Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Oct, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Strong U.S. Dollar Weighs Heavy on Global Economy

During United Airlines’ Oct. 19 earnings call, the company’s executive vice president and chief commercial officer, Andrew Nocella, described the strong U.S. dollar’s silver lining for Americans planning trips abroad. “Quite frankly, where the dollar stands is incredibly useful from a U.S. origin point of view for trans-Atlantic travel. And this season was incredible based on the numbers we've seen,” Nocella said.

The strength of the U.S. dollar has recently led to near parity with the euro, while the exchange rate between the dollar and the British pound has hit its lowest level since 1985. In Asia, the Japanese yen suffered the lowest year-to-date return of any developed market currency versus the dollar.

While a boon for U.S. leisure travel and exporters, the soaring dollar could cause significant problems for the Institute of International Finance, the International Monetary Fund and the World Bank Group, as discussed by global financial leaders at recent meetings in Washington, D.C.

Satyam Panday, chief economist for emerging markets with S&P Global Ratings, spoke at the meetings with policymakers challenged by a strengthening dollar. Emerging market central bankers felt they were being forced to import inflation and raise rates sharply even though domestic demand has not fully recovered from the COVID-19 pandemic.

For policymakers fighting high inflation by raising rates to tighten monetary conditions, a weaker currency resulting from a strong U.S. dollar is a problem. It implies that higher local rates are required to attain the desired monetary conditions.

As the U.S. raises interest rates, net financial outflows in other economies increase. In the first half of 2022, these outflows rose by US$99 billion in six large Asian economies compared with a year earlier. According to S&P Global Ratings’ models, the 16% depreciation of the euro against the dollar in the past 12 months may add half a percentage point of inflation to the eurozone.

Some 81% of emerging market corporate debt and 30% of European corporate debt maturing through 2023 is denominated in U.S. dollars. Issuers without sufficient dollar revenues or adequate hedges against exchange rate risk may be in trouble. More than a quarter of emerging market U.S. dollar-denominated debt is rated at speculative grade. The rising dollar makes interest payments and refinancing more difficult for these borrowers.

The strong U.S. dollar may also have contributed to a contraction in global business activity in September, according to Purchasing Managers’ Index survey data compiled by S&P Global and sponsored by JPMorgan. The Purchasing Managers’ Index reading rounds off the worst calendar quarter since 2009, if pandemic-related lockdowns are excluded. Many countries suffered from higher import prices due to weakened currencies against the dollar.

The U.S. dollar remains the world's risk-free currency, so in times of heightened geopolitical tension or general de-risking — as we are now experiencing — the dollar tends to strengthen. The current situation harkens back to the famous 1971 comment by U.S. Treasury Secretary John Connally, who told his European counterparts: "The dollar is our currency, but it is your problem."

What can be done? Individual central banks can use their dollar reserves, impose capital controls or raise rates to offset the deprecation of their currency. The 1980s was a period of extensive U.S. dollar appreciation. With the Plaza Accord of September 1985, the combined central banks of the U.S., Germany, the U.K., France and Japan intervened in tandem to bring down the value of the dollar. In the same vein as “Back to the Future,” which was released that same year, the global financial system may need to relive the past and take a similar coordinated approach to solve this issue.

Today is Thursday, October 27, 2022, and here is today’s essential intelligence.

Written by Ken Fredman.

Latin America Structured Finance Surveillance Chart Book: October 2022

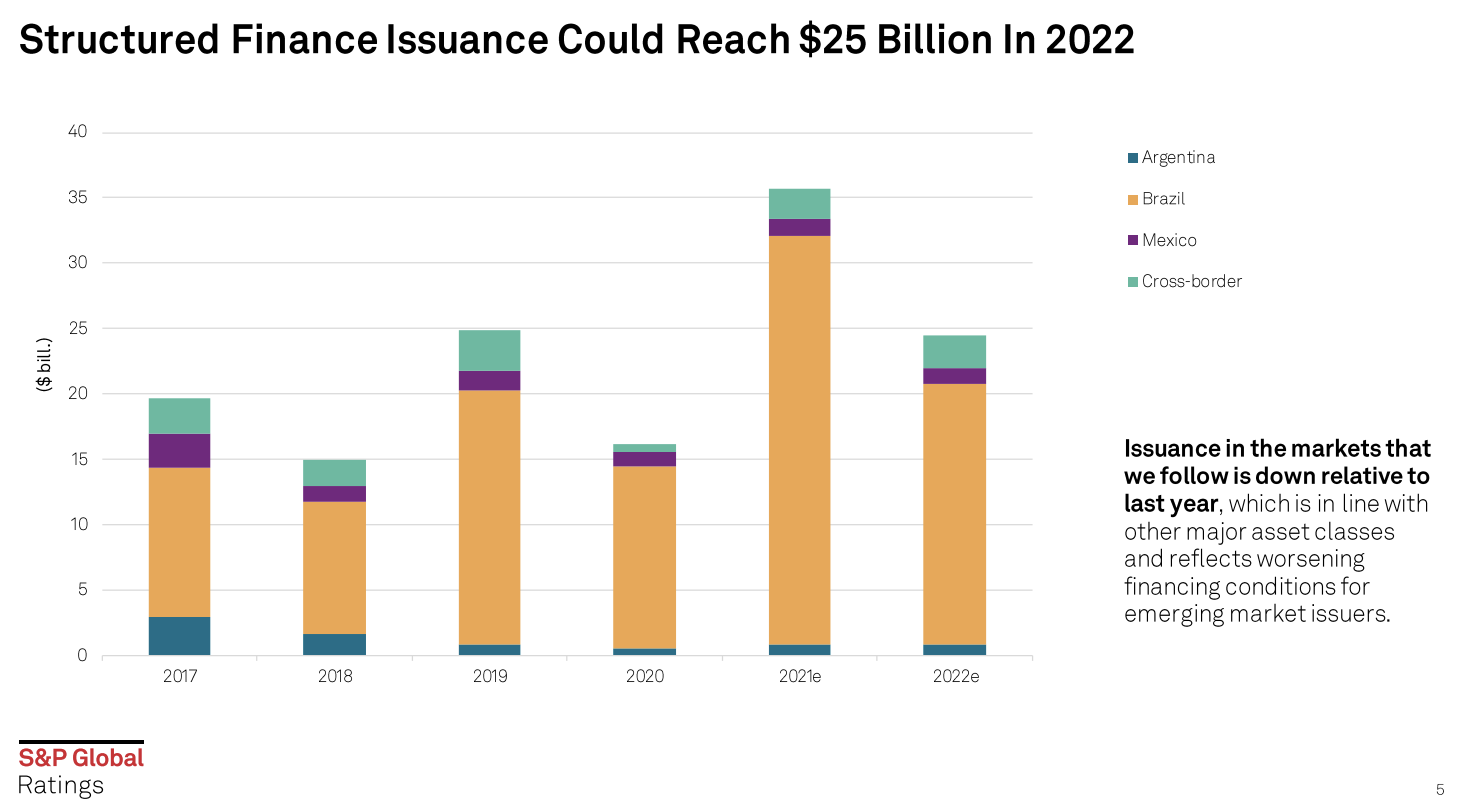

The report includes a round-up of the latest credit developments that S&P Global Ratings has observed in Latin American Structured Finance, a recap and forecast of new issuance across asset types and regions year to date and ratings performance. It also highlights macroeconomic and credit conditions.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

U.S. Banks Log Lowest Specialty Lender Deals So Far In 2022

The number of deals involving U.S. banks acquiring specialty lenders year-to-date in 2022 was the lowest over the past 10 years, supplanting the previous low posted in 2020, a year deeply affected by COVID-19. There have been a total of 12 such deals in 2022 so far, compared with 21 in 2021 and 13 during 2020, according to an S&P Global Market Intelligence analysis.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Russia Likely To Struggle To Find Enough Tankers To Evade G7 Oil Price Cap

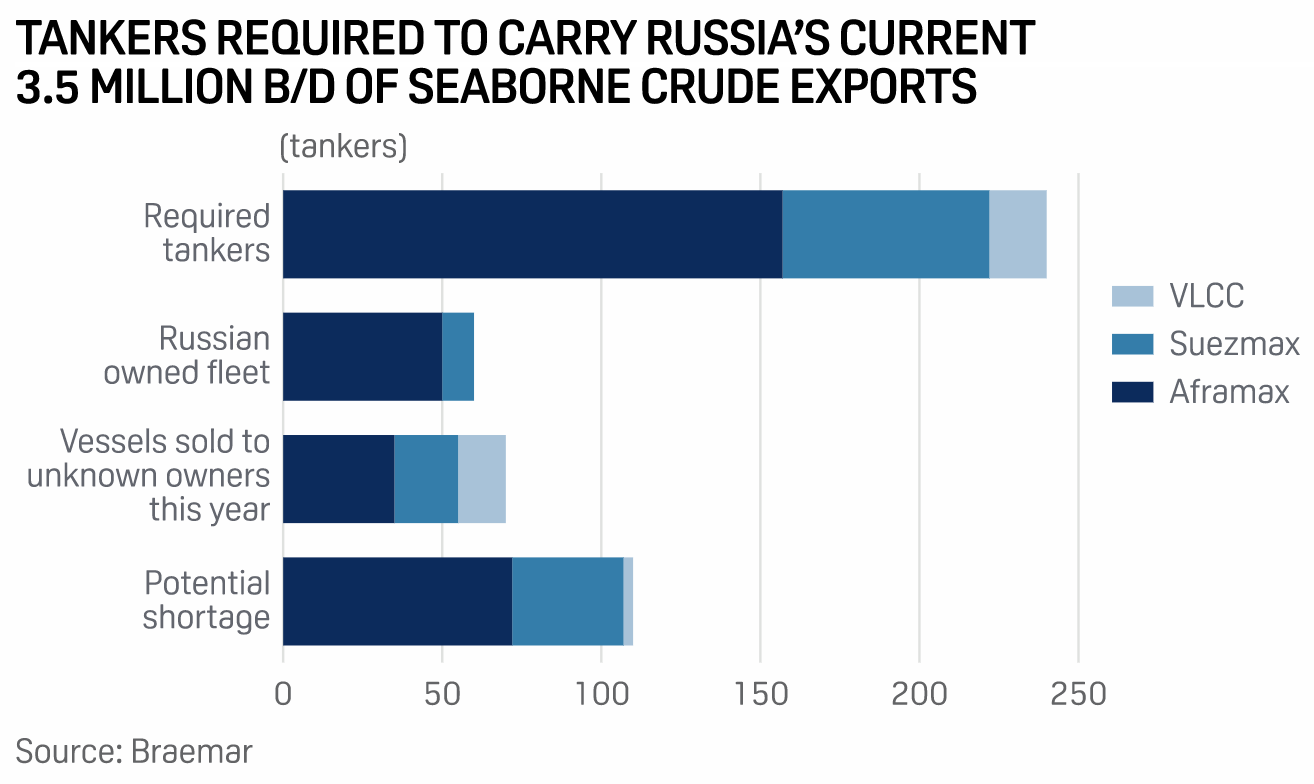

Russia may be unable to redirect all its seaborne oil exports away from Europe as the number of tankers willing to service Russian oil trade dwindles ahead of the G7's price cap mechanism, analysts and shipping brokers told S&P Global Commodity Insights. With the G7's price cap for seaborne Russian crude set to kick in Dec. 5, questions are growing in shipping circles over how the world's second-highest crude exporter will maintain its exports amid rising logistics hurdles.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

COP27: China-U.S. Standoff Threatens To Overshadow Egypt's Collaboration Goal

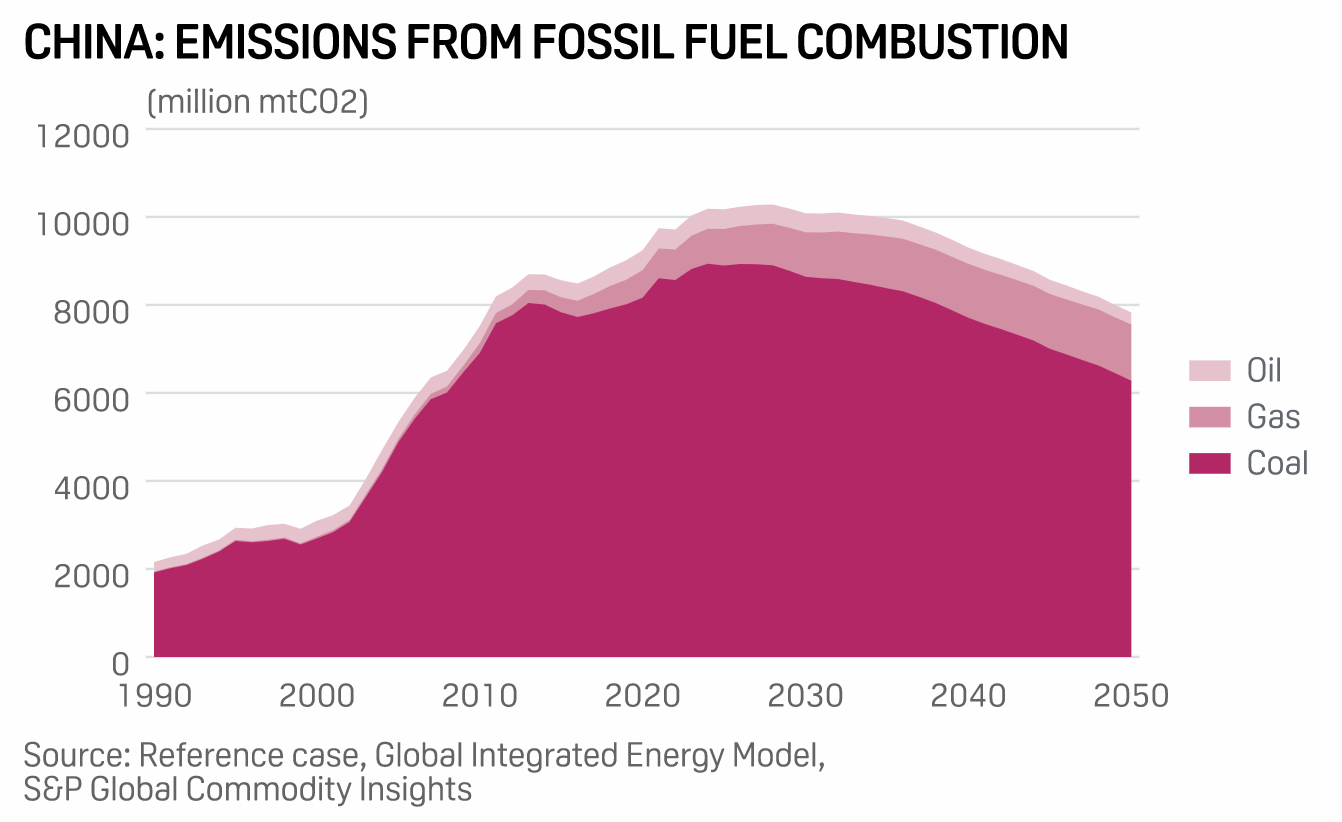

China's decision to halt climate talks with the U.S. after House of Representatives Speaker Nancy Pelosi's visit to Taiwan in August poses a serious challenge to the UN's Climate Change Conference in Sharm el-Sheikh Nov. 6-18. Relations between the two superpowers have been stretched by U.S. efforts to remove China from the list of developing countries, ban imports of certain Chinese solar products and bolster its own research and development to counter Chinese imports.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Europe To The Fore, Elsewhere Through The Floor: How LNG Flows Were Turned On Their Head In 2022

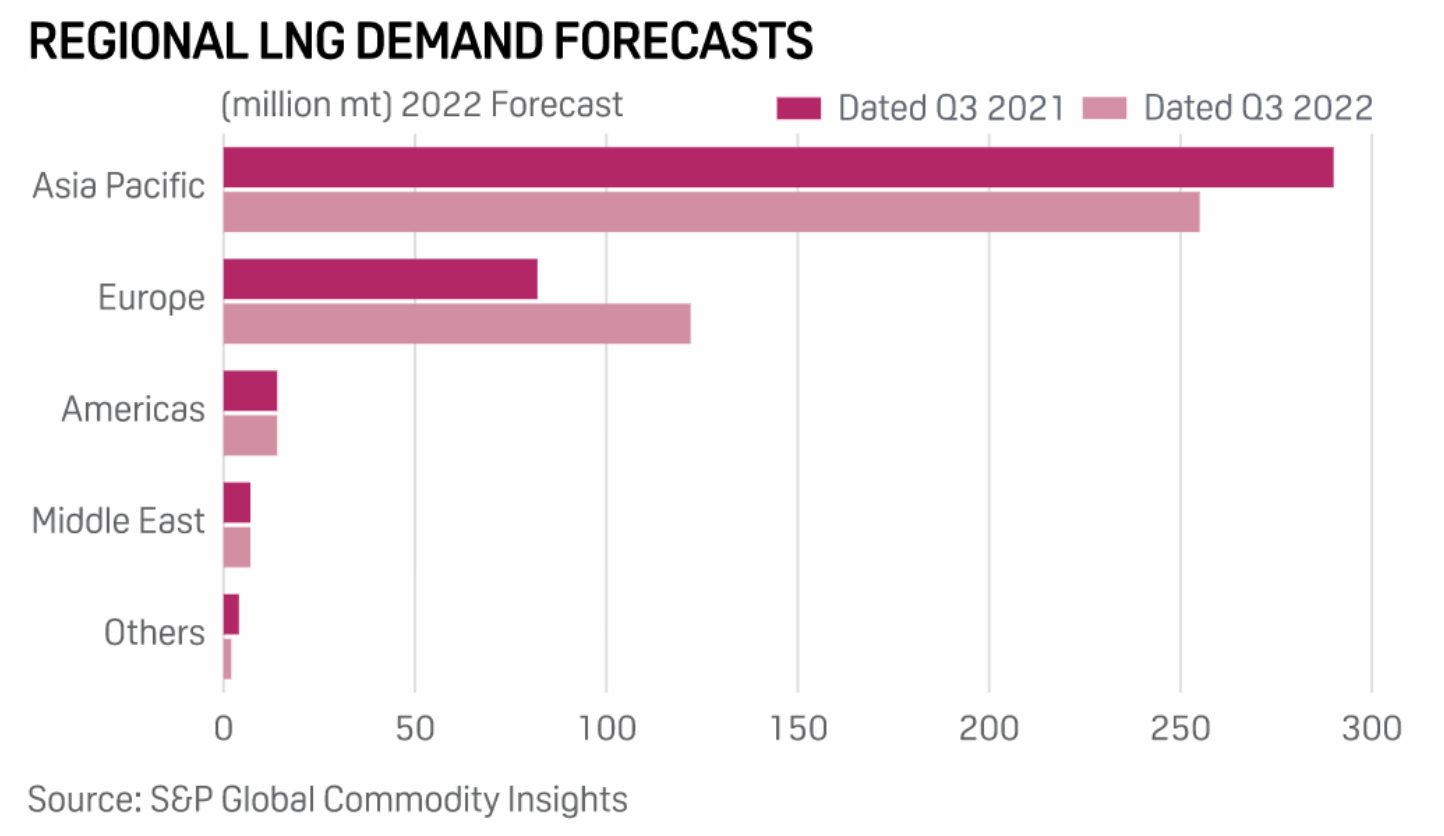

Europe's policy shift to LNG and away from Russian pipeline gas has sent cargo import volumes surging by 65% in the first nine months of 2022 versus the same period in 2021. Unsurprisingly, LNG imports to Europe from almost every supply source will increase, while a significant volume that was previously going to other markets, such as Asia or Latin America, is now being consumed by Europeans.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

A World Redefined By Digital Disruption

Digital disruption is a key change agent for businesses, their competitive and industrial dynamics and the capital markets that fuel growth. Yet while technological advancement and adoption are rapidly catalyzing new networks across an increasingly interconnected world, the frenetic pace of technological progress exposes companies and countries alike to mounting cyber risks. Both the threat landscape and the role cyber insurance plays in risk mitigation are changing: Cyberwar is now baked into any nation-state conflict, entities' reliance on third-partner vendors is exacerbating systemic risks, and it's more important than ever that cybersecurity be an embedded part of risk management, according to new research from S&P Global Ratings and S&P Global Market Intelligence.

—Read the report from S&P Global Ratings