Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 Oct, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Credit Conditions in Europe

Every quarter, the credit conditions committees at S&P Global Ratings, composed of the chief economist at the regional and global level and the most senior rating experts across all asset classes, meet to define the base case that ratings analysts will use to underpin ratings forecasts in Asia-Pacific, North America, Europe and emerging markets. These reports are published on S&P Global Ratings’ website to create full transparency about the assumptions that substantiate credit ratings around the world. The report on Europe, “Credit Conditions Europe Q4 2023: Resilience Under Pressure Amid Tighter Financial Conditions,” was published Sept. 26.

Economic growth in Europe remains typically tepid with projected GDP growth of 0.6% for 2023 and 0.9% for 2024. Sylvain Broyer, chief economist for Europe, the Middle East and Africa at S&P Global Ratings, believes that inflation will remain above the 2% European Central Bank target until 2025. Sylvain estimates inflation to be 5.6% in 2023 and 2.7% in 2024. At the same time, a resilient labor market will buoy European economies and wage growth should ease the squeeze that inflation has placed on disposable incomes. Eurozone countries with export-led economies like Germany have struggled with higher energy prices affecting manufacturing and depressing the trade surplus.

“We had here in Europe a very robust tourism season; [it was] the first time since COVID that we had a full tourism season and this has supported demand,” said Alexandra Dimitrijevic, global head of research and development at S&P Global Ratings, during an upcoming episode of S&P Global’s “Essential Podcast.” “This has supported economies, particularly in the south of Europe. But also, what's really critical for the economy and for credit is employment. Employment remains extremely strong, which explains the resilience of the economy. But employment is also supportive of consumption and supportive of the credit story.”

S&P Global Ratings forecasts that the current ECB interest rate hikes have peaked for this cycle, although quantitative tightening (QT) may continue to put upward pressure on bond yields. QT by the ECB remains the biggest unknown for monetary policy. Should the ECB choose to pursue an active QT strategy by selling off assets, inflation could be tamed more quickly, but this could force bond yields upward. However, if the ECB allows for passive QT, allowing the bonds on its books to mature, the effect on inflation and bond prices would be more gradual. Today, the ECB holds about €5 trillion in bonds. Even in the event of active QT, with bonds sold off to eurozone banks, the effect on banks would be limited. Banks holding these bonds would have added exposure to credit risk, but careful management would mitigate this risk.

According to S&P Global Ratings’ credit conditions report for Europe, interest rates can be expected to stay at an elevated level for some time, creating tighter financing conditions and increasing the focus on cash flows, debt service and sustainability for corporate borrowers. Credit risks for the eurozone are unchanged — the economy remains sluggish and could tip into recession, higher financing costs could impact borrowers particularly at the lower end of the ratings curve, Russia’s invasion of Ukraine continues to impact stability and real estate remains an area of concern. Liquidity concerns and tighter financing conditions will weigh on speculative-grade borrowers for the foreseeable future.

Today is Wednesday, October 4, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Tracking Shariah Compliance With Indices

How are indices helping expand the range of Shariah-compliant tools for market participants? S&P DJI’s John Welling and Chimera Capital’s Sherif Salem join Dubai Financial Markets’ Eric Solomon for a look inside how S&P DJI’s Shariah-compliant and Sukuk indices are helping investors evaluate and access local, regional and global markets while adhering to Islamic law and aligning with client objectives.

—Watch the video from S&P Dow Jones Indices

Access more insights on the global economy >

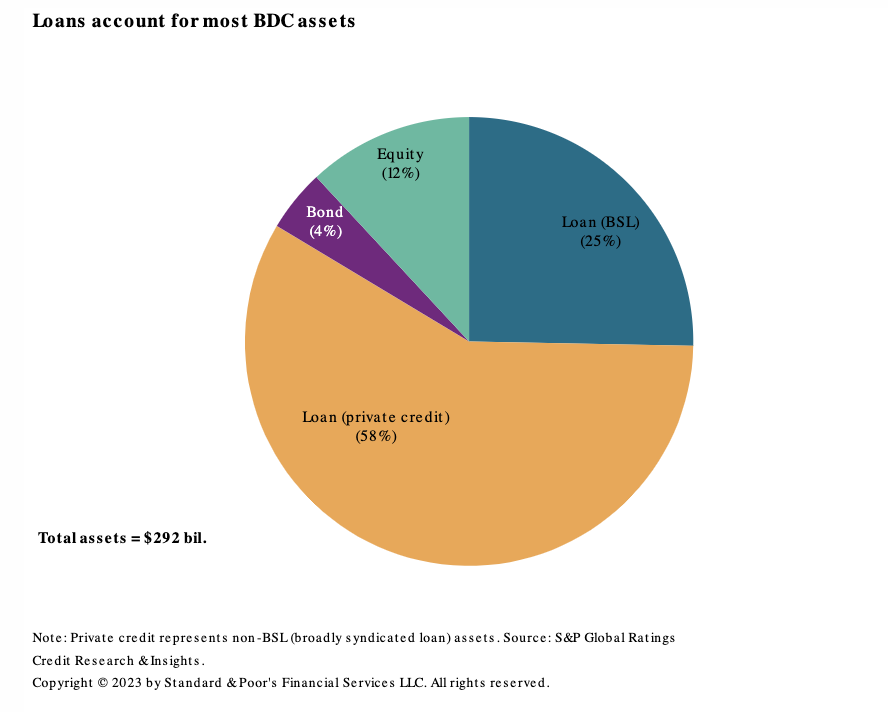

Credit Trends: Business Development Companies' Assets Provide A Glimpse Into The Private Credit Market

This year, higher interest rates and the specter of slowing economic growth have strained rated corporate issuers, particularly those at the low end of the scale — rated 'B-' and below. These challenges are not unique to rated issuers, rather they're confronting all borrowers, including those funded by private credit. The private credit market provides borrowers (typically unrated) with loans that are not publicly traded. Little information is available publicly on these borrowers, which are often private, unrated companies with debt that is not publicly traded on a secondary market. By contrast, more financial and secondary market data is available on the issuers of high-yield bonds and broadly syndicated leveraged loans.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

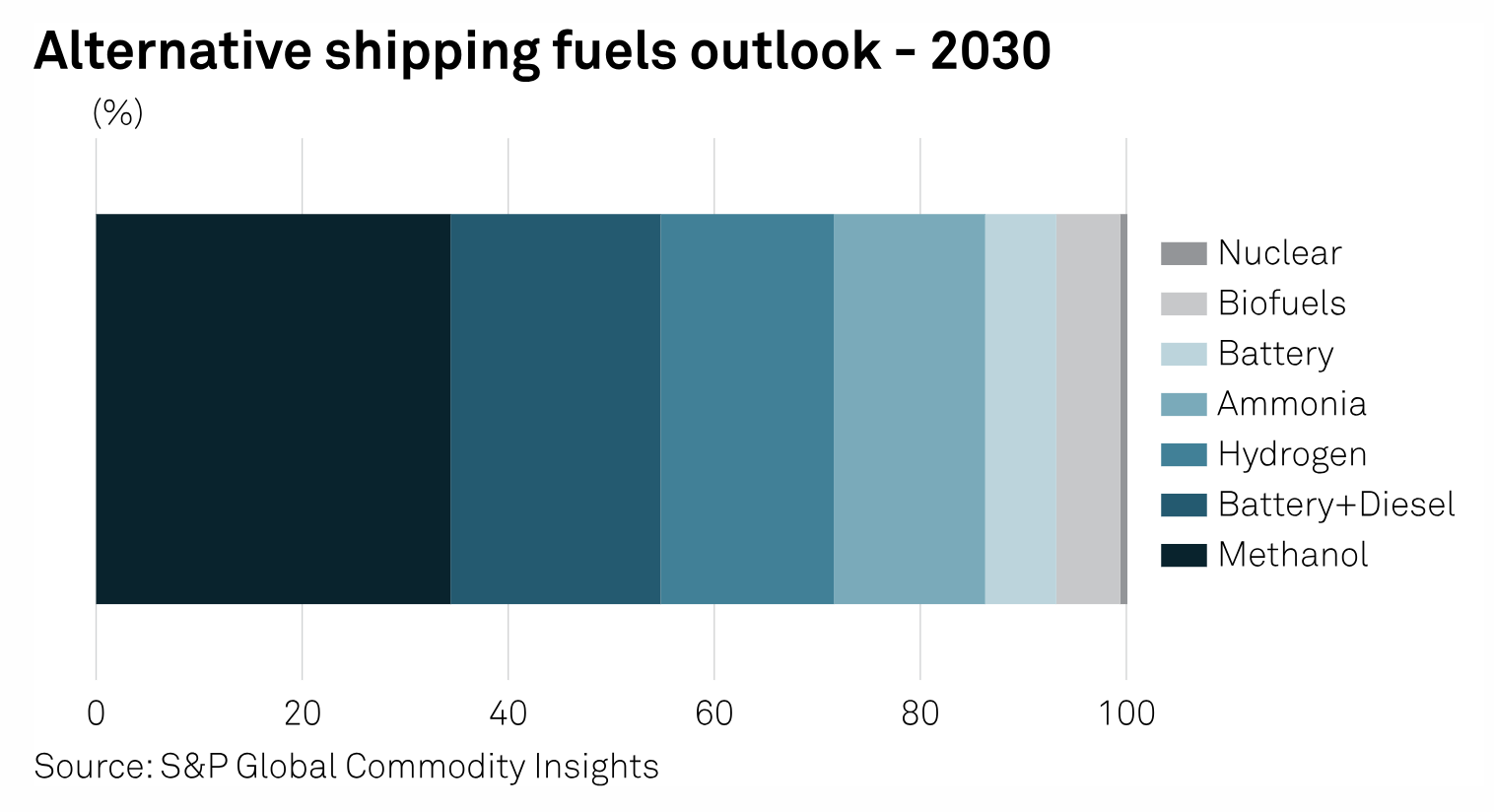

DFDS Sees Battery, Ammonia And Methanol As Future Marine Energy

Danish logistics group DFDS plans to raise the proportion of low-carbon energy sources in its bunker mix to meet its climate target by 2030, likely including electricity, methanol and ammonia, CEO Torben Carlsen told S&P Global Commodity Insights. DFDS, which has aimed to achieve carbon neutrality by 2050, said in its annual report that it burned 818,911 mt of conventional, oil-based marine fuels aside from 1,902 mt biofuels last year.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

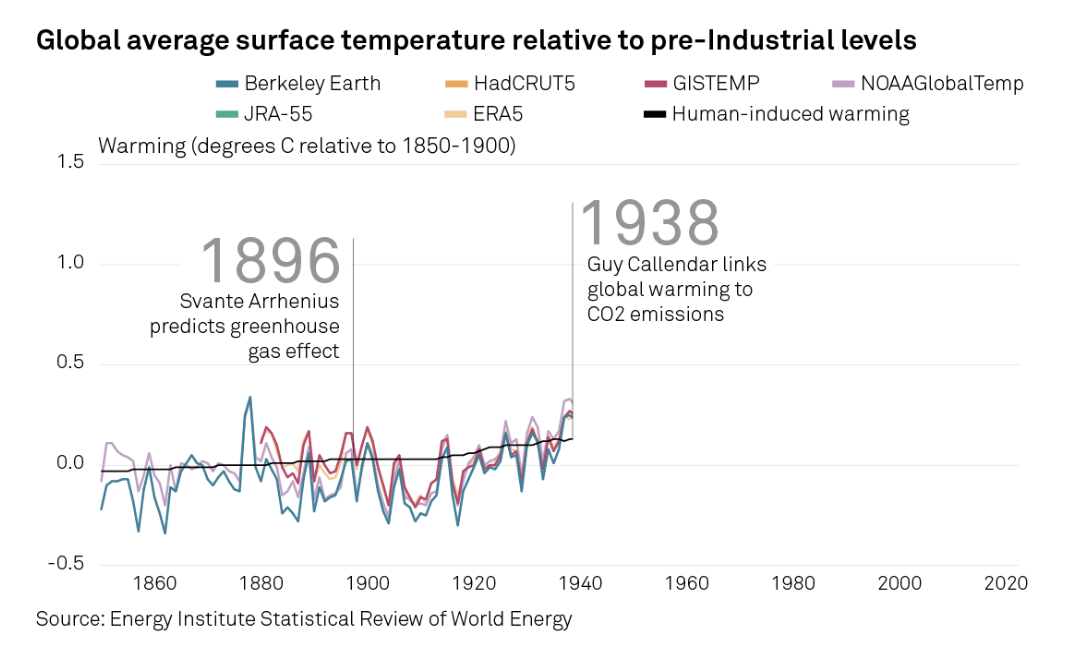

COP28 Climate Talks In Focus

The pressure is on for governments and industry leaders to accelerate global climate action at this year’s UN Climate Change Conference in Dubai. Can they come together and deliver greater ambition in policy based on a first global carbon stocktake? This special interactive report looks at the key issues facing the climate and commodity markets at COP28.

—Read the report from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Emerging Battery Technologies: Will Sodium-Ion Batteries Be A Low-Cost Game Changer?

In this series of podcasts, S&P Global Commodity Insights explores and compares different battery chemistries against the dominant lithium-ion battery sector. Sodium-ion batteries have emerged as a strong competitor to lithium-ion batteries, particularly in the energy storage sector. Some have even hailed it as a game-changer in the entry-level or low-cost EV segment, and that it could threaten the long-standing dominance of lithium-ion batteries in the EV sector. In this podcast, battery metals experts Euan Sadden, Leah Chen and Henrique Ribeiro explore the technical differences between sodium-ion and lithium-ion batteries, the pros and cons of sodium-ion batteries and whether it ultimately plays a competitive or complementary role to lithium-ion batteries.

—Listen and subscribe to Platts Future Energy, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

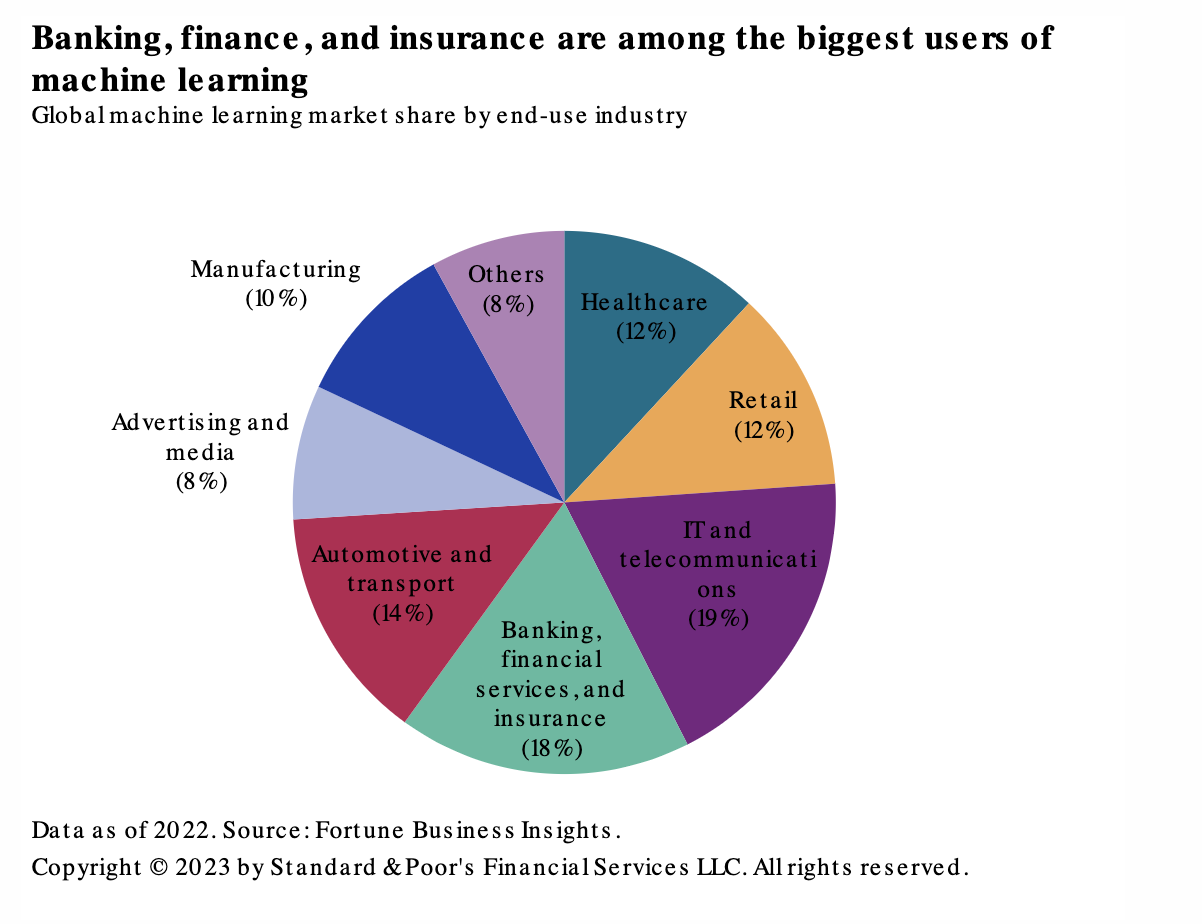

Future Of Banking: AI Will Be An Incremental Game Changer

Given banks' material investment capacity, management of large amounts of proprietary data and often fluid business models, it was perhaps inevitable that they proved to be enthusiastic early adopters of machine and deep learning technology (so-called traditional AI). These systems have (for decades, in fact) been used to improve risk management processes, loss mitigation, fraud prevention, customer retention and to deliver efficiency gains and profit growth.

—Read the report from S&P Global Ratings