Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 7 Oct, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Storm Clouds on the Horizon for a Fragile U.S. Economy

Analyzing the state of the U.S. economy is a matter of balancing the positive indicators with the negative ones. On the plus side, the labor market remains robust. On the negative side, the other nine leading indicators monitored by the S&P Global Ratings economics team are neutral to negative. While the weight of evidence points toward recession, there remains a narrow path to avoid a severe economic downturn.

In 2022, the U.S. economy continues to grow. The current GDP forecast for the year from S&P Global Ratings indicates 1.6% growth. The Economics & Country Risk team points to a particularly strong August for GDP growth, due to net exports and inventory investment from manufacturers and retailers. While this looks positive, there is some indication that inventories were already over-full due to supply chain concerns and nonfarm inventory numbers will decline for the next few months.

Other apparently positive news is the continued strength of the jobs market. Hourly wages in July were up 5% year over year and the unemployment rate is holding steady around 3.7%. The labor force participation rate is also improving. Many U.S. workers left work during the pandemic due to safety concerns or the need to care for children who could not attend school. This decline particularly affected women. However, both male and female labor force participation rates have returned to almost pre-pandemic levels.

“But even this solid pace of wage growth is still not enough to cover ever-higher prices at the grocery store or gas station,” Beth Ann Bovino, U.S. chief economist for S&P Global Ratings, wrote in a recent outlook. “Indeed, while nominal wages are strong, in real terms, August wage gains on a year-over-year basis once again remained negative for the 17th straight month, thanks to inflation.”

Inflation also creates a bit of a catch-22 for the strong labor numbers in the U.S. With the Federal Reserve focused on hawkish monetary policy, continued low rates of unemployment encourage it to raise interest rates more often. A resilient jobs market and higher wages may contribute to the higher inflation that the Fed is committed to controlling. The turning point for this monetary tightening is an economic tumble of variable severity that lowers demand, lowers prices and allows the Fed to change course.

That economic downturn appears increasingly likely. The Financial Fragility Indicator used by the S&P Global Ratings economics team — a blended indicator of various financial risk metrics — has shown rapid deterioration in recent months for both households and nonfinancial corporates. Stock prices have been in bear market territory for months and bond yields continue to rise. Even the strength of the U.S. dollar is bad news for U.S. exporters.

According to S&P Global Ratings, the narrow path to avoid recession still involves an economic stumble and a reversal toward looser monetary policy from the Federal Reserve.

Today is Friday, October 7, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

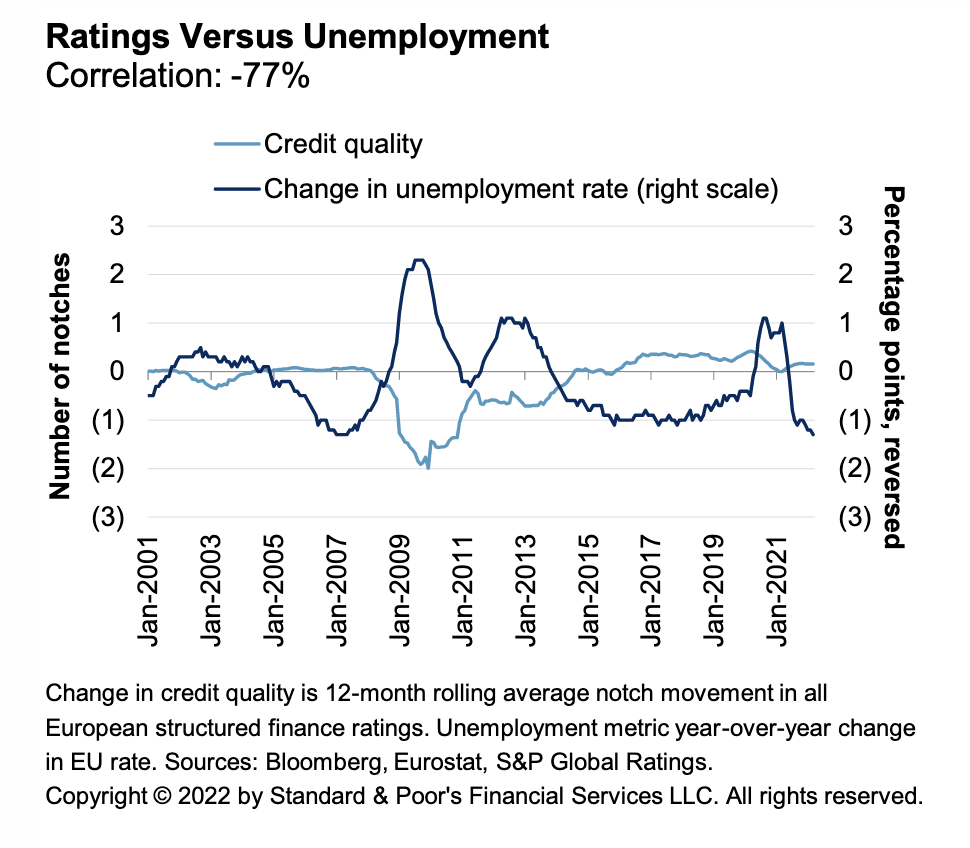

Cost Of Living Crisis: Despite Pockets Of Weakness, European Consumer ABS Shows Structural Resilience

In S&P Global Ratings' opinion, European and U.K. consumer asset-backed securities' credit performance and ratings look set to be resilient in the face of cost-of-living pressures, with collateral performance deterioration likely to appear in unsecured and non-prime ABS earlier than secured and prime ABS. To gauge how European and U.K. consumer ABS transactions that it rates are faring, S&P Global Ratings reviewed their collateral performance, as well as available structural protection to mitigate the impact of any deterioration.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

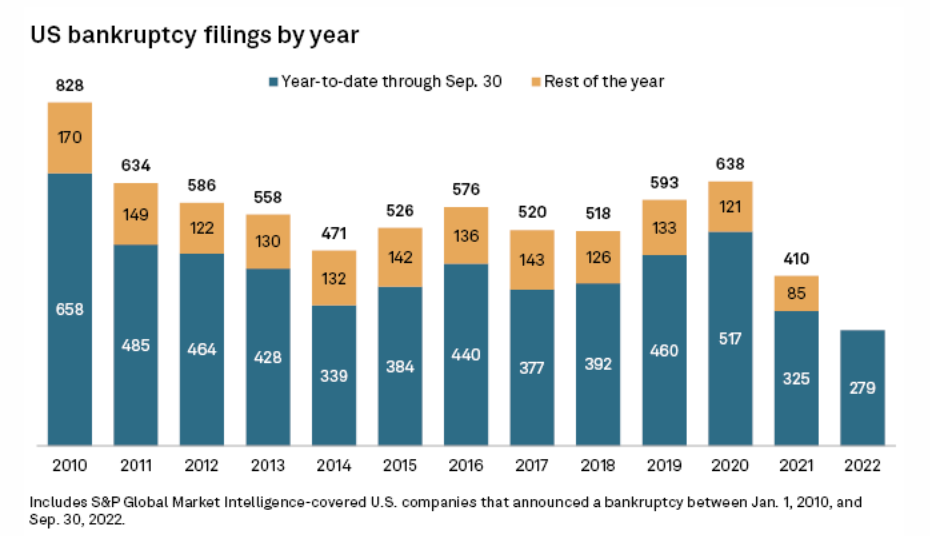

U.S. Corporate Bankruptcy Filings Tick Down In September

U.S. corporate bankruptcies fell slightly in September from the previous month, according to S&P Global Market Intelligence data. There were 31 bankruptcy filings in September, down from 37 in August. As of Sept. 30, 279 companies had filed for bankruptcy in 2022, fewer than any other comparable period going back to at least 2010.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

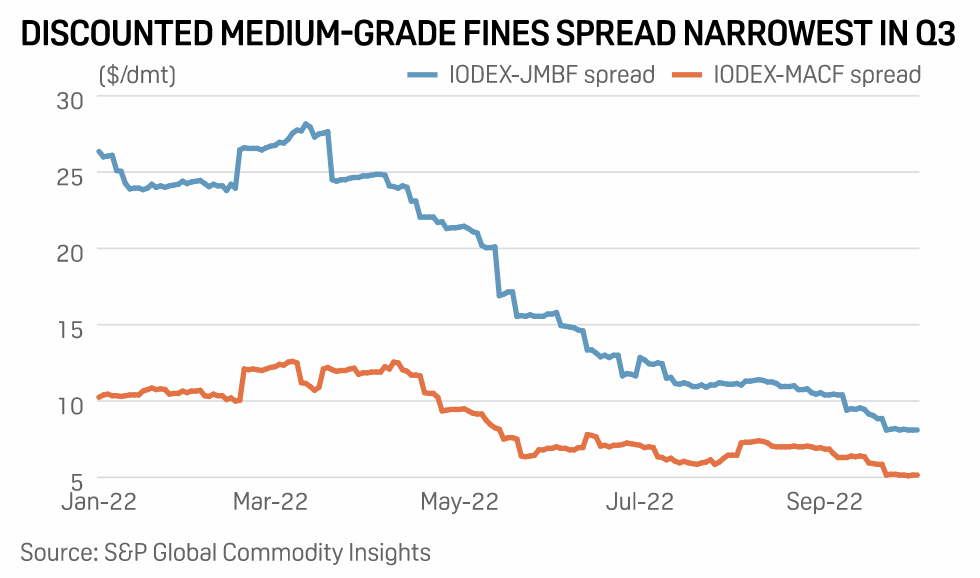

Trade Review: Sluggish Asian Steel Demand To Dampen Pace Of Iron Ore Price Recovery In Q4

With China's property slump and pandemic resurgence putting a lid on hopes for demand recovery, iron ore prices in Asia will continue to grind lower in the fourth quarter as steel production cuts intensify during the winter season. China's property sector had a turbulent last quarter, with default of loans from buyers and developers a common occurrence, slowing private residential construction in the country.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

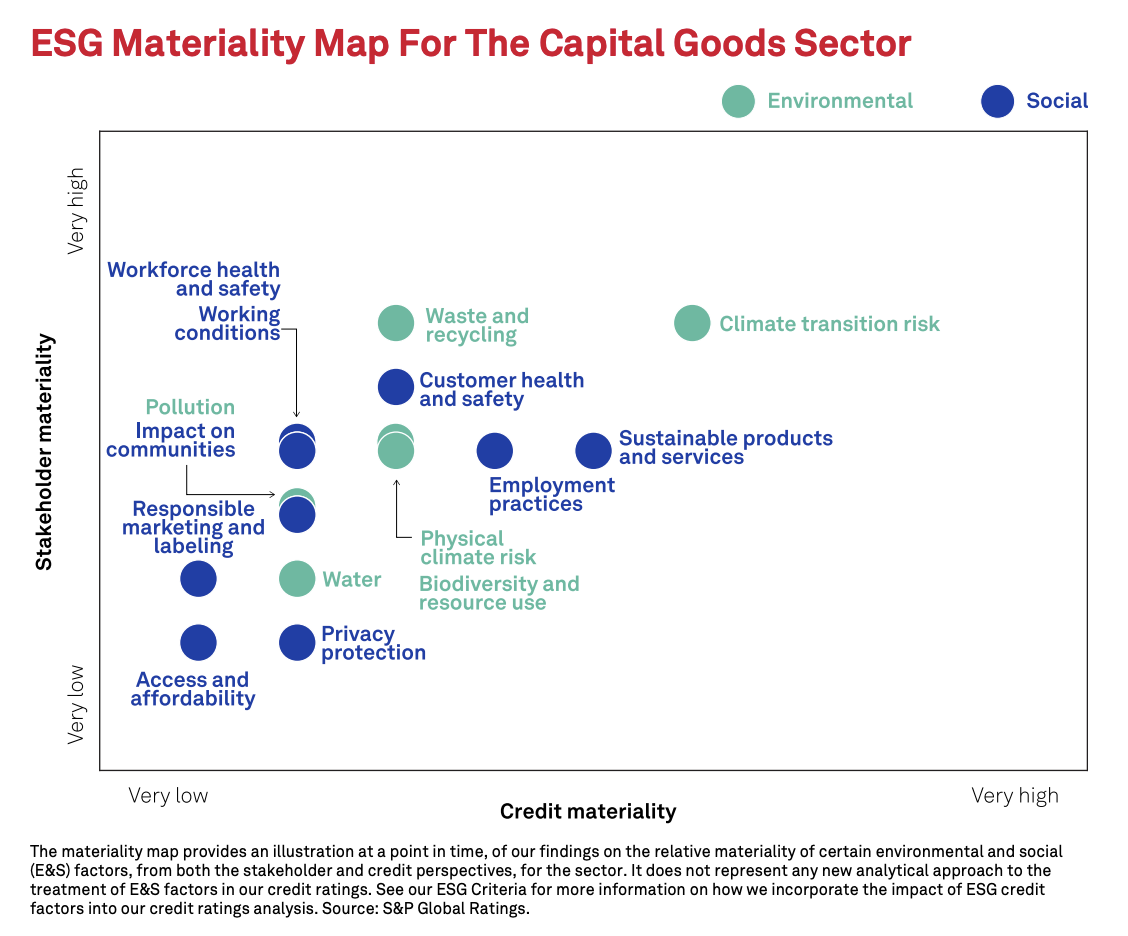

ESG Materiality Map: Capital Goods

Climate transition risks and sustainable products and services are the most material factors for both stakeholders and credit due to the sector’s elevated energy needs. Waste and recycling, and human-capital related factors are examples of factors currently more pronounced for stakeholders than credit.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

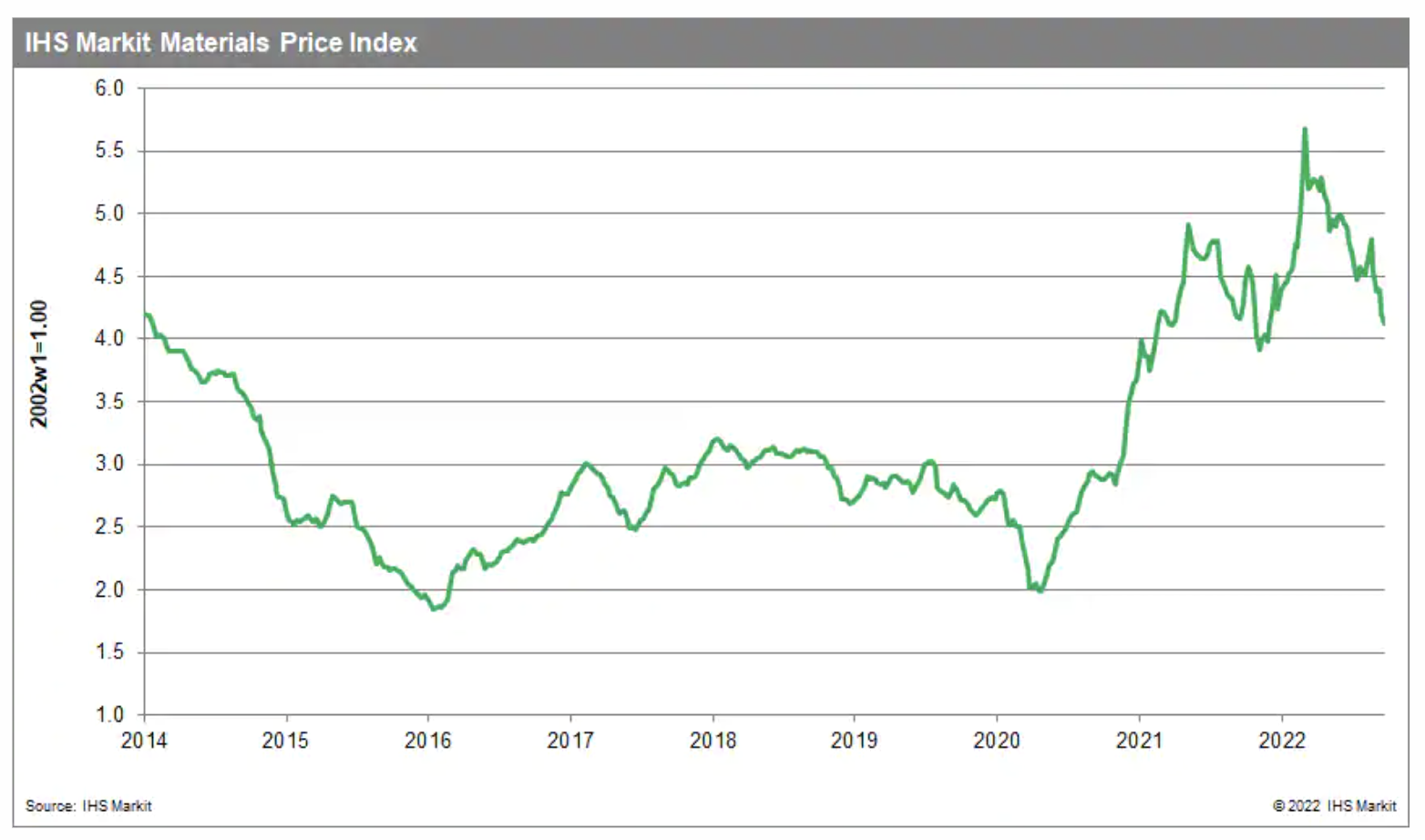

Weekly Pricing Pulse: Commodity Prices Down Amid Bond Market Turmoil

S&P Global Market Intelligence’s Materials Price Index fell another 1.9% last week, its fourth decline in the past five weeks. The sell-off was again broad with eight out of ten subcomponents falling, highlighting the downward momentum in commodity prices over the past seven months — the MPI is now 27.3% lower than its all-time high established back in early March. Commodity prices, as measured by the MPI, are now 3.8% lower than in October of last year.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

451Nexus: Taming Enterprise IT Complexity To Deliver The Digital Next

If nothing else, the past two years have highlighted the criticality of information technology to every organization; there is no longer any doubt that digital strategy is an integral part of business strategy. But, as the saying goes, with great power comes great responsibility. For IT and business leaders, the stakes have never been higher, and in many ways, the path forward has become infinitely more complex.

—Register for the conference from S&P Global Market Intelligence