Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 26 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Continuing protests against police brutality in Nigeria, targeting the country’s federal government and the Special Anti-Robbery Squad known for committing extra-judicial murders, have local and global implications. As the protests impact Nigeria’s oil demand while also renewing the global spotlight on inequality, the current unrest is the latest event to reinforce the accelerating importance of environmental, social, and governance (ESG) issues.

Following a video of a SARS policeman killing a young man that went viral, millions of young Nigerians have for more than two weeks taken to the streets to peacefully protest and to social media with the hashtag #EndSARS. Tensions escalated on Oct. 20 when soldiers attacked peaceful protestors in Lagos, killing at least 10 civilians, according to Amnesty International.

The oil industry in the country has immediately felt the effects of the protests, signaling how social factors can impart physical risk. The rising tensions have curbed gasoline consumption in Lagos, the country’s largest city that is typically highly congested with traffic and where the majority of the unrest has occurred. Lagos accounts for nearly 40% of Nigeria’s domestic oil demand. "To us in the industry, it is a matter of time [until] oil operations are disrupted if the situation remains unchecked and allow to escalate," a Nigerian oil official told S&P Global Platts.

The unrest has drawn parallels to the Black Lives Matter movement in the U.S. and the protests that erupted across the country following the murder of George Floyd by police this summer.

Similar to the evolution of the nationwide protests in the U.S., Nigeria’s young citizens have called for the dissolution of the special police group and an overhaul of inequality in the country. More than 40% of the country’s population of 200 million people are under the age of 30 years old, according to data compiled by Statista. Young Nigerians face the worst of the country’s economic hardships. Nigerians under the age of 35 suffered the highest unemployment rates during the second quarter of this year, with 40.8% of the workforce aged 15 to 24 without a job and 30.% of young Nigerians aged 25 to 34 out of work, according to governmental data. Comparatively, 27.1% of all Nigerians were unemployed in the three-month period from April to June.

“S&P Global Ratings believes more corporations will announce tangible steps to align themselves with stakeholders' social values … The sheer scale of demonstrations against racism and social injustice after George Floyd's death has led some corporations to publicly denounce all forms of discrimination, and we expect this will continue,” S&P Global Ratings said in a July report following the onset of protests after George Floyd’s killing in the U.S. “Only time will tell how social factors, such as racism and inequality, will affect companies' futures. However, failure to address them could have an impact on their ESG performance and, ultimately, on credit quality if loss of customers reduces profitability.”

Many prominent financial services companies in Nigeria have made public statements and donations in support of the protestors and #EndSARS movement, including the Nigerian fintech startups Cowrywise, Flutterwave, and Paystack, which was acquired on Oct. 15 by the U.S. fintech firm Stripe for reportedly $200 million.

Today is Monday, October 26, 2020, and here is today’s essential intelligence.

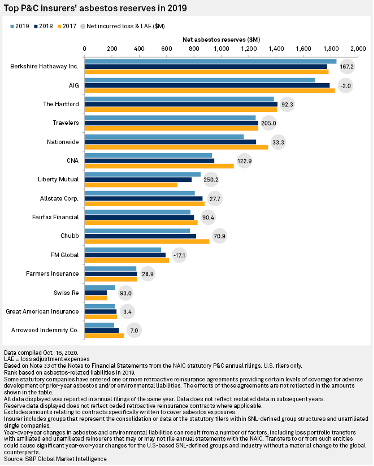

As New Risks Emerge, Liability Carriers Continue to Confront an Old Peril

Social inflation and potential exposure to litigated COVID-19-related claims have dominated the headlines in 2020, but Travelers Cos. Inc.'s third-quarter earnings release offered a reminder that one decades-old risk to liability insurers has not disappeared. Travelers reported its largest amount of unfavorable development of asbestos reserves in a third quarter since the 2006 shift of its annual review of related exposures to that period. The $295 million result exceeded the company's previous high of $250 million for the three months ended Sept. 30, 2014, and the $220 million increase recorded in the third quarter of 2019.

—Read the full report from S&P Global Market Intelligence

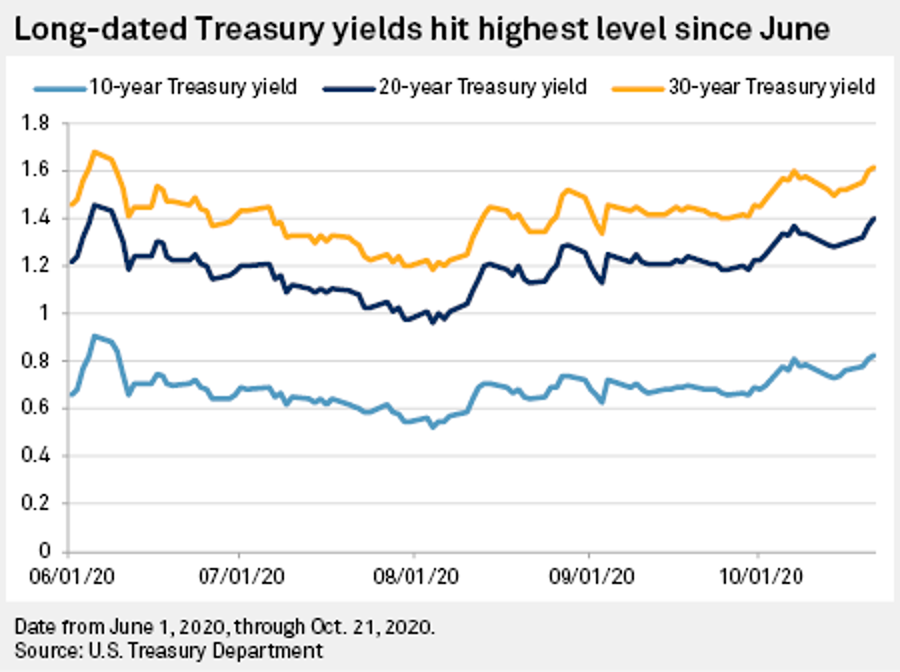

U.S. Yield Curve Steepest in Nearly 3 Years on Potential for Election 'Blue Wave'

The potential of a Joe Biden victory along with a Democratic Senate majority is driving long-dated U.S. Treasury yields to highs not seen since early June, with investors expecting higher inflation as the likelihood of elevated government spending grows. "The main factor is undoubtedly what we like to call the 'Biden reflation trade,'" said Antoine Bouvet, a senior rates strategist with ING. "In short, the market is pricing a greater growth and inflation prospect in the U.S. due to more pro-growth fiscal policy in case of a Democrat sweep at next month's election."

—Read the full report from S&P Global Market Intelligence

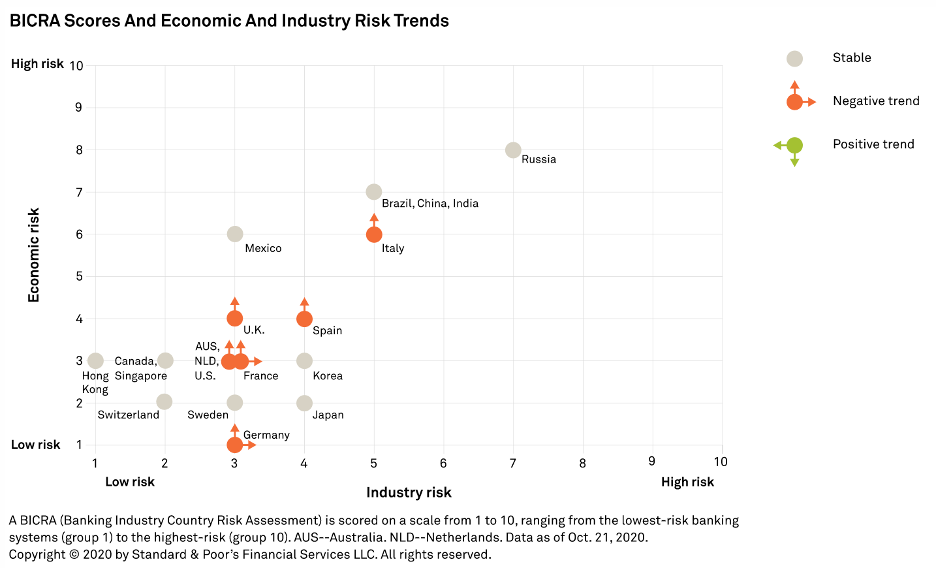

How COVID-19 is Affecting Bank Ratings: October 2020 Update

About one-third of S&P Global Ratings’ bank ratings globally currently carry negative outlooks or are on CreditWatch with negative implications. This follows the actions S&P Global Ratings took in April and May on the back of downward revisions to economic forecasts. S&P Global Ratings currently assumes a gradual recovery in many economies, with risks to the central scenario including extended COVID-19 containment measures due to the recent resurgence in cases in certain countries and the transition to post-COVID-19 policies.

—Read the full report from S&P Global Ratings

North American Financial Institutions Monitor 4Q 2020: Finding Some Respite in the COVID-19 Storm

Over the last few months, most financial institutions (FIs) in North America have entered somewhat calmer waters compared with earlier in the coronavirus pandemic--thanks largely to extraordinary government and central bank economic support and recovering markets. Signs of deterioration in most loan classes have slowed, funding markets have been open to most rated institutions, and early third-quarter earnings look much better than in the first half of the year.

—Read the full report from S&P Global Ratings

EMEA Financial Institutions Monitor 4Q2020: Banks Prepare as Winter is Coming

S&P Global Ratings considers that weaker asset quality and revenue pressure associated with the COVID-19 pandemic will continue to weigh on the profitability of many financial institutions operating in Europe, the Middle East, and Africa (EMEA). Supported by various stimulus measures, EMEA economies that have reopened after the lockdown related to the first wave of the pandemic now face a new challenge. As authorities apply the health lessons learned over the past six months—such as track and trace, limiting nonessential social interactions, and shielding the vulnerable—they are also trying to avoid national lockdowns that triggered the economic meltdowns in the second quarter.

—Read the full report from S&P Global Ratings

Barclays' I-Bank Provides Majority of Q3 Group Profit as Impairments Rate Slows

Barclays PLC CEO Jes Staley has been given a chance during the current earnings season to boast about the success of the U.K. bank’s investment bank after its markets division outperformed peers. The corporate and investment bank delivered £1 billion in pretax profit in the third quarter, said Staley when unveiling quarterly results, adding, "Over 85% of the bank’s profitability in the last three months came from the corporate and investment bank."

—Read the full report from S&P Global Market Intelligence

The Essential Podcast, Episode 24: Beyond the Bin — Climate Solutions in the Circular Economy

Michiel de Smet of the Ellen MacArthur Foundation joins the Essential Podcast to discuss how re-imagining the global economy on circular principles can yield benefits for companies, investors, and the climate. Listen and subscribe to this podcast on our podcast page, Apple Podcasts, Google Podcasts, Deezer, and Spotify.

—Listen and subscribe to the Essential Podcast from S&P Global

EU Carbon Border Measure Should Cover Power, Heavy Industry: EP

A proposed Carbon Border Adjustment Mechanism should be imposed from 2023 to cover imports of electricity and energy intensive products including metals and chemicals into the EU, the EU Parliament's environment committee said in a report late Oct. 22. If introduced, any CBAM would have implications for Europe's energy intensive industrial sectors by reducing the import of carbon intensive goods from other countries; potentially remove the need for free allocation of carbon allowances for those sectors in Europe; and could cause repercussions for Europe's trade relations around the world.

—Read the full report from S&P Global Platts

ESG Metrics No Longer a "Fad" to Mining Industry: LME Week

Environmental, social and governance metrics have become an increasingly hot topic for the mining industry and were not just a gimmick, panelists said at this year's London Metal Exchange Week. Environmental, social and governance metrics have become an increasingly hot topic for the mining industry and were not just a gimmick, panelists said at this year's London Metal Exchange Week.

—Read the full report from S&P Global Platts

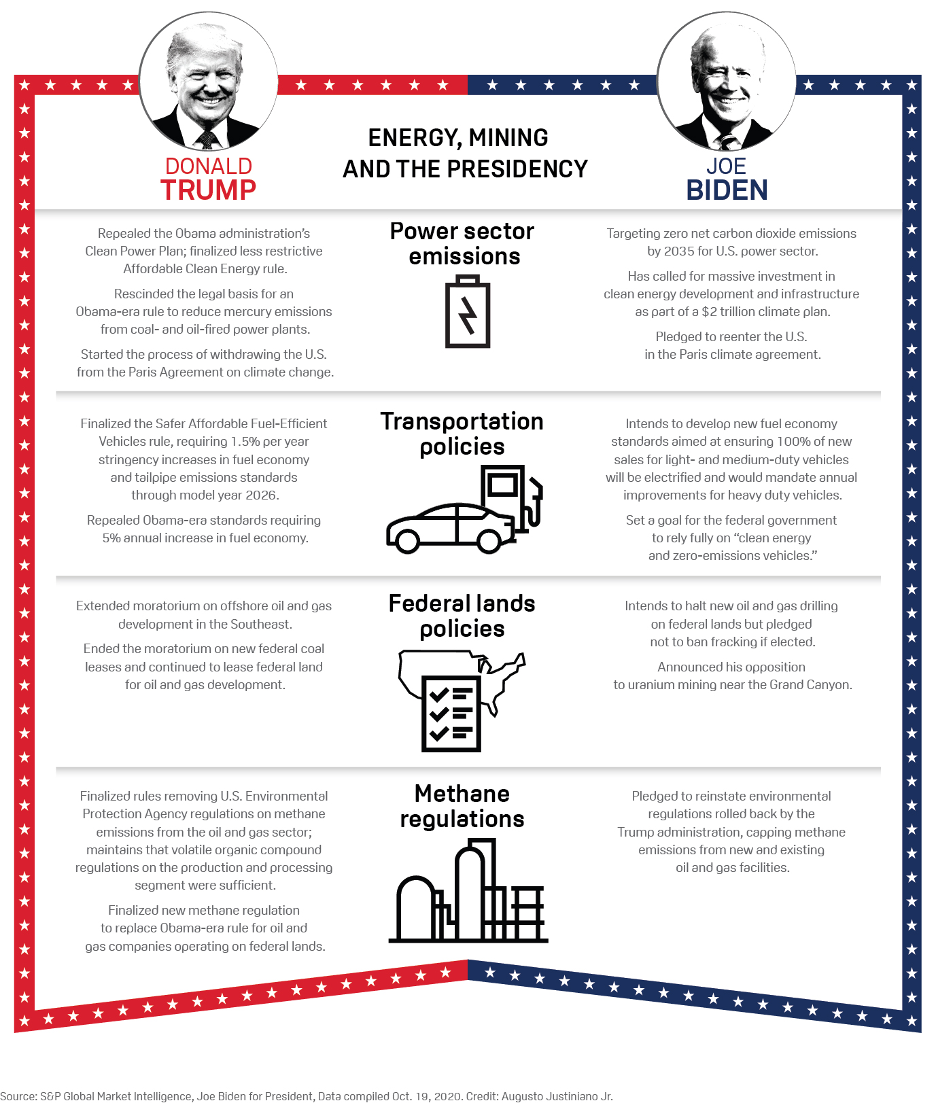

U.S. ELECTIONS: Political Polarization Creating Regulatory 'Ping-Pong Effect' for U.S. Energy

As the U.S. political climate has grown more polarized, the energy sector has faced increasingly significant shifts on the regulatory front every four to eight years, and the industry may have to ready itself for another pendulum swing after the November presidential election. In sharp contrast to incumbent President Donald Trump, Democratic presidential nominee Joe Biden has made aggressive climate proposals and pledged to reinstate regulations the Trump administration rolled back.

—Read the full article from S&P Global Platts

OPEC+ Cut Decision Will Reverberate in U.S. Oil Patch, but Trump Silent as Election Looms

As OPEC and its allies ruminate over whether to ease their collective production cuts at the end of the year, a very interested – though perhaps distracted by the U.S. election – Trump administration will be watching closely from Washington. The OPEC+ agreement, forged in April during the worst of the pandemic market meltdown, saw the 23-country alliance rein in nearly 10% of global crude supply and was critical in clawing back U.S. oil prices from negative territory to about $40/b now. The deal was a relief to the beleaguered U.S. oil industry that President Donald Trump saw as vital to his re-election campaign.

—Read the full report from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language