Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 Sep, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

How will market participants make environmental, social, and governance (ESG) decisions in an increasingly decentralized financial world?

The evolving world of decentralized finance (DeFi) is advancing the digitalization of markets in ways both complementary and disruptive to traditional financial market business models and frameworks, according to new S&P Global Ratings research.

“As is often the case with emerging technologies, the full scale and scope of the market impact-- driven by blockchain, cryptography, and smart contracts--is difficult to understand and even more difficult to accurately predict … But broader institutional investor acceptance may herald a new phase of rapid acceleration,” S&P Global Ratings said in a recent report. “The path ahead for digitalization and digital assets will not be a straight one … As a result, uncertainty and volatility are likely to remain defining characteristics for the foreseeable future. And the credit implications for our rated universe will be a function of the pace of development of these technologies, the relative exposure of specific industries to disruption risk, and the ability of individual issuers to adopt or adjust to these new technologies.”

The approval of bitcoin as legal tender in El Salvador may have more risks than benefits. Blockchain technology has the potential to revolutionize how wealth is recorded and transferred. Cryptocurrencies likely need regulatory agencies to establish controls over their ecosystem. Inefficiencies across key networks like Ethereum showcase opportunities to improve blockchain’s scalability for millions of users experiencing higher costs and slower transaction speeds. The recent explosion the nonfungible token market highlights the appeal of digitalization over holding physical assets.

The ESG aspects of digital markets and DeFi may be the key considerations for market participants to welcome the previously fringe forms of finance into the mainstream.

Environmental concerns permeate the cryptocurrency space. One bitcoin transaction requires 1,695 kilowatt hours of electricity, comparable to what an average U.S. household uses in 58 days, and produces 805 kilos of carbon dioxide—equivalent to the carbon footprint of 1.8 million Visa transactions, according to Dutch economist and blockchain expert Alex de Vries, as reported by S&P Global Market Intelligence. But crypto enthusiasts are seeking ways to integrate renewable energy into the production process, and “the technology could in some cases help corporates and governments better meet their ESG goals,” according to S&P Global Ratings. In addition, S&P Global Ratings sees “the social component of ESG is at the core of decentralized finance’s promise of financial inclusion,” and “transparency and traceability are underpinned by the protocols and codes that underpin the applications and digital assets.”

“When you think about digital assets or blockchain technology in general, what it really is, first of all, is a new method for organizing and polling people broadly. So, decentralized governance, decentralized decision-making, mitigating the problems of concentrated power—that's the value proposition of digital assets as an overall thing,” Rayne Steinberg, CEO and co-founder of the digital asset management company Arca, told S&P Global’s Essential Podcast this week. “The governance part [of ESG investing] is actually the primary directive of blockchain. Making governance decisions and a more equal financial system is a goal.”

Today is Wednesday, September 22, 2021, and here is today’s essential intelligence.

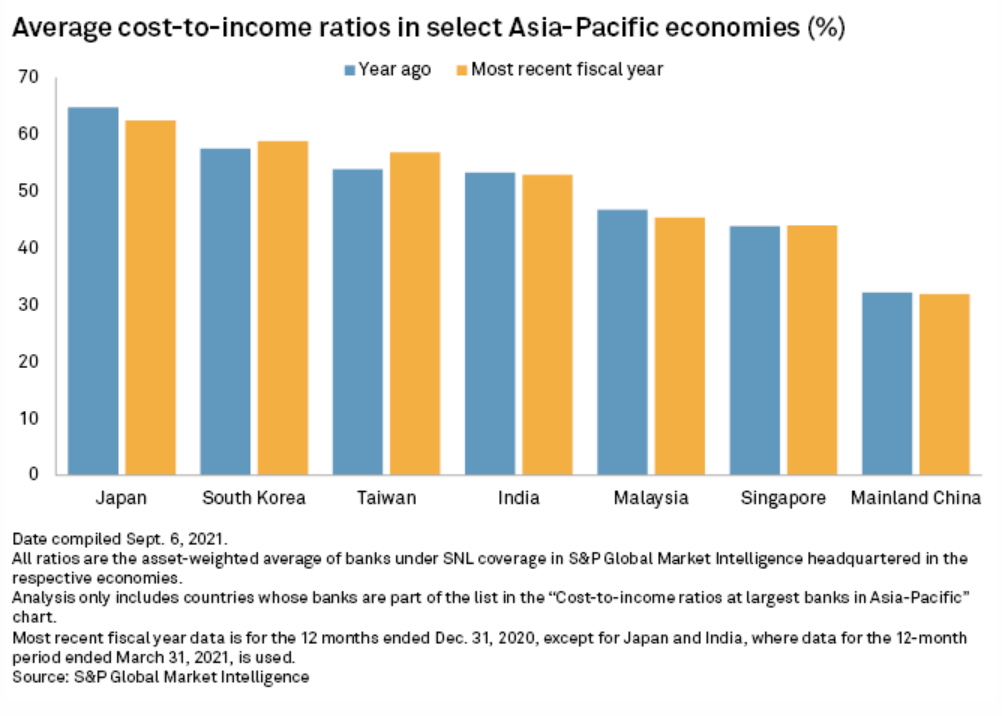

Top Japanese Banks Have Long Way To Go To Become As Efficient As Asian Peers

Major Japanese banks will need to consider expanding their income streams more aggressively, as years of cost cutting have yet to improve their efficiency to match their peers in the Asia-Pacific region.

—Read the full article from S&P Global Market Intelligence

Domestic Deals Fuel Bank M&A Wave In Europe

The number of mergers and acquisitions among banks in Europe in 2021 may outstrip the total in 2020, with deals where buyer and seller are based in the same country making up the lion's share, according to an analysis by S&P Global Market Intelligence.

—Read the full article from S&P Global Market Intelligence

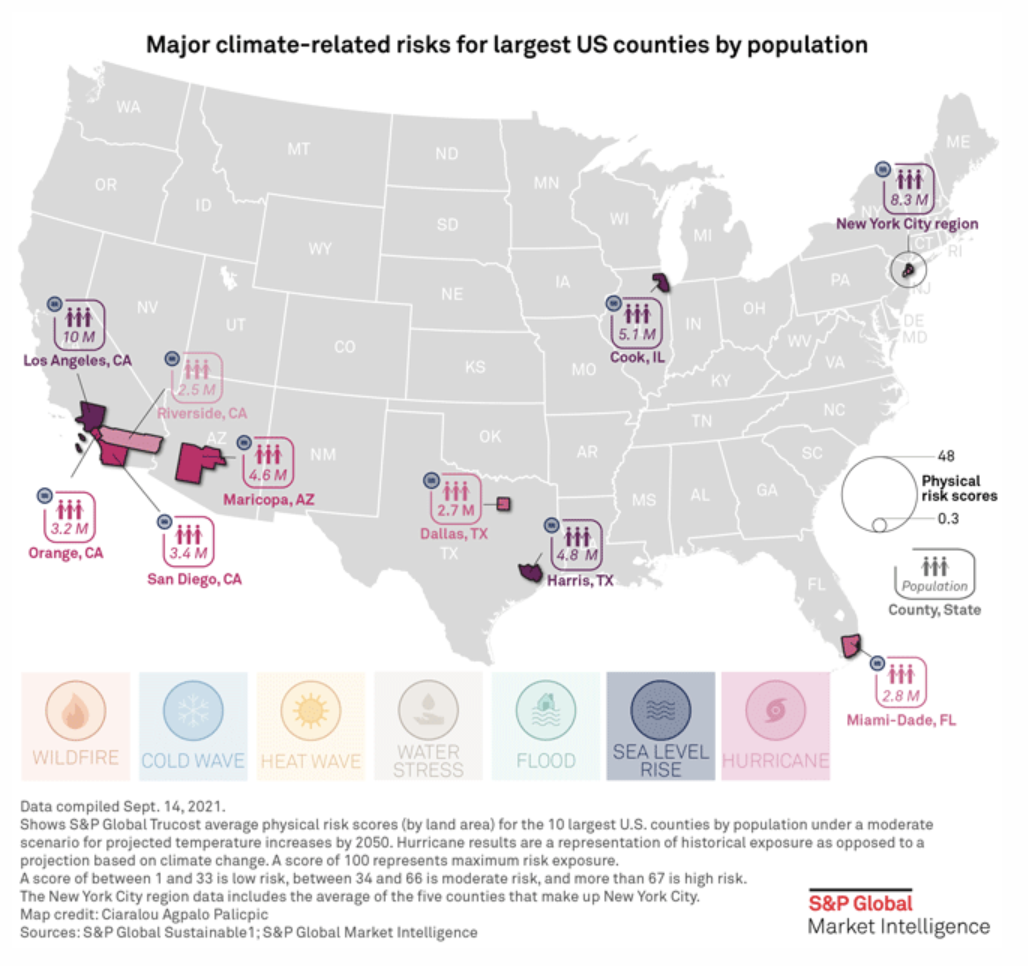

Flooding Isn’t The Only Water-Related Climate Risk Facing New York City

The back-to-back climate disasters — the remnants of Hurricane Ida hammered the city less than two weeks after Hurricane Henri, and the resulting flash floods left New York subways and streets submerged — underscore the potential impact of climate change, and the destruction it can cause if large, urban centers fail to invest in adaptation infrastructure and if governments don’t take action to reduce emissions.

—Read the full article from S&P Global Sustainable1

Guest Opinion: A Heightened Focus On Co2 Emissions Stokes Interest In The Carbon Markets

Several regions have established carbon markets as part of their decarbonization strategies. Europe, California, Northeast U.S., Quebec, and Korea all have carbon markets, with the U.K. and China being notable recent additions.

—Read the full report from S&P Global Ratings

Greenhouse Gas And Gold Mines - Emissions Intensities Unaffected By Lockdowns

S&P Global Market Intelligence reviewed 2020 sustainability reports from more than 90 leading gold mines globally to conduct a year-over-year comparison of greenhouse gas emissions. In 2020, gold output was down 5% globally compared with 2019, largely due to lockdowns imposed to curb the COVID-19 pandemic.

—Read the full article from S&P Global Market Intelligence

EV Impact: Battery Disruptors Are Jolting Metal Supply Chains

As electric vehicle sales ramp up around the globe, key battery metals such as lithium, cobalt and nickel are already facing supply chain constraints. EV-makers are feverishly innovating, attempting to bring down raw material costs and charging times.

—Read the full article from S&P Global Market Intelligence

Analysis: Korean Air's ESG Push Set To Propel South Korea's Eco Jet Fuel Output Amid Other Challenges

South Korea's production of eco-friendly aviation fuel is poised to increase as the national flag carrier Korean Air actively partners with major local refiners for carbon-neutral jet fuel and sustainable aviation fuel to counter climate change, but hurdles remain before SAF sees a significant upsurge in Asia.

—Read the full article from S&P Global Platts

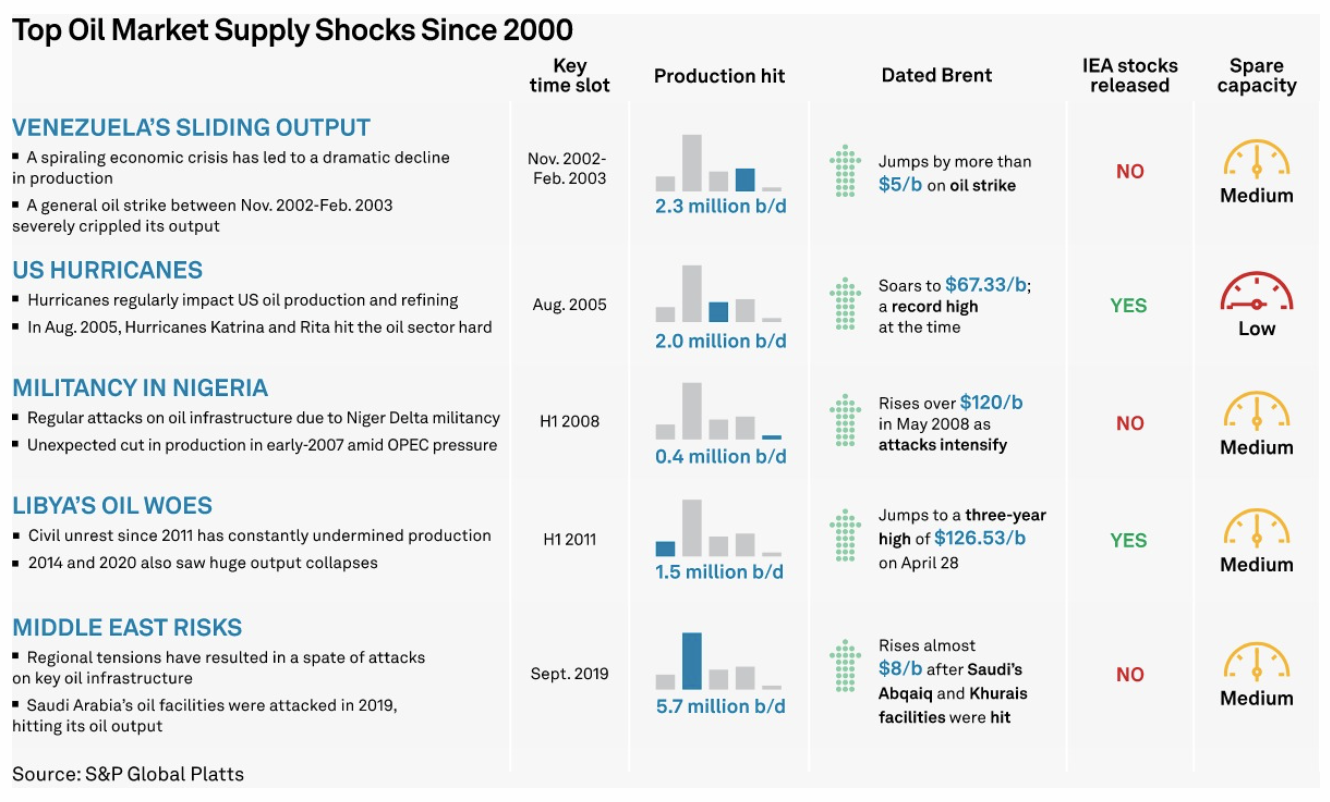

Fuel For Thought: Spare Capacity In Focus As OPEC+ Output Hikes Coincide With Rising Oil Security Risks

Violence aimed at oil infrastructure in the Persian Gulf has tripled on an annualized basis since the start of 2018, according to data in the S&P Global Platts Oil Security Sentinel, a new study on geopolitical risk and price.

—Read the full article from S&P Global Platts

Nigeria Petitions OPEC+ For Higher Oil Quota Despite Production Struggles

Nigeria has requested a higher production quota under the OPEC+ accord, oil minister Timipre Sylva said Sept. 21, claiming that technical problems that have hampered its output will soon be resolved.

—Read the full article from S&P Global Platts

UAE Energy Minister Sees No Need For OPEC+ To Change Course On Oil Production Hikes

OPEC and its allies should maintain their agreement to keep raising crude production every month, UAE energy minister Suhail al-Mazrouei said Sept. 21, adding that the oil market is "in a very good position today."

—Read the full article from S&P Global Platts

Chinese Refineries Maintain High Oil Product Yield Despite Throughput Falls

China maintained high yields for six oil oil products, remaining above 71% in August, despite crude throughput falling to 15-month low, data from the National Bureau of Statistics showed on Sept. 20.

—Read the full article from S&P Global Platts

Chinese Jet Fuel Exports To Stay Robust H2 Sep-Oct Amid Domestic COVID-19 Travel Restrictions

Chinese jet fuel exports are expected to exceed 1 million mt in September, a level not seen since April 2020 and well above the average monthly 663,000 mt exports over January-August, as the country's latest COVID-19 travel restrictions has severely impacted air travel to and from the southern province of Fujian.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language