Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Sep, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

M&A is MIA in First Half of 2022

M&A is a measure of optimism in the markets. When times are good, capital is cheap and valuations are growing, it is easy to imagine that the right merger or acquisition will push a company to new heights. But a bear market requires a different calculus.

This year has been challenging for M&A. Volatility increased in the second quarter, with the Chicago Board Options Exchange Volatility Index, the market’s “fear gauge,” recording an average close of 27.4. Some of this instability was attributable to the Russia-Ukraine war, which has increased global commodity and energy prices, leading to inflation. Other challenges have included lockdowns disrupting supply chains and large stimulus packages in the U.S. and Europe, which may have contributed to the current high inflation. Central banks have responded to this inflation with tighter monetary policy, which drives up the cost of capital.

In the first half of 2022, the total value of M&A announcements dropped 26.2% year over year to $1.710 trillion, according to S&P Global Market Intelligence's “Q2'22 M&A and Equity Offerings Market Report.” Falling equity valuations, surging inflation, rising interest rates and geopolitical uncertainty have depressed M&A dealmaking this year. Meanwhile, the cost of financing transactions has increased due to hawkish monetary policy from central bankers.

These market conditions drove many of the biggest players in the M&A space to go quiet during the first half. Private equity firms have slowed or even stopped pursuing M&A, as the higher cost of capital has made the leverage they depend upon prohibitively expensive. Over the last three years, special purpose acquisition companies have become big players in M&A. But this year, increased regulatory scrutiny and an absence of high-quality targets has meant that many of these companies are lying low.

The technology industry is usually rife with M&A, but regulatory headwinds have caused large segments of the industry, such as semiconductors, to cancel or suspend such activity. Some technology companies have redesigned their M&A strategies to avoid regulators’ ire, concentrating on acquiring smaller companies with lower market share in noncore businesses.

Globally, some regions are showing continued strength in M&A. The long-term prospects in the Gulf remain strong, according to S&P Global Market Intelligence. Activity in Europe accelerated in the second quarter. China, which has been the center of so much M&A activity, has changed its focus. Gone are the big-ticket outbound deals, having been replaced by smaller deals in the domestic market that are less likely to fall afoul of government regulators.

M&A announcements picked up somewhat in August, at least in comparison to June and July. Activity is likely to improve again in the future once a sense of optimism returns to markets. When it does, it will be with higher interest rates and stricter covenants, less debt and more equity.

Today is Wednesday, September 14, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

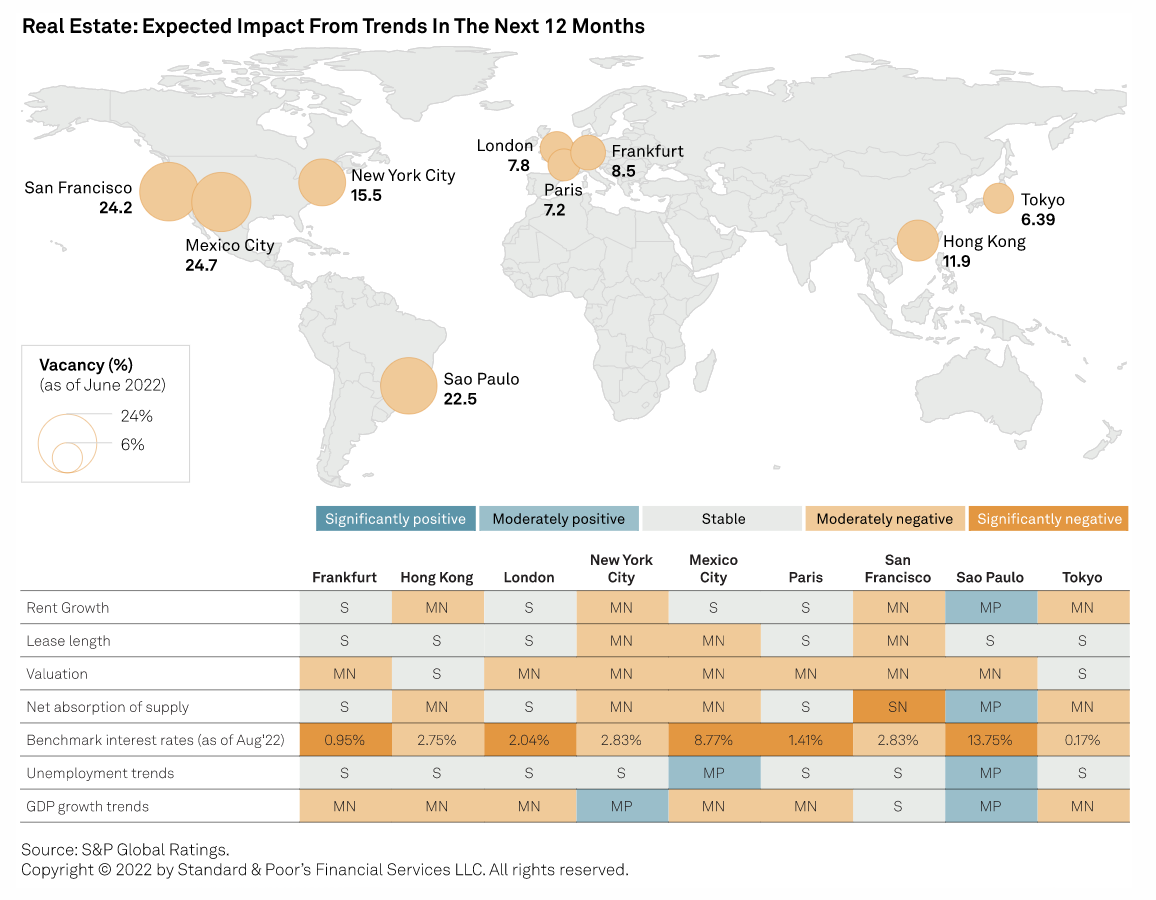

Property In Transition: Slowing Economies And Shrinking Demand Pressure The Credit Outlook For Office Landlords

A resurgence of COVID cases, along with commuting and safety concerns, have delayed the return to office, and employees are settling into rituals of remote work. Despite increased vaccination rates and a lower death rate from COVID, office utilization remains low globally; it has been somewhat stronger in Tokyo, where office utilization is about 60% of pre-pandemic levels, compared to the U.S., where office utilization was only about 44% for a 10-city average as of July 2022, according to Kastle systems, which tracks keycard access to buildings.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Listen: Street Talk | Episode 99 - Higher Rates Punish Bond Portfolios, Weigh On Bank M&A

The Federal Reserve's aggressive tightening of monetary policy has pushed bank bond portfolios deep into negative territory, altered previously struck bank M&A deals and has given pause to some would-be buyers. In the episode, bankers and advisers from Piper Sandler's depository investment bank team and PNC's Financial Institutions Advisory Group discuss how higher rates have negatively impacted bank deal math, tangible book value and changed the way acquirers communicate with the Street.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

Access more insights on capital markets >

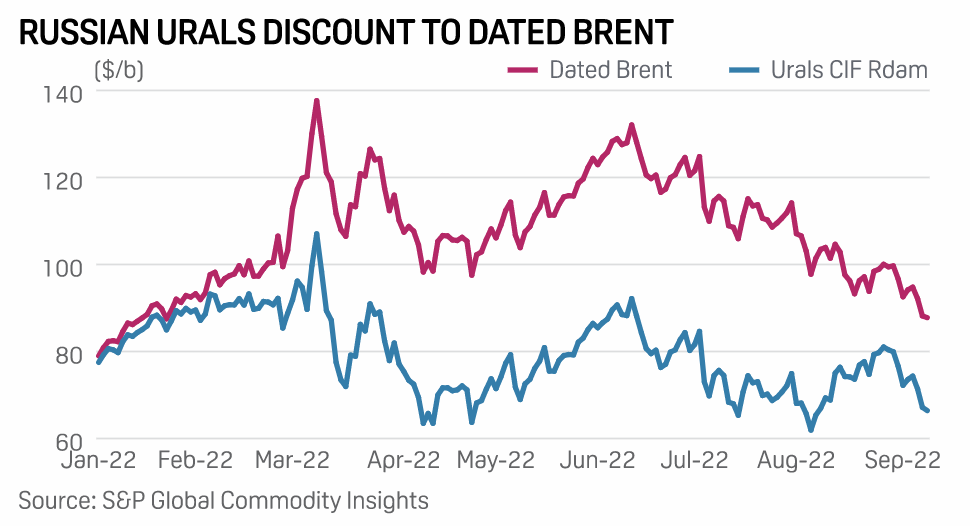

Fuel For Thought: G7 Price Cap On Russian Oil Hangs On Asia’s Ability To Squeeze Russia

China and India hold the key to the success, or failure, of a price cap on Russian oil proposed by the G7. Asia's largest oil consumers are expected to buy even more cheap Russian crude if the U.S.-led coalition's attempt to starve President Vladimir Putin of oil earnings to fund its war in Ukraine plays out. But the market remains divided over whether the latest efforts to hurt Russia financially will fall flat or even backfire, accelerating a potential global recession.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

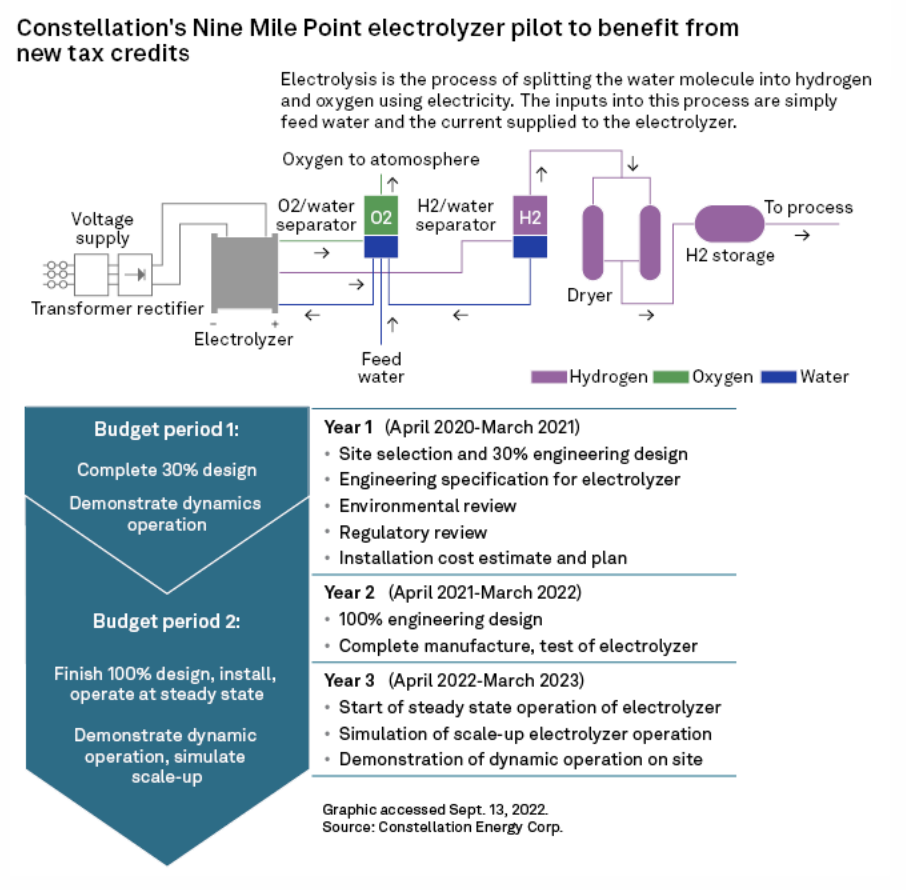

Nuclear Operators Poised To Benefit From Hydrogen Tax Credits In U.S. Climate Law

Nuclear plant owners already looking at a tax credit in the recently passed U.S. federal climate package derive additional benefits by supplying electricity to hydrogen producers, according to industry analysts. Constellation Energy Corp., with a nuclear generation fleet of more than 21,600 MW, in particular, would benefit from unlocking "new potential opportunities for merchant nuclear plants and attractive returns for hydrogen facilities," Morgan Stanley told clients in a Sept. 12 report.

—Read the article from S&P Global Market Intelligence

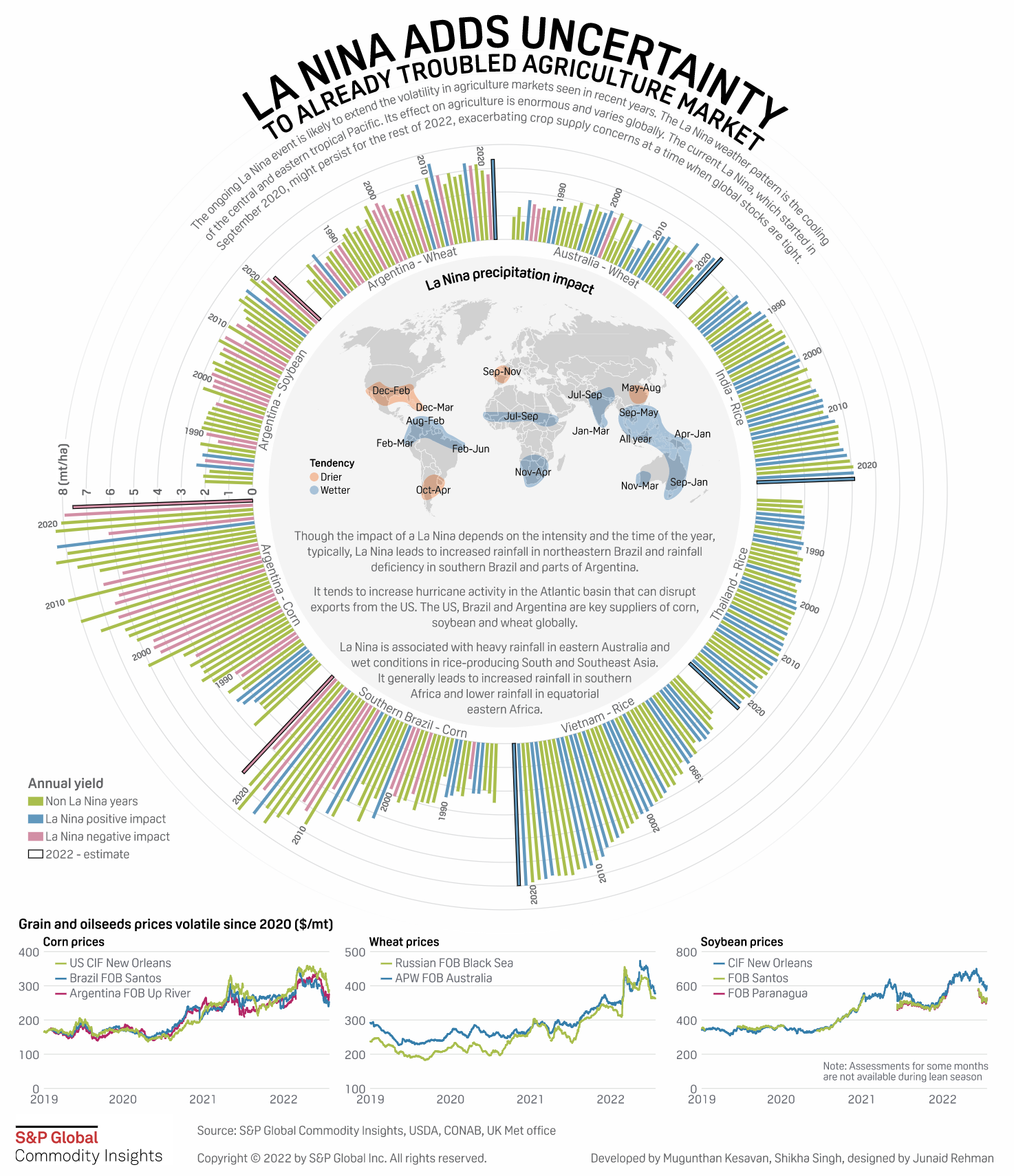

Triple-Dip La Nina May Further Heighten Supply Issues In Agriculture Markets

The ongoing La Nina climate phenomenon may extend into its third year in a rare event to become what is called a triple-dip La Nina. This is likely to extend the uncertainty currently prevailing across agriculture markets as supply estimates for various food commodities faltered this year, largely driven by weather adversities in top producing countries. Prices of wheat, corn and soybeans have remained volatile with an upward edge. Weather, although not the only factor, has been a major driver of these volatilities.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

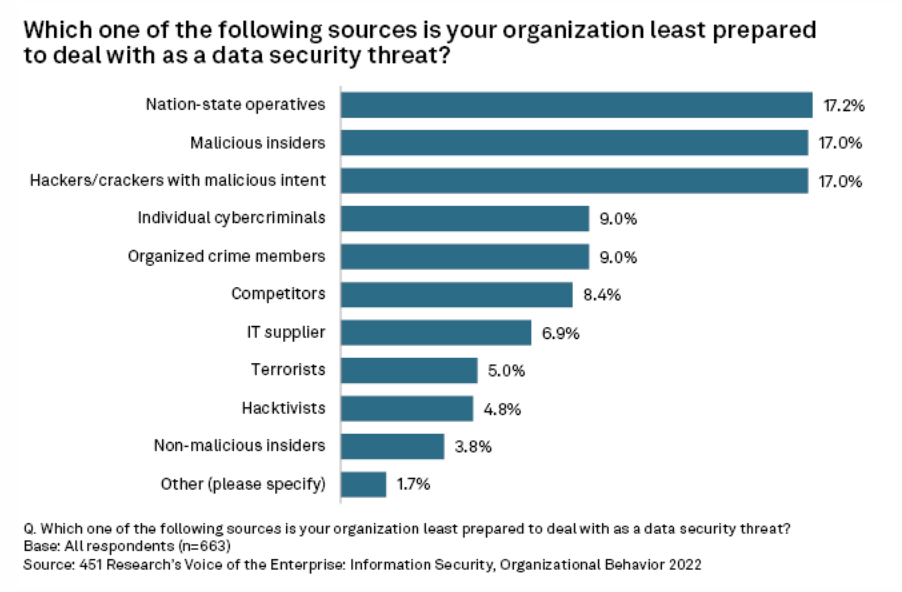

U.S. Still Vulnerable To Cyberattacks On Key Infrastructure, Security Experts Say

As the U.S. works to shore up funding for cyber protections in its 2023 defense bill, security experts warn that critical infrastructure remains vulnerable. More than six months since the U.S. Cybersecurity and Infrastructure Security Agency issued a heightened cybersecurity alert for organizations, security experts and industry executives say more detailed guidance and standardization is needed to better safeguard potential U.S. targets. That may require more investment from both public and private sources, they note.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >