Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Sep, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Updating its official policy statement and economic projections, the U.S. Federal Reserve said it will keep its benchmark interest rate close to zero through at least 2023 and is now more optimistic about the U.S. economy’s recovery from the coronavirus pandemic than it was at the start of the summer.

Until labor conditions improve and “inflation has risen to 2% and is on track to moderately exceed 2% for some time,” the U.S. central bank will keep the federal funds rate at a target of 0% to 0.25%, according to its Sept. 16 statement.

Fed policymakers project that the world’s biggest economy will contract 3.7% this year, while headline unemployment will average 7.6% in the fourth quarter—marking a large improvement from their outlook in June of a 6.5% GDP decline and 9.3% joblessness rate.

“Economic activity has picked up from its depressed second quarter level when much of the economy was shut down to stem the spread of the virus,” Fed Chairman Jerome Powell said during a Sept. 16 press conference following two days of Federal Open Market Committee policy meetings. “The recovery has progressed more quickly than generally expected and forecasts from FOMC participants for economic growth this year have been revised up since our June summary of economic projections. Even so, overall activity remains well below its level before the pandemic and the path ahead remains highly uncertain.”

S&P Global Ratings also foresees the post-pandemic recovery lasting years.

“Even though the health effects of the pandemic may dissipate sometime in 2021, S&P Global Ratings expects credit measures for some sectors will take longer to fully recover. Part of the reason is a massive increase in new debt issuance, with the year-to-date total of $1.6 trillion, rising 60% over the same period in 2019,” S&P Global Ratings said in a June report. “Incremental debt used to finance operations could delay the recovery of credit metrics for some sectors beyond simply a recovery in revenue and earnings into 2022, 2023, and beyond.”

Mr. Powell said that the Fed is “strongly committed” to achieving the monetary policy goals of maximum employment and price stability as outlined by Congress, and emphasized that “the fiscal support has been essential in the good progress we see now” and that “more fiscal support is likely to be needed.”

The statement comes as legislators on Capitol Hill are deadlocked on a $1.5 trillion bipartisan plan proposed Sept. 15 by the House’s Problem Solvers Caucus that would give new $1,200 stimulus checks to Americans. Republican lawmakers expressed concerns that the stimulus package is too expensive, while Democratic lawmakers said the bill doesn’t go far enough.

"The Fed is in a very tough position," Nisha Patel, director of fixed income portfolio management at Parametric Portfolio Associates, told S&P Global Market Intelligence on Sept. 15 ahead of the Fed’s statement. "There's only so much monetary policy can do."

President Donald Trump said at a Sept. 16 press conference that he “like[s] the larger amount” of fiscal stimulus,” although “some of the Republicans disagree,” and that he believes he can “convince them to go along with that because I like the larger number. I want to see people get money.”

The Organization for Economic Cooperation and Development urged governments to implement more targeted and flexible policies to support their economies and restore confidence. In its interim economic outlook, the OECD now projects the U.S. economy to contact by 3.8% this year. The global economy is expected to shrink by 4.5%— an improvement from the OECD’s June forecast of a 6% global GDP decline.

“Even if this crisis is strikingly different from others we have experienced and uncertainty is extremely high, we have seen that policy matters. In the confinement phase of the COVID-19 crisis, policymakers worldwide used a rich policy toolbox,” OECD Chief Economist Laurence Boone said in a Sept. 16 statement. “Policy will continue to play an important role in the next phase of the crisis.”

“Fiscal support will have to continue,” Ms. Boone said. “Policy can only temporarily prevent a rise in bankruptcies and unemployment. Support to firms must evolve to let non-viable firms go and encourage viable ones to grow.”

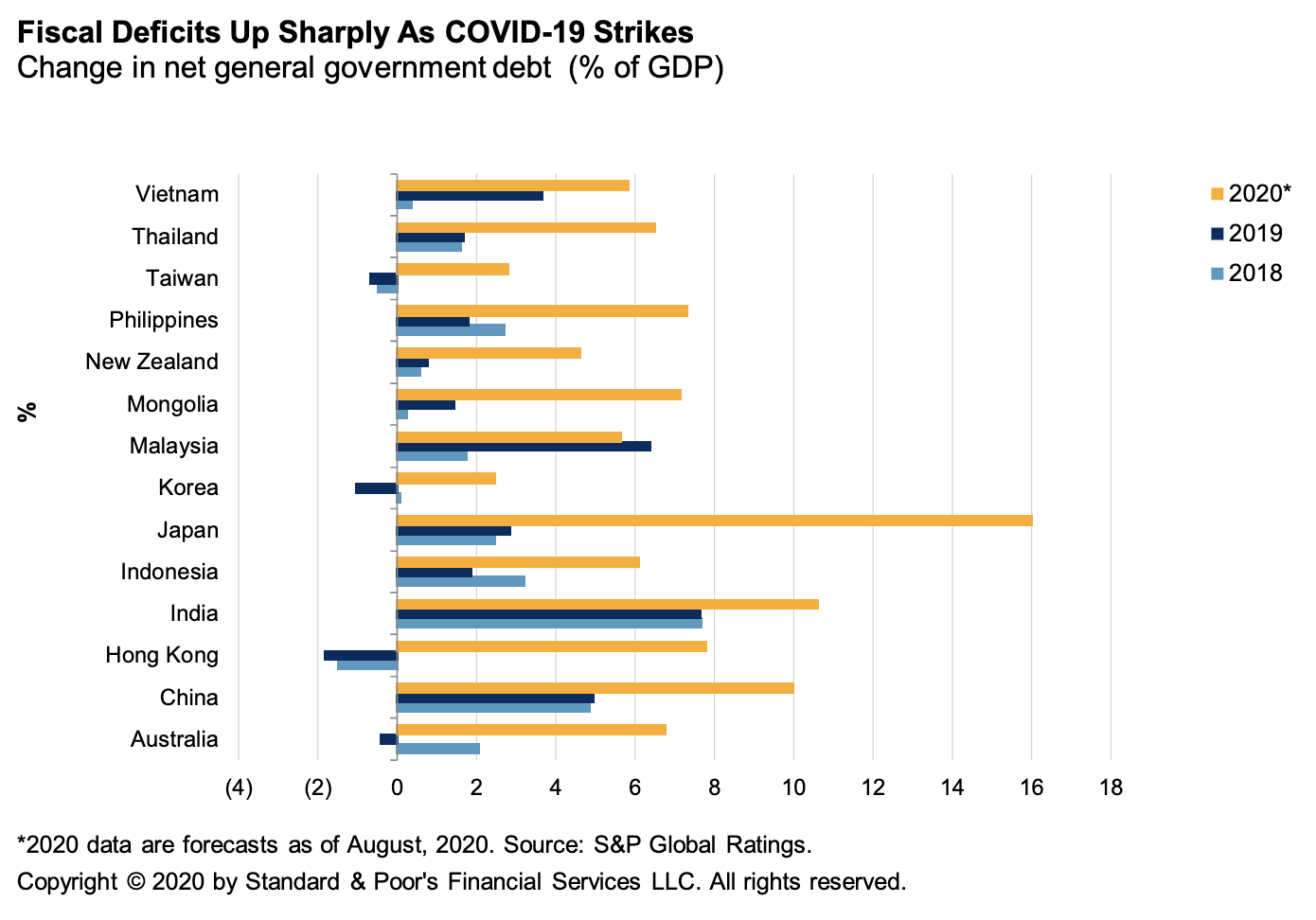

Elsewhere in the world, central banks in emerging market economies that are following their peers in advanced economies like the U.S. in purchasing large amounts of government debt during the current crisis may face reputational risks, according to S&P Global Ratings.

“Pushed too far, S&P Global Ratings believes the programs may impair the ability of central banks to respond to future crises, with rating implications for the respective sovereigns,” S&P Global Ratings said in a Sept. 14 report. “If investors begin to view government reliance on central bank funding as a long-term, structural feature of the economy, these monetary authorities could lose credibility. In this scenario, the central banks are effectively ‘monetizing’ the fiscal deficit by using money creation as a permanent source of government funding. In some cases, this could weaken monetary flexibility and economic stability, which could increase the likelihood of sovereign rating downgrades.”

Today is Thursday, September 17, 2020, and here is today’s essential intelligence.

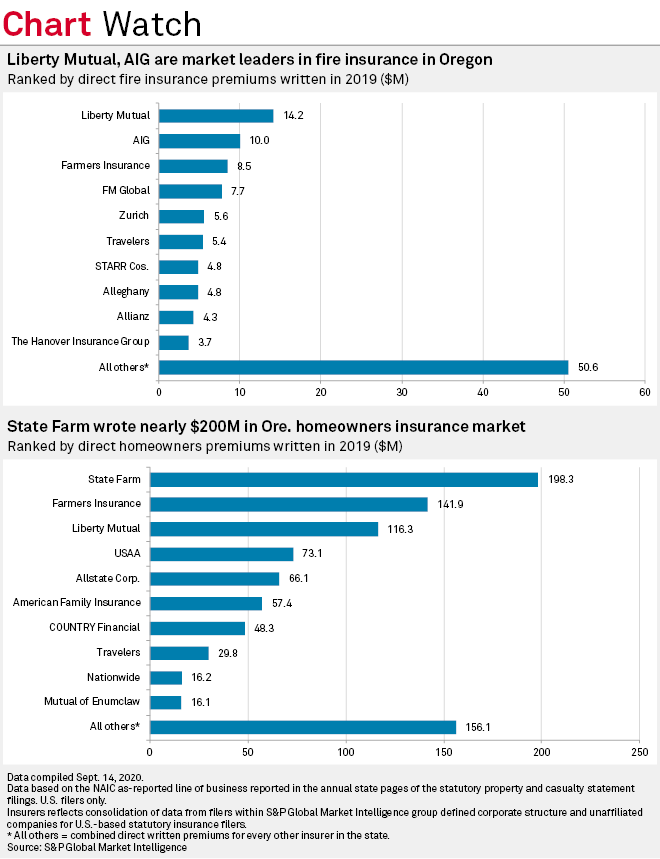

State Farm, Farmers Among Biggest Homeowners Writers in Fire-Scorched Oregon

The destructive blazes in Oregon, which firefighters are still battling, have already destroyed numerous structures and homes in the state. Early estimates of insured losses resulting from the wildfires have yet to be released, but the 2019 annual statutory data shows that State Farm Mutual Automobile Insurance Co. has the largest exposure in the homeowners line of business in Oregon. State Farm subsidiary State Farm Fire & Casualty Co. wrote $198.3 million in direct premium, controlling 22% of the homeowners insurance market in the state.

—Read the full article from S&P Global Market Intelligence

Former U.S. CDC Chief Criticizes COVID-19 Vaccine Opaqueness, Political Meddling

Biopharmaceutical companies that have received billions of dollars from U.S. taxpayers to support COVID-19 vaccine research and development are not being transparent enough with the American public and should share their full study protocols, the former head of the U.S. Centers for Disease Control and Prevention said. "I don't see any valid reason for them not to do so," said Tom Frieden, who ran the CDC for eight years during the Obama administration.

—Read the full article from S&P Global Market Intelligence

EM Central Banks Risk Reputations with Bond-Buying Programs

Some emerging market central banks are following their peers in advanced economies in purchasing sizable amounts of government debt this year. The central banks of India and the Philippines have bought US$24 billion of government bonds this year, with little pushback from investors. Bank Indonesia also started primary market purchases in April, and introduced a comprehensive debt-burden sharing agreement with the government in July. But if these institutions push their purchases too far, price stability and other risks could arise, with implications for sovereign ratings.

—Read the full report from S&P Global Ratings

Rising Funding Costs May Tip China's Weaker SOEs into Default

Many signs point to more defaults by China's state-owned enterprises (SOEs). Corporate leverage is rising amid tough operating conditions and policy-guided investment spending. Funding costs are diverging, with investors demanding much-higher coupons for weaker SOEs. S&P Global Ratings believes tighter monetary conditions could also speed the journey to default.

—Read the full report from S&P Global Ratings

Corporate Bond Markets Resilient Amid Shake-up in Equities – Risk Monitor

The first half of September was turbulent for U.S. equities, with the S&P 500 slumping from a record high before re-gathering momentum, but corporate bond markets largely maintained their serene progress even amid elevated issuance. Between Aug. 31 and Sept. 14, the ICE Bank of America investment-grade corporate bond spread against U.S. Treasurys was unchanged at 136 basis points, remaining range-bound between 134 bps and 137 bps throughout.

—Read the full article from S&P Global Market Intelligence

The Health Care Credit Beat: A Rapid Bounce Back in Demand Accelerates the U.S. Industry’s Recovery Timelines

The U.S. health care industry's drop in demand at the beginning of the pandemic has bottomed out and a recovery is well underway. As such, S&P Global Ratings has shortened it expected recovery timelines for several subsectors and Ratings believes all subsectors should recover by year-end 2021. Even though some regions are still experiencing spikes in COVID-19 cases, due to time and experience, providers are better equipped to deal with the deluge. Ratings doesn’t expect a return to the lows of the earlier stages of pandemic in late March/early April.

—Read the full report from S&P Global Ratings

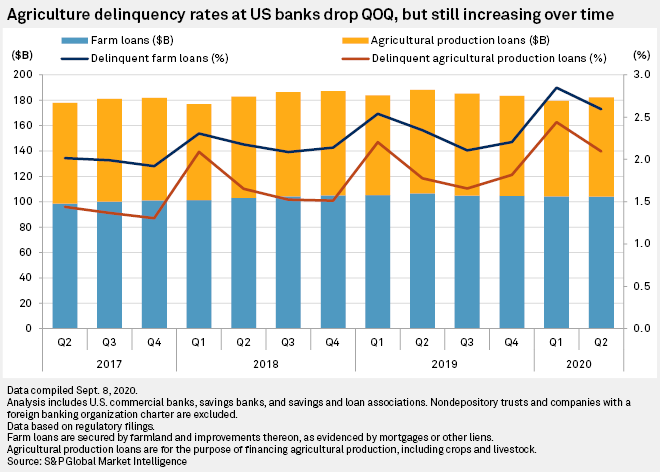

Agriculture Loan Delinquencies Climb YOY at U.S. Banks in Q2'20

Agriculture loans 30 days or more past due or in nonaccrual status hit 2.4% of total agriculture loans at U.S. banks and thrifts as of June 30, up from 2.1% in the same quarter in 2019, but down from 2.7% in the first quarter. Delinquencies for agricultural production loans, which finance things like equipment and seeds, stood at 2.1%, down from 2.4% in March but up compared to 1.8% in June 2019. Meanwhile, delinquencies for farm loans, which finance land, stood at 2.6%. This was 26 basis points less than the previous quarter but 25 basis points higher than the same period last year.

—Read the full article from S&P Global Market Intelligence

Biden's Corporate Tax Plan Could Cost 10 Largest U.S. Banks $7B per Year

As the U.S. elections approach, a changing of the guard could deliver income headwinds through higher taxes, but an increase in the corporate rate can lead to stronger book values for banks with deferred tax assets. Under Democratic nominee Joe Biden's tax plan, the nation's 10 largest banks could see their combined annual net income decline by more than $7 billion, according to an S&P Global Market Intelligence analysis that used the mean of equity analysts' estimates for 2021. The analysis also examined 209 publicly traded banks with at least three analyst estimates and found that a 28% tax rate would reduce the universe's aggregate annual income by $9.36 billion.

—Read the full article from S&P Global Market Intelligence

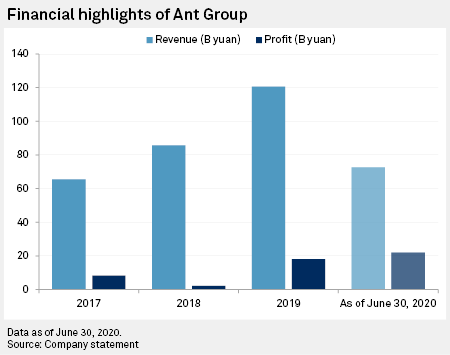

Ant Group's Lack of Strong Messaging Platform Concerns Investors as IPO Looms

Could Alipay, which became China's largest mobile payments platform after it was spun off from e-commerce giant Alibaba Group Holding Ltd., lose its dominance to rival WeChat Pay that is embedded in the nation's most popular messaging app? That billion-dollar question still divides analysts as Alipay's parent, Ant Group Co. Ltd., prepares for what could be the world's biggest-ever IPO to be launched in Hong Kong and Shanghai simultaneously.

—Read the full article from S&P Global Market Intelligence

Listen: How Batteries Can Help California's Grid Problems

As the 2020 wildfire season continues to inflict massive amounts of damage across the American West, a key question will be how much, and how fast, the battery storage sector can mobilize to reinforce the power grid in California and elsewhere. In its latest episode, S&P Global Market Intelligence's Energy Evolution podcast spoke to several experts about the growth prospects for battery storage and the implications for the grid.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Market Intelligence

AMTE Eyes Electrifying Mining Business

UK-based AMTE Power is looking at exporting its technology to Australia, with sights set on helping the mining industry lower its carbon footprint by possibly electrifying its fleet, alongside other battery solutions, company director Kevin Brundish told S&P Global Platts. On Sept. 15, the battery cell manufacturer signed a Memorandum of Understanding with infrastructure specialist InfraNomics, in an attempt to build lithium batteries in Western Australia for the growing storage sector.

—Read the full article from S&P Global Platts

Poland’s PGE Targets Zero Carbon Emissions by 2050: CEO

Poland's largest utility, Polska Grupa Energetyczna (PGE), is planning to phase out coal and offer zero emission energy by 2050, CEO Wojciech Dabrowski said Sept 15. "PGE, as the largest company in the sector, will play a key role in achieving zero emissions by Poland," Dabrowski said at a Q2 results news conference. "Our strategic aspiration is to offer 100% green energy to PGE customers in 2050."

—Read the full article from S&P Global Platts

Kajiyama Re-appointed METI Minister as Japan Prepares for Energy Transition

Japan's newly elected prime minister, Yoshihide Suga, has re-appointed Hiroshi Kajiyama as minister of economy, trade and industry, after the cabinet of former prime minister Shinzo Abe formally resigned, Chief Cabinet Secretary Katsunobu Kato said Sept. 16. This means Kajiyama will be at the helm of Japan's de-facto energy ministry at a time when the country is seeking to square the circle of achieving an energy transition while meeting its energy needs.

—Read the full article from S&P Global Platts

U.S. Agency Proposes Expanding Waters Open to Impacts Without Permits

The Trump administration has proposed further rolling back protections for federal wetlands and waterways impacted by coal mining, renewable energy construction, farming and other kinds of commercial activities. The move could leave drier sections of the U.S. with scant restrictions on damaging rivers and streams, according to environmentalists. The U.S. Environmental Protection Agency and U.S. Army Corps of Engineers issued a regulation in January, which was finalized in April, redefining what the U.S. government classifies as waters regulated under the Clean Water Act, shrinking the number of protected wetlands, seasonal streams and creeks under the statute.

—Read the full article from S&P Global Market Intelligence

APPEC: China's Key Oil Product Exports set to Fall in 2020 Amid Tepid International Demand

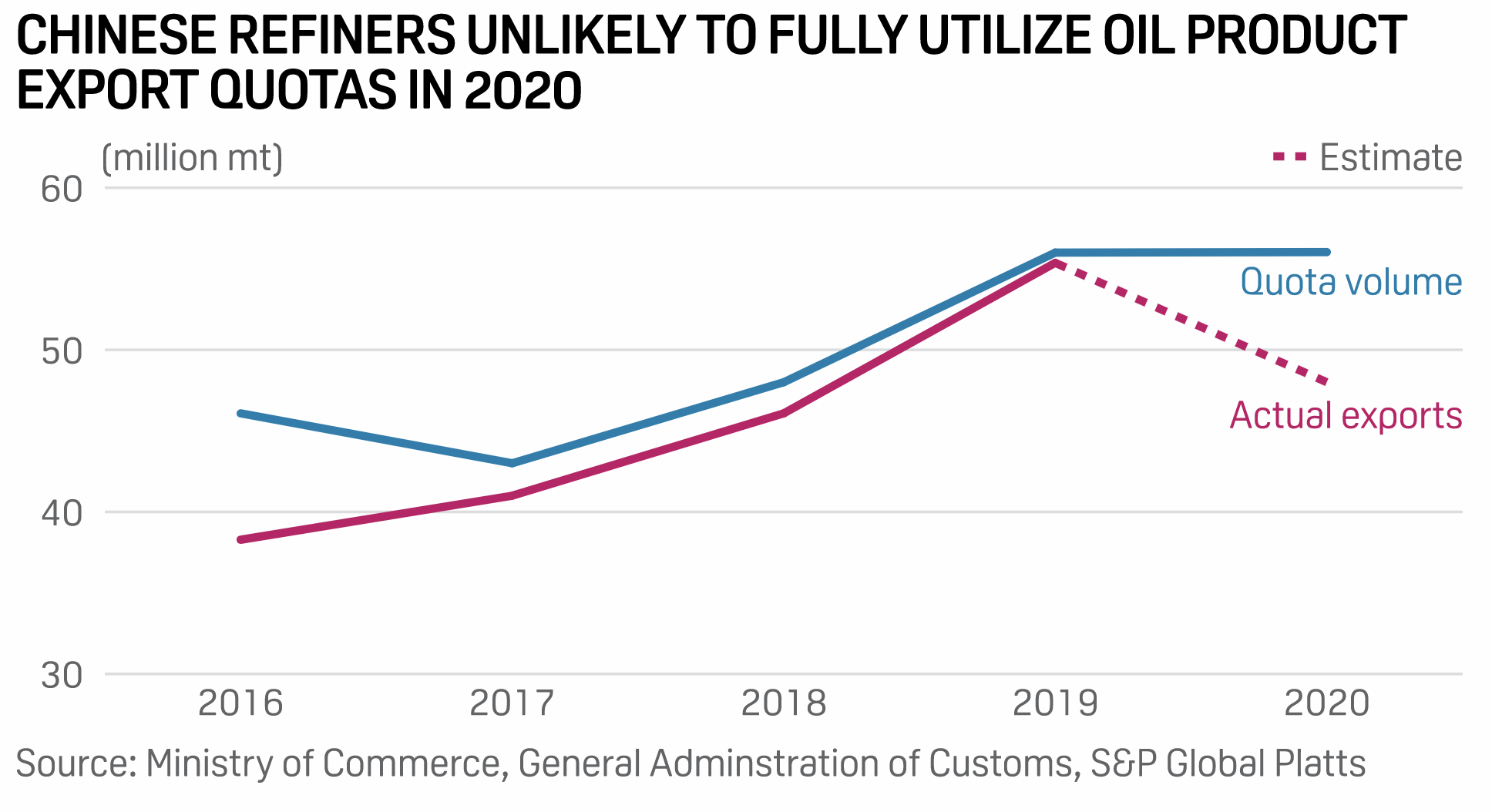

China is set to register a sharp decline in oil product exports for calendar 2020 and oil companies may fail to fully utilize their export quotas as they find sales in the international market difficult during the coronavirus pandemic, a senior trading official at a state-owned oil giant said on the sidelines of the S&P Global Platts Asia Pacific Petroleum Virtual Conference, or APPAC, over Sept. 14-16. Beijing so far has allocated 56.03 million mt quotas for exporting gasoline, gasoil and jet fuel in 2020, slightly higher than the 56 million mt allocated in 2019.

—Read the full article from S&P Global Platts

APPEC: Global Bunker Demand Set for Sharp Fall as COVID-19 Hurts - IBIA Executive

Global bunker fuel demand is expected to decrease significantly in 2020, reflecting the impact of the coronavirus pandemic, with tough market conditions amplifying credit risks in an industry that had to earlier transition to the International Maritime Organization's low sulfur mandate, Unni Einemo, director of International Bunker Industry Association, said on Sept. 16.

—Read the full article from S&P Global Platts

EIA Data Shows U.S. Crude Stocks Fall Amid Refinery Rebound, Import Decline

U.S. crude inventories declined in the week ended Sept. 14 as refinery demand rebounded following Hurricane Laura and imports flagged, U.S. Energy Information Administration data showed Sept. 16. Commercial crude inventories declined 4.39 million barrels during the week ended Sept. 11 to 496.05 million barrels, EIA said, putting stockpiles 13.3% above the five-year average, in from 14.4% the week prior.

—Read the full article from S&P Global Platts

U.S. Watches Iranian Fuel Cargoes to Venezuela, Keeps up Pressure on Other Shippers

U.S. sanctions have deterred all but Iranian tankers from delivering gasoline to fuel-starved Venezuela, and the Trump administration will keep up pressure on the global shipping industry to avoid the trade, a top State Department official said Sept. 16. Elliott Abrams, special representative for Iran and Venezuela, told reporters during a briefing that the Trump administration has successfully pushed out all shipping market participants except Iran from making fuel deals with Venezuela.

—Read the full article from S&P Global Platts

U.S. Storms Buoy Asian Transport Fuels amid Shaky Fundamentals

The arrival of hurricane season in the U.S. has injected some much-needed fresh support for Asia's transportation fuels markets, as crack spreads and cash differentials receive a boost in light of persistently lagging fundamentals. On the gasoline front, the FOB Singapore 92 RON gasoline crack spread against front-month ICE Brent crude futures jumped to a three-month high of $4.31/b at the Asian close on Sept 15, last higher on June 24 at $4.83/b, Platts data showed.

—Read the full article from S&P Global Platts

Analysis: Lower Permian Gas Production, Higher Prices to Drive Shift in Regional Flow Dynamics

The recent drop in Permian gas production could soon drive a significant shift in regional flow dynamics, with higher West Texas gas prices posing a risk to supply flowing to Midcontinent and San Juan markets. Following a 4 Bcf/d, or more-than-30%, decline in the wake of the March oil-market collapse, Permian Basin gas production has struggled to mount a recovery this year. In September, output has averaged just 10.6 Bcf/d as the basin's growing inventory of aging wells reverses a mid-summer rebound that was largely fueled by previously curtailed production.

—Read the full article from S&P Global Platts

Iron Ore & Steel Q4 Outlook: Iron Ore to Stay Strong Despite Fall in Steel Output

Iron ore prices are expected to remain relatively strong in the October-December quarter despite demand falling on the back of reduced crude steel production, according to the latest S&P Global Platts quarterly Iron Ore & Steel Outlook released Sept. 16. The Outlook found that 54% of respondents expected iron ore prices to range between $100/mt and $110/mt CFR China in calendar Q4. Just over one-third believed iron ore prices would stay above $110/mt and 11% thought they would fall below $100/mt.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language