Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Sep, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Prioritizing the customer through digital transformation strategies pays off—so much so that doing so can notably improve companies’ equity and credit performance.

Companies’ customer experience (CX) focus varies widely. At the forefront are data-driven companies that consistently beat their sectors’ equity performance and have prioritized digital transformation, cloud, and other CX topics; next are digital CX learners, which also deploy similar tools but haven’t seen their equity performance outperform peers in their sectors; and lagging are those take more traditional customer service approaches and don’t discuss digitally enabled CX-focused terms.

The top 22% of CX leaders at companies that share digital CX terms during earnings calls have, on average, 2.7 times higher equity returns than their peers across their industries, according to new S&P Global research analyzing the credit ratings, market capitalizations, and earnings transcripts of nearly 10,000 global issuers. Overall, equity returns for digitally driven CX leaders were consistently higher in the past three years. Digital CX leaders were found to have lower default rates during periods of calm macroeconomic and market conditions, and three-quarters of CX leaders are rated ‘BB’ or higher, compared with 62% of their global peers.

“Companies that are using digitization as a way of focusing on and adapting to their customers' needs have a clear advantage from the standpoint of investor appetite,” analysts and researchers from S&P Global Ratings and 451 Research, part of S&P Global Market Intelligence, said in the report released yesterday. “Equity returns for digitally driven CX leaders were consistently higher over the last three years. Consistency can equate to stability as leaders focus on long-term, customer-centric initiatives (outside-in metrics) versus cost reduction and operational performance (inside-out) … An investor holding a portfolio of CX leaders will have significantly less credit risk than will an investor holding a portfolio of the entire bond market—especially during times of market dislocation.”

After all, 80% of businesses say that would likely stop purchasing from a technology vendor as a result of a poor CX strategy, and nearly 60% of U.S. consumers see an unsatisfactory customer-service interaction as a significantly influence to stop shopping with a preferred brand or retailer, according to a recent 451 Research survey.

“The coronavirus pandemic has changed CX, altering strategic priorities and related technology spending trends. Specifically, the widespread economic and societal impacts have accelerated enterprises’ adoption of digital technologies to stay relevant to customers,” the report said. “To achieve growth, we believe businesses will need to not only invest in digital transformation, but also understand and benchmark their progress. The growth of data, along with demands for rich media content and regulatory compliance, are requiring new approaches to managing customer data and intelligence.”

Today is Tuesday, September 21, 2021, and here is today’s essential intelligence.

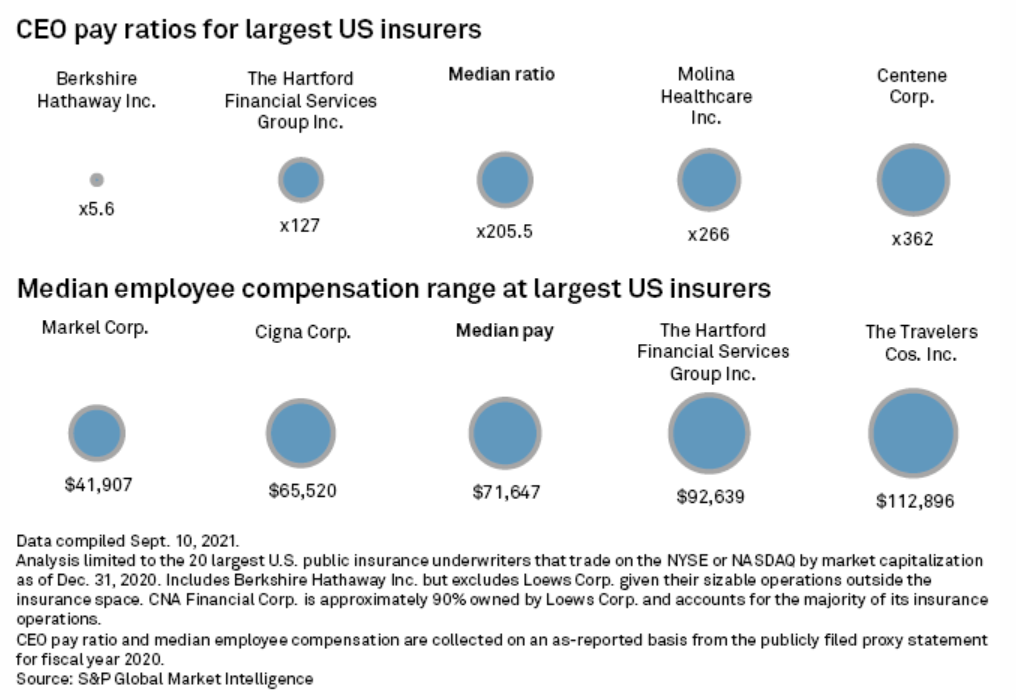

Health Insurers, Aflac Stand Out With Highest CEO Pay Ratios In 2020

Managed care companies accounted for some of the highest ratios of CEO compensation to median insurance company employee salary in 2020, according to an S&P Global Market Intelligence analysis.

—Read the full article from S&P Global Market Intelligence

Regional Theme Parks Bounce Back From COVID Closures, Enjoy Higher Pricing Power

COVID-19 put regional U.S. theme park operators on a financial roller coaster, but improvements made during pandemic-mandated closures could lead to a more profitable industry as parks reopen.

—Read the full article from S&P Global Market Intelligence

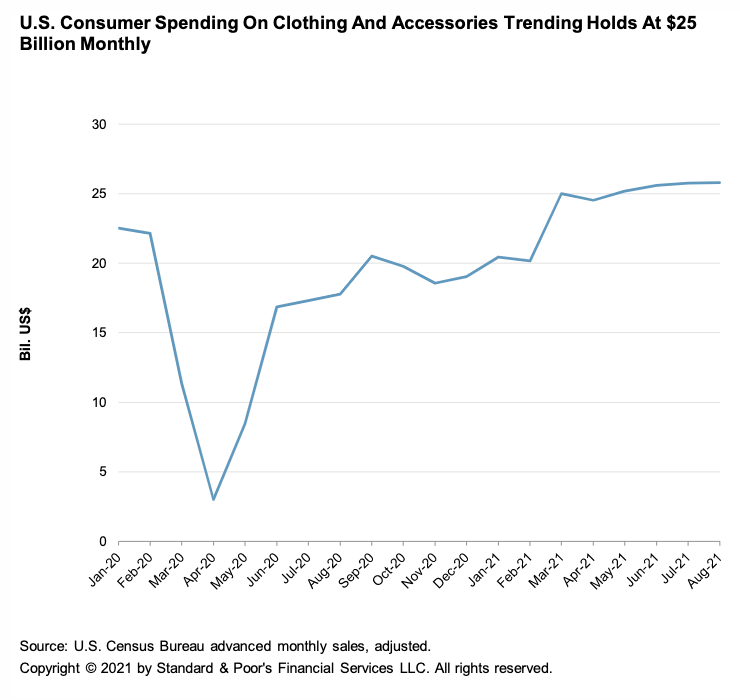

A Modest Shift In Retail Spending Amid Variant Uncertainty Doesn't Dim Outlook On Retail And Restaurant Ratings

Advance estimates of monthly retail sales reported by the U.S. Census Bureau increased modestly by 0.7% in August, assuring retailers and restaurants that fears of the delta variant did not cause consumers to dramatically reverse shopping and dining behaviors that have benefited the sector since the economic reopening in spring 2021.

—Read the full report from S&P Global Ratings

U.S. States Weigh Risk Reduction In Managing Pension And OPEB Liabilities

The average U.S. state funded ratio decreased for fiscal 2020 to 68.9% from 70.9% primarily due to market returns during the pandemic-induced recession; however, S&P Global Ratings expects funded levels will improve for many plans in fiscal 2021 given generally strong market returns to date.

—Read the full report from S&P Global Ratings

Credit Trends: Risky Credits: Upgrade Potential Is Highest Among U.S. Media And Entertainment 'CCC' Issuers

The number of 'CCC' category ratings on U.S. and Canadian companies declined to a prepandemic low of 163 as of Aug. 31, 2021.

—Read the full report from S&P Global Ratings

Default, Transition, And Recovery: Third Quarter Corporate Default Tally At Lowest Level Since 2014

The 2021 corporate default tally remained at 59 after there have been no defaults since Aug. 13. So far, the third quarter has seen the fewest number of defaults (12) since the first quarter of 2014.

—Read the full report from S&P Global Ratings

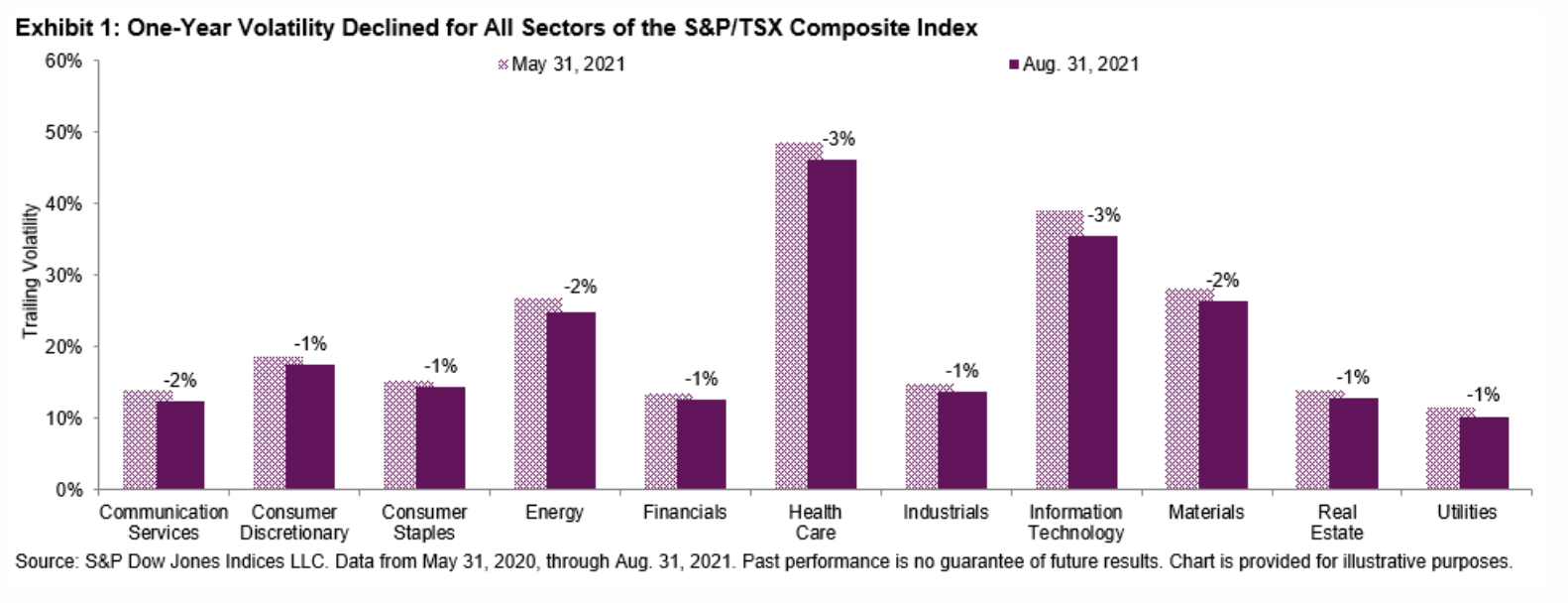

Chugging Along

In the last three months, the Canadian equity market climbed another three percentage points, bringing the S&P/TSX Composite Index up to an impressive 20.4% YTD through Sept. 16, 2021.

—Read the full article from S&P Dow Jones Indices

Asia Takes Center Stage For Blank-Check IPOs As Hong Kong, Singapore Join Fray

The craze for blank-check companies could pick up in Asia, where more regional startups are likely to explore that route to list, seeking to tap the advantages of familiarity among investors, time zones and less onerous paperwork.

—Read the full article from S&P Global Market Intelligence

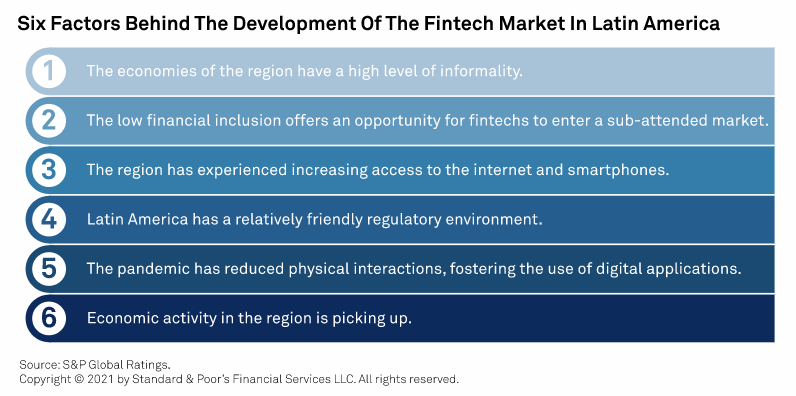

Latin American Fintech Is Paving A Road To Securitization's Future

Fintech—novel technology attempting to advance and automate the application of financial services—is rapidly expanding in Latin America in terms of origination volumes, geographical presence, and capital raised.

—Read the full report from S&P Global Ratings

Vodafone, BT May See Profit Boost From Return Of Roaming Fees

U.K. mobile operators, struggling for growth at home, will likely generate high-margin revenue from the post-Brexit reintroduction of European roaming charges.

—Read the full article from S&P Global Market Intelligence

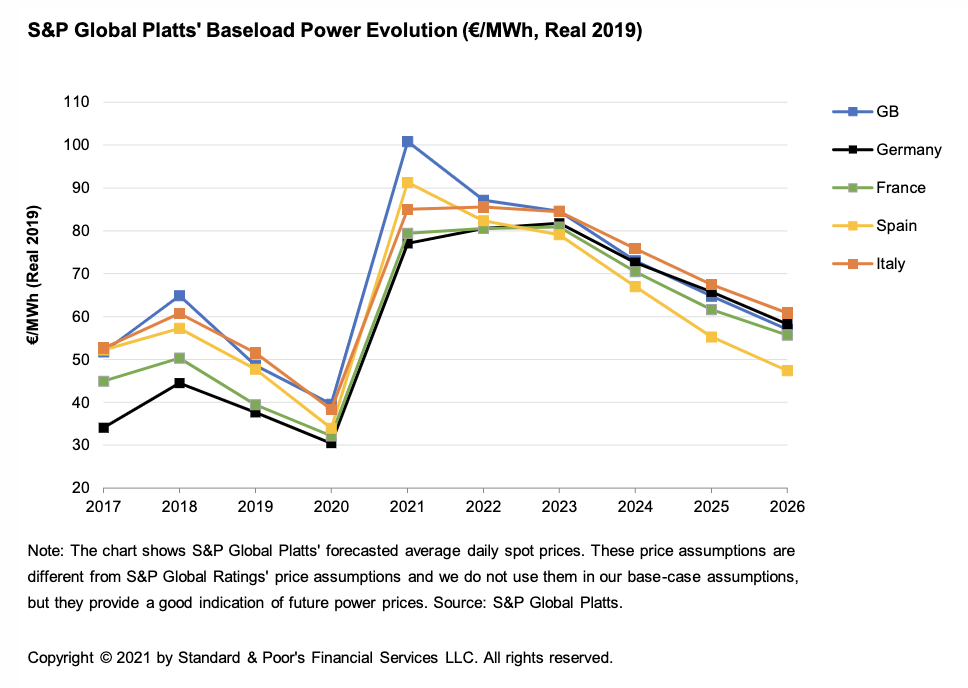

The Energy Transition And What It Means For European Power Prices And Producers: September 2021 Update

European power prices showed a stronger-than-anticipated rebound in 2021. This follows a drop of more than 20% drop in 2020 amid COVID-19 lockdowns and weaker economy; the improvement stemmed mainly from a surge in gas prices and to a lesser extent carbon prices, which reach a record high of close to €60 per ton.

—Read the full report from S&P Global Ratings

Oil Majors Pledge Net Zero Target, Update Goals To Cut Methane, Carbon Intensity

A group of 12 of the world's biggest oil and gas majors pledged Sept. 20 to reach net zero emissions from operations under their control and updated targets for reducing the methane and carbon emission intensity of their upstream operations.

—Read the full article from S&P Global Platts

EV Impact: Electric Vehicle Surge Resonates Across Global Economy

Fueled by skyrocketing demand in Europe, China and the U.S., sales of pure electric and plug-in hybrid passenger vehicles in 2021 are on pace to more than double to a record 6.2 million units, according to S&P Global Market Intelligence data.

—Read the full article from S&P Global Market Intelligence

Biden Asks Nations To Join U.S., EU In Pledge To Cut Global Methane Emissions

President Joe Biden said the U.S. is working with the European Union on a pledge to cut global emissions of methane by at least 30% below 2020 levels by the end of the decade, and he urged other world leaders to sign the pact.

—Read the full article from S&P Global Market Intelligence

S&P Podcast: U.S. Poised For Atlantic Coast Offshore Wind Power Boom

Between extended federal tax credits, states' renewable energy commitments and the recent approval of the country's first utility-scale installation off Massachusetts, the U.S. offshore wind sector is on the cusp of an Atlantic Coast construction boom, several experts told S&P Global's Energy Evolution podcast.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Market Intelligence

Listen: U.S. Natural Gas Utilities Look To Turn Climate Challenges Into Opportunities

The American Gas Association has committed to reducing greenhouse gas emissions and believes that natural gas utilities are well-positioned to help the Biden administration achieve the ambitious climate goals laid out by the president, though they're not on board with some proposals floated on Capitol Hill, including the methane fee. Jasmin Melvin spoke with Richard Meyer, AGA's vice president of energy markets, analysis and standards, about the administration's climate agenda and what natural gas utilities are doing about their carbon and methane footprints.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

Mapping Out ADNOC’s Downstream Ambitions

In the 1970s when Abu Dhabi National Oil Co. was looking for a city to house its industrial staff, it chose a rural desert town close to its onshore fields with deep waters for easy access to oil tankers. Today, Ruwais is more than just a port city. It is key to ADNOC's oil ambitions, including its quest to turn the newly-launched Murban futures contract into an international benchmark for oil headed to Asia.

—Read the full article from S&P Global Platts

Factbox: Rising Gas Price Threatens U.K. Retail Energy Market

Gas and power wholesale prices have risen strongly across Europe this summer but the U.K. has come under particular pressure due to its high dependence on gas for power generation as well as for domestic heat and cooking.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language