Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Sep, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

One day after Japan’s first new prime minister in nearly eight years was elected, the Bank of Japan changed its outlook for the world’s third-largest national economy, while keeping monetary policy unchanged.

The country’s central bank maintained its short-term policy interest rate at -0.1%, said it will continue to implement quantitative and qualitative easing until inflation reaches the 2% target, and announced it will still purchase unlimited government bonds to keep the 10-year yields close to 0%.

"Japan's economy has started to pick up with economic activity resuming gradually, although it has remained in a severe situation due to the impact of the novel coronavirus (COVID-19) at home and abroad," the BoJ said in its Sept. 17 monetary-policy statement. “The pace of improvement is expected to be only moderate while the impact of COVID-19 remains worldwide.”

Japan’s new prime minister, 71-year-old Yoshihide Suga, is likely to continue the economic reforms set by his predecessor, Shinzo Abe, who resigned due to health concerns.

"Prime Minister Suga will usher in policy continuity and we do not expect major innovations in economic policy. The three arrows of Abenomics—reflationary monetary policy, flexible fiscal policy, and moderate structural reforms—will therefore live on. In practice, Mr. Suga does not have much room for maneuver on the economy," S&P Global Ratings Chief APAC Economist Shaun Roache told the Daily Update. "The Bank of Japan is already running extremely easy policies and is under the day-to-day control of Governor [Haruhiko] Kuroda. The government’s fiscal policy, for some time, will focus more on supporting demand during the COVID recovery than on longer term goals."

Following his landslide election victory within the Liberal Democratic Party (LDP) on Sept. 14, and his appointment as prime minister two days later, Mr. Suga reappointed 11 of 19 ministers of the previous administration as part of what he described as his “continuity cabinet” of “reform-minded, hard-working people.”

“I have been tasked with carrying on the work of the Abe administration to overcome the current crisis so that all the people can safely return to a normal way of life,” Mr. Suga said on Sept. 16, during his first press conference in the role. “In order to restore the safe lives and livelihood of all the people, my mission is to succeed and advance what the Abe administration has implemented.”

Taro Aso will keep his role as finance minister, as will Toshimitsu Motegi as foreign minister and Yasutoshi Nishimura as the economic revitalization minister.

Hiroshi Kajiyama will retain his role as Japan’s minister of economy, trade, and industry—a move that will continue his leadership as the country works to achieve an energy transition from fossil fuels to renewable generation, according to S&P Global Platts. Prior to Mr. Suga’s ascent, Mr. Kajiyama announced on July 3 a directive to begin creating a more effective framework for Japan to phase out inefficient coal-fired power plants by 2030 as part of the country’s strategic energy plan.

“What the people want is a quick end to the coronavirus pandemic and an economic recovery,” Mr. Suga said. “That’s what my cabinet will put every effort into first and foremost.”

A notable addition to Mr. Suga’s cabinet is Nobuo Kishi, Mr. Abe’s younger brother, who will oversee Japan’s defense. Taro Kono , the previous defense minister, will now operate as the country’s administrative reforms minister.

Only two of Mr. Suga’s cabinet members are women, down from the three from Mr. Abe’s. Yoko Kamikawa is Japan’s new justice minister, and Seiko Hashimoto is the minister for the Olympics.

Mr. Suga previously served as the chief cabinet secretary to Mr. Abe and was seen as one of his closest aides. For his part, Mr. Abe is the longest-serving prime minister in Japan’s history, serving terms from 2006-2007 and again from 2012-2020 before his resignation three weeks ago.

“After [the LDP] took over political power, I’ve worked to the best of my abilities every single day to revitalize the economy and carry out diplomacy to protect national interests,” Mr. Abe told reporters on Sept. 16, prior to formally resigning. “I’d like to ask you all for your strong support and understanding for the Suga Cabinet that will launch today.”

Mr. Abe’s successor comes to power as Japan faces one of the worst economic crises in its history. In the second quarter, GDP contracted 27.8% on a seasonally adjusted annualized basis, or 7.8% quarter-over-quarter—its worst decline on record.

"Where we may see change is structural reform. Mr. Suga has, in the past, shown a liking for market-based reforms and he has already floated some new ideas, such as encouraging the dominant telecoms operators to reduce mobile phone charges. Still, we expect mostly tinkering rather than a slate of reforms that could, finally, raise Japan’s long-term economic growth," Mr. Roache said.

As the crisis continues, Japan’s central bank said it will continue to work closely with the country’s government. "[We] will continue to support the Japanese economy with the current monetary policy," BoJ Governor Haruhiko Kuroda told reporters on Sept. 17.

Mr. Suga told the Nikkei Asian Review on Sept. 5, while campaigning within his party for the position, that he “highly appreciates" the BoJ’s quantitative easing program and wants to "inherit the current framework."

He also hinted that he will accelerate the consolidation of Japan's regional banks. On Sept. 2, Mr. Suga told reporters that because there are "too many" regional banks, reorganization can be "an option" for them to survive debilitating profit losses that have proliferated during the first fiscal quarter, according to S&P Global Market Intelligence.

"Chances are high that he [Mr. Suga] will take action [to push mergers of banks] to show his presence as new prime minister," Makoto Kikuchi, the chief executive officer of the Japanese firm Myojo Asset Management, told S&P Global Market Intelligence in a Sept. 14 interview.

Today is Friday, September 18, 2020, and here is today’s essential intelligence.

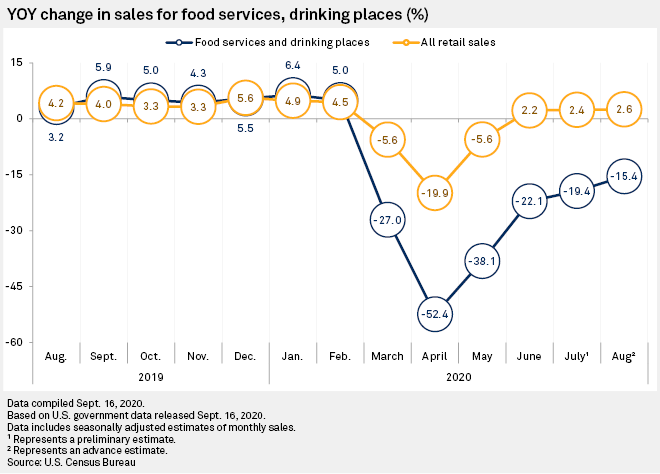

Dining Out: August U.S. Restaurant Sales Increase as Industry Struggles Continue

The recovery of sales and employment at U.S. restaurants continued in August but at a pace slower than previous months. August sales for the embattled industry fell about 15% from the year-ago period, leaving the U.S. restaurant industry on pace to lose $240 billion in sales by the end of the year, according to the National Restaurant Association. On a year-over-year basis, the decline in August sales was still another monthly improvement after the sector's sales fell a revised 19.4% year over year in July and 22.1% in June.

—Read the full article from S&P Global Market Intelligence

Russia Urges End to Nord Stream 2 'Politicization' as Debate Enters Overdrive

Russia has called for an end to the "politicization" of the Nord Stream 2 gas pipeline as the political debate over the controversial project enters overdrive. Politicians across Europe have waded deeper into the debate since the poisoning of Russian opposition politician Alexei Navalny on Aug. 20. with new calls for Nord Stream 2 to be halted in response to the incident.

—Read the full article from S&P Global Platts

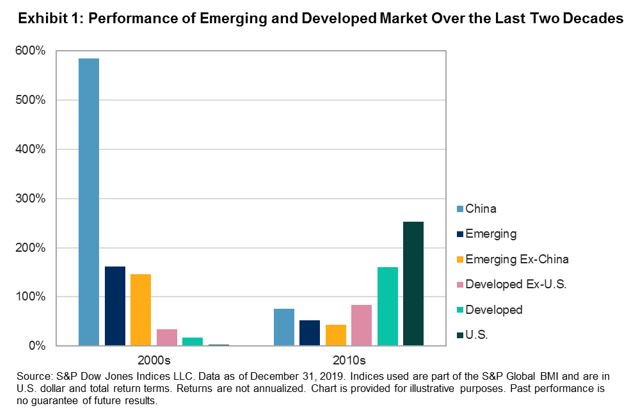

What Would Emerging Markets Be Without China?

While the S&P 500 is now up a healthy 6% YTD, the S&P Emerging BMI is essentially flat, with a total return in U.S. dollars of -0.06% (as of Sept. 14, 2020). The index’s performance masks a wide dispersion of returns among its constituents: a 53% spread separates the top performer, China, from bottom-of-the-pack Colombia. Few countries have begun the decade with gains: in fact, only China and Taiwan are in the green for 2020. Thanks in part to such strong recent performance, China has now become as important to the emerging markets as the U.S. is to developed markets, if not even more.

—Read the full article from S&P Dow Jones Indices

Comparing Defensive Factors During the Last 3 Bear Markets

In the factor world of investing, Low Volatility and Quality have been commonly referred to as defensive factors. The following is an examination of the performance of the S&P 500 Quality Index and the S&P 500 Low Volatility Index compared to the S&P 500 during the last 3 equity bear markets.

—Read the full article from S&P Dow Jones Indices

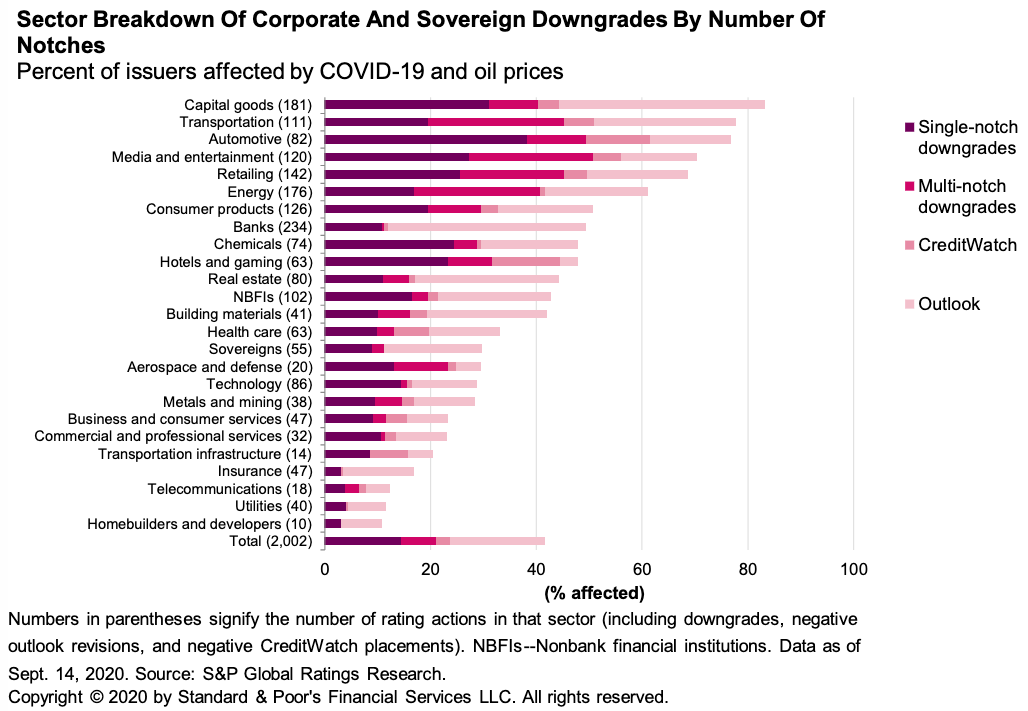

COVID-19- And Oil Price-Related Public Rating Actions on Corporations, Sovereigns, and Project Finance to Date

Rating actions have declined considerably since the highs in late March and early April. In fact, the tally of negative actions related to the COVID-19 pandemic and the oil-price dislocation declined to 20 this week--roughly one-10th the peak weekly amount. Most of the more recent negative rating actions have been downgrades, and most of these downgrades affected companies that had either negative outlooks or ratings on CreditWatch negative.

—Read the full report from S&P Global Ratings

Report Card: COVID-19 Casts Cloud Over Rated Irish Corporates’ Performance Gains

Stable and improving margin and leverage trends exhibited by most Irish-incorporated corporates in 2019 will be eroded in 2020 due to increased pressure on operating performance as the impact of the pandemic unfolds. Negative rating outlooks and CreditWatch placements have risen sharply by 33% to 39% to date in 2020, primarily because of the impact of COVID-19. However, downgrades have been limited and largely weighted toward more vulnerable sectors such as the transport-related industry.

—Read the full report from S&P Global Ratings

Listen: Take Notes: 2020 European Structured Finance Conference Recap: Where do We Go from Here

Head of S&P Global Ratings EMEA Structured Finance Research Andrew South joins host Tom Schopflocher to recap our third annual European Structured Finance Conference. We touch on key takeaways from the conference such as what’s driving low issuance volumes, how the securitization markets have fared since COVID-19 began, and what the outlook could look like going forward.

—Listen and subscribe to Take Notes, a podcast from S&P Global Ratings

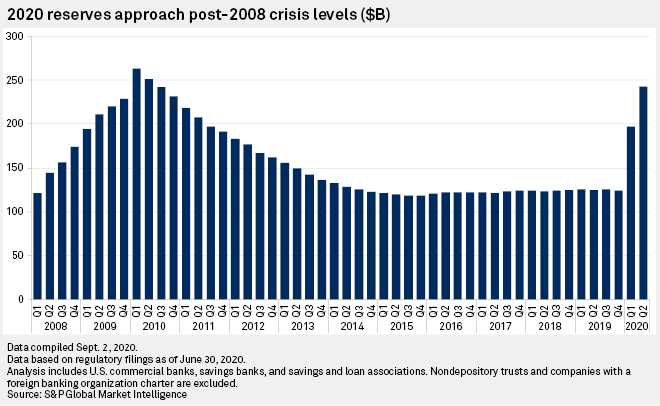

U.S. Loan Loss Reserves Approach Great Financial Crisis Levels

Banks' loan loss reserves approached Great Financial Crisis levels in the second quarter, but analysts are hopeful that the recent drop in deferral rates will enable a similar decline in provisioning. During the second quarter, the banking industry, in aggregate, had loan loss reserves totaling $242.79 billion, only slightly behind the Great Financial Crisis' peak of $263.11 billion in the 2010 first quarter.

—Read the full article from S&P Global Market Intelligence

China's Ant Group May Seek Clear Blue Skies in Southeast Asia to Grow via M&A

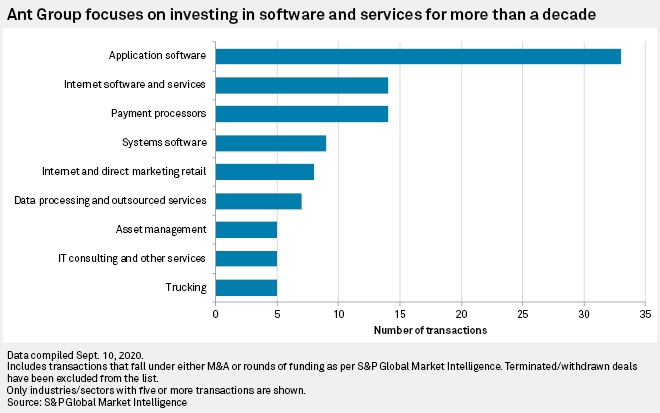

Ant Group Co. Ltd. may need to double down on its investments and consider more acquisitions in Southeast Asia after its IPO, as the parent of China's biggest mobile payments app, Alipay, seeks to tap the economic growth in the region where it faces relatively fewer challenges to its expansion. Excluding acquisitions and funding rounds that were less than US$50 million each, Ant made 46 investments globally totaling US$48.12 billion over the past five years, according to S&P Global Market Intelligence data.

—Read the full article from S&P Global Market Intelligence

Cyber Risk in a New Era: Remedy First, Prevent Second

Cybersecurity is a key risk that S&P Global Ratings embeds, as relevant, in its overall assessment of an entity's creditworthiness. The increasing frequency of attacks and the potential for rapid deterioration in credit profiles after an attack are risk factors that are relevant for Ratings’ rating assessments now. Leadership, communication, and external transparency are key to limiting the damage caused by a cyber attack. From a credit perspective, Ratings believes that these factors are the most important in limiting potential rating changes post attack.

—Read the full report from S&P Global Ratings

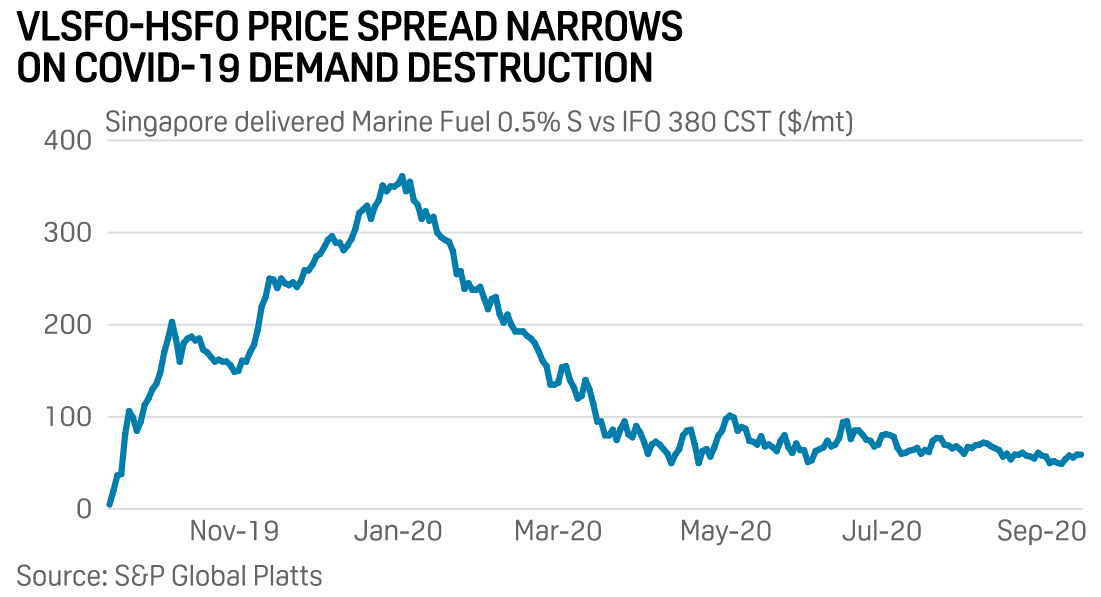

APPEC: Bunker Industry's Smooth Transition to IMO 2020 Paves Way for Decarbonization

The global bunker industry's smooth transition into the low-sulfur era mandated by the International Maritime Organization has sent a strong signal to the sector that it can achieve its next goal of decarbonization equally free of hurdles, industry sources said. "The IMO deserves credit as it was a [role] model to implement the regulation on an international basis," Mitsuyasu Kawaguchi, general manager of crude oil and tanker department at Japanese refiner Cosmo Oil said at the 36th Annual Asia Pacific Petroleum Virtual Conference, or APPEC 2020.

—Read the full article from S&P Global Platts

Businesses Call on U.S. Insurers to Join Global Trend of Ditching Fossil Fuels

A coalition of businesses across the United States joined to push the country's insurance sector to stop insuring and investing in the fossil fuel sector. A growing movement to push insurers, bankers and others in the financial sector away from coal, oil and other fossil fuels has achieved substantial success in Europe and is expanding in the United States. On Sept. 17, nearly 60 businesses called on U.S. insurers to drop their investments in fossil fuels to avoid worsening the impacts of global climate change. The list includes ice-cream maker Ben & Jerry's Homemade Inc., outdoor apparel retailers Aspen Skiing Co. LLC and Patagonia Inc., and tea manufacturer Bigelow Tea.

—Read the full article from S&P Global Market Intelligence

FDI Could Help Build the UK's EV Gigaplant Ambitions: CBI Executive

One possibility for the UK to build out its electric vehicle manufacturing ambitions would be for foreign companies to invest in the sector, according to the Confederation of British Industry's head of energy and climate change James Diggle. In conversation with S&P Global Platts on Sept. 16 Diggle said that there is a big question around domestic manufacturing, exacerbated by the pending Brexit process.

—Read the full article from S&P Global Platts

Watch: Market Movers Asia, Sep 14-18: All Eyes on #PlattsAPPEC as Key Stakeholders Tackle Oil Demand Recovery Roadmap

The highlights in Asia this week: Platts APPEC conversations keep oil markets abuzz, thermal coal traders eye further easing in Chinese import quotas, and bearish sentiments grip the dry bulk shipping sector. But first, the roadmap for oil demand recovery is in focus at the 36th Asia Pacific Petroleum Virtual Conference organized by S&P Global Platts. The conference is taking place at a time of plummeting oil consumption in Asia. The coronavirus pandemic had exposed weaknesses in regional refineries, and a slew of fuel producers have been constantly reviewing their 2020 operation plans in the face of falling margins and fast filling onshore storage.

—Watch and share this Market Movers video from S&P Global Platts

Saudi Arabia Keeps Pressure on OPEC+ Compliance, Warns Market Not to Test Bloc

Saudi energy minister Prince Abdulaziz bin Salman on Sept. 17 said he's secured commitments from OPEC+ compliance laggards to make good on their pledged crude production cuts by the end of December, then delivered a warning to market speculators betting against the alliance: "Make my day." Even as he declined to signal whether OPEC and its allies would taper their cuts, as scheduled, in 2021, saying he wanted to the market guessing and traders "jumpy," the prince said the producer coalition would keep its hand firmly on its taps and be "proactive and preemptive" on output policy as the global situation warrants.

—Read the full article from S&P Global Platts

Oil Crisis has Created New Market Dynamics, says Euronav CEO

The coronavirus pandemic has led to a shift in the tanker sector's supply-and-demand dynamics, with the floating storage bonanza that caused freight rates to spike higher set to provide three bumper quarters in 2020, according to Hugo De Stoop, CEO of Euronav, one of the largest global tanker operators. De Stoop said in an interview with S&P Global Platts on Sept. 7 the current "oil crisis" has affected many people in many directions in terms of investment capacity, with an intensification of temporary storage used as a buffer forming a key part of the landscape.

—Read the full article from S&P Global Platts

U.S. Coal Companies Now Squeezed by Pandemic Spent Billions on Shareholder Returns

Weak demand exacerbated by the global COVID-19 pandemic is putting pressure on U.S. coal mining companies that doled out cash to shareholders prior to the outbreak. Two of the country's largest coal producers, Peabody Energy Corp. and Arch Resources Inc., have spent $2.17 billion on share buybacks since 2016, favoring such spending to saving the cash, paying down more debt or investing in additional capital projects.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language