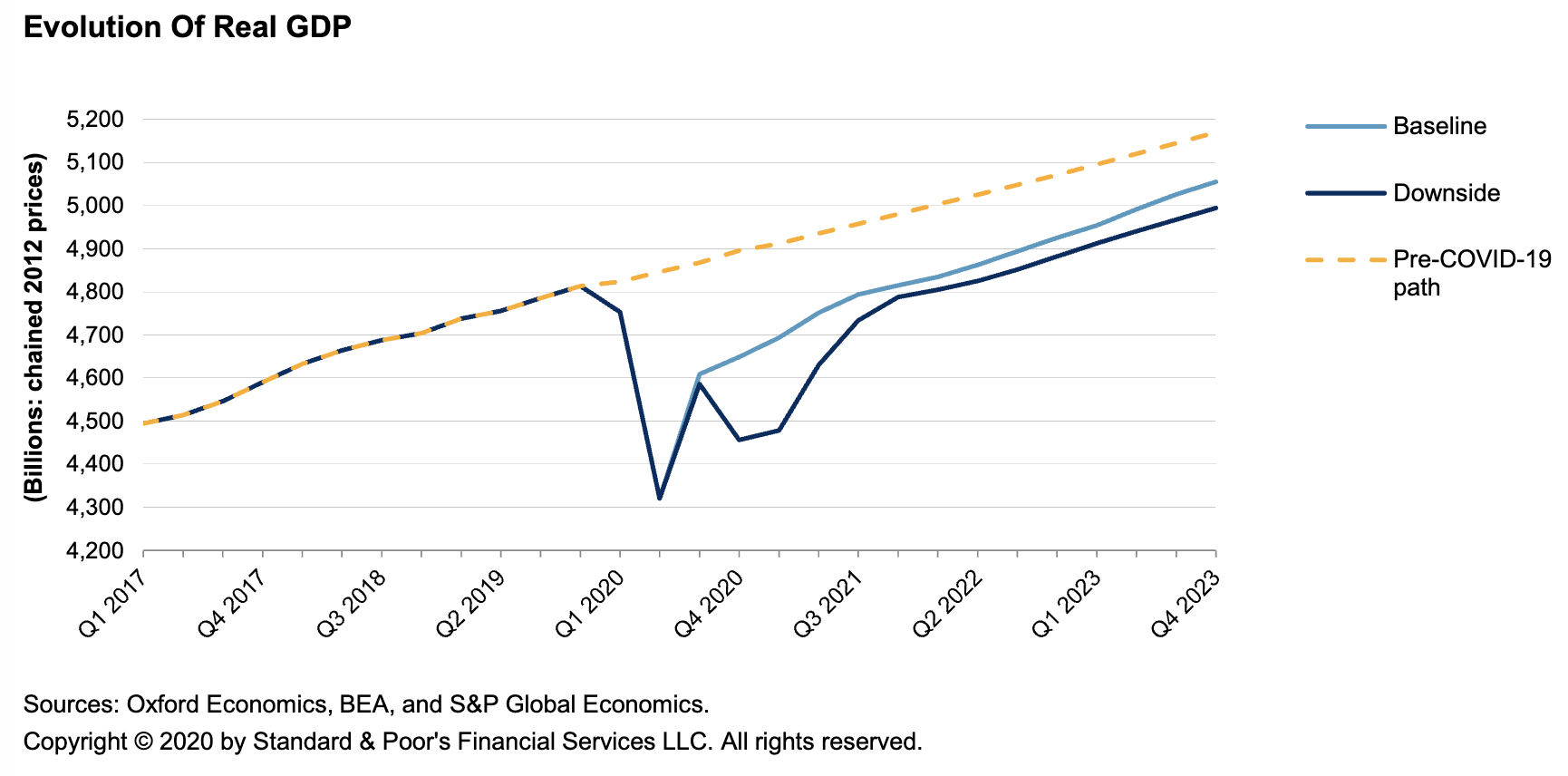

The U.S. economy has taken a few promising steps toward recovery, with consumer spending largely resilient through the summer and the unemployment rate declining a bit more than S&P Global Economics had forecast (though still in recession territory). S&P Global Economics expects a 29.5% bounce in third-quarter U.S. GDP, though that will only partly offset the massive losses in the first half of the year. While the drop in the unemployment rate to 8.4% in August from its post-1947 record high of 14.75% (in April) was a relief, that was likely the easier half of the jobs market recovery. S&P Global Economics doesn’t expect the unemployment rate to reach its precrisis level until mid-2024. For full-year 2020, real GDP is likely to contract by 4% (was a 5% drop in S&P Global Economics’ June forecast) and then grow a modest 3.9% in 2021 (was 5.2% in June). As this sluggish recovery unfolds, three big risks remain: no coronavirus vaccine yet available as the country heads into flu season, a lack of new fiscal stimulus, and trade tensions with China on the rise.

—Read the full report from S&P Global Ratings

Economic Research: The Eurozone Is Healing From COVID-19

The eurozone economy has recovered faster than expected from the first wave of COVID-19. S&P Global Economics now forecasts GDP will fall only by 7.4% this year and rebound by 6.1% next year. S&P Global Economics is also lowering slightly our expectations for unemployment, which we forecast will peak at 9.1% in 2021. Yet, the eurozone is now entering a tricky transition period from gradual withdrawal of government support toward implementing the EU's economic reform program. Liquidity, households' behavior, and demand will be crucial in enabling the European economy to weather this transition, and much could go wrong along the way. As low inflationary pressures will persist, S&P Global Economics doesn’t expect the European Central Bank to tighten monetary policy any time soon, either in terms of interest rates or balance sheets.

—Read the full report from S&P Global Ratings

Retail Trends In August Illustrated Consumers' Resilience And Shifts In Spending

The impact of the pandemic on the U.S. retail sector has resulted in a wide variety of unexpected dynamics (for example, the demand for products that enhance life at home). We paid special attention to the benefits consumers received from the federal government (from either stimulus checks or supplemental unemployment benefits) through the spring and early summer months. Many retailers and restaurants reported significant upticks in demand when these benefits were distributed (Walmart Inc. reported a pop in sales of discretionary items at the end of their fiscal first quarter driven in large part by the stimulus).

—Read the full report from S&P Global Ratings

S&P Global Ratings Lifts Price Assumptions For Most Metals

S&P Global Ratings is raising our assumptions for commodity prices for the rest of 2020 and 2021, amid a better-than-expected recovery of the global economy to date, especially in China. S&P Global Ratings believes that China's $500 billion stimulus package will continue to drive the country's demand for commodities in the short term, supporting our revised assumptions and even higher prices. A second wave of lockdowns and the elections in the U.S. will result in some uncertainty, causing higher–than-normal volatility in commodity prices. In S&P Global Ratings’ view, despite the improved outlook for prices, mining companies are unlikely to increase their recently reduced capex programs, leading to some capacity constraints over the medium and long term.

—Read the full report from S&P Global Ratings

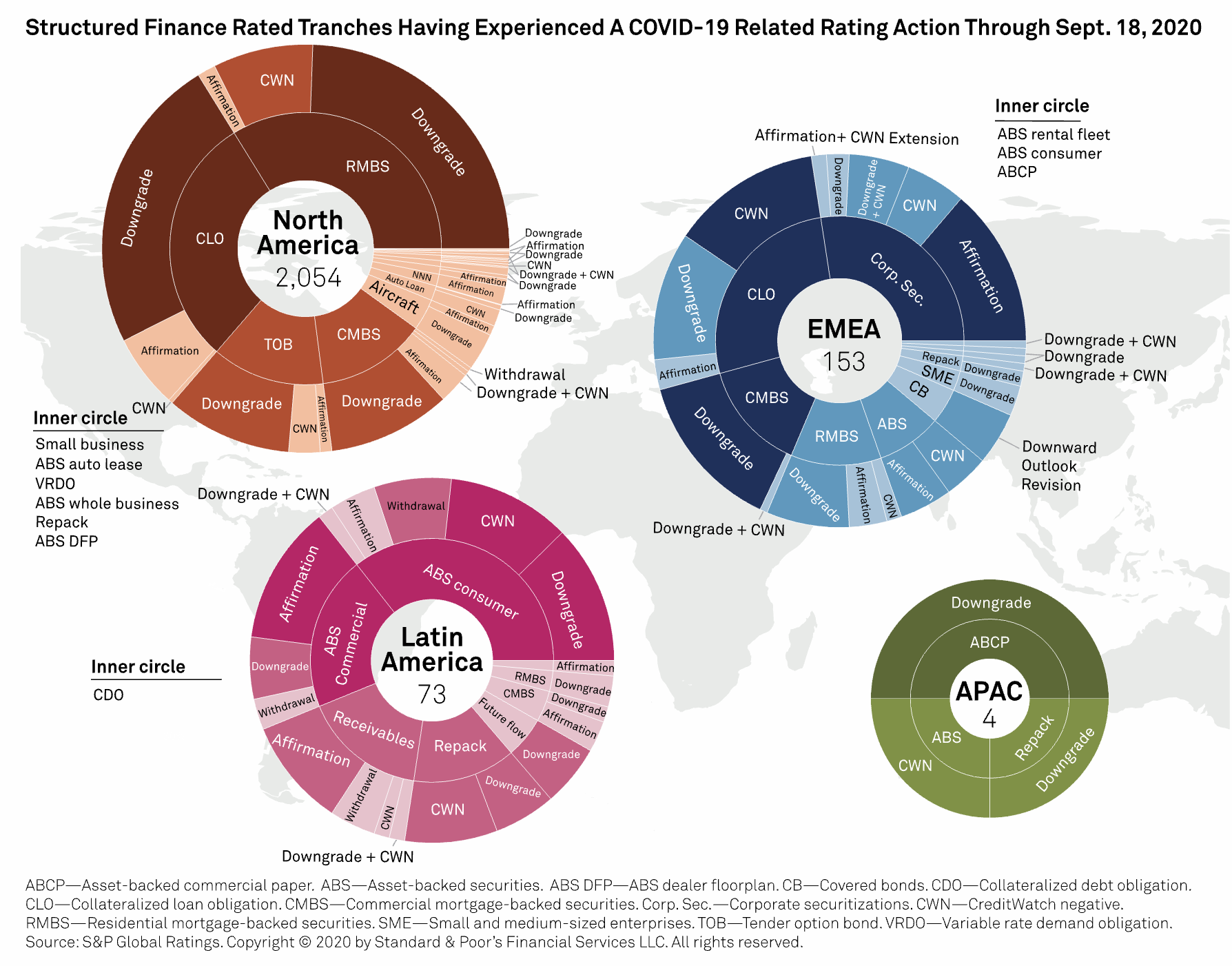

COVID-19 Activity In Global Structured Finance As Of Sept. 18, 2020

S&P Global Ratings took rating actions on 932 rated tranches--638 of which were resolutions of previous CreditWatch placements--across various structured finance sectors globally between Aug. 17, 2020, and Sept. 18, 2020, as a result of the COVID-19 pandemic. In 2020, 2,284 structured finance rated tranches experienced at least one rating action through Sept. 18, due to the impact of the COVID-19 pandemic and/or the decline in oil and gas prices.

—Read the full report from S&P Global Ratings

Capacity utilization demonstrates Fed's impact on high-yield overvaluation

A quarter-century of empirical study of the high-yield risk premium (spread-versus-Treasuries) has identified its key determinants as the state of the economy, credit availability, and the Treasury yield, which is inversely correlated with the spread. Among many indicators of the state of the economy, including GDP, unemployment, and business confidence, capacity utilization stands out for its ability to explain the high-yield spread. The FridsonVision Fair Value Model, discussed below, also employs industrial production to characterize economic conditions.

—Read the full article from S&P Global Market Intelligence

52 markets worldwide have commercial 5G services

5G deployments accelerated in the first half of 2020 in spite of the COVID-19 pandemic, with at least 35 new operators launching commercial 5G services, up from just 21 operators in the same period last year. Seventeen more operators have commenced commercial 5G operations in the second half of 2020 as of September, bringing the worldwide total to at least 113 operators spread across 52 markets.

—Read the full article from S&P Global Market Intelligence

China 2020 survey summary: COVID-19 crisis accelerated media and tech trends

Kagan's 2020 China online consumer survey fielded in June revealed that the COVID-19 pandemic accelerated the adoption of existing trends, such as increased OTT video viewing, active social media and e-commerce engagement, and high interest in 5G. China was the first country to be hit by the COVID-19 pandemic. The first cases were traced to the city of Wuhan, in Hubei province, in late December 2019, and the disease quickly spread through China as people traveled to their hometowns ahead of the Chinese New Year holidays in January 2020. Lasting for more than two weeks, the Chinese New Year season is usually the busiest time of the year in China, but most festivities for this year were canceled due to the pandemic. China Central Television's New Year's Gala, the most-watched TV program in terms of live viewers, remained in broadcast on Jan. 24 and attracted 1.23 billion viewers, up by 59 million from the previous year.

—Read the full article from S&P Global Market Intelligence

China may seek to raise yuan's stature via a digital avatar

China may become the first major country to launch its currency in a digital form, aiming to get a better grip on the money in circulation and raise the stature of the yuan as a global reserve that may rival the U.S. dollar some day. The People's Bank of China trialed the digital yuan in four large cities earlier this year. That was, in part, to prepare for the 2022 Winter Olympic Games in Beijing, Beijing News reported on April 19. Such central bank-issued digital currencies, called CBDCs, will be fiat money, but in a digital form. They will be a store of value in and of themselves, in contrast with digital payments, which are representations of money. China's CBDC would make the world's second-biggest economy pioneer what experts believe may become a trend.

—Read the full article from S&P Global Market Intelligence

The Energy Transition and COVID-19: A Pivotal Moment for Climate Policies and Energy Companies

The COVID-19 pandemic is one of the most severe economic and energy shocks in modern history. On top of the massive disruptions to business, mobility, and everyday life, there clearly will be longer-lasting implications for the energy transition away from fossil fuels. While the shocks from the pandemic are leading to reductions in fossil fuel consumption and emissions, they won't be enough to put the world on a path to meet 2 degree global warming target, nor bring forward peak oil demand, nor drive coal consumption to near zero.

—Read the report from S&P Global

Global carbon markets need price transparency, rule harmonization to mature

Global carbon markets are evolving as more countries select carbon dioxide trading schemes to help meet their nationally determined contributions under the Paris climate agreement, but work remains on standardizing rules and transparent pricing, market experts said Sept. 24. "Price transparency is the building block for any institutional commodity business and without price transparency we can have no confidence in the value of our positions," Ariel Perez, head of environmental products at merchant commodities firm Hartree Partners, said during a virtual New York City Climate Week event hosted by IHS Markit.

—Read the full article from S&P Global Platts

Q2: U.S. Solar and Wind Power by the Numbers

Wrestling with the COVID-19 pandemic, solar project developers installed nearly three times as much solar power capacity in Q2'20 compared to the same period a year ago. Meanwhile, the U.S. wind industry posted one of its strongest second quarters on record in 2020, adding 2,369 MW of capacity, and the 2020 development pipeline stands strong at 30,554 MW.

—Read the full article from S&P Global Market Intelligence

Oil, gas companies talk up role in advancing clean energy transition

Oil and natural gas industry executives asserted their industry is uniquely positioned to lead globally on innovation and technological breakthroughs required to advance low carbon energy solutions, but also stressed that the energy transition will require their collaboration with government and others. Speaking during a National Clean Energy Week event, a panel of leaders from companies investing heavily in lower carbon technologies on Sept. 23 discussed progress and challenges to the transition underway.

—Read the full article from S&P Global Platts

Colorado regulatory agency approves new rules to prevent leaks at new well sites

As the Colorado oil and gas industry grapples with regulators seemingly intent on pushing back drilling setbacks fourfold, the state's air quality commission adopted rules to strengthen monitoring of methane leaks during the completion process as well as the first six months after a new well comes online. Colorado's Air Quality Control Commission unanimously adopted preliminary new rules to reduce leaks from oil and gas operations across the state during a meeting Sept. 23. Once in effect, the rules will require high-frequency monitoring for gas leaks starting when construction on a well begins and continuing through early production. The rules also prohibit natural gas venting during the early period of well completion. Operators will have to capture and eliminate 95% of air pollutants released when hydraulically fracturing wells, and then monitor well-site emissions continuously for six months. The new rules are slated to go into effect in May 2021.

—Read the full article from S&P Global Platts

COVID-19 stalls China's economic transition as stimulus bypasses consumers

China's transition to a consumer-led economy is on hold. Faced with plummeting output during a pandemic-hit first quarter, Beijing resorted to what it knows best and launched a 3.6 trillion yuan ($500 billion) fiscal stimulus in May aimed at boosting investment. While most developed economies directed much of their support toward workers in the form of furlough payments or, in the case of the U.S., sending checks directly to households, Chinese consumers were only secondary beneficiaries of their government's recovery efforts.

—Read the full article from S&P Global Market Intelligence

The S&P 500 ESG Index: Defining the Sustainable Core

The launch of the S&P 500 ESG Index in April 2019 signaled an evolution in sustainable investing. Indices based on environmental, social, and governance (ESG) data were no longer simply a means for companies to declare their sustainability credentials or tools to manage tactical investments playing a minor role in investors’ portfolios. The S&P 500 ESG Index and other such indices were built to underlie strategic, long-term allocations at the core of investors’ portfolios. This paper outlines the characteristics of the S&P 500 ESG Index that have appealed to investors, including: the easy-to-understand methodology behind the index; how “financial materiality” drives index construction; the similar risk/return profiles of the S&P 500 ESG Index and the S&P 500; how the ESG characteristics of the S&P 500 ESG Index improve on those of the S&P 500; and specific examples demonstrating how the S&P 500 ESG Index methodology sorts and selects companies.

—Read the full article from S&P Dow Jones Indices

Listen: Beyond The Buzz: Climate Change Diplomacy With Christiana Figueres

In this episode of Beyond the Buzz, Corinne Bendersky talks with Christiana Figueres about the diplomatic history of climate change negotiations and how COVID-19 may affect climate action going forward. Ms. Figueres was the executive secretary for the U.N. Framework Convention on Climate Change from 2010-2016, during which the historic Paris Agreement was signed. She reveals how collaborative--not confrontational--diplomacy was used to find common ground among stakeholders and help advance a shared agenda among 197 countries. Afterward, Corinne and Mike Ferguson discuss how the climate and COVID-19 crises intertwine--are there opportunities in the massive COVID recovery spending packages to not only accelerate the economy, but make progress toward climate goals?

—Listen and subscribe to Beyond the Buzz, a podcast from S&P Global Ratings

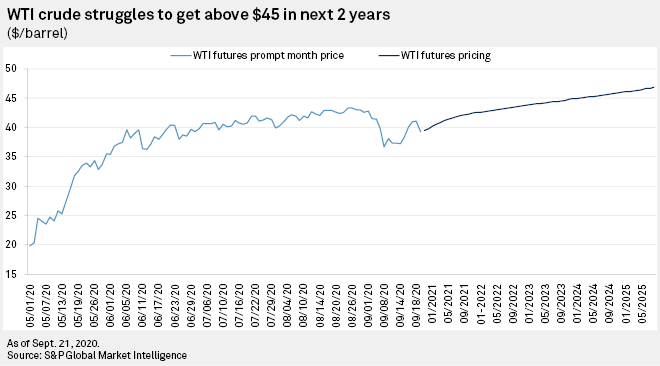

Oil producers in no-win scenario as prices stall at $40/b, COVID-19 risk remains

U.S. oil producers continue to struggle from the fallout of the COVID-19 pandemic as crude prices continue to languish near $40 per barrel with little hope for a substantial or sustainable rally in the foreseeable future. West Texas Intermediate crude oil was trading above $70/b in September 2018, and if WTI prices were to get within $10/b of that number anytime within the next 12 months, independent producers would have good reason to celebrate. The WTI prompt-month contract closed Sept. 23 at $39.93/b, or about 45% below where it was in late September 2018. With demand rocked by the COVID-19 crisis, prices have yet to rebound in spite of massive cuts in production by U.S. companies – and it is very hard to find anyone optimistic things will improve anytime soon.

—Read the full article from S&P Global Market Intelligence

US oil, gas rig count up 15 on week, biggest gain since downturn: Enverus

The US oil and gas rig count rose by 15 to 308 in the week ending Sept. 23, rig data provider Enverus said, marking the largest weekly gain in the more than six months since the current industry downturn began. The week-on-week increase brought the nationwide rig count, which had been rangebound in low 280s to the mid-290s for 14 weeks, above 300 for the first time since early June.

—Read the full article from S&P Global Platts

Long-term role for gas at stake in Biden-Trump election

The U.S. presidential election coincides with an inflection point in public sentiment on natural gas, and the outcome could have substantial impacts on gas consumption, infrastructure permitting and production. President Donald Trump has pledged to continue his pro-fossil fuel, deregulation "energy dominance" agenda. While analysts see Democratic presidential nominee Joe Biden preserving a role for gas, his climate plan would invest $2 trillion in renewable power, electric grid upgrades, green building initiatives and other clean energy initiatives that would displace fossil fuels. The winner will face an environment that has changed much since the 2016 election.

—Read the full article from S&P Global Market Intelligence

US ELECTIONS: Trump v. Biden outcome portends major impacts on US natural gas sector, markets

The US presidential election coincides with an inflection point in public sentiment on natural gas, and the outcome could have substantial impacts on gas consumption, infrastructure permitting and production. President Donald Trump has pledged to continue his pro-fossil fuel, anti-regulation "Energy Dominance" agenda. While analysts see Democratic nominee Joseph Biden preserving a role for gas, his climate plan would invest $2 trillion in renewable power, electric grid upgrades, green building initiatives and other clean energy initiatives that would displace fossil fuels.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Language