Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Oct, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

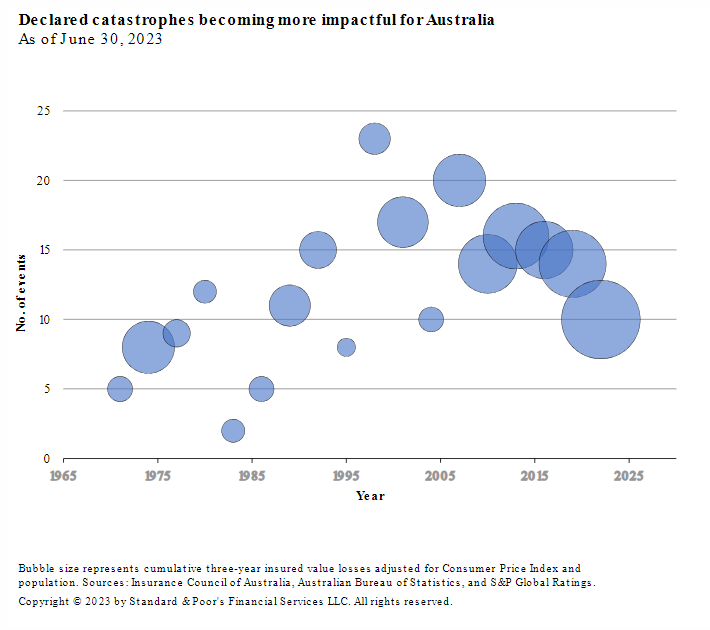

Insurance Companies Pricing in Catastrophe

The cost of catastrophe has become a normal part of the US property and casualty insurance business. An increase in extreme weather events such as heat waves, floods and wildfires has forced many insurance companies to choose between dropping coverage in affected geographies and pricing in the cost of possible environmental disaster. Both options have a negative impact on consumers, who are left to bear the cost of a warming planet.

The third quarter was good for a majority of US property and casualty insurers, with earnings and revenues up year over year. So far, insurers have been successful in pushing inflation-led price increases on to customers. But the third quarter stands out in an otherwise grim year for US insurance companies.

In the second quarter, catastrophe losses doubled year over year for Allstate, Travelers and Progressive, three of the largest insurers in the US. Most of the losses were attributed to severe weather, including hailstorms, which most scientists believe is caused in part by anthropogenic climate change. Allstate took the biggest hit, with losses related to extreme weather totaling close to $2.70 billion. Forty-two catastrophe events drove the losses, which affected over 160,000 customers. Allstate’s first quarter was not much better. In February, Allstate experienced catastrophe losses of close to $211 million, stemming from nine geographically widespread events.

Industry observers expect a continuation of recent trends, with insurers rushing price increases into the market while pulling back from geographic areas with unfavorable regulatory environments.

California has earned a reputation for having a difficult regulatory environment for insurers. However, in a shift, California's insurance department will allow insurers to use catastrophe modeling in making rate filing requests. While these changes indicate a willingness to recognize the reality of more-frequent catastrophes, S&P Global Market Intelligence believes that further changes to the regulatory landscape will be necessary to entice property and casualty insurers back to California. Current regulations force insurers to obtain prior approval for any rate increases from the regulator. Since an increase of greater than 6.9% triggers further regulatory approvals, many insurers simply apply for a 6.9% increase again and again to account for extreme weather and inflation.

While insurers may be frustrated with California regulations, Florida still stands out as the most unfavorable state for insurers from a regulatory perspective. Not only is the state prone to hurricanes, insurers find that they struggle to make money providing coverage even with higher premiums. Farmers Insurance recently announced it would depart the Florida market altogether. The privately insured losses from Hurricane Idalia that made landfall near Keaton Beach, Fla., in late August totaled $2.2 billion.

Today is Friday, October 27, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

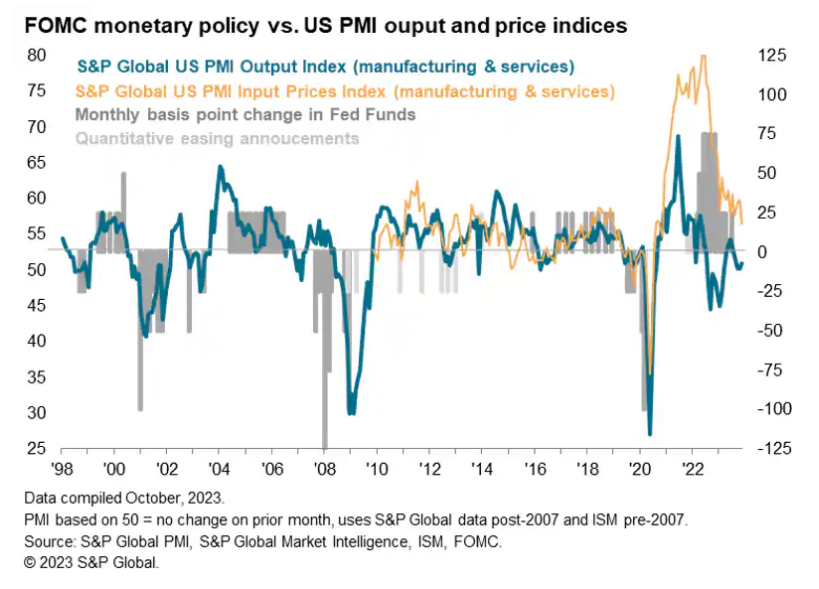

US Soft Landing Hopes Boosted As Flash PMI Lifts Higher And Price Pressures Abate

Hopes of a soft landing for the US economy will be encouraged by an improved situation seen in October, with headline flash PMI rising to a three-month high. Future optimism also improved, in part due to hopes of interest rates having peaked, something which looks increasingly likely given a further cooling of inflationary pressures signaled in October.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

The Importance Of Profitability In Australian Small Caps

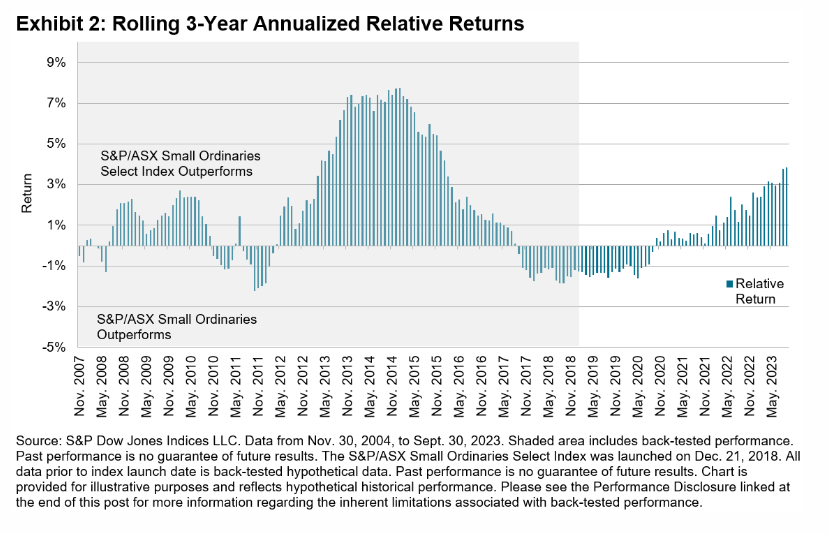

It has long been evident that small-cap companies with a track record of generating earnings have outperformed relative to their peers. Profitability matters for small-cap companies, and the S&P/ASX Small Ordinaries Select Index was launched in 2018 to provide a measurement of these companies in Australia. The S&P/ASX Small Ordinaires Select Index — which includes a profitably screen on constituent selection — turns five this December. This is a timely moment to reflect on the index’s performance versus its benchmark, the S&P/ASX Small Ordinaries.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

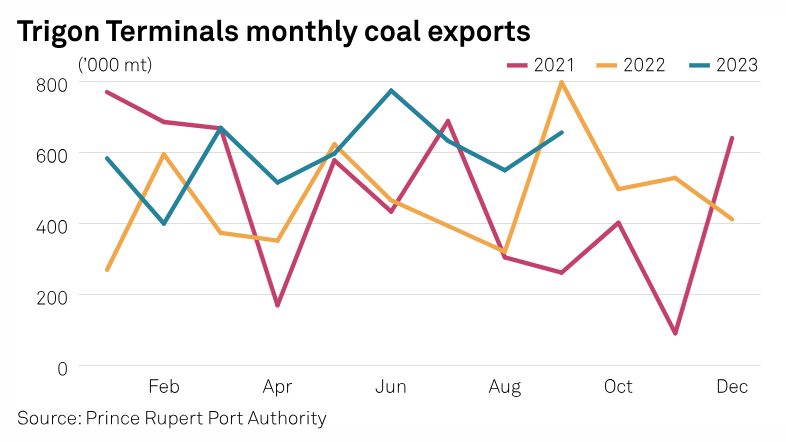

Coal Exports Rise 19.3% On Month At British Columbia's Trigon Terminals: Port Authority

Exports of thermal and metallurgical coal from Canada's Trigon Terminals climbed 19.3% from the previous month to 656,338 mt in September, Prince Rupert Port Authority data showed Oct. 24. Through the first nine months of 2023, the British Columbia terminals exported 5.4 million mt of coal, which was 28.4% higher than the year-ago period. Compared with the year-ago month, Trigon Terminals coal exports were 17.7% lower. September coal exports were at an 8.9% deficit to the five-year average.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

The Evolving Impact Of Environmental And Social Factors On Credit Ratings

S&P Global Ratings’ credit ratings are forward-looking opinions that reflect the ability and willingness of debt issuers, like corporations or governments, to meet their financial obligations on time and in full.

Its environmental, social and governance (ESG) factors concern an entity's effect on and impact from the natural and social environment and the quality of its governance. However, not all of these factors influence creditworthiness and, thus, credit ratings.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

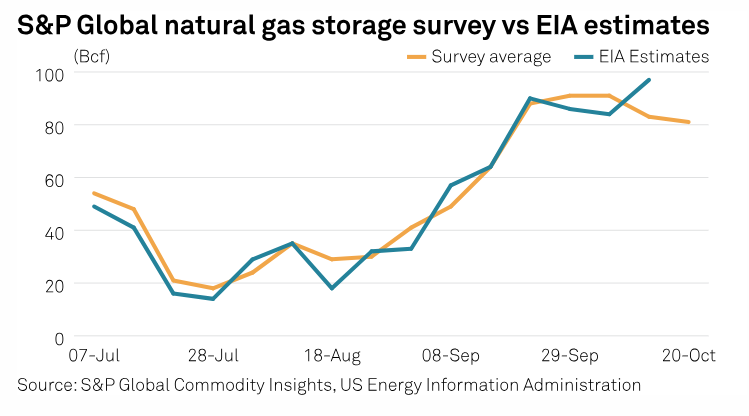

Analysts See US Gas Storage Surplus Widening As Mild Autumn Weather Persists

Injections to US natural gas storage likely outpaced the historical average again in mid-October, even as cooler weather in the Northeast and central south fueled weekly gains in heating and power demand. In its upcoming Oct. 26 inventory report, the US Energy Information Administration is expected to announce an 81 Bcf build to US gas storage in the week prior, according to the latest survey of market analysts from S&P Global Commodity Insights. Responses to this week's survey were mostly reported in a narrow range from about 70-85 Bcf, excluding just one high-side outlier estimate.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

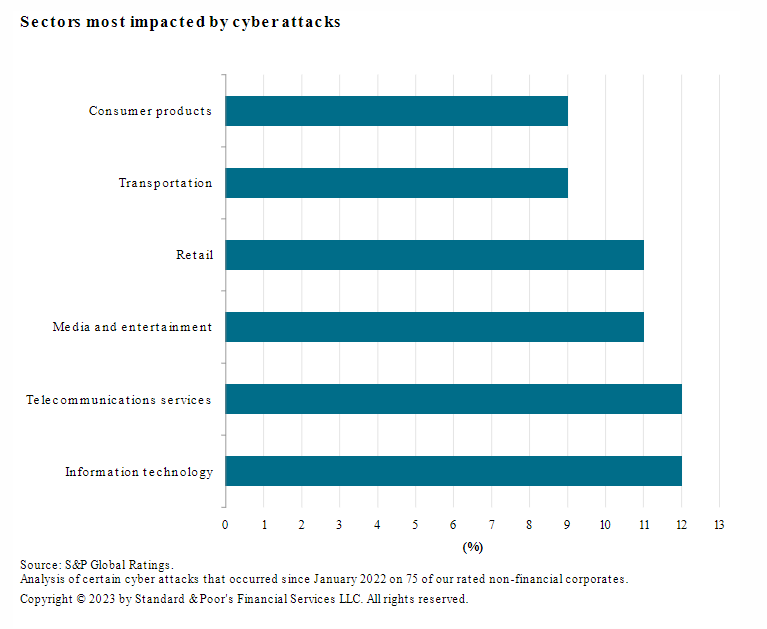

Corporates Up Their Cyber Preparedness As Cyber Attacks Become More Widespread

To identify common themes arising from cyber incidents, including the nature and type of cyber attacks, management teams' response and communication and the impact of cyber attacks on credit quality, S&P Global Ratings analyzed certain cyber attacks that occurred since January 2022 on 75 of its rated non-financial corporates across the world. The data it used for the survey and analysis was based on publicly available information, management disclosures, S&P Global Ratings research and press reports.

—Read the report from S&P Global Ratings