Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 5 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Hospitalized with COVID-19, U.S. President Donald Trump was treated over the weekend with the anti-viral drug remdesivir, the anti-inflammatory steroid dexamethasone, which has been shown to help treat critically ill patients but has carried risk for those who aren’t severely infected, and an infusion of an experimental antibody treatment that is currently being developed by the biotechnology company Regeneron.

At least 10 people within the president’s orbit have also tested positive for the virus since Sept. 30—including his wife, First Lady Melania Trump; campaign manager Bill Stepien; and Republican National Committee Chairwoman Ronna McDaniel.

As investors monitor the health of the leader of the world’s largest economy, markets avoided extreme volatility. On Sunday night, in overnight trading, futures on the S&P 500 benchmark equities index rose 0.7% and on the Dow Jones Industrial Average by 170 points. In the Asia-Pacific region’s trading this morning, Japan’s Topix benchmark index rose 1.9%, Australia’s S&P/ASX rallied 2.2%, and Hong Kong’s Hang Seng climbed 2.5%.

Still, that isn’t to say that volatility won’t increase as more information is made known about the president’s circumstances and as the Nov. 3 presidential election nears. Since 1945, the S&P 500 has risen in 78% of presidential election years and gained an average of 6.3% during those periods, according to S&P Dow Jones Indices.

President Trump’s COVID-19 case is likely to raise the stakes regarding the search for a vaccine to treat the illness. However, as many clinical trials have been accelerated, experts have expressed that it may be difficult to draw meaningful conclusions from study results on how safe and effective the treatments are, according to S&P Global Market Intelligence.

"With the early stage of vaccines that we're seeing, there's actually very little information about those right now," Gustav Ando, vice president of industry services and life sciences at IHS Markit, told S&P Global Market Intelligence in an interview. "We don't have the clinical data to understand their broader potential in this disease, so all we have to go on right now is the theoretical understanding that the technology and the approach could work."

Mixed messages regarding the state of President Trump’s health have painted an unclear portrait of his status.

“The president’s vitals over the last 24 hours were very concerning and the next 48 hours will be critical in terms of his care,” White House Chief of Staff Mark Meadows said on Oct. 3.

After providing an upbeat update during an Oct. 3 briefing, the president’s lead physician, White House doctor Sean Conley, said that the president’s oxygen levels had dropped twice over the weekend.

“I was trying to reflect the upbeat attitude that the team, the president, over his course of illness, has had,” Mr. Conley said at an Oct. 4 briefing at Walter Reed National Military Medical Center, where the president is being treated. “I didn’t want to give any information that might steer the course of illness in another direction. And in doing so, you know, it came off that we were trying to hide something, which wasn’t necessarily true.”

The doctor said that “the president has continued to improve,” acknowledged that “as with any illness, there are frequent ups and downs over the course,” and, to the surprise of many experts, said that President Trump could be discharged as early as today if his condition continued to improve.

“It’s been a very interesting journey,” President Trump said in an Oct. 4 video he shared on Twitter. “I learned a lot about COVID. I learned it by really going to school. This is the real school. This isn’t the let’s-read-the-books school. And I get it. And I understand it. And it’s a very interesting thing and I’m going to be letting you know about it.”

After posting the message, he left the hospital in his motorcade to drive by and greet supporters outside of the hospital from his SUV—a move criticized by medical experts as unnecessarily exposing the Secret Service agents accompanying him in the vehicle to the virus.

The situation comes with less than one month until the U.S. presidential election, and as almost 210,000 Americans have died during the pandemic, which is likely to worsen.

"Our worst-case scenario is if we have a bad flu season together with a bad COVID season, that will be our upper bound. If we have a good flu season, together with a good COVID season, that'll be our lower bound," Amy Compton-Phillips, the executive vice president and chief clinical officer for Washington state-based Providence St. Joseph Health, the hospital that treated the first confirmed COVID-19 patient in the U.S., said in an interview with S&P Global Market Intelligence. "How do we get ready for everything between those two bounds?"

Today is Monday, October 5, 2020, and here is today’s essential intelligence.

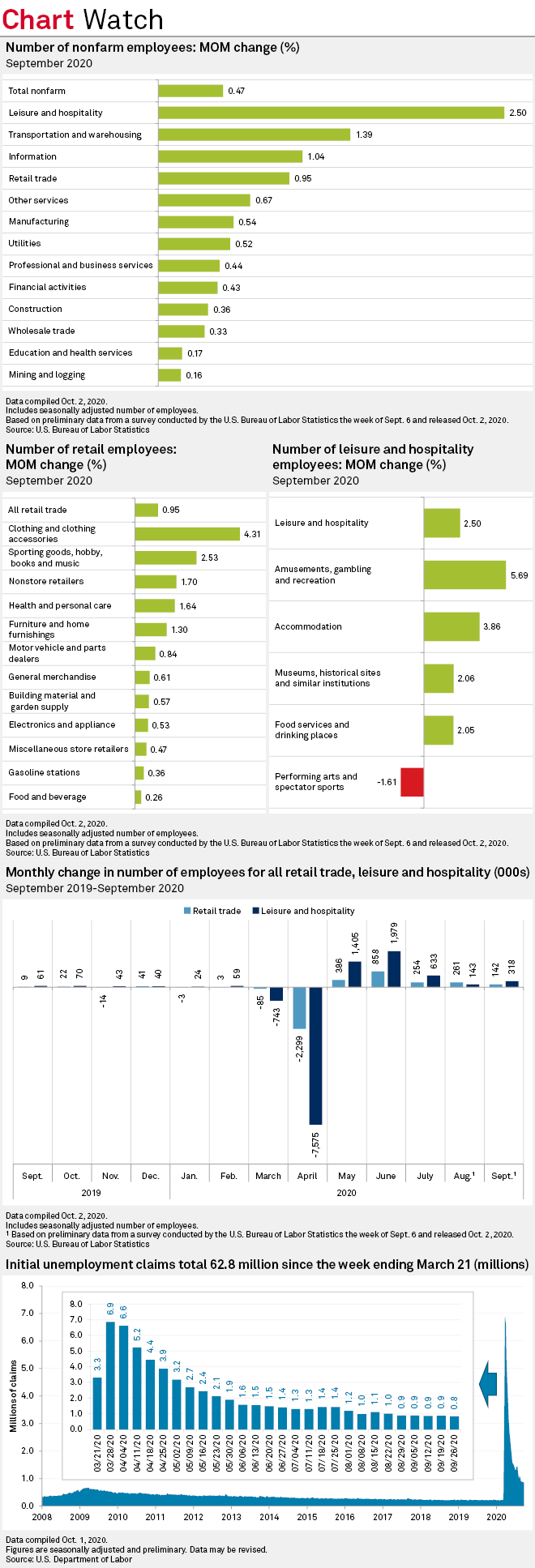

Consumer Sector Leads U.S. Job Gains in September as Employment Recovery Cools

Consumer-focused sectors made up nearly 70% of the U.S. job gains in September as the pace of employment recovery cooled during the month. The U.S. economy added 661,000 jobs in September, missing a forecast by economists polled by Econoday that called for the creation of 894,000 jobs. September's numbers mark the slowest monthly gain in employment since May when the job market began to recover from the coronavirus-induced slump.

—Read the full article from S&P Global Market Intelligence

Workers' Comp Premiums Decline YOY in H1; Travelers Retains Top Spot

U.S. workers' compensation premiums fell 8.1% year over year to $24.84 billion in the first half of 2020, an S&P Global Market Intelligence analysis showed. Of the top 20 U.S. workers' comp underwriters, only Starr International Co. Inc. and Arch Capital Group Ltd. recorded higher direct premiums earned during the half.

—Read the full article from S&P Global Market Intelligence

Most Major U.S. Homeowners Insurers Maintained Premium Growth in Q2

Nearly all of the top 20 U.S. homeowners insurers posted year-over-year premium growth in the second quarter, while their loss ratios stayed below 100%, according to an S&P Global Market Intelligence analysis. The nine largest homeowners insurers by premiums written remain unchanged from the prior-year quarter, with State Farm Mutual Automobile Insurance Co. at the top of the ranking with $5.38 billion of direct premiums written.

—Read the full article from S&P Global Market Intelligence

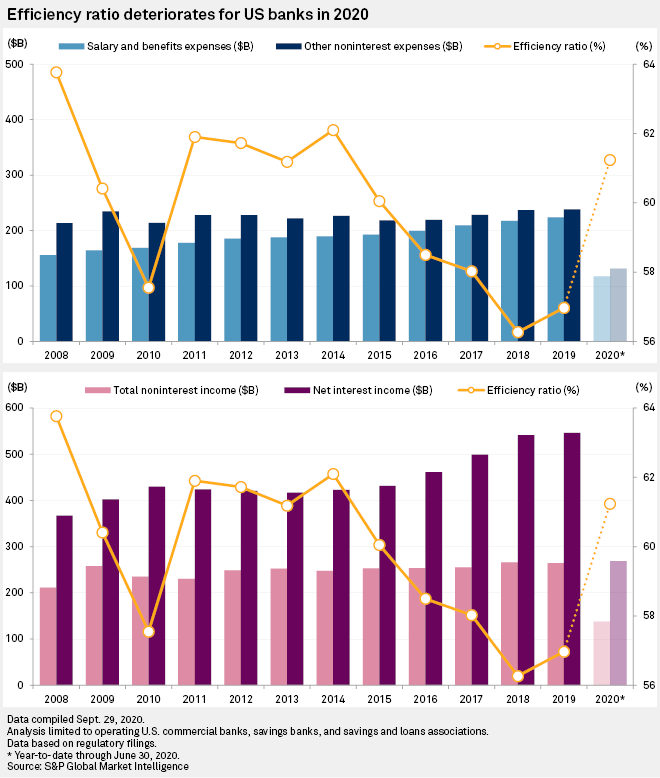

U.S. Banks Look for Turning Point on Payroll, Expenses Amid Dim Revenue Outlook

Banks facing what could be years of ultra-low interest rates and constrained revenues have been outlining aggressive cost-cutting plans, perhaps setting the stage for an industrywide break in a long trend of mounting payroll and other expenses. "The focus around cost reduction for the business is enormous," said Mark Shilling, who leads the banking and capital markets practice at Deloitte Consulting LLP.

—Read the full article from S&P Global Market Intelligence

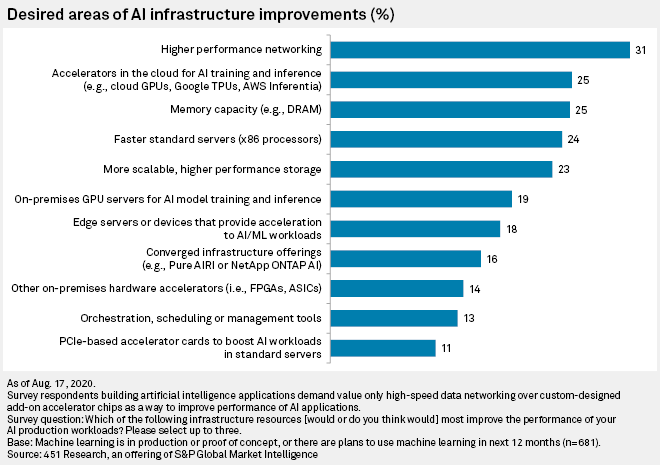

Nvidia Seeks to Straddle Line Between Partner, Competitor After Arm Deal

As Nvidia Corp. prepares to acquire contract chip designer Arm Holdings Ltd, a new software agreement with VMware Inc. seems aimed at reassuring the industry that Nvidia can compartmentalize competing interests in its widening business portfolio. Unlike Nvidia and other chip companies that sell chips and other devices, Arm makes money by licensing patented designs for chips and electronic components to hardware-makers who pay a licensing fee and royalties on Arm designs they build into their own products.

—Read the full article from S&P Global Market Intelligence

Army Tactics, Managed Services Could Aid Power Industry in Thwarting Cyberattacks

Protecting a cleaner, more distributed grid from cyberattacks will require greater situational awareness, power sector stakeholders agreed Oct. 1 and offered options for keeping the grid secure. Digital technology is playing a key role in ensuring grid reliability as more renewable resources are integrated into the grid and as consumers demand more control over their power, including the ability to plug-in electric vehicles.

—Read the full article from S&P Global Platts

Listen: The Key to Electric Vehicle Uptake: Subsidies

Overall global electric vehicle sales have been weaker in 2020, mostly due to the COVID-19 pandemic hitting sales in Asia, although European sales are notably up year on year, with European governments employing a number of incentives and subsidies to encourage car buyers to switch over to EVs. In the latest Battery Metals Podcast, S&P Global Platts senior pricing specialists Emmanuel Latham and Jacqueline Holman discuss the subsidies and incentives in place for electric vehicles and their impact on sales and uptake.

—Listen and subscribe to Battery Metals, a podcast from S&P Global Platts

U.S. Refiners Reach for Renewables Lifeline as Pandemic Lays Bare Excess Capacity

U.S. refiners boosted refinery utilization in the third quarter of 2020, but runs remain well below optimum levels as coronavirus pandemic shutdowns still weigh on demand for transportation fuels. Refinery run rates averaged 77.8% of capacity nationally for Q3 2020, according to Energy Information Administration data, up from 71.5% in Q2 -- the lowest quarterly run rate recorded by the EIA since it began keeping records starting with the first quarter of 1985.

—Read the full article from S&P Global Platts

Shell Backs Hydrogen for Shipping's Decarbonization

Energy group Shell has revealed plans to back hydrogen fuel cells on the road to shipping's 2050 decarbonization goals, tagging LNG bunkers as the bridging fuel between that and conventional oil-based bunker fuels. "We believe liquid hydrogen to be advantaged over other potential zero-emissions fuels for shipping, therefore giving a higher likelihood of success," it said in its latest report, 'Decarbonising Shipping: Setting Shell's Course.'

—Read the full article from S&P Global Platts

U.S., Israel and UAE to Cooperate in Oil, Gas, Renewable Energy

The U.S., Israel and the UAE agreed to cooperate in the fields of oil, gas and renewables among other energy sectors, following the signing of a peace agreement between Israel and the UAE in September. The three countries "agree to encourage greater coordination in the energy sector, including renewable energy, energy efficiency, oil, natural gas resources and related technologies, and water desalination technologies," according to a joint statement by the energy ministers of all three countries posted on the U.S. Department of Energy website Oct. 1.

—Read the full article from S&P Global Platts

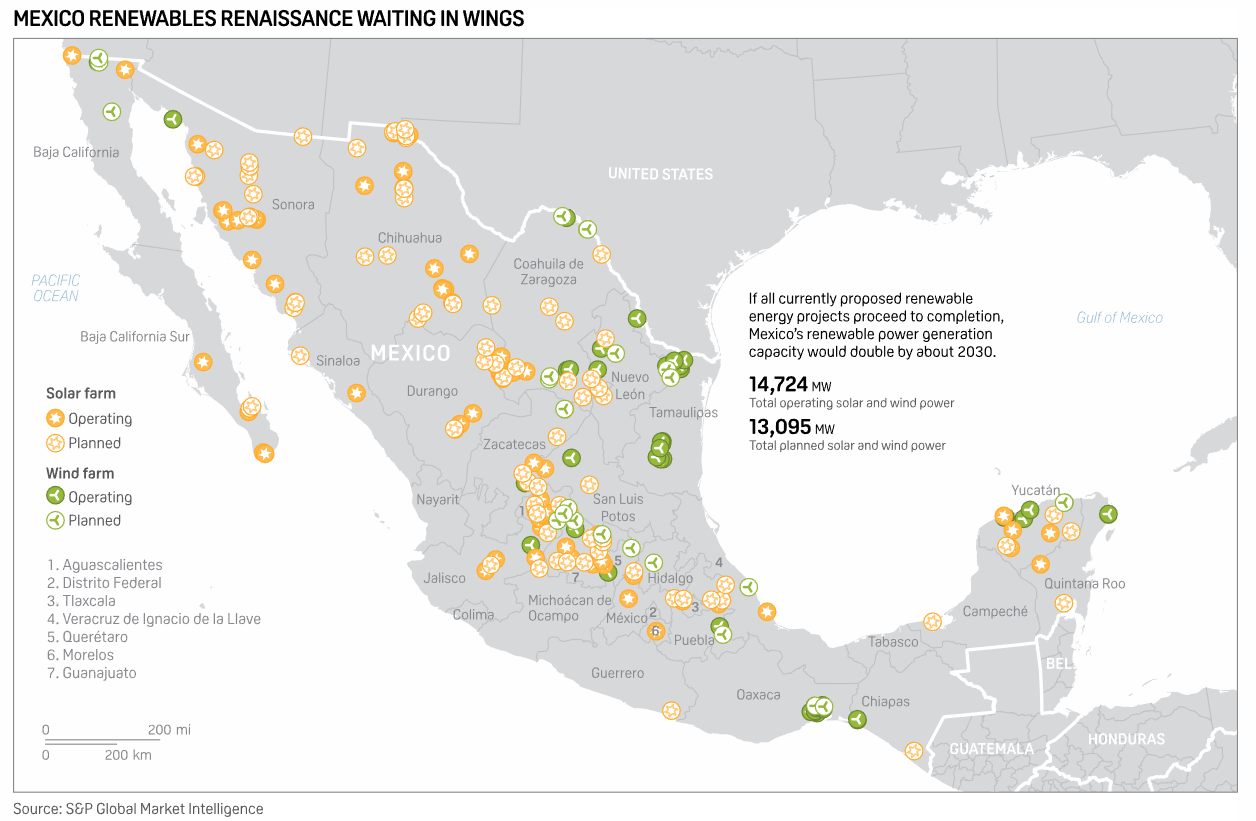

Biden Victory could Push Mexico Closer Toward Green Energy

If Joe Biden wins the US presidency in November, he could hasten the country's migration to more renewable energy by enforcing the Paris Agreement and the energy chapter under the US-Mexico-Canada Agreement. Should this happen, Mexico may have to rethink its own current hydrocarbon-focused energy strategy. If Donald Trump holds onto the White House, however, Mexico will continue to pursue its strategy of fossil fuel independence.

—Read the full article from S&P Global Platts

Fossil Fuel Headwinds to Challenge OPEC in a Post-Coronavirus Oil Market

OPEC's long-term prospects took a hit in recent weeks, with BP declaring peak oil demand may have already been reached, California mandating a phaseout of internal combustion engine cars by 2035 and China vowing to be "carbon neutral" by 2060. The policy details are vague and the forecasts uncertain, but the announcements were yet another reminder that oil's day in the sun could be drawing to an accelerated end, as COVID-19 prompts governments and companies to rethink future energy generation and use.

—Read the full article from S&P Global Platts

Iraq's $8 bil U.S. Energy Deals seen at Risk if Baghdad Embassy Closed

Iraq's $8 billion worth of deals with US energy companies and waivers for OPEC's second largest producer to import Iranian gas and power are under threat from Washington's warnings it might close its Baghdad embassy due to lax security, analysts say. Baghdad's heavily fortified green zone, home to the US embassy and other diplomatic missions, has been the target of rocket attacks which have intensified in recent weeks in a country still struggling to control armed groups linked to Iran.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language