Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 26 Oct, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The growing consensus among investors in the energy sector is that the energy transition is real and is already in progress. But underinvestment in the mining and processing of critical elements could have implications for the timing and cost of the transition. The International Energy Agency (IEA) warned in its World Energy Outlook on Oct. 13 that supplies of certain key minerals such as lithium, cobalt, nickel, and graphite are inadequate to meet projected world demand under most scenarios for the energy transition. Already, price spikes of 5%-15% are expected this year for solar modules, wind turbines, electric car batteries, and power lines based on shortages of these materials. Demand for elements like lithium, dysprosium, and other rare-earth elements is expected to increase to many multiples of existing levels. To meet this demand, more mining and processing facilities will be required. According to the IEA, higher prices are likely due to “long lead times for the development of new projects, declining resource quality, growing scrutiny of environment and social performance, and a lack of geological diversity in extraction and processing operations." Creating more capacity is a time-consuming process, one that investors have been hesitant to support despite a growing commitment to environmental sustainability. Even more common elements, such as nickel and copper, are forecast to have a structural deficit in the next 10 years, with higher prices coming as a result. “I think today, everybody wants to invest in batter-manufacturing facilities, sort of the next Tesla Inc. Nobody wants to do the really hard, gritty things such as actually providing the natural resources to make that energy transition occur,” Rhett Bennett, CEO of Black Mountain, a family of natural resource companies, told S&P Global Market Intelligence. Complicating the development of new mining and processing projects is the fact that many of these critical elements are located in areas with low levels of political stability. The IEA is recommending to its 30 member nations that they consider establishing or expanding strategic reserves of critical metals including alumina bauxite, lithium, and copper. "In the years ahead, the lack of internationally coordinated strategic reserves, combined with some geopolitically unstable sources of supply, portend a high likelihood of volatile prices," Paul Sheldon, chief geopolitical adviser at S&P Global Platts Analytics, said. Today is Tuesday, October 26, 2021, and here is today’s essential intelligence.

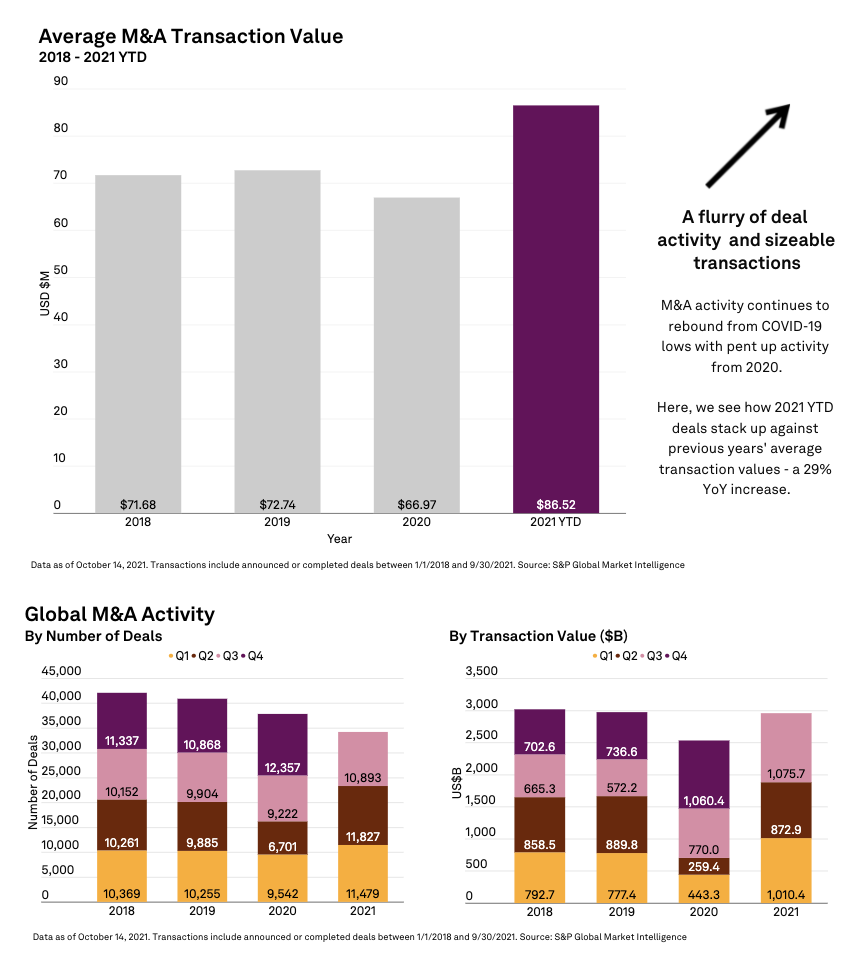

Global M&A By The Numbers: Q3 2021

M&A deal value in Q3 surpassed $1 trillion, eclipsing the previous high of $1.06T in Q4 2020. 2021 investment activity by year's end is expected to surpass 2018 and 2019 totals as well. Examine the rebound from COVID-19 lows and notable deals of 2021.

—Read the full article from S&P Global Market Intelligence

Payments To Continue To Drive Finance M&A In Asia-Pacific

Asia-Pacific’s financial technology acquisition boom may have further to run, as operators and private equity investors target a sector experiencing a pandemic-fueled growth spurt. Payment providers, in particular, will likely drive activity due to rising demand, capital-light business models, and the ability to cross-sell other financial services, such as loans.

—Read the full article from S&P Global Market Intelligence

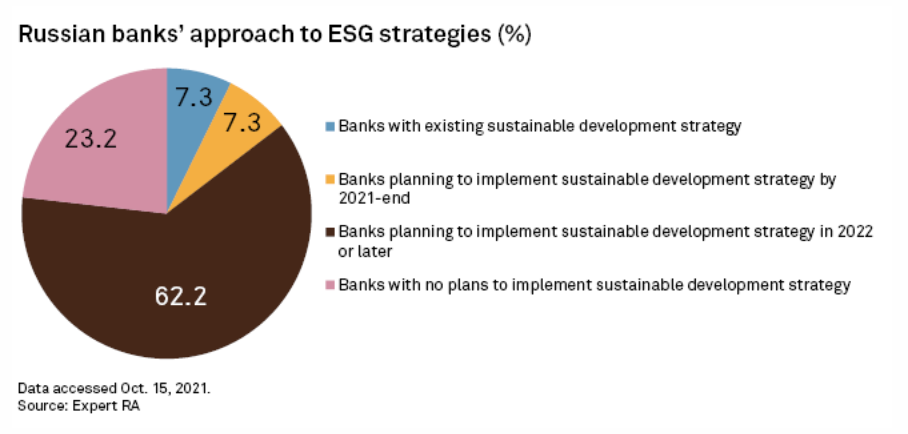

Russian Banks Slow To Adopt ESG Policies

Just 15% of Russian banks have introduced environmental, social, and governance strategies, or will do so by the end of 2021, as insufficient regulatory support and the issue's perceived lack of importance hold back adoption, according to a survey by local credit rating agency Expert RA.

—Read the full article from S&P Global Market Intelligence

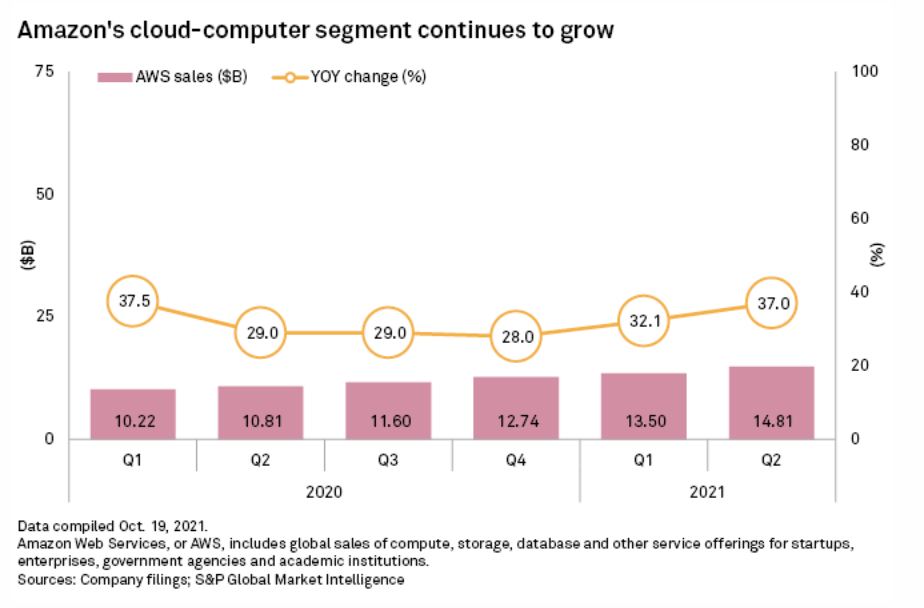

AWS, Advertising Expected To Power Amazon's Q3 Growth As Online Sales Slow

Amazon.com Inc. is expected to post strong third-quarter growth in its advertising and cloud-computing segments that should help offset slowing e-commerce sales as more shoppers returned to retail stores. The change in consumer behavior led to a miss in Amazon's second-quarter results, and while Wall Street predicts year over year revenue growth in the third quarter, tough comparisons and e-commerce uncertainties put more pressure on the company's other segments to outperform.

—Read the full article from S&P Global Market Intelligence

Verizon Leads Telcos With Top Median Employee Salary

Among the top 20 U.S. publicly traded telecommunications firms by market capitalization, Verizon Communications Inc. had the highest median employee salary in 2020, reporting a median employee salary of $170,288. The figure included a change in pension value during the year, which resulted in an increase of $47,830 for the median employee compensation.

—Read the full article from S&P Global Market Intelligence

FCC's Carr Expects Healthcare System Will Help Foot The Bill On Telehealth Costs

Telehealth has become of utmost importance over the past year and a half as the pandemic forced people into virtual work environments, and America's communications agency continues to play a role in making such services as accessible as possible.

—Read the full article from S&P Global Market Intelligence

Listen: Beyond The Buzz - The ESG Implications Of The Global Supply Chain Disruption

In this highly topical episode, Corinne Bendersky and Mike Ferguson dissect the global supply-chain disruption and unpick the reasons for and ESG challenges underlying the worldwide disruption. The pandemic brought the complexities and interconnectedness of global supply chains to light, but the virus can’t take all the blame.

—Listen and subscribe to Beyond the Buzz, a podcast from S&P Global Ratings

Navigating Climate Risk With Indices

How can indices bring greater transparency to climate risk? Designed to go beyond the requirements of EU Low Carbon Benchmark minimum standards, the S&P Paris-Aligned & Climate Transition Indices were created to help market participants looking to chart a path to net zero by 2050.

—Watch the full video from S&P Dow Jones Indices

Oil Giant Saudi Arabia Pledges To Achieve Carbon Neutrality By 2060

Saudi Arabia, the world's largest crude oil exporter, aims to achieve net-zero carbon emissions by 2060, with more than 60 initiatives planned at an initial cost of almost $190 billion, Crown Prince Mohammed bin Salman announced Oct. 23.

—Read the full article from S&P Global Platts

U.K. COP26 Presidency Admits Defeat On Meeting $100 Billion Finance Goal This Year

A $100 billion/year Climate Finance Delivery Plan will not be met this year as hoped ahead of the UN's Climate Change Conference in Glasgow, the U.K. presidency of the COP26 talks said Oct. 25. In 2009, developed countries agreed to mobilize $100 billion in climate finance per year by 2020 to support developing economies' efforts to decarbonize. In 2015 they agreed to extend this goal through to 2025.

—Read the full article from S&P Global Platts

Nine EU Member States Reject Need For Energy Market Reform Or Climate Rethink

Nine EU member states have rejected suggestions from France and Spain that Europe's wholesale energy markets need reform in response to the current energy price crisis, they said in a joint letter ahead of an emergency meeting of EU energy ministers to be held Oct. 26.

—Read the full article from S&P Global Platts

Middle Eastern Countries Stress International Efforts, Tech Transfer To Tackle Climate Change

Leaders in the Middle East emphasized the role of international cooperation, technology transfer, and financial instruments in the transition to a green global economy ahead of the UN Climate Change Conference, talking up investments in renewables and highlighting the need to not damage economic growth at the inaugural Middle East Green Initiative Summit in Riyadh Oct. 25.

—Read the full article from S&P Global Platts

'Blue Carbon' Gains Interest In Effort Against Greenhouse Gases, But Challenges Remain

Increased focus on using carbon offset projects to remove greenhouse gases is prompting greater interest in "blue carbon" projects, which use coastal and marine ecosystems to cut or altogether avoid GHGs. Such coastal ecosystems sequester carbon in the body of the plants but also especially in underlying sediments.

—Read the full article from S&P Global Platts

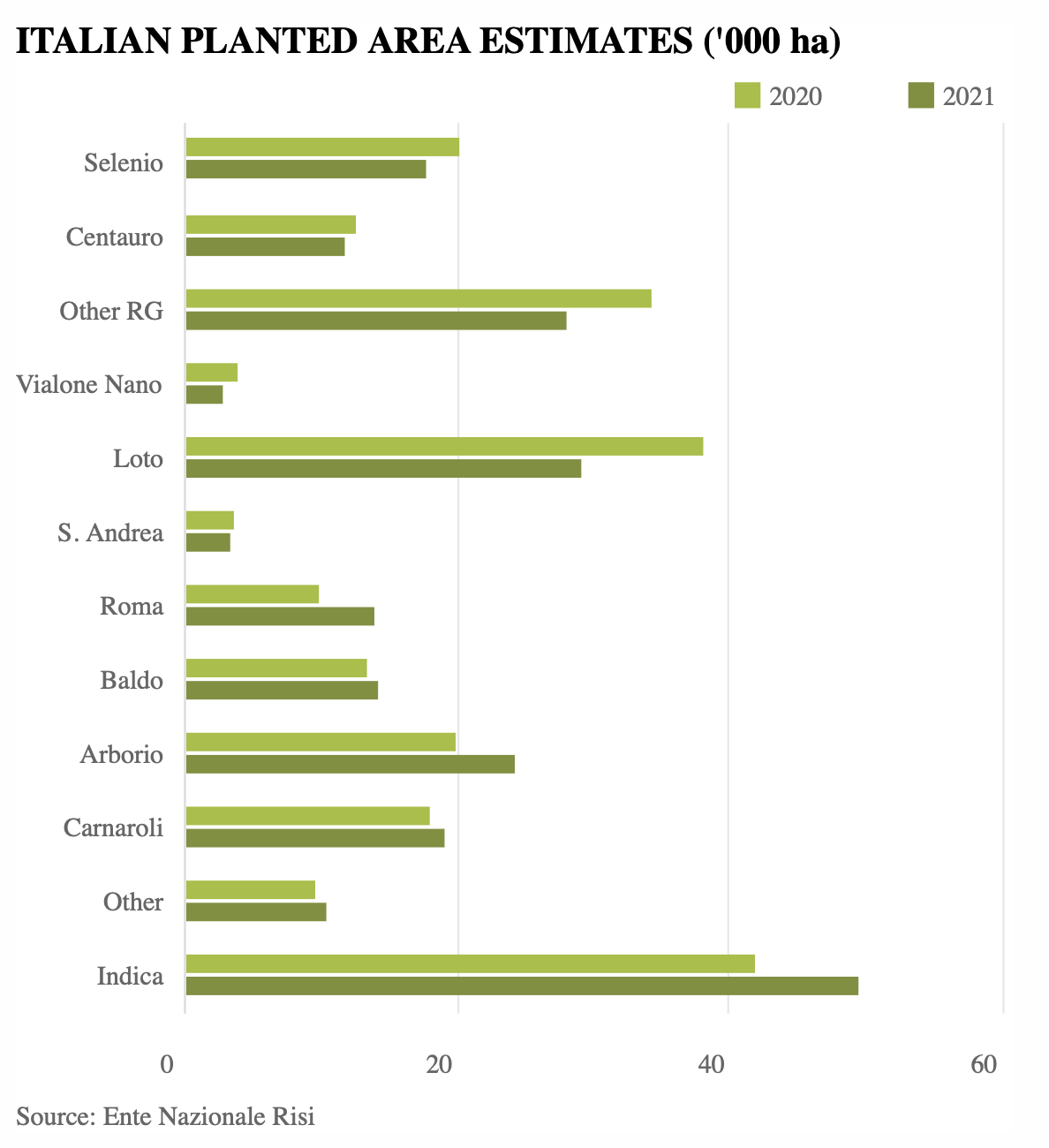

Italian Rice Market Concerned By Price Rises As Harvesting Peaks

While October is typically a month of price softness as the bulk of the harvest arrives on the market, October 2021 has differed in northern Italy. As one broker remarked, "the quantities of paddy rice offered on the market should be higher, the rice mills should not have difficulty in finding the quantities they need, and prices should be softer."

—Read the full article from S&P Global Platts

Mild Weather, Lengthening Supply Balances Weigh On Gas Market Bulls

Unseasonably warm temperatures this October continue to drag on U.S. residential-commercial gas demand, setting the stage for a bearish start to the winter heating season. From Oct. 1 to date, the U.S. population-weighted temperature has averaged a balmy 66.4 degrees Fahrenheit, making for the warmest start to October dating back to at least 2005.

—Read the full article from S&P Global Platts

European Gas Liberalization Cut Import Costs By $70 Bil In Last Decade: IEA

A report published by the International Energy Agency aggregated the total cost of import as the Continent shifted away from 30% gas-on-gas competition in 2010 to 80% in 2020, and also from oil-indexation within long-term supply contracts.

—Read the full article from S&P Global Platts

Energy Planners Must 'Go Back To The Drawing Board' And Include Oil And Gas: ADNOC CEO

The world's efforts to address climate change through an energy transition must include oil and gas in the mix after a period of six or seven years of underinvesting in resources, particularly hydrocarbons, that is now causing prices to climb, the CEO of the UAE's Abu Dhabi National Oil Co. said Oct. 23.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language